Better Ways to Manage Your Crypto and Fiat

The integration of cryptocurrencies into the traditional financial system has introduced new opportunities and challenges for managing wealth. Whether you're a seasoned investor or just starting out, effectively managing both crypto and fiat currencies requires a strategic approach.

This article provides a sophisticated guide on how to optimize the management of your digital and traditional assets, ensuring financial stability and growth.

Understanding the Fundamentals: Differentiating Crypto and Fiat Management

The Nature of Fiat Currency Management

Stability and Regulation: Fiat currencies, like the US dollar or the euro, are government-issued and backed by central banks. This backing provides a level of stability and predictability, making fiat ideal for day-to-day transactions and long-term savings.

Inflation and Interest Rates: Fiat currencies are subject to inflation and interest rate changes, which can erode purchasing power over time. Effective management involves staying informed about macroeconomic trends and adjusting strategies accordingly.

The Volatility and Potential of Cryptocurrencies

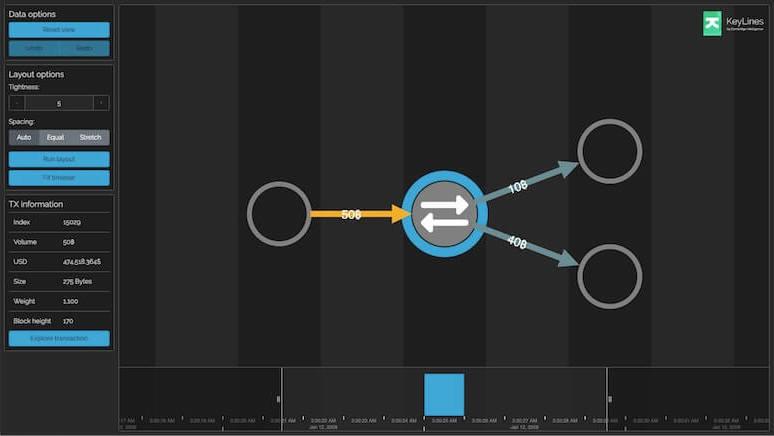

Decentralization and Innovation: Cryptocurrencies operate on decentralized networks, free from government control. This autonomy offers the potential for high returns, particularly in emerging markets, but also comes with significant volatility.

Market Dynamics: The value of cryptocurrencies is influenced by factors such as technological advancements, regulatory changes, and market sentiment. Understanding these dynamics is crucial for making informed investment decisions.

Diversification: Balancing Crypto and Fiat Assets

One of the most effective strategies for managing wealth in both crypto and fiat is diversification. By spreading investments across different asset classes, you can mitigate risks and capitalize on growth opportunities.

The Role of Asset Allocation

Strategic Allocation: A balanced portfolio typically includes a mix of fiat-based investments (such as bonds, stocks, and savings accounts) and cryptocurrencies. The specific allocation depends on individual risk tolerance, financial goals, and market conditions.

Rebalancing: Regularly reviewing and adjusting your portfolio ensures that it remains aligned with your financial objectives. Rebalancing involves shifting assets between fiat and crypto to maintain the desired level of risk and return.

Investing in Stablecoins and Other Crypto Assets

Stablecoins as a Bridge: Stablecoins, which are cryptocurrencies pegged to fiat currencies, offer the stability of traditional money with the flexibility of digital assets. They can serve as a hedge against crypto volatility while providing liquidity in digital markets.

Exploring Diverse Crypto Assets: Beyond Bitcoin and Ethereum, consider exploring altcoins and decentralized finance (DeFi) projects that offer innovative solutions and potential growth. However, due diligence is essential to avoid high-risk investments.

Security and Risk Management: Protecting Your Wealth

Managing both crypto and fiat assets requires a strong focus on security and risk management. The digital nature of cryptocurrencies, in particular, presents unique challenges that necessitate robust protective measures.

Safeguarding Fiat Assets

Traditional Banking Protections: Fiat assets benefit from established banking protections such as deposit insurance and fraud prevention. Regularly monitoring accounts and leveraging banking tools like alerts and transaction limits can enhance security.

Inflation Hedging: To protect against inflation, consider investing in assets that traditionally perform well in inflationary environments, such as real estate, commodities, or Treasury Inflation-Protected Securities (TIPS).

Ensuring Crypto Security

Cold Storage Solutions: For long-term crypto holdings, cold storage solutions (offline wallets) provide the highest level of security against hacking and theft. Hardware wallets, in particular, are recommended for storing significant amounts of digital assets.

Two-Factor Authentication (2FA): Enabling 2FA on all crypto accounts adds an additional layer of security. This method requires not only a password but also a secondary form of verification, making unauthorized access more difficult.

Smart Contract Audits: When investing in DeFi projects or other crypto assets that rely on smart contracts, ensure that these contracts have been audited by reputable firms. This reduces the risk of vulnerabilities that could lead to financial loss.

Strategic Planning and Future-Proofing: Preparing for Market Changes

The financial landscape is continually evolving, especially in the realm of cryptocurrencies. Effective management of both crypto and fiat requires strategic planning and a forward-looking approach to ensure long-term financial health.

Tax Implications and Regulatory Considerations

Understanding Tax Obligations: Cryptocurrency transactions may be subject to capital gains tax, income tax, or other regulatory requirements. Consult with a tax professional to ensure compliance and optimize tax strategies.

Staying Informed on Regulation: The regulatory environment for cryptocurrencies is rapidly changing. Keeping abreast of new regulations and legal developments is essential for mitigating risks and capitalizing on opportunities.

Future-Proofing Your Portfolio

Embracing Technological Advancements: As blockchain technology and cryptocurrencies evolve, new opportunities will arise. Stay informed about technological advancements and consider integrating them into your financial strategy to remain competitive.

Long-Term Financial Planning: Incorporate both crypto and fiat assets into your long-term financial planning. This includes setting clear financial goals, developing a retirement strategy, and considering estate planning to ensure wealth preservation across generations.

Conclusion

Managing crypto and fiat currencies effectively requires a nuanced understanding of their differences, a commitment to diversification, and a focus on security. By strategically balancing your portfolio, safeguarding your assets, and preparing for future market changes, you can optimize your financial management in a rapidly changing economic landscape. The integration of cryptocurrencies into traditional finance offers unprecedented opportunities, but it also demands a sophisticated approach to ensure stability, growth, and long-term success.

References

CoinDesk - Understanding Stablecoins: The Future of Digital Payments

Forbes - How to Diversify Your Cryptocurrency Portfolio

Investopedia - Asset Allocation and Diversification Strategies

Protecting Your Wealth: Crypto Security Essentials

Bloomberg - The Evolution of Crypto Regulations and What It Means for Investors

Fiat Currency Management in a Digital Age

Balancing Risk and Opportunity in Cryptocurrency Investments

Financial Times - The Role of Cold Storage in Securing Crypto Assets

CryptoSlate - The Future of Decentralized Finance: Opportunities and Risks

CNBC - Tax Implications of Cryptocurrency Transactions: What You Need to Know