How High Could BTC Price Surge Following Trump’s Bullish Bitcoin Speech?

The cryptocurrency market has been abuzz following former U.S. President Donald Trump's recent speech at the Bitcoin 2024 conference in Nashville.

The cryptocurrency market has been abuzz following former U.S. President Donald Trump's recent speech at the Bitcoin 2024 conference in Nashville.

Trump, known for his influence and bold declarations, proposed integrating Bitcoin into the United States' strategic reserves and making the nation the "crypto capital of the world."

This vision includes creating a national Bitcoin "stockpile" and elevating Bitcoin to a "permanent national asset." Such a move has led to significant speculation about the potential future price of Bitcoin (BTC).

Trump's Vision: A New Era for Bitcoin

Trump's speech has marked a significant shift in the discourse around Bitcoin, proposing the cryptocurrency as a critical component of the United States' economic strategy.

The idea of establishing a national BTC reserve, akin to gold reserves, has been met with bullish reactions from the crypto community and analysts alike.

This proposal not only legitimizes Bitcoin but also potentially paves the way for widespread institutional adoption, which has long been considered a key factor in driving Bitcoin's price.

The $800,000 Prediction: A Bold Outlook

One of the most optimistic projections comes from the market analyst known as "Crypto Rover," who predicts that Bitcoin's price could soar to $800,000 if Trump's vision is realized.

This estimate is based on the assumption that Bitcoin could overtake gold's market capitalization, a scenario that would significantly increase BTC's valuation. As of now, Bitcoin's market cap is a fraction of gold's, but growing acceptance and investment could narrow this gap.

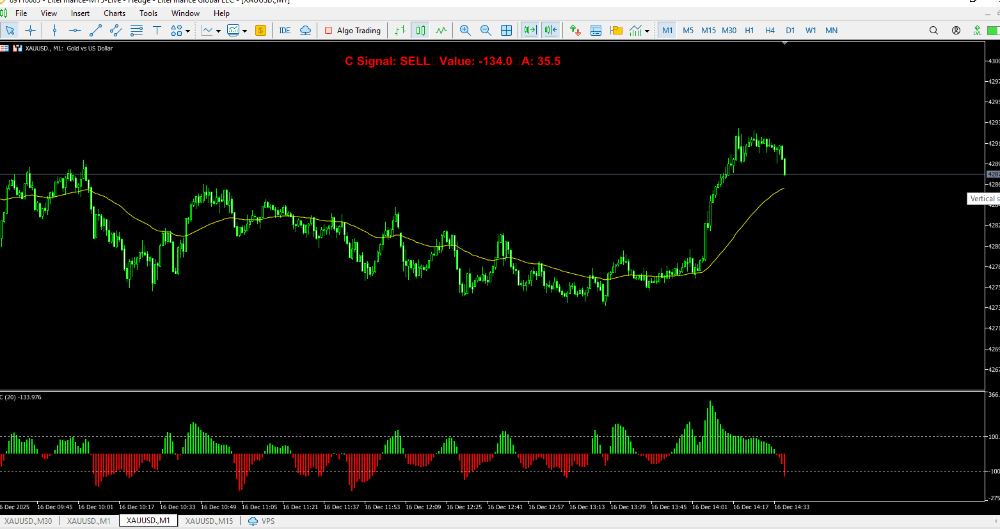

Bitcoin vs. gold market capitalization. Source: Crypto Rover

Bitcoin vs. gold market capitalization. Source: Crypto Rover

Republican Senator Cynthia Lummis of Wyoming has further supported this outlook, proposing a legislative plan to establish a federal reserve of 1 million BTC, representing nearly 5% of the total supply. This proposal underlines the growing political and institutional interest in Bitcoin as a strategic asset, potentially influencing its future price.

Institutional and Market Dynamics

The potential surge in Bitcoin's price is also linked to the broader trend of increasing institutional involvement in the cryptocurrency market.

The rise of Bitcoin ETFs in the United States, managing assets worth billions, indicates a growing acceptance among traditional investors.

These ETFs have seen a significant uptick in interest, particularly following Trump's speech, suggesting that institutional players are positioning themselves for a potentially bullish market.

Analysts like Dan Crypto Traders and Tanaka foresee Bitcoin reaching $100,000 in the near term, driven by a combination of political support, institutional investment, and market dynamics.

The prediction of a $100,000 Bitcoin aligns with a broader trend of rising digital asset valuations, supported by factors such as limited supply, increasing demand, and macroeconomic conditions favoring alternative assets.

Technical Analysis: Rising Wedges and Ascending Channels

From a technical analysis perspective, Bitcoin's price movements have been characterized by patterns such as rising wedges and ascending channels, indicating potential price targets and support levels.

According to the analyst Cryptomist, BTC could reach $100,000 based on these patterns, particularly if it breaks out of the current wedge formation.

A near-term target of $74,000 has been identified, with the possibility of a correction to the $60,000-66,000 range if the price fails to maintain its upward trajectory.

These technical insights underscore the volatile nature of the cryptocurrency market, where bullish predictions are tempered by the inherent risks and uncertainties of market dynamics.

Conclusion

Donald Trump's bullish stance on Bitcoin, coupled with growing institutional interest and political support, has sparked significant optimism in the crypto market.

While predictions of Bitcoin reaching $800,000 or even $100,000 are ambitious, they highlight the transformative potential of mainstream acceptance and integration of cryptocurrencies into national economic strategies.

As the market navigates these developments, investors and analysts will continue to watch closely, evaluating the impact of policy, market trends, and technical indicators on Bitcoin's price trajectory.

Sources

- Cointelegraph: How high can BTC price go? Trump Bitcoin speech

- Bitcoin 2024 Conference Insights

- Analysis by Crypto Rover on Twitter