How to get Blast Airdrop

Blast Main Page — Here’s How and Why You Should Focus on Blast During this Bullrun

Blast Main Page — Here’s How and Why You Should Focus on Blast During this Bullrun

With the goal of resolving concerns with transaction speed and cost on the Ethereum mainnet, Blast is a recent addition to the Ethereum Layer 2 (L2) scaling solution scene.

Since late 2023, Blast has been offering bridging crowd loans, which lock your Ethereum for three months prior to the mainnet’s release.

After the launch of the Blast mainnet, users can still take advantage of a lot of airdrop opportunities by interacting with the Blast ecosystem.

In order to help readers engage with the dapp in the Blast Ecosystem and qualify for the upcoming airdrop, I’m creating a comprehensive, step-by-step tutorial.

Here’s a quick summary of Blast L2:

- Consider it a highway: The Ethereum mainnet is clogged with costly and delayed transactions, much like a busy city street. Transactions can move more quickly and affordably thanks to Blast L2’s role as a distinct highway.

- Optimistic Rollup Technology: Blast makes use of optimistic rollups, just like other L2 systems. By processing transactions off-chain, or outside of the mainnet, transaction speed and cost are greatly increased. For ultimate settlement, the network is dependent on the Ethereum blockchain’s security.

- Indigenous Yield: Blast stands out in part because of its emphasis on “native yield.” This implies that users that keep specific cryptocurrencies in their Blast wallets, including as ETH, USDC, USDT, and DAI, may be eligible to receive incentives.

- Debate: The main idea behind Blast is that ETH, or the stable coin known as USDB, will give a 3–5% annual return. Certain people are skeptical about the concept of “native yield” and doubt its long-term viability. Before using Blast, it’s imperative that you do your own study and comprehend any potential risks.

Advantages:

- Faster and Cheaper Transactions: Compared to the Ethereum mainnet, off-chain transactions may be completed much more quickly and affordably.

- Passive Income: Rewarding users through native yield may be a compelling perk.

Considerations:

- Early Stage: Since this is a new initiative, now is an opportune moment to contribute to the Blast ecology.

- Concerns over Native Yield: The long-term durability of the “native yield” paradigm requires further observation and study.

- Other Opportunities: While Blast has a high TVL, it is worth noting that there are other airdrop opportunities that require your attention, such as Mode, Scroll, or LayerZero.

To activate your blast point account, you will need an invite code and a bridge. Here’s the link to activate your Blast account: blast.io/NB5YI

To activate your blast point account, you will need an invite code and a bridge. Here’s the link to activate your Blast account: blast.io/NB5YI

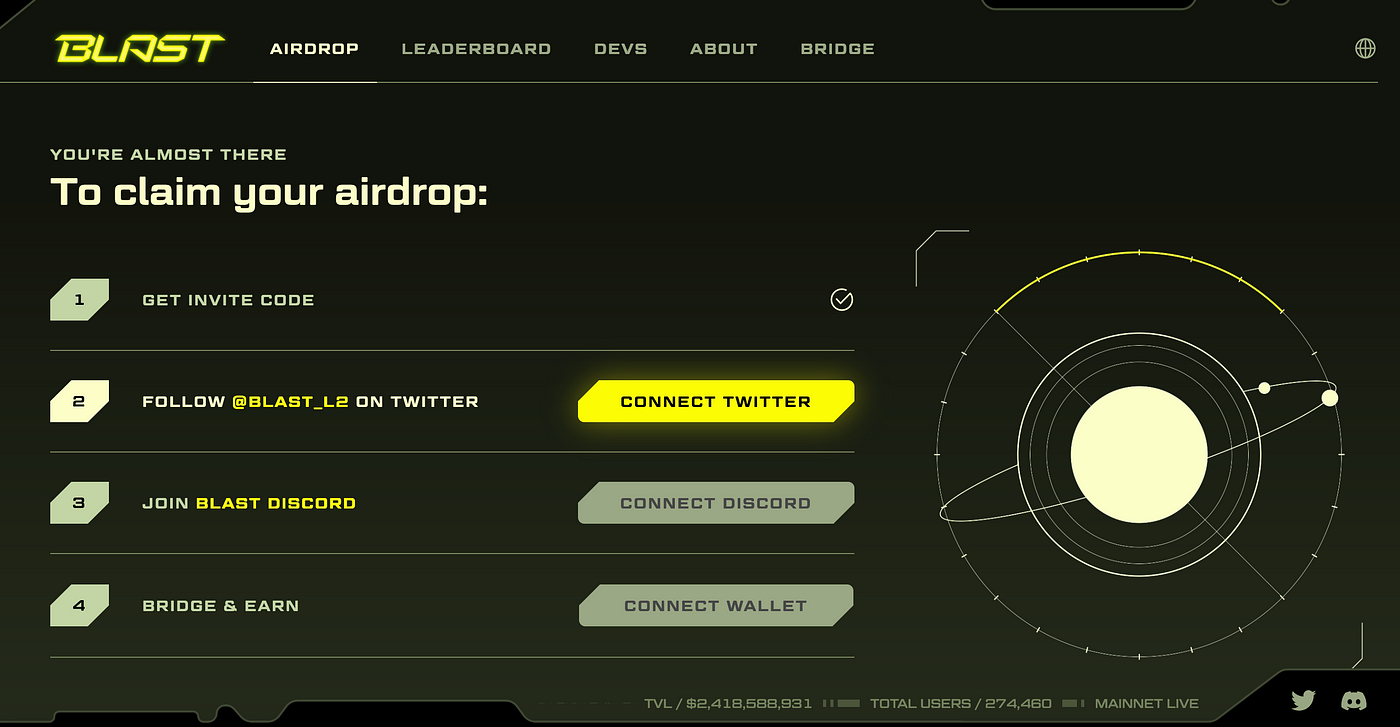

How to interact and bridge with Blast:

1. Connect to the Blast Ecosystem: blast.io/NB5YI

Invite code: NB5YI

2. Follow @Blast_L2 on Twitter.

3. Follow Blast Discord

4. To use the Blast Bridge, transfer 0.05 ETH to the Blast Ecosystem.

After you’ve bridged from the official bridge, you can add more ETH and stablecoins to the Blast Ecosystem by using the following bridges to save gas fees:

Rhino.fi — https://app.rhino.fi/?ref=6A83687425

Rhino.fi (formerly DeversiFi) is a platform that connects people to various DeFi options across multiple blockchains in one place. It allows you to buy, trade, and transfer assets between different chains. Essentially, Rhino.fi simplifies DeFi by offering a common location for exploring DeFi potential across several blockchains.

Meson — https://meson.fi/

Meson was originally established as a protocol multi-chain bridge for stable coins. Swaps were quick, had a modest price impact, and used a zero-free protocol. They now charge a minimal price, and we expect an airdrop for Meson this year.

Orbiter — https://www.orbiter.finance/

Orbiter is a multichain protocol bridge that provides a point system. Orbiter had made vague promises to launch its own chain in the future.

Which Dapp in Blast will host potential Airdrops?

Once you’ve connected ETH to Blast, the next step is to interact with the Blast ecosystem to earn Blast Points. There are two ways to get Blast Points. Simply hold native ETH and USDB to gain daily points and yield, but you will miss out on dapp airdrops. Here are some intriguing airdrop protocol users to connect with.

SynFutures — Ref: https://oyster.synfutures.com/#/odyssey/L0ZCG

SynFutures Market is a decentralized derivatives marketplace. It employs a unique technology known as the Oyster AMM, which combines order book and AMM capabilities to provide efficient trading for cryptocurrency derivatives. SynFutures now operates on a points program. In addition to APY, you can now earn Blast points, Blast Gold, and SynFutures points by investing in the liquidity pool.

Blast Name Service — https://app.blastns.org/?ref=717D99D79F (Must do, very easy)

Blast Name Service is a domain service within Blast. Create your own.blast domain for a low cost. An airdrop is expected to occur soon. Use my link above to receive a 5% discount.

BladeSwap — https://app.bladeswap.xyz/hG3k15

BladeSwap operates as a cryptocurrency exchange. It describes how to buy and sell bitcoin using liquidity pools and swapping methods. BladeSwap’s Capsule system allows you to claim your daily and weekly treasure boxes based on your swap and liquidity contribution volume. I deposited wETH and USDB in the liquidity pool to take advantage of the current 100% APR.

Juice — https://app.juice.finance/leaderboard?inviteCode=32580f

Juice is a loan procedure in Blast that focuses on overleveraged farming. Users can deposit wETH or USDB to interact with the DEX pool via the Juice protocol.

Ring — https://ring.exchange/#/earn

Ring Swap is a decentralized crypto trading technology that allows users to swap tokens, earn fees for supplying liquidity to pools, and engage in yield farming. It is supported by Ring Labs.

Blume — https://blume.fm/#/core-pool

Blume is a lending procedure in Blast. Currently, only USDB and WETH pools are accessible for lending; no borrows are available currently.

Ambient — https://blast.ambient.finance/explore

Ambient handles the whole DEX through a single smart contract, resulting in speedier transactions, lower costs, and more liquidity incentives. It also supports both focused and ambient liquidity, as well as range and limit orders. Finally, the article discusses the advantages of Ambient for traders and liquidity providers.

Abracadabra — https://app.abracadabra.money/

Abracadabra.money is a DeFi platform that allows you to borrow USD stablecoins using your crypto holdings as collateral, allowing you to access cash without having to liquidate any assets. Consider borrowing cash using your cryptocurrency as collateral.

Blitz — https://app.blitz.exchange/portfolio/overview

Blitz is a lending platform on Blast that accepts USDB and WETH as collateral. Borrowing is currently unavailable, however it would be in your best interests to invest a little sum of ETH in the protocol.

Conclusion:

Blast L2 takes a novel approach to Ethereum scaling, focusing on speed, cost, and native yield. I’ll divide the content into two sections. The first will discuss how to connect ETH to the Blast Ecosystem. Unlike Stark, which emphasizes on developers, the Blast team paid Dapps with 50% Blast Tokens for building in their ecosystem. This is a fantastic step since it encourages the Blast community to utilize the Blast protocol. Good luck to all airdrop seekers, and I hope Blast rewards you richly during this bull market. I plan to cover additional possible airdrops in the future.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

- End

Written by DeFi Secret

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)