Beyond Money: What Is Cryptocurrency Good For?

Beyond Money: What Is Cryptocurrency Good For?

Introduction

Cryptocurrency, a groundbreaking innovation, has captured the world’s attention primarily as a new form of money. Bitcoin, Ethereum, and a plethora of other digital assets have proven their worth as alternative stores of value and mediums of exchange. But what is cryptocurrency truly good for, beyond being a means of payment or investment? In this article, we will explore the diverse use cases and the untapped potential of cryptocurrency technology.

What is Crypto being used for now?

Luckily, Vitalik Buterin answered this question when he published his white paper back in 2014:

In general, there are three types of applications on top of Ethereum. The first category is financial applications, providing users with more powerful ways of managing and entering into contracts using their money. This includes sub-currencies, financial derivatives, hedging contracts, savings wallets, wills, and ultimately even some classes of full-scale employment contracts. The second category is semi-financial applications, where money is involved but there is also a heavy non-monetary side to what is being done; a perfect example is self-enforcing bounties for solutions to computational problems. Finally, there are applications such as online voting and decentralized governance that are not financial at all.¹

Since you are reading this article, I am assuming you know the most basic reason why people use crypto — it’s use as money. I’ll skip the “it’s a medium of exchange, store of value, blah blah blah.” This is already obvious and you aren’t here for that. The reason crypto or more specifically, blockchain technology, is being used today can can be summed up using Vitalik’s white paper. To simplify his ideas into four alternative use cases:

- Smart contracts

- Tokenization

- Identity

- Governance

Smart Contracts: The Digital Law of the Future

Smart Contracts

Smart Contracts

One of the most significant contributions of cryptocurrency technology is the introduction of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These digital agreements automatically execute when predefined conditions are met, eliminating the need for intermediaries and offering a level of trust and efficiency that was previously unattainable.

If you have interacted with any decentralized (DeFi) app then you have used a smart contract. Why are these so special? — They have the potential to revolutionize how we interact with contracts and agreements in nearly every aspect of our lives. Transparency is usually a good thing. Putting contracts on the blockchain (whether private or public) are binding agreements that execute when triggered.

Remember the saying “trust but verify?” It’s usually better to trust immutable code rather than humans. Now that we have smart contracts enabling DeFi, we can add functionality such as tokenization.

Tokenization: Real-World Assets on the Blockchain

Tokenization

Tokenization

Tokenization is the process of representing real-world assets, such as real estate, art, stocks, and more, as digital tokens on a blockchain. This innovation opens doors to greater liquidity and accessibility for traditionally illiquid assets. Imagine being able to own a fraction of a Picasso painting or a piece of prime real estate, all facilitated through cryptocurrency.

The hot idea right now is owning tokenized treasury bills. Instead of owning USDC which is always pegged to the dollar, you can have sDAI or stUSDT. Both are giving you 5% APY and can be traded just like USDC. More and more assets will be represented digitally because of the transparency of relying on smart contracts rather than the secrecy of the traditional banking system.

If you are looking to figure out where the best tokenized treasury bill yields are, see my recent article here!

As users slowly shift towards a more digital life, whether this is truly Ready Player One or Web3, a new identity will form. Even here, cryptocurrencies are solving a major problem with online identity.

Decentralized Identity: Empowering the Individual

Digital Identity

Digital Identity

Cryptocurrency technology has the potential to redefine how we handle identity and personal data. The most obvious has been the moment you learned about needing a “seed phrase.” By owning that phrase, you are in control of your private wallet and no one else is. Banks can’t take money from it, the government can’t either, only you can. Having self-custody starts the path to controlling your identity.

When it comes to personal data, crypto has been at the forefront in building zero trust and zero knowledge code. Basically, you share the minimum information required to verify a transaction and no one will know who you are. Once you are in control of your own data, tech companies can’t sell your data unless you let them.

Lastly, identity has been a major problem in Web2. If you’ve ever looked at comments on Youtube or Instagram, then you know what I mean. Web2 has allowed people to write comments they would never dare say to someone directly. Crypto can change this. The early version of identity has been your wallet. This has expanded to unique identification such as your eyeball. WorldCoin is one of these projects which scans your eyeball (yes this is real), and gives you a key as a verifier on the blockchain. Eventually, there will be ways to verify the person who sent that tweet was a real person and not a bot. And hopefully, one day everyone will show their identity rather than hide behind their terrible comments to make their sorry life feel better.

In-line with the path towards building an identity, will be bringing everyone together to build a public square through governing mechanisms.

Governance: A New Era of Decentralized Decision-Making

Decentralized Autonomous Organization (DAO)

Decentralized Autonomous Organization (DAO)

The concept of decentralized governance is gaining momentum in DeFi. Decentralized autonomous organizations (DAOs) allow community-driven organizations to make decisions collectively through voting. These organizations can fund projects, make governance decisions, and even create new rules and protocols. Decentralized governance has the potential to bring about more inclusive, transparent, and democratic decision-making processes.

Imagine if we didn’t have politicians and we could vote on policies ourselves? There’d be anarchy! We’d vote for free money! Have you seen any of that happen with DAOs? No….. So why wouldn’t this approach work for governing other bodies? DAOs could be answer but realistically, we will have to wait and see if there is a limit to the size of an organization before decentralization losses its efficiency. Until then, the idea of a transparent organization with smart contracts as its rules, is a much better idea than politicians or C-Suite executives mouthing off platitudes or lining their own pockets.

Conclusion

Cryptocurrency is not just about creating digital money; it is about reimagining the very fabric of our financial, social, and political systems. Vitalik first mentioned the primary use cases back in 2014: smart contracts, tokenization, decentralized identity and decentralized governance. These are just a few examples of the transformative potential of cryptocurrency technology.

As the ecosystem continues to evolve, we can anticipate even more innovative and impactful use cases. Cryptocurrency’s versatility and decentralization enable it to be a force for change in countless areas of our lives, far beyond its original conception as an alternative form of money.

But crypto’s biggest impact in the future will be money as the world enters a new era of geopolitics and Moloch traps. Stay tuned for my next article to hear more!

-Just Another Crypto Analyst

Doing this for fun but if you want to leave a tip: 0xa33aE4207466cD866D13fA587067B1F824C06d4A

Source:

[1] Vitalik Buterin. 2014. Ethereum Whitepaper. https://ethereum.org/en/whitepaper/#applications

Follow

Follow

Written by Just Another Crypto Analyst

8 Followers

·

Writer for

Coinmonks

Crypto Analyst sharing what I've learned over the years

More from Just Another Crypto Analyst and Coinmonks

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

How to Get the Highest Yield on Your Stablecoins (Oct 2023)

All over the news, we are hearing that money markets, U.S. treasuries, and high interest savings accounts are all offering +5% APYs. And…

8 min read

·

Oct 15, 2023

8

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

38K

1021

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

What is the Best ETH Liquid Staking Tokens?

Introduction

6 min read

·

Oct 29, 2023

8

See all from Just Another Crypto Analyst

Recommended from Medium

Mike Coldman

Mike Coldman

Top 4 Crypto Gems Set to Explode in 2024 !

Unlock the Secret Strategies of Elite Investors and Transform Your Portfolio Overnight !

·

5 min read

·

Jan 8

170

3

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.7K

119

Lists

data science and AI39 stories

·

43

saves

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

623

saves

Natural Language Processing1097 stories

Natural Language Processing1097 stories

·

564

saves

Financeable

Financeable

12 Side Hustles You Can Do From Your Phone ($600+ Per Day)

Let’s be honest, if you’re reading this article, you probably have a phone or a laptop. And with this thing, you can make as much as $600…

13 min read

·

Dec 25, 2023

6K

109 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

423

10

Abdus Salaam Muwwakkil

Abdus Salaam Muwwakkil

in

Rather Labs

The Top 10 Blockchain Trends in 2024 that Everyone Must Be Ready For

Exploring BaaS, DeFi Expansion, Scalability Solutions, and Regulatory Trends in Blockchain’s Enterprise Adoption through 2024.

12 min read

·

Jul 18, 2023

739

18

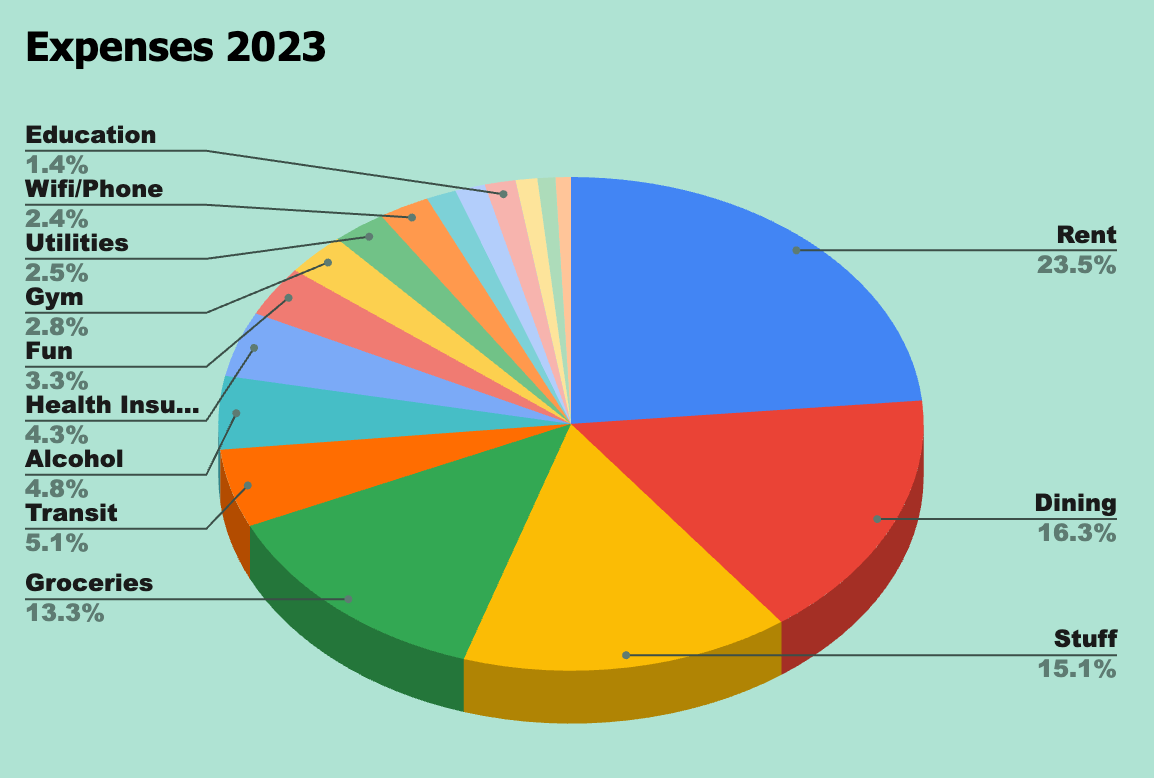

Shawn Forno

Shawn Forno

in

The Startup

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)