Future of crypto

Cryptocurrency investors were on edge when 2022 rolled in. The price of the leading token Bitcoin (BTC 0.58%) was up 61%, and Ethereum (ETH 0.4%) had climbed 409% over the previous year. But the last massive surge in 2017 was followed by an ice bath in 2018, and the leading coins started to trend downward in November 2021. Was the crypto market headed for another sharp correction?

As it turns out, the mostly positive market momentum of 2021 was overwhelmed by bearish trends in the spring of 2022. The stock market dipped due to surging inflation, Russia's invasion of Ukraine, and other macroeconomic challenges. Cryptocurrencies followed suit, falling back much faster than the S&P 500 in this period.

The 2023 calendar may answer some important questions that were left unanswered in previous years, setting the course for cryptocurrencies and their investors for the long run. Here's what to expect.

Crypto market predictions for 2023

It's impossible to say exactly what will happen to the cryptocurrency market in 2023 and beyond. There are still more questions than answers. But by keeping an eye on a few overarching themes of crypto, you will be able to make better investing decisions as the market continues to evolve.

You should pay particularly close attention to a handful of crucial details:

- Regulation in the U.S. and abroad.

- Mass-market adoption of cryptocurrency payments.

- Exchange-traded funds based on Bitcoin and other digital currencies.

- Countries adopting Bitcoin (or other digital currencies) as legal tender.

Exchange-Traded Fund (ETF)

An exchange-traded fund, or ETF, allows investors to buy many stocks or bonds at once.

As these issues develop and are resolved, the long-term future of the cryptocurrency sector will take shape. The picture may start to crystallize by the end of 2022 as governments and blockchain developers hammer away at their long-term crypto plans.

Even so, a series of baby steps that started with Bitcoin's creation in 2009 are likely to continue for many more years.

Why cryptocurrency could be the future of money

In one best-case scenario for 2023 and beyond, regulators around the world might come together on a global framework for crypto regulation. However, that looks unlikely today since international views of crypto range from, "Bitcoin is an official currency," in El Salvador and the Central African Republic to, "Crypto transactions are illegal," in China. Global unity on the issue seems unlikely in the short term.

Crypto regulations are moving forward on a federal level, though. The Biden administration has put together a highly qualified team to steer the cryptocurrency regulation process led by U.S. Treasury Secretary Janet Yellen and Gary Gensler, chairman of the Securities and Exchange Commission. Yellen has been tracking the sector for years, although sometimes taking a skeptical view. Gensler taught classes on Bitcoin, blockchains, and other cryptocurrency topics at the Massachusetts Institute of Technology in 2018.

SEC (Securities and Exchange Commission)

The SEC, or Securities and Exchange Commission, is an independent government agency responsible for ensuring the integrity of the capital markets in the United States.

Alert: The highest cash back card we've seen now has 0% intro APR until nearly 2025

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. In fact, this card is so good that our experts use it personally. Click here to read our full review for free and apply in just 2 minutes.

See Full Review

Note: While it doesn't influence our opinions, we may receive compensation from products appearing here.

With highly knowledgeable people setting the tone for future regulations, there's hope that a workable system can be developed for investors, consumers, cryptocurrency businesses, and traditional banks. Informed regulators will understand crucial and meaningful issues such as the differences between a value storage system such as Bitcoin and a sophisticated ledger with smart contracts such as Ethereum. Congress introduced a few crypto regulation bills in the first half of 2022, but the wheels of bureaucracy move slowly, and this issue deserves some deep thinking and careful analysis.

As government entities work out a legal framework and taxation system, cryptocurrencies could find their way into the digital wallets of U.S. consumers on a large scale. But even though Bitcoin became legal tender in El Salvador in 2021 and the Central African Republic in 2022, the U.S. isn't likely to follow suit anytime soon.

However, many retailers are likely to start accepting payment in cash-like digital currencies such as Bitcoin, Litecoin (LTC -0.53%), or the clone of a clone of Bitcoin known as Dogecoin (DOGE 0.95%). Increased use of crypto should spur regulatory agencies and politicians to take faster action, and the blockchain systems should also benefit from widespread usage.

The processes will percolate through the crypto market over the next few years. Investors can't stand uncertainty, so even an overly strict regulatory framework is likely to be an improvement over today's ramshackle oversight.

Why cryptocurrency may not be the future of money

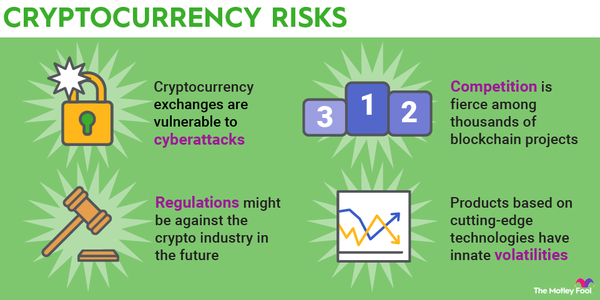

A brighter future could be delayed in several ways:

- Policymakers may drag their feet and fail to reach a sensible regulatory framework in the next couple of years.

- They could decide that currencies such as Bitcoin and Litecoin only serve illegal activities and bad actors, and that none of that activity belongs on U.S. soil.

- Retailers might balk at the unpredictable value of digital currencies and insist on traditional cash or credit card transactions instead.

- A sudden rash of security breaches, failing technology platforms, and other threats to the security of blockchain-based payment systems could undermine public trust in digital currencies. For example, algorithmic stablecoins got a bad rap after the collapse of TerraUSD (USDT 0.03%) in April 2022.

Related Crypto Topics

Is Cryptocurrency a Good Investment?

What Is the Next Cryptocurrency to Explode in 2024?

Learn about the leading cryptos that are next to explode this year.

Investing in Bitcoin ETFs

We look at a handful of Bitcoin-oriented ETFs designed to save you time while making you money.

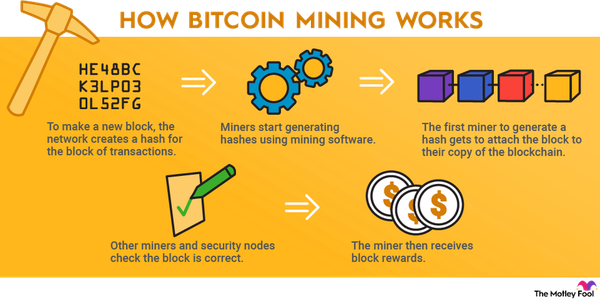

How to Mine Cryptocurrency

Like physical mining, cryptocurrency mining can be difficult, requires large capital expenditures, and is occasionally lucrative.

Under any combination of these circumstances, the digital currency revolution could be delayed by several years. And, assuming it finally does arrive, it might look very different from the Bitcoin-led sea change that surged in 2021. In the very long run, it seems unlikely that any government or group of nations will stop the cryptocurrency idea entirely, but they can slow down the movement and steer the final product in various directions.

These risks might sound hypothetical, but they are very real. In the end, the cryptocurrency community must get along with regulators around the world. Failing to do so could throw massive roadblocks in front of the digital currency sector's progress.

That's why you shouldn't bet the farm on Bitcoin, Ethereum, or crypto in general. This market tends to move in mysterious and unpredictable ways, skyrocketing one year and crashing down in the next. Informed investors want to build a diversified portfolio for the long run that is able to withstand dramatic setbacks in any particular sector.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

And right now, we’re offering a limited-time 60%-off New Year's discount to new Stock Advisor members who join today.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has nearly quadrupled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 20, 2023

Anders Bylund has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.

Our credit card experts use this card, and it could earn you $1,306 (seriously)

This top-rated card has one of the highest cash back rates we’ve seen (up to 5%), offers 0% interest on purchases and balance transfers for 15 months, and still sports a $0 annual fee.

Those are just some reasons why our experts signed up for this card after reviewing it. And remember: Credit cards protect against fraud better than debit cards and can help you raise your credit score when used properly. Note: While it doesn’t influence our opinions, we may receive compensation from products appearing here.

View the Credit Card >

INVEST SMARTER WITH THE MOTLEY FOOL

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

MOTLEY FOOL INVESTING PHILOSOPHY

- #1 Buy 25+ Companies

- #2 Hold Stocks for 5+ Years

- #3 Add New Savings Regularly

- #4 Hold Through Market Volatility

- #5 Let Winners Run

- #6 Target Long-Term Returns

Why do we invest this way? Learn More

RELATED ARTICLES

3 Reasons Toast's Stock Could Soar Higher in 2024 (and 1 Reason It Might Struggle)

3 Reasons Toast's Stock Could Soar Higher in 2024 (and 1 Reason It Might Struggle) Here's Why Nvidia and AMD Are Set to Skyrocket in 2024

Here's Why Nvidia and AMD Are Set to Skyrocket in 2024 These 3 Overrated Artificial Intelligence (AI) Stocks Could Crash in 2024

These 3 Overrated Artificial Intelligence (AI) Stocks Could Crash in 2024 2 Stocks to Buy Hand Over Fist Before the Nasdaq Soars Higher in 2024

2 Stocks to Buy Hand Over Fist Before the Nasdaq Soars Higher in 2024 Almost Half of Warren Buffett-led Berkshire Hathaway's $370 Billion Portfolio Is Invested in Only 1 Stock

Almost Half of Warren Buffett-led Berkshire Hathaway's $370 Billion Portfolio Is Invested in Only 1 Stock Better Artificial Intelligence (AI) Stock for 2024: Nvidia vs. Microsoft

Better Artificial Intelligence (AI) Stock for 2024: Nvidia vs. Microsoft Worried About Risks to ASML Stock in 2024? Don't Overlook This Small-Cap Chip Stock.

Worried About Risks to ASML Stock in 2024? Don't Overlook This Small-Cap Chip Stock.

MOTLEY FOOL RETURNS

Market-beating stocks from our award-winning analyst team.

Market-beating stocks from our award-winning analyst team.

STOCK ADVISOR RETURNS

544%

S&P 500 RETURNS

139%

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Returns as of 01/01/2024.

Discounted offers are only available to new members. Stock Advisor list price is $199 per year.

Cumulative Growth of a $10,000 Investment in Stock Advisor

Calculated by Time-Weighted Return since 2002. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Our Guides

Investing in Ethereum

Investing in Ethereum What is Ripple?

What is Ripple? How Does Cryptocurrency Work?

How Does Cryptocurrency Work? What is the Overall Cryptocurrency Market Cap?

What is the Overall Cryptocurrency Market Cap? How are Cryptocurrency Prices Determined?

How are Cryptocurrency Prices Determined? Crypto vs. Stocks: What Should I Invest In?

Crypto vs. Stocks: What Should I Invest In? What Are Risks of Trading Cryptocurrencies?

What Are Risks of Trading Cryptocurrencies? Fiat vs Crypto: How Crypto Will Affect Money Printing

Fiat vs Crypto: How Crypto Will Affect Money Printing Virtual Currency Transactions: What They Are and How They Work

Virtual Currency Transactions: What They Are and How They Work Why do Cryptocurrencies Have Buy and Sell Walls?

Why do Cryptocurrencies Have Buy and Sell Walls? What Does 'To The Moon' Mean in Cryptocurrency?

What Does 'To The Moon' Mean in Cryptocurrency? How to Create a Well-Balanced Crypto Portfolio

How to Create a Well-Balanced Crypto Portfolio How Much Are Cryptocurrency Transaction Fees?

How Much Are Cryptocurrency Transaction Fees? Investing in Eco-Friendly Cryptocurrencies

Investing in Eco-Friendly Cryptocurrencies Is Cryptocurrency a Good Investment?

Is Cryptocurrency a Good Investment? What Is Shiba Inu Coin Cryptocurrency?

What Is Shiba Inu Coin Cryptocurrency? How to Safely Store Cryptocurrency

How to Safely Store Cryptocurrency Investing in Cryptocurrency ETFs

Investing in Cryptocurrency ETFs How Is Cryptocurrency Taxed? (2024 IRS Rules)

How Is Cryptocurrency Taxed? (2024 IRS Rules) Best Time to Buy Cryptocurrency

Best Time to Buy Cryptocurrency What Is Cryptocurrency? A Complete Guide to Crypto and Digital Currencies

What Is Cryptocurrency? A Complete Guide to Crypto and Digital Currencies Types of Cryptocurrency

Types of Cryptocurrency How to Invest in Cryptocurrency

How to Invest in Cryptocurrency What Is the Next Cryptocurrency to Explode in 2024?

What Is the Next Cryptocurrency to Explode in 2024? 9 Best Penny Cryptocurrencies to Watch Now

9 Best Penny Cryptocurrencies to Watch Now What Gives Bitcoin Value?

What Gives Bitcoin Value? Is Crypto Here to Stay?

Is Crypto Here to Stay? How Many Cryptocurrencies Are There?

How Many Cryptocurrencies Are There? When to Sell Crypto

When to Sell Crypto How to Mine Cryptocurrency

How to Mine Cryptocurrency Why Should You Use Crypto?

Why Should You Use Crypto? Investing in Cryptocurrency Mutual Funds

Investing in Cryptocurrency Mutual Funds Investing in Cryptocurrency Index Funds

Investing in Cryptocurrency Index Funds How Does Bitcoin Mining Work?

How Does Bitcoin Mining Work? Investing in Gaming Coins

Investing in Gaming Coins Investing in Bitcoin ETFs

Investing in Bitcoin ETFs What Is Peercoin?

What Is Peercoin? What Is Dogecoin? Should You Invest?

What Is Dogecoin? Should You Invest? How to Spot a Pump-and-Dump Cryptocurrency Scam

How to Spot a Pump-and-Dump Cryptocurrency Scam What Is Bitcoin? Should You Invest?

What Is Bitcoin? Should You Invest?

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Making the world smarter, happier, and richer.

© 1995 - 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.

ABOUT THE MOTLEY FOOL

OUR SERVICES

AROUND THE GLOBE

FREE TOOLS

OUR AFFILIATES

- Motley Fool Asset Management

- Motley Fool Wealth Management

- Motley Fool Ventures

- 1623 Capital

- Terms of Use Privacy Policy Disclosure Policy Accessibility Policy Copyright, Trademark and Patent Information Terms and Conditions Do Not Sell My Personal Information

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)