The Art Of Trading

Trading! There are unwritten rules to this game, and they are not the same for everyone.

I won't overextend this introduction, since I can assume this will be a long text. No, I don't predict the future...I just wrote the text before, and working on the intro now... So yeah, it is better to cut to the chase.

When it comes to trading you don't have to be like everyone else, but there are a couple of rules, that I think are necessary to improve your trading rate.

1️⃣ Win some, lose some

100% ratio doesn’t exist, because perfection does not exist. Assuming that you gonna be profitable in all your trades is naive. The rule is, that you have to win more than what you lose. That is what makes a good trader. For example for being a pro basketball player, your “hit the basket” percentage has to be something around 70%. The other 30% are dedicated to failure. And you will fail, and you will panic if you are anything like me. Has soon as I see a little bit of red in my trades, I start feeling tilted. Don’t ask me why. Can be as little as a couple of cents after my entry point! If I see red, I get triggered, like a Bull in Pamplona. This is something that I have to learn how to control definitely. The thing is, if I start losing on a trade, I always think…” I should allocate this in my spot bag instead”. I have to realize that these are two different things.

2️⃣ Expected price action does not occur overnight

Patience is key! But sometimes seems like I lost the key… Is only human, to expect immediate results, especially in uncomfortable situations. What I think happens is an emotional stage of anxiety. Before you place your trade, you have an idea of a possible price target, which you are super confident about, but as soon as you place your “bet”, doubts start surfing, and if the results to confirm your thesis are not immediate, it is normal to start doubting yourself causing this “anxiety” trigger. And that’s when you tend to change your bias, or overreact, and change the game plan, which often results in loss, rather than wins. And guess what? If you have to wait a little longer, probably you will have a green bag to bring home. It happens often. So time, and patience are everything.

3️⃣ You have to be OK with the risk

This is something that I probably will never be okay with. Doesn’t matter if is $10 K, $100 K, or even $100. I don’t like to splurge money. It is hard for me. I know I should look at this like a “game” for being easier for me, after all, we are speaking about digital numbers behind a screen. I should be able to disassociate and be okay with my choices, after all, I only trade what I can afford to lose. Yeah, well… I don’t like to lose. And so automatically this poses a risk to me! The thing I came to realize is that if I don’t stick to the plan, I am the bigger risk in all of this operation.

4️⃣ Excessive leverage is not good

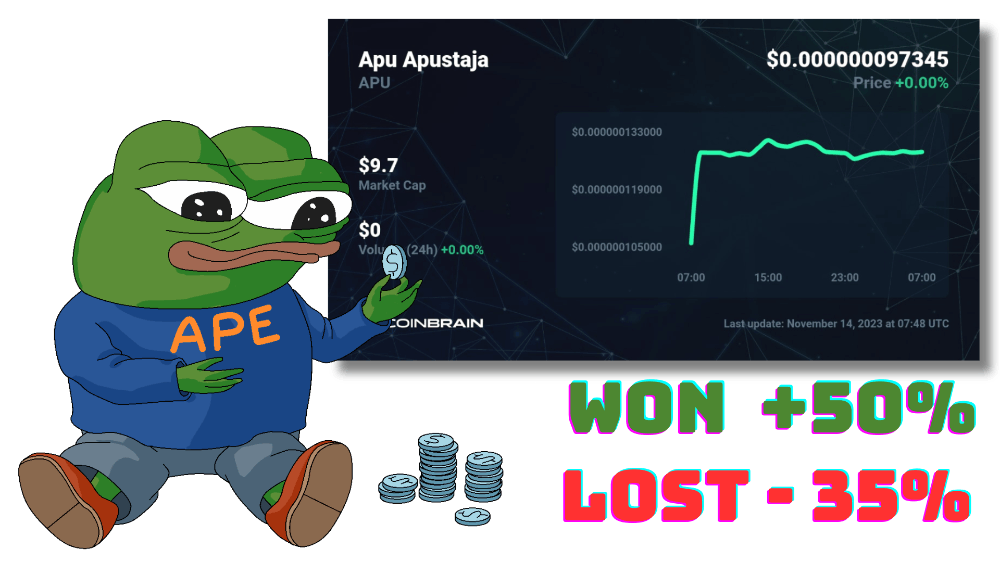

This should be imperative. I mean you see the news out there. “$3 Billion longs wiped out in minutes”; “$5 Billion short liquidated”; “dramatic headline here”… You get the point. For those who don’t know, every time you see short, or long, most likely people are speaking about leveraging an asset. Basically, this works as a “multiplier” on top of your money, which can vary from 1X to 50X, according to your desires of degeneracy. So let’s suppose that you decide to use a 5X leverage on your trade, a 10% successful trade, in this case, would represent 50%. Amazing right?! Well, it goes both ways. You can win a lot, but you can lose a lot too. It’s not advisable to use excessive leverage, because you can get liquidated. If you have to follow this route, don’t let greed play a part. It’s to go on social media, and see people bragging about their 200% profits, due to leverage, but don’t forget, that most just share what they win…not what they lose. Don’t let the flex of others be a reflex of yours.

Okay, Okay! I feel like that just like a trade, I may be over-extending, so will insert an image here, to pause a bit...

Alright, the image was inserted successfully... Let's get back to it.

5️⃣ Don’t force the trade, the trade will come to you

On the same note, we tend to check social media, and we tend to get itchy, when influencers start shilling how great they are, and how the last trade will buy them a mansion… Don’t fall for it. Here is where you start getting emotional, and here is where you probably will mess up. Why? Because you want the same results, and you want it now! NOW ANON! Not after, now! And so, you will form a bias, and chase possible charts, that are not posed for your success. But since you already had the FOMO in you, you won’t stop. No, you will force a trade, and by forcing it, you will feel uncomfortable, and the likelihood of this scenario ending up badly for your finances, is astronomical.

6️⃣ Don’t get overexposed, you will not get rich overnight

This goes along with the leverage point, that I already wrote on point 4. But still, this is so important, that somehow has to be said over and over again, until you interiorize it, in your heart, mind, and soul. If somehow, you get rich or achieve financial freedom overnight, that is luck! Yes, it is luck. And yes, I do believe in hard work. But hard work doesn’t materialize overnight. It’s a process. Knowledge and hard work can get you money, but not overnight. So… if somehow you manage to accumulate stupid wealth, out of a sudden, it’s due to lack factor, and I don’t like to leave my faith, in the hands of luck. You shouldn’t either. You probably won’t get what you want without hard work, so don’t seed your mind, that success is guaranteed without work, and this process takes time. don’t do something stupid, that will set you back. Is not worth it.

7️⃣ Don’t trade coins you don’t like or don't know

Why? Why would you bet on something that you didn’t research or know? Look, I believe in technical analysis and fundamental analysis. It’s okay, you don’t have to, but I do. So with that said, for me is kind of hard to trade something that I don’t know if it will rug at any given time. And this kind of information you cannot see in a chart. It requires research, and time invested… But there are like gazillions of projects nowadays, and it’s hard to follow 1% of them. So, in my opinion, stick to what you know and what you believe. It makes it easier to trade, and if you find yourself underwater, it will be easier for you to cope. For example, if I buy “WHATEVS COIN” that I don’t know anything about, and it starts dumping, my immediate reaction will be to press the “sell” button and leave at a loss. But if I am trading a bag of Bitcoin, or Ethereum, or something on this basis, I will feel more “calm” in the event of momentary loss, and probably will not panic.

Well, there are many more rules, and these are just some of them. I truly believe that the difference between a successful trader, and an average one, are in the details. And the only way to perfect your trading is via trial and error. Nobody ever will be 100% successful while trading, but that it's not the goal. The goal is to be profitable, and that's it. Keep that in mind chief!

Thank you very much for reading. Hope you have enjoyed the article! Would really appreciate it if you could drop a follow on 👉🏽Twitter(X)👈🏽

See you soon fam!