Perception and Fear of Risk in Financial Markets: A Deep Dive into Investment Psychology

Introduction: The Nature of Financial Markets and Risk

Financial markets, with their dynamic and constantly changing nature, present both opportunities and challenges for investors. A fundamental characteristic of these markets is the presence of risk. Risk is an integral part of the financial decision-making process and directly affects investment outcomes. In this blog post, we will explore the perception and fear of risk in financial markets, their psychological foundations, and their impacts on investor behavior.

The Psychological Foundations of Risk Perception

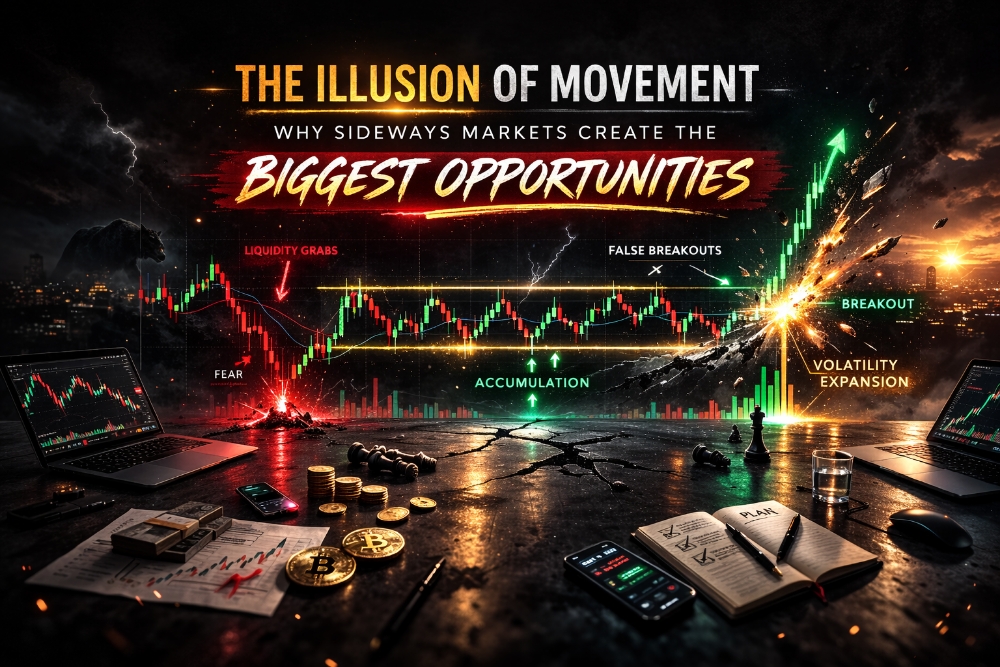

Risk perception varies from individual to individual and has a significant impact on investors' decisions. Behavioral finance suggests that investors often make irrational decisions and market trends can be influenced by these psychological tendencies. For instance, a past loss experience can increase an investor's risk perception in the future.

Sources of Market Fears

Fear in financial markets is often derived from economic uncertainties, past market crashes, and information presented by the media. Particularly, the role of media can amplify market movements or trigger investors' emotions, increasing risk perception.

Risk Management Strategies

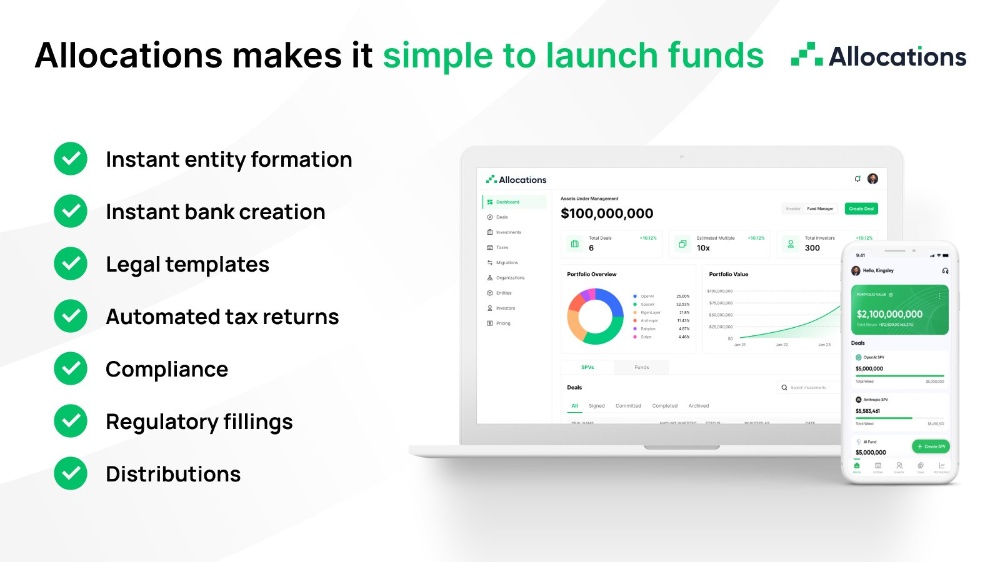

Risk management is one of the keys to success in financial markets. Diversifying a portfolio can spread risk and reduce potential losses. Hedging, on the other hand, can help limit potential losses. Additionally, techniques for stress management and emotional discipline are important to enhance investors' psychological resilience.

Balancing Risk and Return

Investors need to understand the balance between risk and return and set investment goals that align with their risk tolerance. Long-term planning and patience are fundamental components of risk management.

Understanding Investor Behavior

Investor behavior in financial markets can be influenced by psychological factors like FOMO (Fear of Missing Out). Decisions made at market peaks and troughs are often shaped by emotional reactions, leading to erroneous investment decisions.

Risk Management Approaches of Successful Investors

Successful investors typically employ disciplined risk management strategies and can make sound investment decisions even during crisis periods. Studying the strategies and advice of expert investors can be valuable in developing your own investment approach.

Conclusion: Conscious Investing and Accepting Risk

Accepting that risk is an inevitable part of financial markets is an important step in your investment journey. Knowledge and experience can help you make more informed decisions in risk management. In conclusion, achieving success in financial markets involves understanding risk and effectively managing it