Business cycles and bonds

Bonds and the business cycle

Fixed income securities

Bond yields have a high and low point throughout business cycles. The best time to be invested in bonds is when long-term yields are at their cycle high because there’s an inverse relationship between yields and bond prices. By the same logic, the best time to short bonds is when long-term yields make cycle low and are set to rise.

Long-term bonds have greater duration than short-term bonds which means that they are more sensitive to fluctuations in interest rates. This, in its turn, implies that when interest rates increase, long-term bonds lose more value, and when rates fall, they appreciate more than short-term bonds. Therefore, when interest rates have peaked and are believed to decline, it makes sense to increase allocation to long-term bonds with the highest possible duration. This typically occurs at the end of the tight monetary policy.

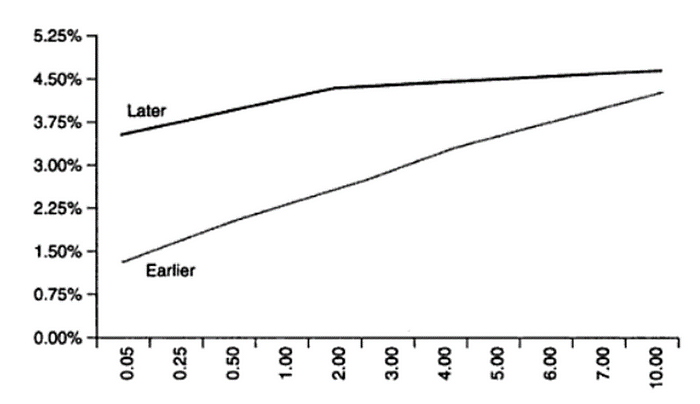

Let’s introduce two terms at this point to better explain what we said above — bear-flattening and bull-flattening. Bear flattener is the movement in interest rates when short-term rates increase faster than long-term rates. The “bear” refers to the bear market in bonds — since rates are rising, bond prices are falling. The “flattening” refers to the convergence of rates. Yield curve changes its shape from steepness to excessive flatness. This is the early phase of monetary tightening.

An example of how a bear flattener might look like: When long-term rates don’t rise as much as short-term rates, it predicts that tightening phase is near its end. What follows is called bull flattening. Bull flattener is a yield-rate environment in which long-term yields fall faster than short-term rates. In this phase the shape of yield curve can change from flat to inverted.

When long-term rates don’t rise as much as short-term rates, it predicts that tightening phase is near its end. What follows is called bull flattening. Bull flattener is a yield-rate environment in which long-term yields fall faster than short-term rates. In this phase the shape of yield curve can change from flat to inverted.

An example of how a bull flattener might look like: Relationship between business cycles, yield curve and tactical allocation to duration risk

Relationship between business cycles, yield curve and tactical allocation to duration risk

Let’s first look at the early-recovery phase of the business cycle. Central bank’s main aim here is to solidify economic recovery and not to let the economy go into a recession again as was the case with Europe in 2011. Therefore, this is the phase of high, perhaps maximum accommodation. Accommodation means that market is expecting more interest rate cuts; which is why the lowest bond yields are observed during this period. Yield curve also gets the maximum steep shape in early-recovery phase because the shape shows the level of monetary accommodation.

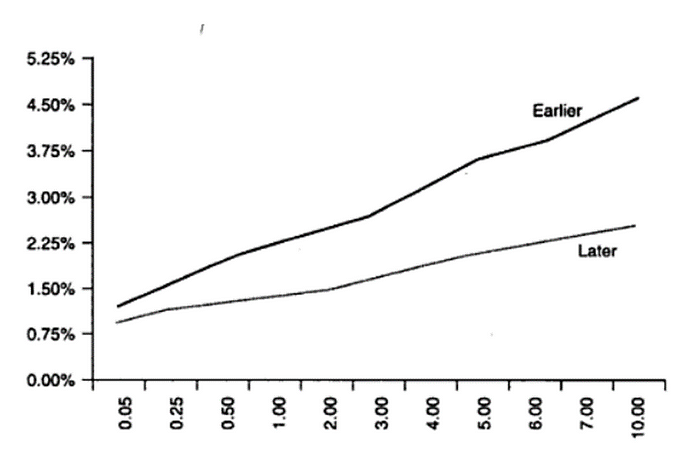

This phase is followed by the early-to-mid-cycle expansion in which Fed tends to change its monetary policy. Since economic recovery is solid at this point, it is expected that Fed will hike interest rates to normalize short-term rates which results in the yield curve with a “normal” steepness (the difference between short-term and long-term rates is 100 bps). This is phase when bondholders can experience largest losses from the duration risk. As already mentioned, long-term bonds will lose more value when interest rates rise; that’s why it makes sense to be underweight duration during the early-to-mid-cycle expansion phase.

At this step, the central bank continues to increase rates which from the tactical allocation aspect means that investors should decrease their exposure to bonds. At one point during this phase the shape of the yield curve changes from steepness to “flatter than normal”. As the tightening goes on, the risk of a recession becomes real and dominates the inflation risk.

If market participants think that the central bank has gone too far and recession is inevitable, then the yield curve may transform from flat to inverted. Recall that this is the point when interest rates make the cyclical high and are set to decline. Falling interest rates will push bond prices higher. Therefore, the period before recession is the time to increase allocation to fixed-income securities. From tactical duration view, one should also increase duration during this phase.