You should be careful about AI in FinTech

Not everything is AI solvable

Wow! Such two fancy words, AI and FinTech. That ought to be a fantastic article.

Whether you’re a junior economist or a business transformation CEO, chances are you feel under pressure by the monstrous AI. This article is a sole reminder that AI was built to solve issues and that the FinTech industry should take great precautionary measures to reinstate their livelihood.Photo by Clay Banks on Unsplash

This article is about pointing out the twists, the nonsenses, and the collateral damages of the forceful AI&FinTech combination. Inquisitive or not, this article just might make you question the challenge at hand.

Making all the wrong deductions

Let me give you an example. Your company is building a predictive behavioral analytics engine for customers on the platform. The team decides to keep a quarterly analytics report of the users to tune the model.

Number #1: -> the roots of these problems are not mathematical, they are psychological. Hire people who understand the different choices people/consumers make, why they make them, and exemplify scientific findings with clear data visualizations. Focus on customer acquisition as a whole(I’ve picked this up from Shark Tank :))

Pitch your solution to someone outside the AI world to see if the ultimate goal is still being tested.

- Number #2: -> Let’s say you comply with the fact that it’s a data science problem. At this point, there are great chances you will be looking at 50 numerical column data with low correlation. The data scientists will have considered running binary classification or a clustering algorithm to figure out who likes the platform or who doesn’t. First of all, you couldn’t have run a proper EDA — exploratory data analysis — with such poor data. Secondly, what you’re doing is fitting the model to the data, when in fact you’re missing out on the objective. All of these models have a clear algorithm behind them. Listen. The Algorithm works. It’s the data and the objective that has to be heavily upgraded. With this in mind, I’ll let you wonder for a bit about Andrew and his new thesis.

The irrevocable decision you have come to is probably a RandomForest or a Decision Tree. Just don’ tell me you normalized all the categories and disregarded all the outliers?

- Number #3: -> Of course you should take the time component into consideration. Actions taking place further down in the past have negligible effects relative to the present ones. Working with AI/time series I encourage you to try the following. Lately, I have been working on a reinforcement learning trading bot (Don’t tell anyone) and I’ve been unveiling the loss that takes into account γ — gamma, the discount factor. For each timestamp earlier, a gamma factor to the negative one power is added to the equation. Do not use colinearity because the problem is not linear. You can find the neatly written paper about it below.

Time-Series Forecasting in Real Life: Budget forecasting with ARIMA

In depth example on how to forecast with ARIMA

towardsdatascience.com

- Number #4: -> Do not assign a similar task to an intern. I do not argue that interns lack the creative or mathematical intelligence to solve this. However, the odds are they will follow the by-the-book process. And we’re back to square one. They are interns, you have to delegate their work accordingly to their capabilities and work experience. You have to lead them, not the other way around.

Where the hype really is :)

Addressing the company that is starting to pursue AI in FinTech, I’d say the following:

- You should be focusing on creating more value than an 18-year old with a laptop can. Create a valuable product.

- When it comes to financing, the developer market volume is currently located in Blockchain Applications(Oh, boy, do I have a course for you!)

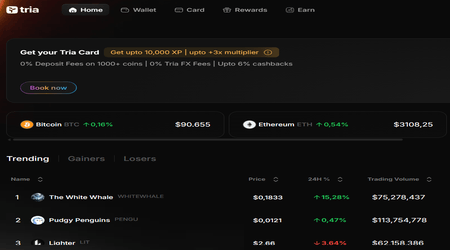

- Trading Algorithms. Modern-day reinforcement learning algorithms use the so-called Deep Q Networks to estimate the trading shares in a market.

- Market Making

- Tokenization: digital assets are represented by tokens on a distributed ledger. The possibilities are endless as to what an asset can be.

- Credit scores

Credit Scoring with Machine Learning: AI-Based Tool from Datrics

Machine learning for fraud detection, Ai, Datrics Machine learning is an innovative approach to improving fraud…

datrics.ai

Conclusion

Make your case against the task given in hand clearly. The decision of whether AI should be incorporated to solve your problem follows later. Get to know what you’re working with. Not everything is AI solvable and it shouldn’t be. In fact, if it can be avoided, it should be.

Connect and Read more

Hey, if you like my article, I’d immensely appreciate any feedback from your end so I can make more quality content.

Cheers, good luck, and happy coding!!! :)Photo by Jonathan Daniels on Unsplash

This labrador is just a reminder to smile, breathe and keep creating.

LinkedIn, Medium, GitHub, Gmail