Markets Update: Bullish Sentiment Returns to Crypto Markets

Cryptocurrency markets have been accumulating gains again after the significant dips in value during the first two months of 2018. BTC/USD prices are holding steady above the $11,450 price range after bouncing off the $5,900 bottom not too long ago. Digital asset enthusiasts speculate the market is starting to show strong bullish sentiment once again.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The Steady Uptrend Back to Higher Price Regions

Over the past twenty days, BTC/USD markets have been on a tear once again as markets are up well over 80 percent since touching its price bottom. Crypto-proponents, speculators, and traders believe digital asset markets will continue to rise to even higher price levels than before. BTC trade volume is fairly decent with roughly $8.9Bn swapped over the past 24-hours. Exchanges trading the most BTC volume today include Bitfinex, Okex, Binance, Upbit, and Bithumb. Currently, the Japanese yen is dominating currency volumes by 47 percent. This is followed by the USD (24%), tether (USDT 15%), the Korean won (5.5%), and the euro (4.6%). Presently BTC/USD market averages have been hovering around $11,450-11,550 over the past 12-hours. BTC/USD Coinbase February 20, 2018. 4-hour chart.

BTC/USD Coinbase February 20, 2018. 4-hour chart.

Technical Indicators

Looking at the 4-hour, daily and weekly charts BTC/USD markets have formed a solid uptrend over the last twenty days. The two Simple Moving Averages (SMA) both short and long-term have been close to crossing paths over the past 24-hours. Right now the short term 100 SMA is above the longer term 200 SMA indicating the path to resistance is on the upside. The Relative Strength Index (RSI) and Stochastic oscillators are also heading northbound showing bullish sentiment is in the air during Tuesday’s morning trading sessions. The MACd is also following suit but is showing there is much heavier resistance within these current price levels. BTC/USD Bitstamp February 20, 2018. 1-day chart.

BTC/USD Bitstamp February 20, 2018. 1-day chart.

Order books show on the upside there’s some resistance around the $11,900 zone as well as heavier opposition around the $12,200 range. If bulls can manage to muster up some strength and push past this region a $13K target isn’t too far off from sight. On the backside, there’s lots of foundational support between the $11,200 all the way to the $10,500 range. A break below the $10,200 area could bring the price below the $10K region but this scenario seems unlikely at the moment.

The Top Digital Assets

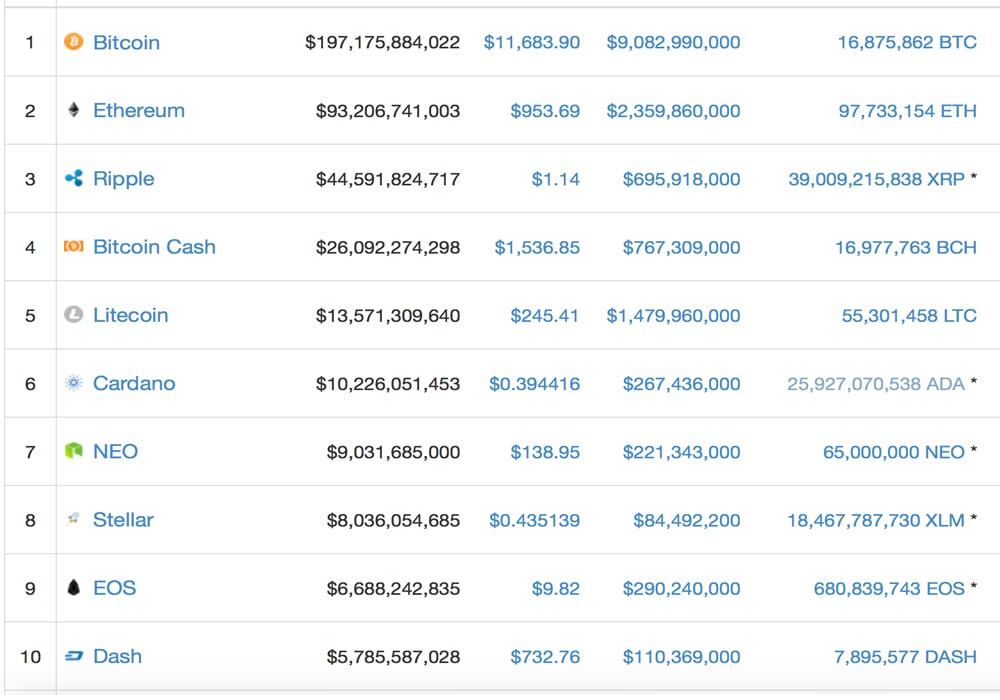

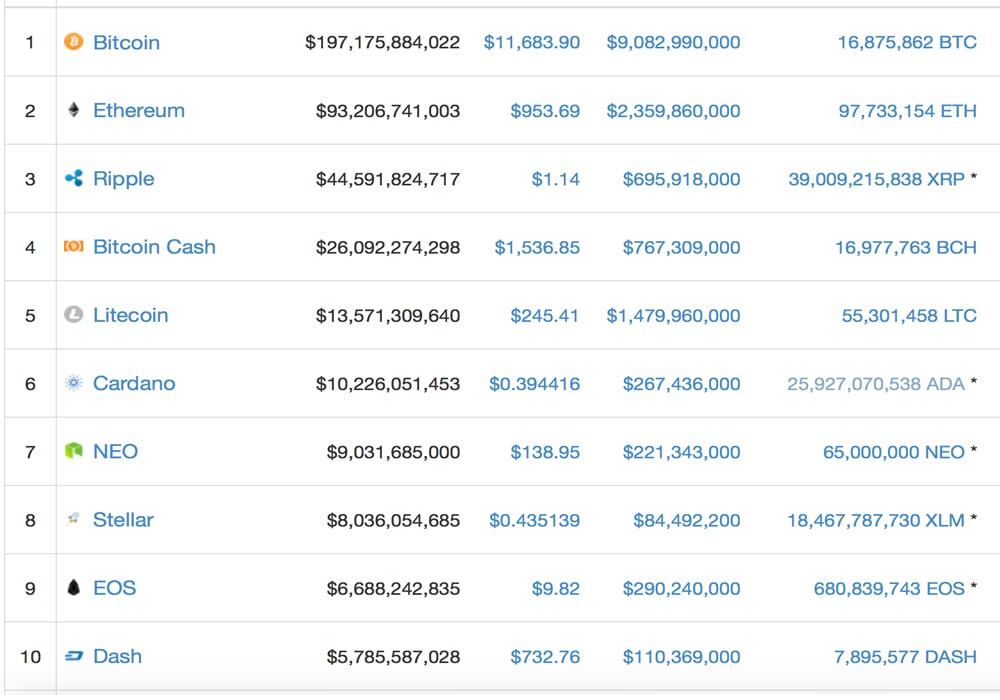

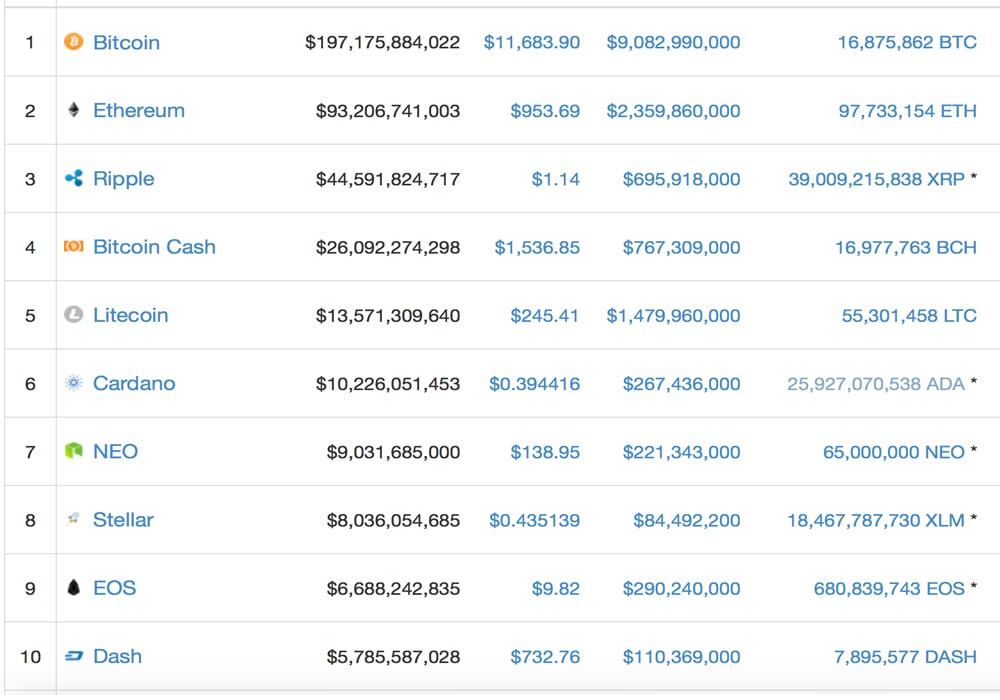

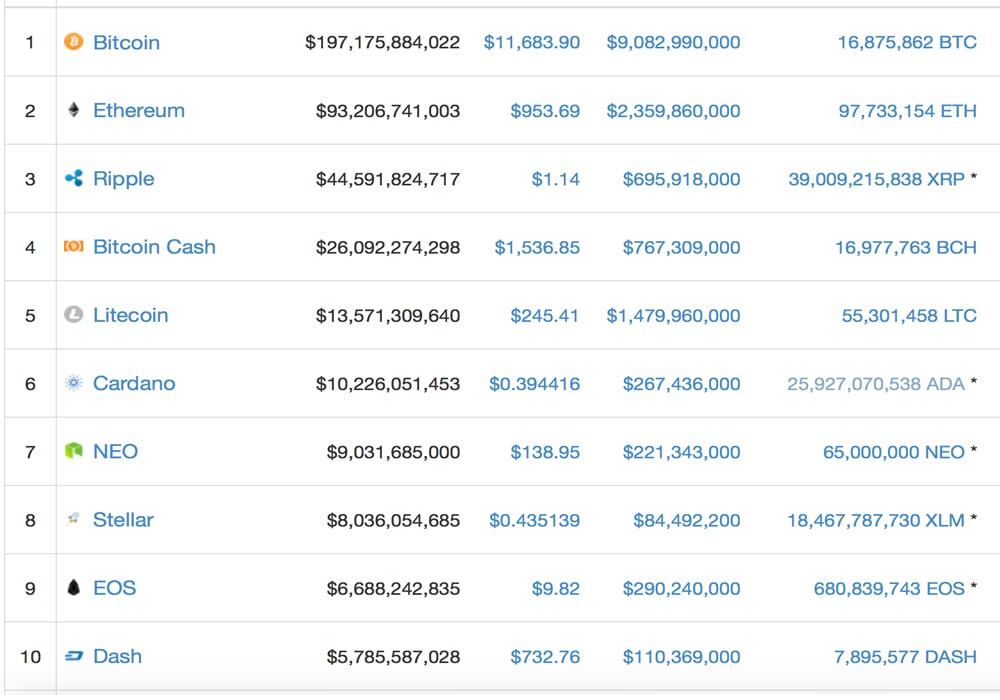

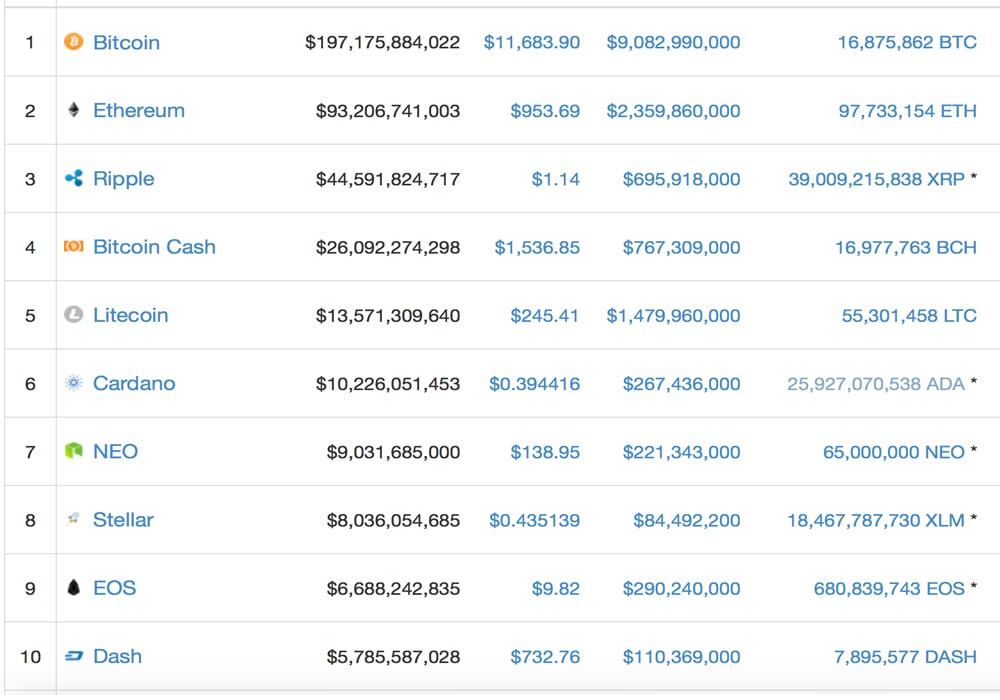

Most digital asset prices, in general, are up between 0.2-10 percent today following BTC/USD markets. Ethereum (ETH) prices are up 0.5 percent this morning as one ETH is hovering around $953 today. Ripple (XRP) markets are down today 0.6 percent as each token is worth $1.14. Bitcoin cash (BCH) values have been correlated with BTC/USD markets and BCH prices are up 0.26 percent. Lastly, Litecoin (LTC) now commands the fifth highest market cap as the currency has knocked Cardano (ADA) from its position. LTC prices are up over 9 percent and one token is averaging around $245. Today the total market capitalization of all 1,500 digital assets is above $512Bn at the time of publication. This week litecoin takes the #5 position and dash comes back into the top ten.

This week litecoin takes the #5 position and dash comes back into the top ten.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic that the bull market sentiment will continue. Many traders are envisioning all-time highs this year will reach between $30-50K before the next big correction. Of course, much of the predictions are based on speculation, Elliot Wave theories, and other forms of technical analysis that are spot on at times and sometimes way off the radar. In general, the BTC/USD rebound back above the $11K price region is a good sign compared to the lows touched a few weeks prior.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

- Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Cryptocurrency markets have been accumulating gains again after the significant dips in value during the first two months of 2018. BTC/USD prices are holding steady above the $11,450 price range after bouncing off the $5,900 bottom not too long ago. Digital asset enthusiasts speculate the market is starting to show strong bullish sentiment once again.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The Steady Uptrend Back to Higher Price Regions

Over the past twenty days, BTC/USD markets have been on a tear once again as markets are up well over 80 percent since touching its price bottom. Crypto-proponents, speculators, and traders believe digital asset markets will continue to rise to even higher price levels than before. BTC trade volume is fairly decent with roughly $8.9Bn swapped over the past 24-hours. Exchanges trading the most BTC volume today include Bitfinex, Okex, Binance, Upbit, and Bithumb. Currently, the Japanese yen is dominating currency volumes by 47 percent. This is followed by the USD (24%), tether (USDT 15%), the Korean won (5.5%), and the euro (4.6%). Presently BTC/USD market averages have been hovering around $11,450-11,550 over the past 12-hours. BTC/USD Coinbase February 20, 2018. 4-hour chart.

BTC/USD Coinbase February 20, 2018. 4-hour chart.

Technical Indicators

Looking at the 4-hour, daily and weekly charts BTC/USD markets have formed a solid uptrend over the last twenty days. The two Simple Moving Averages (SMA) both short and long-term have been close to crossing paths over the past 24-hours. Right now the short term 100 SMA is above the longer term 200 SMA indicating the path to resistance is on the upside. The Relative Strength Index (RSI) and Stochastic oscillators are also heading northbound showing bullish sentiment is in the air during Tuesday’s morning trading sessions. The MACd is also following suit but is showing there is much heavier resistance within these current price levels. BTC/USD Bitstamp February 20, 2018. 1-day chart.

BTC/USD Bitstamp February 20, 2018. 1-day chart.

Order books show on the upside there’s some resistance around the $11,900 zone as well as heavier opposition around the $12,200 range. If bulls can manage to muster up some strength and push past this region a $13K target isn’t too far off from sight. On the backside, there’s lots of foundational support between the $11,200 all the way to the $10,500 range. A break below the $10,200 area could bring the price below the $10K region but this scenario seems unlikely at the moment.

The Top Digital Assets

Most digital asset prices, in general, are up between 0.2-10 percent today following BTC/USD markets. Ethereum (ETH) prices are up 0.5 percent this morning as one ETH is hovering around $953 today. Ripple (XRP) markets are down today 0.6 percent as each token is worth $1.14. Bitcoin cash (BCH) values have been correlated with BTC/USD markets and BCH prices are up 0.26 percent. Lastly, Litecoin (LTC) now commands the fifth highest market cap as the currency has knocked Cardano (ADA) from its position. LTC prices are up over 9 percent and one token is averaging around $245. Today the total market capitalization of all 1,500 digital assets is above $512Bn at the time of publication. This week litecoin takes the #5 position and dash comes back into the top ten.

This week litecoin takes the #5 position and dash comes back into the top ten.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic that the bull market sentiment will continue. Many traders are envisioning all-time highs this year will reach between $30-50K before the next big correction. Of course, much of the predictions are based on speculation, Elliot Wave theories, and other forms of technical analysis that are spot on at times and sometimes way off the radar. In general, the BTC/USD rebound back above the $11K price region is a good sign compared to the lows touched a few weeks prior.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Cryptocurrency markets have been accumulating gains again after the significant dips in value during the first two months of 2018. BTC/USD prices are holding steady above the $11,450 price range after bouncing off the $5,900 bottom not too long ago. Digital asset enthusiasts speculate the market is starting to show strong bullish sentiment once again.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The Steady Uptrend Back to Higher Price Regions

Over the past twenty days, BTC/USD markets have been on a tear once again as markets are up well over 80 percent since touching its price bottom. Crypto-proponents, speculators, and traders believe digital asset markets will continue to rise to even higher price levels than before. BTC trade volume is fairly decent with roughly $8.9Bn swapped over the past 24-hours. Exchanges trading the most BTC volume today include Bitfinex, Okex, Binance, Upbit, and Bithumb. Currently, the Japanese yen is dominating currency volumes by 47 percent. This is followed by the USD (24%), tether (USDT 15%), the Korean won (5.5%), and the euro (4.6%). Presently BTC/USD market averages have been hovering around $11,450-11,550 over the past 12-hours. BTC/USD Coinbase February 20, 2018. 4-hour chart.

BTC/USD Coinbase February 20, 2018. 4-hour chart.

Technical Indicators

Looking at the 4-hour, daily and weekly charts BTC/USD markets have formed a solid uptrend over the last twenty days. The two Simple Moving Averages (SMA) both short and long-term have been close to crossing paths over the past 24-hours. Right now the short term 100 SMA is above the longer term 200 SMA indicating the path to resistance is on the upside. The Relative Strength Index (RSI) and Stochastic oscillators are also heading northbound showing bullish sentiment is in the air during Tuesday’s morning trading sessions. The MACd is also following suit but is showing there is much heavier resistance within these current price levels. BTC/USD Bitstamp February 20, 2018. 1-day chart.

BTC/USD Bitstamp February 20, 2018. 1-day chart.

Order books show on the upside there’s some resistance around the $11,900 zone as well as heavier opposition around the $12,200 range. If bulls can manage to muster up some strength and push past this region a $13K target isn’t too far off from sight. On the backside, there’s lots of foundational support between the $11,200 all the way to the $10,500 range. A break below the $10,200 area could bring the price below the $10K region but this scenario seems unlikely at the moment.

The Top Digital Assets

Most digital asset prices, in general, are up between 0.2-10 percent today following BTC/USD markets. Ethereum (ETH) prices are up 0.5 percent this morning as one ETH is hovering around $953 today. Ripple (XRP) markets are down today 0.6 percent as each token is worth $1.14. Bitcoin cash (BCH) values have been correlated with BTC/USD markets and BCH prices are up 0.26 percent. Lastly, Litecoin (LTC) now commands the fifth highest market cap as the currency has knocked Cardano (ADA) from its position. LTC prices are up over 9 percent and one token is averaging around $245. Today the total market capitalization of all 1,500 digital assets is above $512Bn at the time of publication. This week litecoin takes the #5 position and dash comes back into the top ten.

This week litecoin takes the #5 position and dash comes back into the top ten.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic that the bull market sentiment will continue. Many traders are envisioning all-time highs this year will reach between $30-50K before the next big correction. Of course, much of the predictions are based on speculation, Elliot Wave theories, and other forms of technical analysis that are spot on at times and sometimes way off the radar. In general, the BTC/USD rebound back above the $11K price region is a good sign compared to the lows touched a few weeks prior.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Cryptocurrency markets have been accumulating gains again after the significant dips in value during the first two months of 2018. BTC/USD prices are holding steady above the $11,450 price range after bouncing off the $5,900 bottom not too long ago. Digital asset enthusiasts speculate the market is starting to show strong bullish sentiment once again.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The Steady Uptrend Back to Higher Price Regions

Over the past twenty days, BTC/USD markets have been on a tear once again as markets are up well over 80 percent since touching its price bottom. Crypto-proponents, speculators, and traders believe digital asset markets will continue to rise to even higher price levels than before. BTC trade volume is fairly decent with roughly $8.9Bn swapped over the past 24-hours. Exchanges trading the most BTC volume today include Bitfinex, Okex, Binance, Upbit, and Bithumb. Currently, the Japanese yen is dominating currency volumes by 47 percent. This is followed by the USD (24%), tether (USDT 15%), the Korean won (5.5%), and the euro (4.6%). Presently BTC/USD market averages have been hovering around $11,450-11,550 over the past 12-hours. BTC/USD Coinbase February 20, 2018. 4-hour chart.

BTC/USD Coinbase February 20, 2018. 4-hour chart.

Technical Indicators

Looking at the 4-hour, daily and weekly charts BTC/USD markets have formed a solid uptrend over the last twenty days. The two Simple Moving Averages (SMA) both short and long-term have been close to crossing paths over the past 24-hours. Right now the short term 100 SMA is above the longer term 200 SMA indicating the path to resistance is on the upside. The Relative Strength Index (RSI) and Stochastic oscillators are also heading northbound showing bullish sentiment is in the air during Tuesday’s morning trading sessions. The MACd is also following suit but is showing there is much heavier resistance within these current price levels. BTC/USD Bitstamp February 20, 2018. 1-day chart.

BTC/USD Bitstamp February 20, 2018. 1-day chart.

Order books show on the upside there’s some resistance around the $11,900 zone as well as heavier opposition around the $12,200 range. If bulls can manage to muster up some strength and push past this region a $13K target isn’t too far off from sight. On the backside, there’s lots of foundational support between the $11,200 all the way to the $10,500 range. A break below the $10,200 area could bring the price below the $10K region but this scenario seems unlikely at the moment.

The Top Digital Assets

Most digital asset prices, in general, are up between 0.2-10 percent today following BTC/USD markets. Ethereum (ETH) prices are up 0.5 percent this morning as one ETH is hovering around $953 today. Ripple (XRP) markets are down today 0.6 percent as each token is worth $1.14. Bitcoin cash (BCH) values have been correlated with BTC/USD markets and BCH prices are up 0.26 percent. Lastly, Litecoin (LTC) now commands the fifth highest market cap as the currency has knocked Cardano (ADA) from its position. LTC prices are up over 9 percent and one token is averaging around $245. Today the total market capitalization of all 1,500 digital assets is above $512Bn at the time of publication. This week litecoin takes the #5 position and dash comes back into the top ten.

This week litecoin takes the #5 position and dash comes back into the top ten.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic that the bull market sentiment will continue. Many traders are envisioning all-time highs this year will reach between $30-50K before the next big correction. Of course, much of the predictions are based on speculation, Elliot Wave theories, and other forms of technical analysis that are spot on at times and sometimes way off the radar. In general, the BTC/USD rebound back above the $11K price region is a good sign compared to the lows touched a few weeks prior.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”.

Cryptocurrency markets have been accumulating gains again after the significant dips in value during the first two months of 2018. BTC/USD prices are holding steady above the $11,450 price range after bouncing off the $5,900 bottom not too long ago. Digital asset enthusiasts speculate the market is starting to show strong bullish sentiment once again.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The Steady Uptrend Back to Higher Price Regions

Over the past twenty days, BTC/USD markets have been on a tear once again as markets are up well over 80 percent since touching its price bottom. Crypto-proponents, speculators, and traders believe digital asset markets will continue to rise to even higher price levels than before. BTC trade volume is fairly decent with roughly $8.9Bn swapped over the past 24-hours. Exchanges trading the most BTC volume today include Bitfinex, Okex, Binance, Upbit, and Bithumb. Currently, the Japanese yen is dominating currency volumes by 47 percent. This is followed by the USD (24%), tether (USDT 15%), the Korean won (5.5%), and the euro (4.6%). Presently BTC/USD market averages have been hovering around $11,450-11,550 over the past 12-hours. BTC/USD Coinbase February 20, 2018. 4-hour chart.

BTC/USD Coinbase February 20, 2018. 4-hour chart.

Technical Indicators

Looking at the 4-hour, daily and weekly charts BTC/USD markets have formed a solid uptrend over the last twenty days. The two Simple Moving Averages (SMA) both short and long-term have been close to crossing paths over the past 24-hours. Right now the short term 100 SMA is above the longer term 200 SMA indicating the path to resistance is on the upside. The Relative Strength Index (RSI) and Stochastic oscillators are also heading northbound showing bullish sentiment is in the air during Tuesday’s morning trading sessions. The MACd is also following suit but is showing there is much heavier resistance within these current price levels. BTC/USD Bitstamp February 20, 2018. 1-day chart.

BTC/USD Bitstamp February 20, 2018. 1-day chart.

Order books show on the upside there’s some resistance around the $11,900 zone as well as heavier opposition around the $12,200 range. If bulls can manage to muster up some strength and push past this region a $13K target isn’t too far off from sight. On the backside, there’s lots of foundational support between the $11,200 all the way to the $10,500 range. A break below the $10,200 area could bring the price below the $10K region but this scenario seems unlikely at the moment.

The Top Digital Assets

Most digital asset prices, in general, are up between 0.2-10 percent today following BTC/USD markets. Ethereum (ETH) prices are up 0.5 percent this morning as one ETH is hovering around $953 today. Ripple (XRP) markets are down today 0.6 percent as each token is worth $1.14. Bitcoin cash (BCH) values have been correlated with BTC/USD markets and BCH prices are up 0.26 percent. Lastly, Litecoin (LTC) now commands the fifth highest market cap as the currency has knocked Cardano (ADA) from its position. LTC prices are up over 9 percent and one token is averaging around $245. Today the total market capitalization of all 1,500 digital assets is above $512Bn at the time of publication. This week litecoin takes the #5 position and dash comes back into the top ten.

This week litecoin takes the #5 position and dash comes back into the top ten.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic that the bull market sentiment will continue. Many traders are envisioning all-time highs this year will reach between $30-50K before the next big correction. Of course, much of the predictions are based on speculation, Elliot Wave theories, and other forms of technical analysis that are spot on at times and sometimes way off the radar. In general, the BTC/USD rebound back above the $11K price region is a good sign compared to the lows touched a few weeks prior.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Cryptocurrency markets have been accumulating gains again after the significant dips in value during the first two months of 2018. BTC/USD prices are holding steady above the $11,450 price range after bouncing off the $5,900 bottom not too long ago. Digital asset enthusiasts speculate the market is starting to show strong bullish sentiment once again.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The Steady Uptrend Back to Higher Price Regions

Over the past twenty days, BTC/USD markets have been on a tear once again as markets are up well over 80 percent since touching its price bottom. Crypto-proponents, speculators, and traders believe digital asset markets will continue to rise to even higher price levels than before. BTC trade volume is fairly decent with roughly $8.9Bn swapped over the past 24-hours. Exchanges trading the most BTC volume today include Bitfinex, Okex, Binance, Upbit, and Bithumb. Currently, the Japanese yen is dominating currency volumes by 47 percent. This is followed by the USD (24%), tether (USDT 15%), the Korean won (5.5%), and the euro (4.6%). Presently BTC/USD market averages have been hovering around $11,450-11,550 over the past 12-hours. BTC/USD Coinbase February 20, 2018. 4-hour chart.

BTC/USD Coinbase February 20, 2018. 4-hour chart.

Technical Indicators

Looking at the 4-hour, daily and weekly charts BTC/USD markets have formed a solid uptrend over the last twenty days. The two Simple Moving Averages (SMA) both short and long-term have been close to crossing paths over the past 24-hours. Right now the short term 100 SMA is above the longer term 200 SMA indicating the path to resistance is on the upside. The Relative Strength Index (RSI) and Stochastic oscillators are also heading northbound showing bullish sentiment is in the air during Tuesday’s morning trading sessions. The MACd is also following suit but is showing there is much heavier resistance within these current price levels. BTC/USD Bitstamp February 20, 2018. 1-day chart.

BTC/USD Bitstamp February 20, 2018. 1-day chart.

Order books show on the upside there’s some resistance around the $11,900 zone as well as heavier opposition around the $12,200 range. If bulls can manage to muster up some strength and push past this region a $13K target isn’t too far off from sight. On the backside, there’s lots of foundational support between the $11,200 all the way to the $10,500 range. A break below the $10,200 area could bring the price below the $10K region but this scenario seems unlikely at the moment.

The Top Digital Assets

Most digital asset prices, in general, are up between 0.2-10 percent today following BTC/USD markets. Ethereum (ETH) prices are up 0.5 percent this morning as one ETH is hovering around $953 today. Ripple (XRP) markets are down today 0.6 percent as each token is worth $1.14. Bitcoin cash (BCH) values have been correlated with BTC/USD markets and BCH prices are up 0.26 percent. Lastly, Litecoin (LTC) now commands the fifth highest market cap as the currency has knocked Cardano (ADA) from its position. LTC prices are up over 9 percent and one token is averaging around $245. Today the total market capitalization of all 1,500 digital assets is above $512Bn at the time of publication. This week litecoin takes the #5 position and dash comes back into the top ten.

This week litecoin takes the #5 position and dash comes back into the top ten.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic that the bull market sentiment will continue. Many traders are envisioning all-time highs this year will reach between $30-50K before the next big correction. Of course, much of the predictions are based on speculation, Elliot Wave theories, and other forms of technical analysis that are spot on at times and sometimes way off the radar. In general, the BTC/USD rebound back above the $11K price region is a good sign compared to the lows touched a few weeks prior.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)