Ethereum vs Solana: A Comparative Analysis

Ethereum vs Solana: A Comparative Analysis of Two Leading Blockchains

Ethereum vs Solana: A Comparative Analysis of Two Leading Blockchains

In the rapidly evolving landscape of blockchain technology, Ethereum and Solana have emerged as two prominent platforms, each offering unique features and capabilities. As decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain applications gain traction, understanding the differences between these two ecosystems becomes crucial for investors, developers, and users alike. Let's delve into a comparative analysis of Ethereum and Solana.

1. Scalability:- Ethereum:

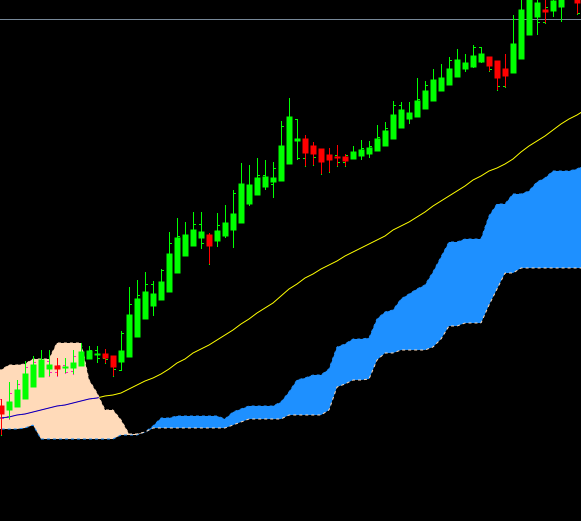

Historically, Ethereum has faced scalability issues, leading to congestion and high transaction fees during periods of heavy network usage. While efforts such as Ethereum 2.0 aim to address scalability through the transition to a proof-of-stake consensus mechanism and sharding, these upgrades are still in progress. - Solana: Solana prides itself on its high throughput and scalability. Its unique architecture, utilizing a combination of proof-of-stake and proof-of-history mechanisms, enables Solana to process thousands of transactions per second with low fees. This scalability is particularly advantageous for applications requiring high throughput, such as DeFi protocols and gaming platforms.

2. Transaction Speed and Cost: -

Ethereum: Due to its scalability challenges, Ethereum transactions can be slow and costly, especially during peak periods. Users often find themselves waiting for confirmations and paying significant gas fees to prioritize their transactions. - Solana: Solana boasts near-instant transaction finality and low fees, making it attractive for developers and users seeking efficient and cost-effective blockchain solutions. The network's high throughput and low latency enable real-time interactions and seamless user experiences.

3. Ecosystem and Adoption:

- Ethereum: Ethereum has a robust and diverse ecosystem, with a vast array of decentralized applications (dApps), protocols, and tokenized assets. It has established itself as the leading platform for DeFi, NFTs, and smart contracts, attracting developers and users from around the world. - Solana: Although relatively newer compared to Ethereum, Solana has experienced rapid growth and adoption. Its performance-oriented architecture has attracted developers looking to build scalable applications, resulting in a burgeoning ecosystem of DeFi projects, gaming platforms, and NFT marketplaces.

4. Security and Decentralization:-

5. Future Outlook:

- Ethereum: Despite its scalability challenges, Ethereum remains a dominant force in the blockchain space, with significant developer mindshare and institutional interest. The successful implementation of Ethereum 2.0 could further solidify its position and unlock new possibilities for innovation. -

Solana: Solana's impressive performance and growing ecosystem position it as a strong contender in the blockchain industry. Its focus on scalability and efficiency resonates with developers and users seeking alternatives to Ethereum. Continued adoption and development could propel Solana to greater heights in the future.

In conclusion, Ethereum and Solana represent two distinct approaches to blockchain technology, each with its strengths and weaknesses. Ethereum's established ecosystem and upcoming upgrades demonstrate its resilience and potential for growth, while Solana's scalability and performance offer compelling advantages for developers and users alike. As the blockchain landscape continues to evolve, both platforms are likely to play integral roles in shaping the future of decentralized finance, digital assets, and beyond.

Ethereum is a decentralized blockchain with smart contract functionality. Ether (Abbreviation: ETH;[a] sign: Ξ) is the native cryptocurrency of the platform. Among cryptocurrencies, ether is second only to bitcoin in market capitalization.[2][3] It is open-source software.

References

- ^ "Clients". Other nodes. 6 June 2023. Retrieved 6 June 2023.

- ^ Jump up to:

- a b Szalay, Eva; Venkataramakrishnan, Siddharth (28 May 2021). "What are cryptocurrencies and stablecoins and how do they work?". Financial Times. Retrieved 14 August 2021.

- ^ Jump up to:

- a b Vigna, Paul (3 June 2021). "DeFi Is Helping to Fuel the Crypto Market Boom—and Its Recent Volatility". The Wall Street Journal. Retrieved 14 August 2021.

- ^ Jump up to:

- a b c d Tapscott & Tapscott 2016, pp. 87.

- ^ Paumgarten, Nick (15 October 2018). "The Prophets of Cryptocurrency Survey the Boom and Bust". The New Yorker. Archived from the original on 9 January 2020. Retrieved 7 December 2021.