Has the crypto market cycle broken?

Market cycles in crypto are price fluctuations that tend to be repetitive and predictable based on the Bitcoin Halving event. However, in the 4th Bitcoin Halving cycle, everything is gradually going out of rhythm.

Familiar crypto market cycle

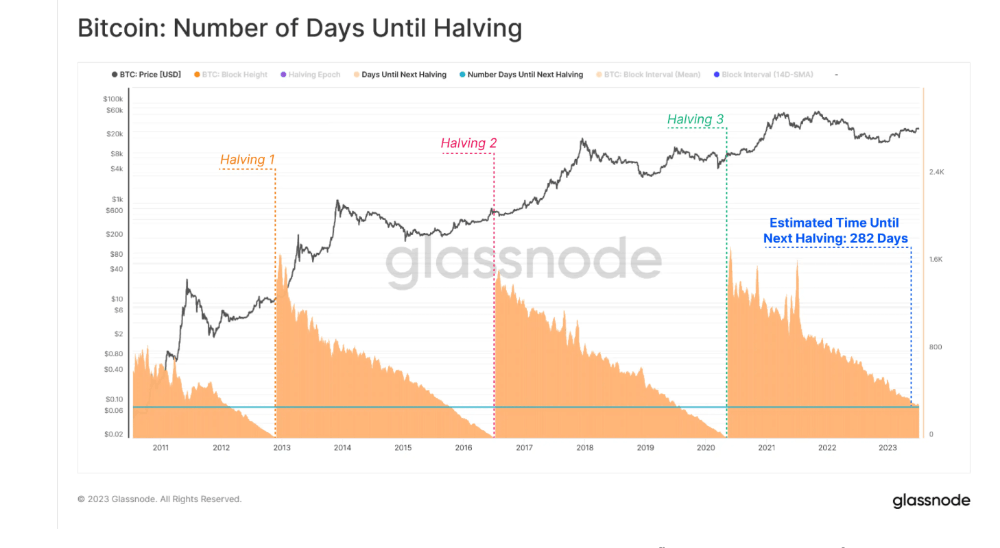

Bitcoin Halving is an event that reduces the block reward by half for Bitcoin miners, helping to control inflation and increase the scarcity of Bitcoin.

This event has a strong correlation with Bitcoin price. Accordingly, Bitcoin price usually peaks about 300-500 days after Bitcoin Halving. Specifically:

- 1st Bitcoin Halving: Bitcoin increased 97 times, peaking about 370 days after Halving.

- Second Bitcoin Halving: Bitcoin increased 30 times, peaking about 554 days after Halving.

- 3rd Bitcoin Halving: Bitcoin increased 7 times, peaking about 336 days after Halving.

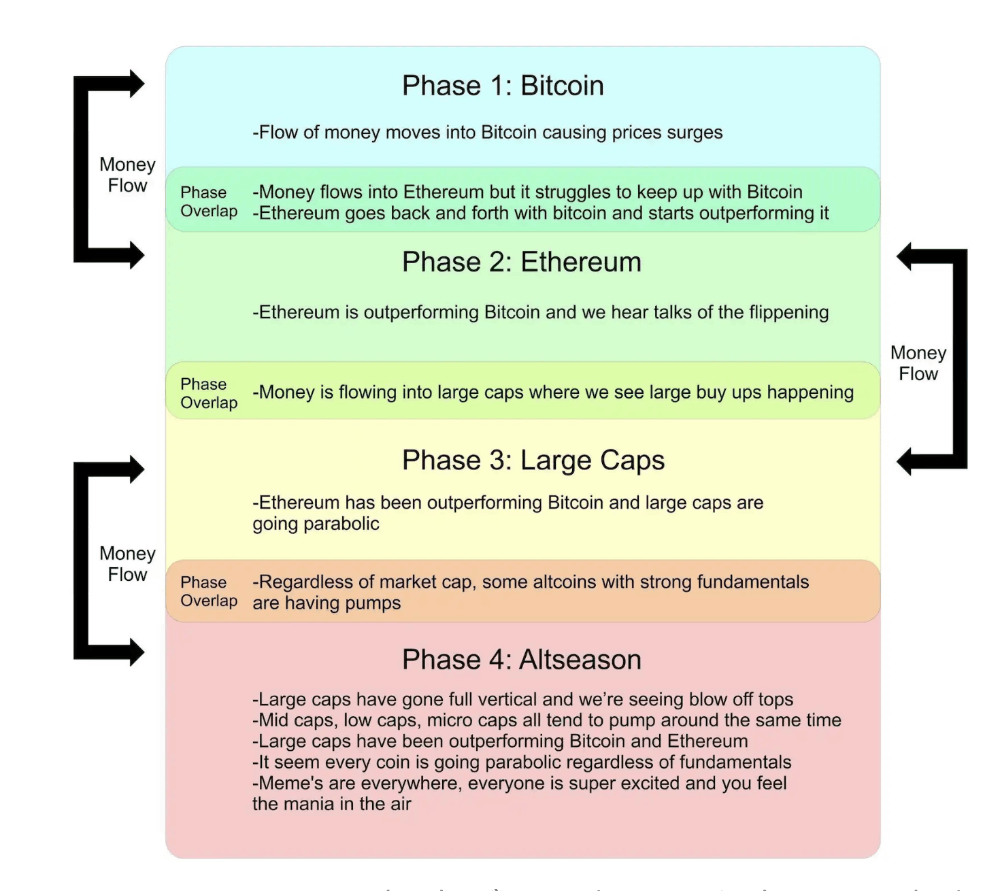

Regarding cash flow, after Bitcoin increases strongly, cash flow often moves to other coins with lower capitalization such as Ethereum and large-cap altcoins, before moving on to midcap altcoins (midcap altcoins) and low-cap altcoins (lowcap altcoins).

This phenomenon is called altcoin season. Finally, the money flow stopped at meme coins, implying that the market had peaked and was about to plummet. However, all this seems to be changing.

Bitcoin hits ATH before Halving

On March 5, 2024, Bitcoin created a new peak on some exchanges about 30 days before the Halving. This has never happened in history. It creates shock for many investors, especially those who rely on historical data to trade.

Bitcoin's growth this time is mainly driven by Bitcoin ETFs investment funds. These funds allow traditional investors to convert a small percentage of their portfolios into Bitcoin.

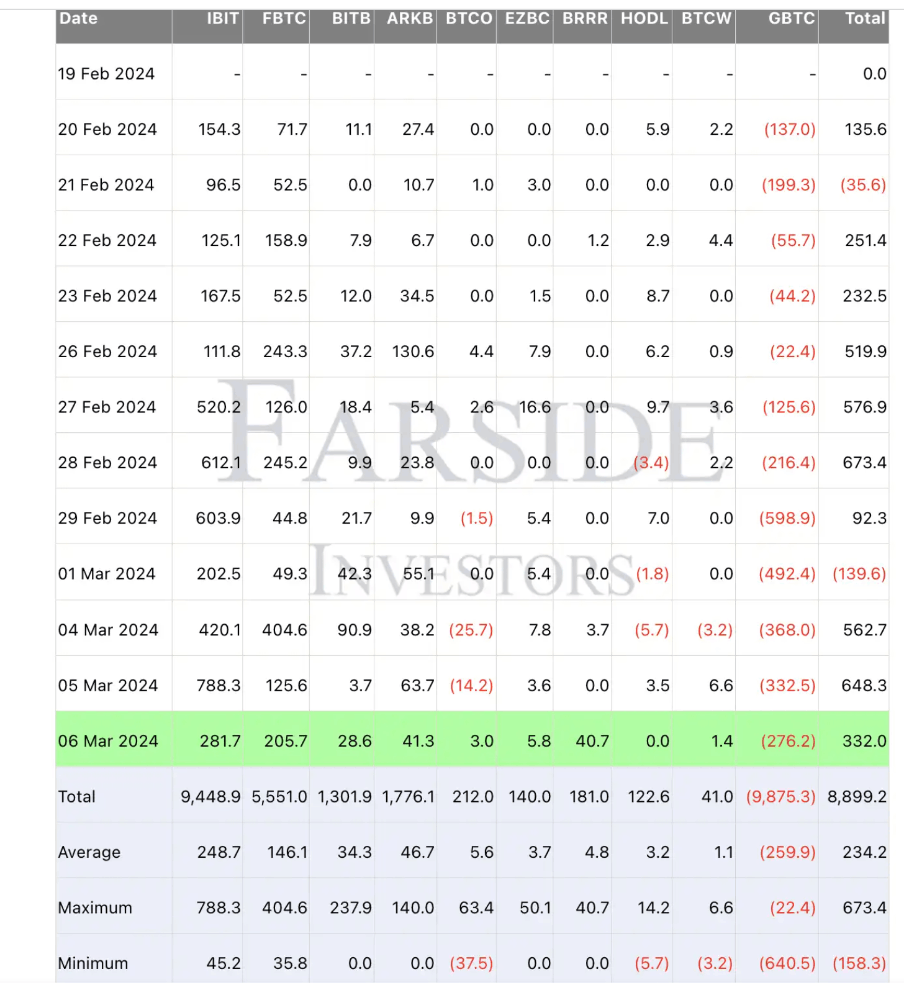

Bitcoin has a total supply of 21 million, with 900 Bitcoins mined every day. This number reduces to 450 Bitcoins after the next Halving. Meanwhile, an average of 5,378 BTC was purchased each day from February 20 to March 6 by Bitcoin ETFs.

According to data from Blockworks (here), Bitcoin ETFs are holding 4% of the total Bitcoin supply. If Bitcoin demand from Bitcoin ETFs increases, with a fixed supply, Bitcoin price could increase even more.

Many investors believe that Bitcoin price may be going faster than history, or this cycle will be larger than previous cycles. “This cycle's recovery and price increases are happening faster than in previous years. This speaks to the growing acceptance and trust of Bitcoin holders in the market.

Another possibility is that accelerated demand from the market, largely driven by Bitcoin ETFs, means this cycle will be larger than the last,” said Brett Munster, portfolio manager at Blockforce Capital. , shared with Forbes.

FOMO sentiment reached its peak but quickly faded when Bitcoin price plummeted 6.7% after just over an hour to reach a new peak.

Thus, Bitcoin price is running very differently from previous cycles, signaling a volatile future. Not only Bitcoin, the cash flow in the crypto market also has clear differences.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)