Bitcoin Outlook Clouded by Falling Miner Reserves Ahead of April’s Halving

Bitcoin Outlook Clouded by Falling Miner Reserves Ahead of April’s Halving

- Amount of Bitcoin held by miners has declined of late

- Reserves drop may signal a headwind for Bitcoin’s price

By Sidhartha Shukla and David Pan

February 7, 2024 at 11:08 AM GMT+6

Save

Bitcoin miners are getting a jump on an anticipated decline in revenue from the so-called halving in April, when the blockchain’s network protocol will reduce rewards for verifying transactions by half.

Miner reserves — unsold Bitcoin held in digital wallets associated with the companies — have dropped by 8,400 tokens since the start of 2024 to 1.8 million, a level last seen in June 2021, according to data compiled by CryptoQuant. Analysts said the decrease indicates miners are selling tokens.

Have a confidential tip for our reporters? Get in Touch

Before it’s here, it’s on the Bloomberg Terminal

Up Next

Stocks Pare Gains as Traders Weigh China Support: Markets Wrap

More From Bloomberg

US Bitcoin Miners Use as Much Electricity as Everyone in Utah

US Bitcoin Miners Use as Much Electricity as Everyone in Utah End of An Era: Grayscale’s Once Double-Digit Bitcoin Fund Discount Evaporates

End of An Era: Grayscale’s Once Double-Digit Bitcoin Fund Discount Evaporates Bitcoin ETF Price War Is Trickling Down to Crypto Custodians

Bitcoin ETF Price War Is Trickling Down to Crypto Custodians UK Police Uncovered $1.7 Billion Bitcoin Linked to China Fraud

UK Police Uncovered $1.7 Billion Bitcoin Linked to China Fraud

Top Reads

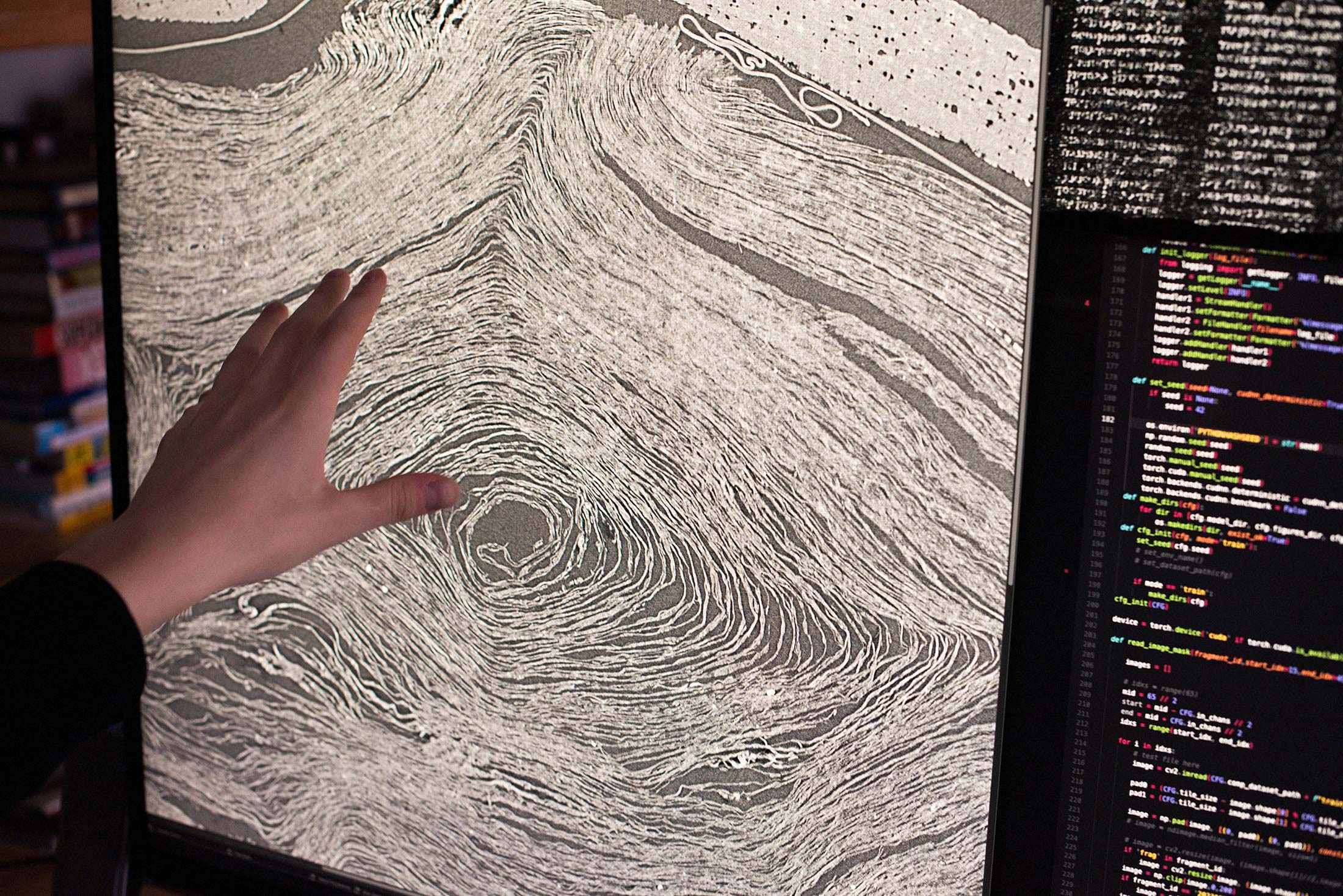

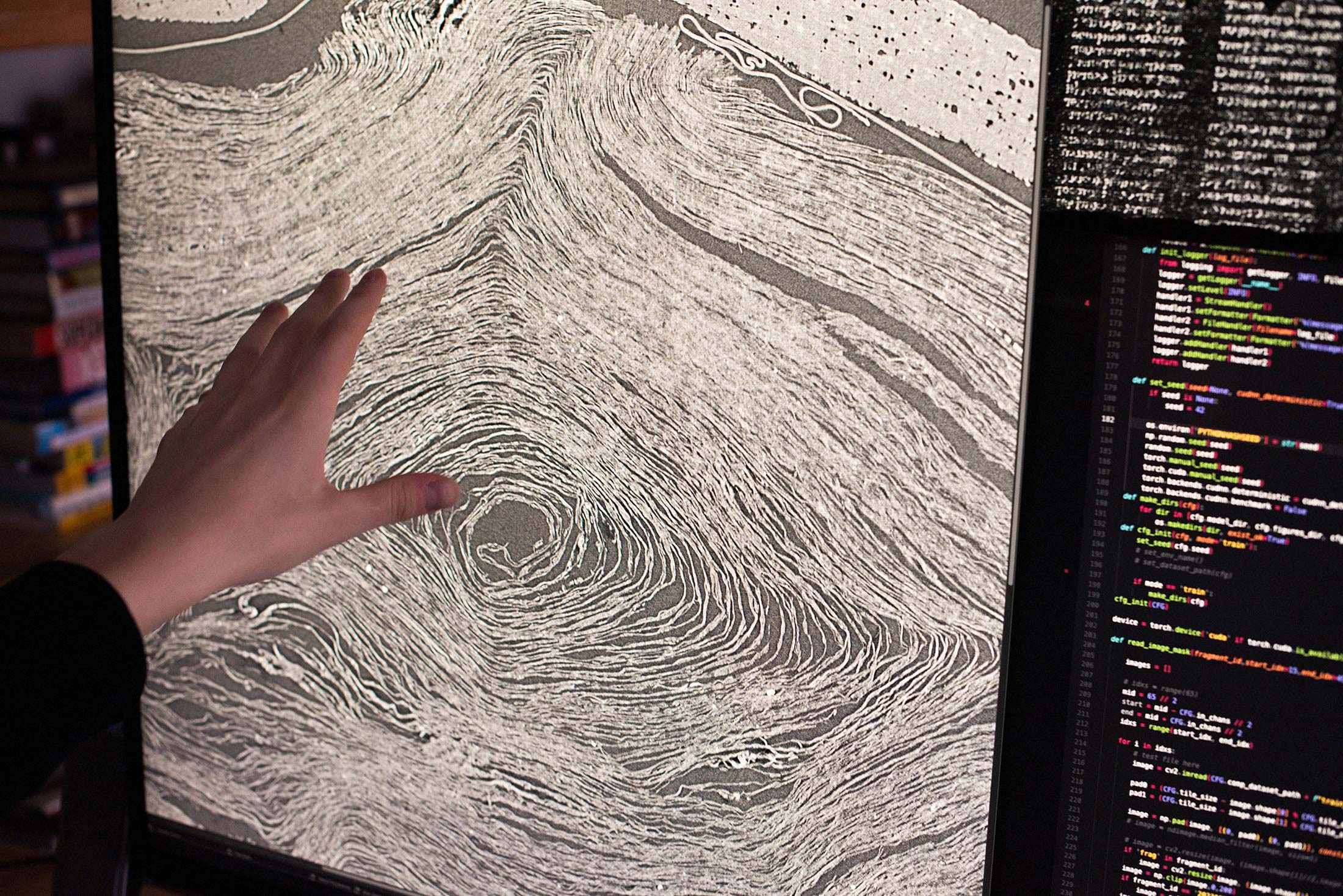

Can AI Unlock the Secrets of the Ancient World?

Can AI Unlock the Secrets of the Ancient World?

by Ashlee Vance and Ellen Huet Inside a Private Jet Club Where Everything Went Wrong

Inside a Private Jet Club Where Everything Went Wrong

by Brent Crane Why NYC Apartment Buildings Are on Sale Now for 50% Off

Why NYC Apartment Buildings Are on Sale Now for 50% Off

by Patrick Clark and Prashant Gopal Putin’s Posturing on NATO’s Doorstep Raises Alarm

Putin’s Posturing on NATO’s Doorstep Raises Alarm

by Alan Crawford, Aaron Eglitis, Ott Tammik and Milda Seputyte

For you

Based on your reading history and topics you follow

Trump Denied Immunity in DC Election Case by Appeals Court ‘Money Dysmorphia’ Traps Millennials and Gen Zers

‘Money Dysmorphia’ Traps Millennials and Gen Zers Wall Street Snubs China for India in a Historic Markets Shift

Wall Street Snubs China for India in a Historic Markets Shift NYCB Extends $4.5 Billion Stock Rout to Lowest Level Since 1997

NYCB Extends $4.5 Billion Stock Rout to Lowest Level Since 1997 Add more topics to your feed

Add more topics to your feed

Emerging Markets

Government

Infrastructure

Markets

Fixed Income

Politics

Regulation

Policy

Markets

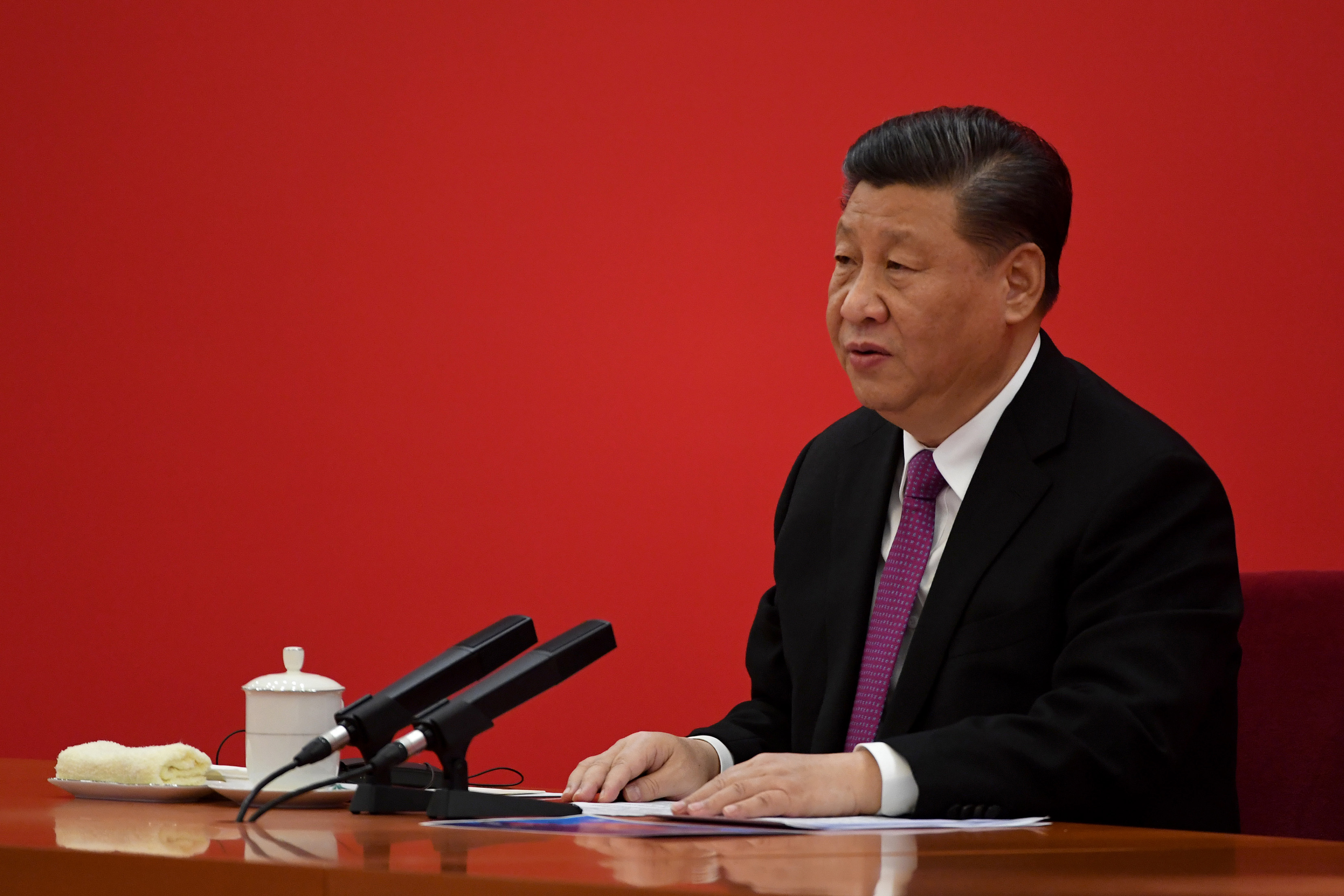

Stocks Pare Gains as Traders Weigh China Support: Markets Wrap

- Hong Kong stocks erase rally while China shares volatile

- Investors are gearing up for record sale of 10-year Treasuries

By Winnie Hsu

February 7, 2024 at 4:55 AM GMT+6

Updated on February 7, 2024 at 12:56 PM GMT+6

Save

Stocks in Asia came off their session highs as investors weighed the impact of China’s efforts to prop up the market and a slew of cautious remarks from Federal Reserve officials.

Shares in Hong Kong dipped while those on the mainland whipsawed before moving higher again, pointing to doubts over the potency of Beijing’s measures to stabilize the market. Volatility is likely big as Chinese markets are closed for a weeklong Lunar New Year holiday starting Friday.

Have a confidential tip for our reporters? Get in Touch

Before it’s here, it’s on the Bloomberg Terminal

Up Next

Stocks Pare Gains as Traders Weigh China Support: Markets Wrap

More From Bloomberg

Xi to Discuss China Stocks With Regulators as Rescue Bets Build

Xi to Discuss China Stocks With Regulators as Rescue Bets Build China Small-Cap Stocks Slump in Eighth Day of Declines

China Small-Cap Stocks Slump in Eighth Day of Declines China Stocks Post More Wild Swings After Beijing Stability Vow

China Stocks Post More Wild Swings After Beijing Stability Vow China Biotech Stocks Lag Benchmark Most in Four Years on US Bill

China Biotech Stocks Lag Benchmark Most in Four Years on US Bill

Top Reads

Meet the DIY Diggers Who Can’t Stop Making ‘Hobby Tunnels’

Meet the DIY Diggers Who Can’t Stop Making ‘Hobby Tunnels’

by Teresa Xie Record 2 Million Foreign Workers Are Changing the Face of Japan

Record 2 Million Foreign Workers Are Changing the Face of Japan

by Erica Yokoyama Japan’s Convenience Stores Can Span the Globe, 7-Eleven CEO Says

Japan’s Convenience Stores Can Span the Globe, 7-Eleven CEO Says

by Kanoko Matsuyama and Stephen Engle The US Can’t — and Shouldn’t — Escape the Middle East

The US Can’t — and Shouldn’t — Escape the Middle East

by Hal Brands

For you

Based on your reading history and topics you follow

Trump Denied Immunity in DC Election Case by Appeals Court ‘Money Dysmorphia’ Traps Millennials and Gen Zers

‘Money Dysmorphia’ Traps Millennials and Gen Zers Wall Street Snubs China for India in a Historic Markets Shift

Wall Street Snubs China for India in a Historic Markets Shift NYCB Extends $4.5 Billion Stock Rout to Lowest Level Since 1997

NYCB Extends $4.5 Billion Stock Rout to Lowest Level Since 1997 Add more topics to your feed

Add more topics to your feed

Emerging Markets

Government

Infrastructure

Markets

Fixed Income

Politics

Regulation

Policy

TechnologyHyperdrive

Tesla Sold Only One Car in Korea in January

- EV sales are hurt by inflation to concerns about car fires

- Consumers await government announcement on subsidies

Tesla’s Model Y electric vehicle.Photographer: Samsul Said/Bloomberg

Tesla’s Model Y electric vehicle.Photographer: Samsul Said/Bloomberg

By Heejin Kim

February 7, 2024 at 10:53 AM GMT+6

Save

Tesla Inc. sold just one electric vehicle in South Korea in January as a raft of headwinds, from safety concerns to price and a lack of charging infrastructure, weigh on demand.

The company’s sale of a solitary Model Y SUV was its worst month since July 2022, when the Austin, Texas-based automaker sold no vehicles at all, according to data from Seoul-based researcher Carisyou and the Korean trade ministry. Across all carmakers, the number of new EVs registered in Korea fell 80% in January from December, Carisyou data show.

Have a confidential tip for our reporters? Get in Touch

Before it’s here, it’s on the Bloomberg Terminal

Up Next

Stocks Pare Gains as Traders Weigh China Support: Markets Wrap

More From Bloomberg

Tesla Runs Afoul of Font-Size Rule in 2.2 Million Electric Cars

Tesla Runs Afoul of Font-Size Rule in 2.2 Million Electric Cars Tesla’s Profit Margins Deserve More Appreciation

Tesla’s Profit Margins Deserve More Appreciation Elon's Cage Fight With Zuckerberg Just Happened. He Lost

Elon's Cage Fight With Zuckerberg Just Happened. He Lost Tesla to Open US Battery Plant With Equipment From China’s CATL

Tesla to Open US Battery Plant With Equipment From China’s CATL

Top Reads

Can AI Unlock the Secrets of the Ancient World?

Can AI Unlock the Secrets of the Ancient World?

by Ashlee Vance and Ellen Huet Inside a Private Jet Club Where Everything Went Wrong

Inside a Private Jet Club Where Everything Went Wrong

by Brent Crane Why NYC Apartment Buildings Are on Sale Now for 50% Off

Why NYC Apartment Buildings Are on Sale Now for 50% Off

by Patrick Clark and Prashant Gopal Putin’s Posturing on NATO’s Doorstep Raises Alarm

Putin’s Posturing on NATO’s Doorstep Raises Alarm

by Alan Crawford, Aaron Eglitis, Ott Tammik and Milda Seputyte

Terms of Service Trademarks Privacy Policy ©2024 Bloomberg L.P. All Rights Reserved

Careers Made in NYC Advertise Ad Choices Help

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕖𝕒𝕟𝕚𝕖 𝔹𝕒𝕓𝕚𝕖𝕤 - Have Fun Staying Poor](https://cdn.bulbapp.io/frontend/images/17e87f53-0225-4de1-995f-9f66198cb037/1)