Cryptography, and distributed ledger

39

- Research and education: Start by learning about cryptocurrencies and their underlying technology, blockchain. Familiarize yourself with the basic concepts, such as decentralization, cryptography, and distributed ledger systems. Read books, articles, and watch videos to gain a comprehensive understanding.

- Choose a reliable cryptocurrency wallet: Select a reputable cryptocurrency wallet that allows you to securely store, send, and receive digital currencies. There are different types of wallets, such as hardware wallets, software wallets, and online wallets. Research and compare their features, security measures, and user reviews before making a decision.

- Decide on the cryptocurrencies you want to invest in: With thousands of cryptocurrencies available, narrow down your choices based on their market capitalization, technology, use cases, and team behind the project. Consider diversifying your portfolio by investing in multiple cryptocurrencies to spread your risk.

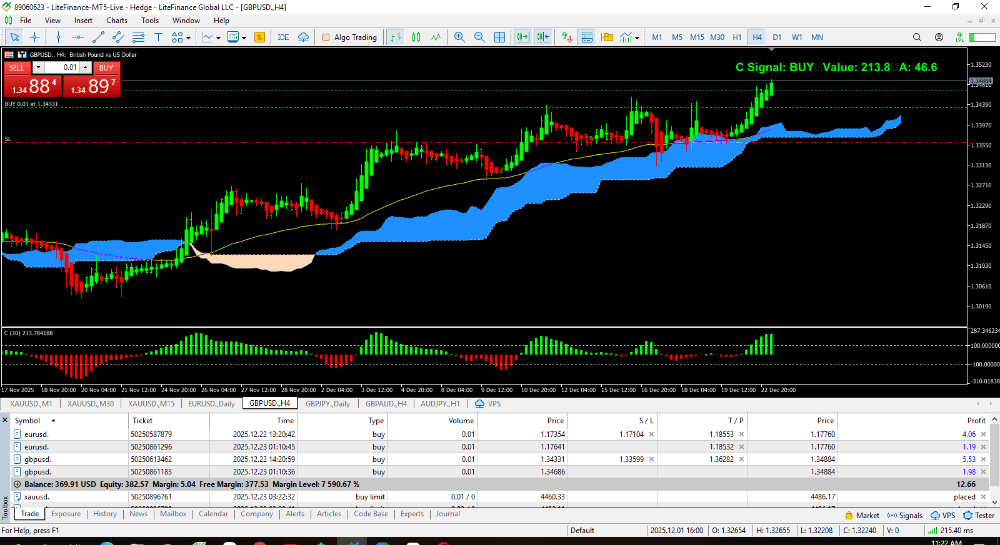

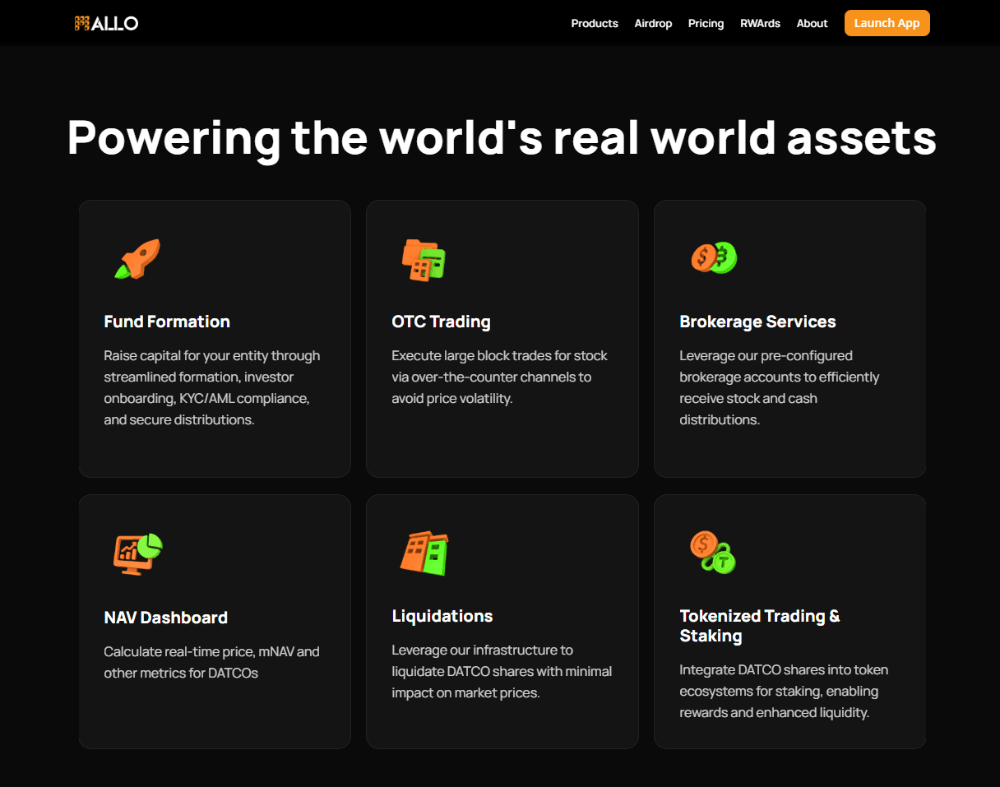

- Select a cryptocurrency exchange: Find a reliable cryptocurrency exchange platform where you can buy, sell, and trade cryptocurrencies. Research the platform's security features, fees, liquidity, user experience, and the cryptocurrencies it supports. It's essential to choose a reputable exchange that adheres to proper regulatory standards.

- Perform the necessary verification: Register an account on the chosen cryptocurrency exchange and complete the verification process. This typically involves providing identification documents, proof of address, and sometimes a selfie or additional security measures. Verification is crucial to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Fund your account: After your account is verified, deposit funds into your exchange account using a bank transfer, credit/debit card, or other accepted payment methods. Ensure you understand the deposit fees and minimum deposit requirements associated with the chosen payment method.

Execute trades or investments: Once your account is funded, navigate the exchange's trading platform to buy or trade the cryptocurrencies of your choice. You can place market orders (buy/sell at the current market price) or limit orders (buy/sell at a specific price). Consider setting stop-loss orders to manage risk and protect your investments.

- Practice proper security measures: As cryptocurrencies are digital assets, maintaining strong security practices is vital. Enable two-factor authentication (2FA) on your accounts, regularly update your wallet and exchange passwords, and be cautious of phishing attempts and suspicious links. Consider offline storage options like hardware wallets for long-term holdings.

- Stay updated and informed: Keep up with cryptocurrency news, market trends, and regulatory developments. Follow reputable sources, join communities, and engage in discussions to stay informed about potential opportunities and risks.

Remember, investing in cryptocurrencies carries risks, and it's essential to do thorough research, understand the technology, and make informed decisions. Consult with financial professionals if needed and never invest more than you can afford to lose.

- Understand the concept of blockchain: Cryptocurrencies operate on a decentralized technology called blockchain. Blockchain is a transparent and immutable ledger that records all transactions across a network of computers. It ensures security, trust, and eliminates the need for intermediaries like banks.

- Explore different types of cryptocurrencies: While Bitcoin is the most well-known cryptocurrency, there are thousands of other cryptocurrencies with unique features and use cases. Some popular examples include Ethereum (known for smart contracts and decentralized applications), Ripple (designed for fast and low-cost international money transfers), and Litecoin (a peer-to-peer digital currency similar to Bitcoin).

- Learn about token standards: Many cryptocurrencies are built on specific token standards that define their functionality and purpose. For instance, Ethereum-based tokens follow the ERC-20 standard, which enables the creation of fungible tokens. Other token standards include ERC-721 for non-fungible tokens (NFTs) and ERC-1155 for both fungible and non-fungible tokens.

- Be aware of Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs): ICOs and IEOs are fundraising methods used by cryptocurrency projects to secure funding. In an ICO, investors purchase tokens in exchange for established cryptocurrencies or fiat currencies. An IEO is a similar concept, but the tokens are sold directly on a cryptocurrency exchange platform.

- Understand the volatility and risks: Cryptocurrency markets are highly volatile, and prices can fluctuate dramatically within short periods. This volatility can present opportunities for profits but also carries inherent risks. It's important to carefully assess the risks, diversify your investments, and consider your risk tolerance before entering the cryptocurrency market.

- Explore decentralized finance (DeFi): DeFi refers to the use of blockchain and cryptocurrencies to recreate traditional financial systems in a decentralized manner. It offers various financial services such as lending, borrowing, decentralized exchanges, and yield farming. DeFi has gained significant attention in recent years for its potential to disrupt traditional financial intermediaries.

- Consider the regulatory landscape: Cryptocurrencies operate in a complex regulatory environment that varies by country. Governments and regulatory bodies are developing frameworks to address concerns like investor protection, anti-money laundering, and tax compliance. Stay informed about the legal and regulatory aspects of cryptocurrencies in your jurisdiction to ensure compliance and mitigate risks.

- Be mindful of security risks: Cryptocurrencies are susceptible to hacking, scams, and theft. Safeguard your investments by using secure wallets, keeping your private keys offline, and being cautious of phishing attempts and fraudulent projects. Regularly update your software and follow best practices for secure cryptocurrency storage.

- Learn about mining and consensus mechanisms: Mining is the process of validating and adding transactions to a blockchain. It is typically associated with proof-of-work (PoW) consensus mechanisms, where miners solve complex mathematical puzzles to secure the network. However, alternative consensus mechanisms like proof-of-stake (PoS) and delegated proof-of-stake (DPoS) have emerged, reducing energy consumption and increasing scalability.

- Stay informed about technological advancements: The cryptocurrency ecosystem is rapidly evolving, with ongoing technological advancements and innovations. Keep up with developments such as Layer 2 solutions (e.g., the Lightning Network), scalability improvements, interoperability protocols, and advancements in privacy and security measures.

- Consider consulting with professionals: If you are new to cryptocurrencies or uncertain about certain aspects, consider seeking guidance from financial advisors, cryptocurrency experts, or legal professionals with expertise in the field. They can provide personalized advice based on your financial goals and help navigate the complexities of the cryptocurrency market.

Remember that the cryptocurrency market is highly dynamic, and it's crucial to stay updated, remain vigilant, and continuously educate yourself about the evolving landscape.