Top 3 Altcoins to Watch Out for in 2024: A Simple Technical Analysis

More than $2 billion have been wash traded through decentralized exchange (DEX) liquidity providers since 2020, reports Solidus Labs.

More than 20,000 tokens saw their prices and volumes manipulated.

Out of 30,000 DEX liquidity pools in Solidus Labs sample, not only LPs have executed wash trades in 67% of them, but wash trading amount to no less than 13% of their total trading volume.

These mind-blowing figures are estimated to be on the “lower bound,” at that, by the Solidus Team!

Wash trading scandals have splattered every prominent actors of the crypto space.

But usually those are associated with centralized entities like centralized exchanges rather than the decentralized sphere.

The Centre for Economic Policy Research (CEPR) unveiled in its April 2023 analysis, that over 70% of reported volume on unregulated crypto exchanges consists of wash trading, with some newly established exchanges faking more than 90% of the reported volume.

That was also the case for a rug pull we uncovered and that lasted for years: ZB Exchange.

The Solidus Labs report highlights though that wash trading is also a rampant phenomenon in DeFi.

So who is doing what, how and where?

W

ash trading is a deceptive trading practice where an investor simultaneously buys and sells the same financial instruments to create the appearance of active trading and increase the trading volume artificially.

This practice is considered illegal and unethical in most financial markets because it can mislead other investors, manipulate market prices, and create a false sense of liquidity.

For Solidus Labs, the crypto space reunites the pefect conditions to become a wash trading paradise:

“[…]liquidity is fragmented across a variety of centralized and decentralized venues, resulting in smaller markets that are easier to manipulate.”

Crypto exchanges may fake transaction volume to attract liquidity, investment and customers, especially in the first stages of their creation, as we saw earlier.

Sellers of NFTs wash trades to create the impression that the assets are more in-demand than they truly are. Wash trades accounted for half the NFT sales on Ethereum and flood Blur marketplace in 2023. Creating a totally ringed NFT landscape.

Market makers also engage in wash trading! Solidus underlines that they do so to meet order-to-trade ratio requirements outlined in contracts with centralized exchanges and token issuers. Additionally, they might employ this deceptive practice to maintain a token’s market price above the strike price of a call option negotiated with the token’s issuer. Wash trading can create a false appearance of market activity and liquidity, influencing both contractual obligations and options pricing.

For CEX, market makers and NFT sellers DeFi liquidity pools are not either a possible or rewrding washing strategy.

CEX and market makers would be remiss if they do not choose to use centralized entities where they can “wash trade at a no cost or a lower cost,” says Solidus Labs.

A certain type of actors though would see all of their washing trade needs met in LPs.

Who Wash Trades on LPs

One type of entity has made of LPs their wash trading spot: token deployers!

According to Solidus Labs, token deployers engage in wash trades to “trick traders into investing in rug pulls, qualify for listings on centralized exchanges, and/or mislead investors about their project’s health.”

If token deployers, “legit” and scammy ones, use LPs although the transaction fees are higher and the trades are executed on-chain rather than off-chain and for lower fees on CEXs, its because they don’t really have the choice, really.

In a bid to safeguard their reputation and also their users main CEXs, most of the time, try to stear away from scam tokens, so for a token to be listedon their platform it has to go through hoops and loops.

One such a CEX gained a reputation for (almost) only listing legit token through an enhance screening process, it is Binance.

Being listed on Binance can make the value of a cryptocurrency jump from 20 to 200%.

This phenomenom has even been dubbed the “Binance Effect.”

A January 2023 study led by

Ren & Heinrich

revealed that, on average, newly listed tokens on Binance would see their price spike of 41%.With even more bountiful cases, like in December 2023, when meme coin Satoshi saw a 140% price surge within hours of Binance announcing it would list the token.

Getting listed on CEX is the ultimate goal of most token deployers.

But to do so they must first “prove themselves” on DEX liquidity pools, that are their first, if not only, listing venue.

To be able to attract attention from retail investors and whales, to web3 powerhouse, you need to be seen. The only way to be seen for a token is to bring in volume.

If your token is not from a well-established web3 entity, you do not have the necessary useful and well connected crypto people in your address book or don’t have the means to invest in a widespread marketing strategy, the possibility of getting the necessary traction is close to non-existent.

Resorting to wash trading, especially for scam tokens, becomes a must-do.

Now, how do they do it?

Modus Operandi

Solidus Labs identified two distinc modus operandi in their report:

The A-A wash trading MO Source: Solidus Labs

Source: Solidus Labs

$960 million worth of A-A wash trades were registered since September 2020 by Solidus.

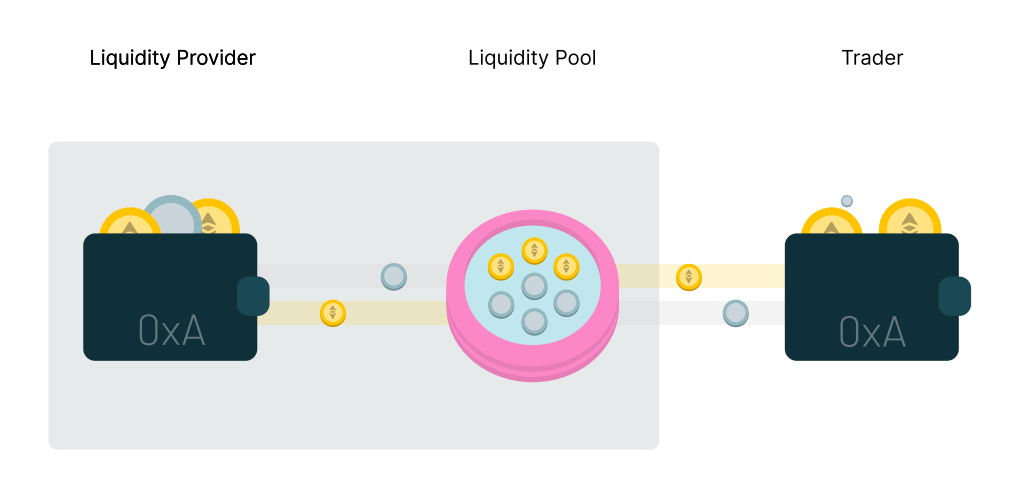

It consists in a wash trader at address ‘0x1’ pulling off a dual role: playing the liquidity provider and the sly swapper in token swaps.

Basically, funds jump back and forth through a single crypto address during a token swap.

This one-player show manipulates prices and volumes of less-established tokens without any change in ownership, crafting a symphony of artificial market signals.

The Multi-party wash trading MO Source: Solidus Labs

Source: Solidus Labs

Approximately $1.1 billion worth of multi-party wash trades were registered since September 2020 by Solidus.

As it is clearly portrayed in the schema, opposedly to A-A trade, multi-party wash trading involves mutliple wallets controlled by the same wash trader.

The liquidity provider struts under 0x1’s spotlight, while 0x2, 0x3, and 0x4 slyly masquerade as individual swappers, swapping tokens and orchestrating a grand illusion of bustling trade.

Allowing the fraudster to dodge detection and paint a deceptive picture of a thriving investor crowd clamoring for the token.

To illustrate this strategy, Solidus deep dived into the Shibafarm token case, whose deployer raked in nearly $2 million in profits within a mere two-hour timeframe in May 2021.

Using the multi-party wash trading strategy, Shibafarm deployer ingeniously orchestrated a network of “25 distinct traders.”

These traders executed over 30 token swaps, contributing to a whopping 40% surge in trading volume and a subsequent spike in the Shibafarm price. Simultaneously, the deployer cunningly thwarted potential token sellers by deploying a Honey Pot smart contract, locking it in all the ill-acquired funds. Source: Solidus Labs

Source: Solidus Labs

In between rampant insider trading, never-ending blockchain security failures, fraud projects, ponzinomics and wash trading among many other things plaguing the DeFi space, it has many challenges to take on.

But Solidus Labs say this challenge is one they could take on easily!

It suffices for DeFi actors to implement A-A and multi-party wash trading detection tools, which would be able to report if not prevent them from happening.

So what is DeFi waiting for?

Maybe the same thing that spurred wash trading prevention and detection efforts among their centralized counterparts: regulatory bodies coming knocking at their doors!

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)