COPA claims visible forgery in Craig Wright’s Bitcoin origin document

AdNext 100x SOL Meme Coin? Claim the FREE Airdrop!Get Free $SMOG

Skip to content

crypto.news

Search

search

Close searchBitcoin (BTC)

$46,608.00

4.3%

Bitcoin priceEthereum (ETH)

$2,470.50

1.98%

Ethereum priceBNB (BNB)

$322.05

2.03%

BNB priceSolana (SOL)

$105.17

3.43%

Solana priceXRP (XRP)

$0.52

1.62%

XRP priceShiba Inu (SHIB)

$0.0000094

2.11%

Shiba Inu pricePepe (PEPE)

$0.0000010

2.54%

Pepe priceEl Hippo (HIPP)

$0.0000000050290

0.38%

El Hippo price Bonk (BONK)

Bonk (BONK)

$0.0000113

6.6%

Bonk priceBitcoin (BTC)

$46,608.00

4.3%

Bitcoin priceEthereum (ETH)

$2,470.50

1.98%

Ethereum priceBNB (BNB)

$322.05

2.03%

BNB priceSolana (SOL)

$105.17

3.43%

Solana priceXRP (XRP)

$0.52

1.62%

XRP priceShiba Inu (SHIB)

$0.0000094

2.11%

Shiba Inu pricePepe (PEPE)

$0.0000010

2.54%

Pepe priceEl Hippo (HIPP)

$0.0000000050290

0.38%

El Hippo price Bonk (BONK)

Bonk (BONK)

$0.0000113

6.6%

Bonk price

COPA claims visible forgery in Craig Wright’s Bitcoin origin document

By Mohammad Shahidullah

By Mohammad Shahidullah

February 6, 2024 at 9:08 pm Edited by Brian Stone

Edited by Brian Stone

NEWS

Collect the article

share

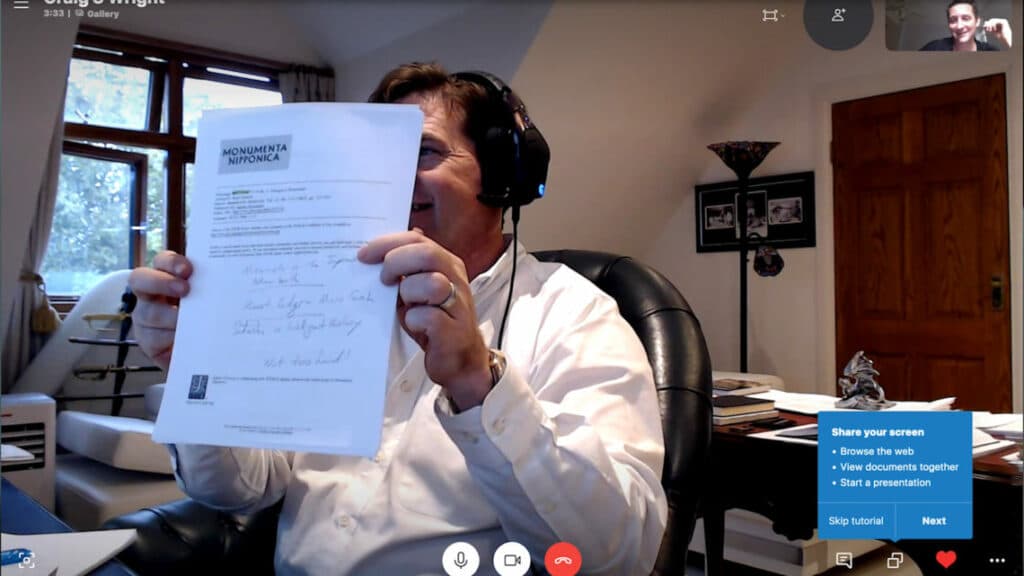

On the second day of the Craig Wright v. COPA trial, the plaintiff claimed that Wright had forged the date in his infamous “Nakamoto is the Japanese Adam Smith” document. This document is pivotal to the case, as Wright showed it in a video back in 2019, where he claimed to be Bitcoin’s originator, Satoshi Nakamoto. The date stamp on the document shows that it was from 2008, before the Bitcoin whitepaper was published.

This document is pivotal to the case, as Wright showed it in a video back in 2019, where he claimed to be Bitcoin’s originator, Satoshi Nakamoto. The date stamp on the document shows that it was from 2008, before the Bitcoin whitepaper was published.

COPA highlighted that the numeral “08” in the document’s date appeared smaller than the “20” and was not aligned properly, suggesting the document might have been altered or forged. Wright acknowledged the visual discrepancies but maintained the document’s authenticity, stating it had been in his possession for a long time and he couldn’t recall its origin.

Wright also mentioned not personally managing his Twitter account, which had claimed the document was authentic. Craig Wright showing the document of how he came up with the name ‘Satoshi’ in 2019 | Source: Modern Consensus

Craig Wright showing the document of how he came up with the name ‘Satoshi’ in 2019 | Source: Modern Consensus

COPA presented findings from Mr. Madden, an expert who compared the document to versions found in online archives. Madden noted alignment issues and differences in footers compared to those typical of the 2008 period, which Wright disputed by arguing about the variability of database formats.

You might also like:

Janet Yellen calls for Congress to regulate stablecoins, crypto spot markets

Wright rejected the suggestion that COPA’s expert found the original document, saying it was part of the effort to discredit him. He also emphasized that if the document were forged, it would have been done flawlessly, suggesting he wouldn’t make such amateurish mistakes.

Bitcoin domain and email: You claim you paid Anonymous Speech? Yes.

COPA shows Wright's "Evidence and law" article. Wright confirms he wrote it, but doesn't control it. COPA quotes from it. "I used my credit card." Wright confirms he wrote that.

— Norbert ⚡️ (@bitnorbert) February 6, 2024

The trial is set to continue with further testimony and cross-examination. The proceedings are expected to last several weeks, with both parties prepared for a lengthy legal battle.

The legal dispute started in 2016 when Dr. Craig Wright, originally an Australian computer scientist, publicly claimed to be Nakamoto and asserted intellectual property rights associated with Bitcoin. Cryptocurrency Open Patent Alliance (COPA) filed a lawsuit against Wright, seeking a court declaration that the Bitcoin whitepaper is public domain material and that no individual has copyright claims over it or the ‘Bitcoin’ name.

Major crypto stakeholders formed the COPA to prevent patent aggression and ensure open access to the technology.

Read more:

Grayscale CEO calls for regulatory approval on spot Bitcoin ETF options READ MORE ABOUT

READ MORE ABOUT

bitcoin

craig wright

satoshi nakamoto

Is cryptocurrency investment in 2024 worth the risk?

By Ankish Jain

By Ankish Jain

February 6, 2024 at 7:47 pm Edited by Lena Bozhkova

Edited by Lena Bozhkova

MARKETS

Collect the article

share

Get answers to your crypto investment questions. Learn about trends, promising coins, market risks, and whether investing in cryptocurrency is wise in 2024.

Despite a buoyant surge in Dec. 2023, leading to an over 16% increase in the total crypto market cap to reach $1.66 trillion as of Feb. 6, we still find ourselves in the shadow of the highs of 2021.Total crypto market cap from Dec. 23 till Feb. 6 | Source: CoinMarketCap

Amid this, 2024 started off with good news, Bitcoin (BTC), finally received a nod with the SEC’s approval of spot Bitcoin ETFs, hinting at an institutional embrace that could funnel fresh capital into the market.

The anticipation of Bitcoin’s halving in April teases a possible supply shock, fueling speculations that could redefine market dynamics.

Meanwhile, an upcoming update is expected to reduce Ethereum’s (ETH) gas fees. It is predicted that this could result in average transaction fees dropping to less than $0.01, enhancing Ethereum’s competitiveness and attractiveness for users.

There also are predictions of crypto becoming the native currency of the internet as AI assistants adopt it for transactions, painting a picture of a sector on the brink of mainstream adoption.

Yet, as we stand at this juncture, the question that looms large is: is crypto still a good investment in 2024? Let’s find out.

You might also like: Can AI truly predict cryptocurrency prices?

Is crypto worth investing in 2024?

Exploring the question of is crypto still a good investment in 2024, let’s uncover several key trends and factors that could influence the crypto market this year:

Bitcoin halving and ETFs

The Bitcoin halving event scheduled for April 2024 is set to reduce the mining reward from 6.25 BTC to 3.125 BTC per block. Historically, halving events have led to significant price increases. For instance, following the 2020 halving, Bitcoin’s price surged to record highs in 2021.

Coupled with the approval of U.S. spot Bitcoin ETFs, these factors could significantly impact Bitcoin’s value, whether it results in bullish outcomes or bearish, remains to be seen.

Stablecoins and digital payments

Stablecoins are predicted to surpass the transaction volumes of Visa. Such a development could boost the utility and value of stablecoins, making them an attractive component of the crypto investment landscape.

Prediction #4: More money will settle using stablecoins than using Visa.

Stablecoins are one of crypto’s “killer apps,” growing from effectively zero to a $137 billion market in the past four years, and we think 2024 will be another major year of growth. pic.twitter.com/uGjRxZjsyt

— Ryan Rasmussen (@RasterlyRock) December 13, 2023

Meanwhile, the adoption of stablecoins for daily transactions can increase their growing acceptance and make them a cornerstone in the future of digital payments.

Ethereum, layer 2 networks, and TVL

Ethereum’s ongoing development, particularly with upgrades like EIP-4884’s Proto-danksharding, could improve scalability and reduce transaction fees, with Ethereum predicted to double its revenue to $5 billion in 2024.

Meanwhile, layer 2 solutions like Polygon (MATIC) and Arbitrum (ARB), which aim to address the scalability issues of Ethereum, could also gain traction as Ethereum becomes mainstream.

Amid this, the overall total value locked (TVL) data suggests a rebounding ecosystem from under $70 billion in Mar. 2023 to nearly $106 billion as of Feb. 6, according to CoinMarketCap. Total defi TVL as of Feb. 6 | Source: CoinMarketCap

Corporate adoption and defi integration

The increasing involvement of corporate entities in the crypto space signals its growing mainstream acceptance.

Moreover, the move to integrate know-your-customer (KYC) protocols within defi platforms could attract institutional liquidity, potentially making the defi sector more attractive to traditional investors.

You might also like: How crypto becomes a big player in the 2024 presidential elections

Social innovations

The growth of SocialFi, blending defi and social media, and integrating crypto in gaming and virtual worlds could broaden crypto’s potential to penetrate various sectors.

These innovations could expand the use cases of crypto assets and open up new avenues for investment, particularly as platforms similar to friend.tech attract mainstream attention, marking the beginning and monetization potential of SocialFi applications.

What is the best crypto to invest in right now?

Focusing on the recent growth and potential, let’s see which coins are trending and where they might be headed, bearing in mind the volatility and risks inherent in the crypto market.

Pendle (PENDLE)

Pendle has seen a significant uptrend, trading at around $3.20 as of Feb. 6, with a reported 140% growth over the last 30 days, attributed to its unique position in the defi space. PENDLE one-month price chart | Source: CoinMarketCap

Pendle allows for tokenizing and trading yield-bearing assets, enabling users to manage yields more flexibly. This, coupled with strategic investments and partnerships, such as the one from Binance Labs in 2023, suggests a budding ecosystem.

The protocol’s multi-chain expansion and focus on both retail and institutional users could further boost its ecosystem’s value and PENDLE’s price. However, like any asset, it faces its share of market volatility and risks, especially in the short term.

Sui (SUI)

Sui (SUI) has seen a growth of over 80% in the last month, trading at $1.54 as of Feb. 6. SUI one-month price chart | Source: CoinMarketCap

Sui is a blockchain platform designed for high throughput and low latency, supporting various decentralized applications (dapps).

Its rising popularity could be attributed to its technical capabilities, including scalability and developer-friendly features.

Investors might be optimistic about Sui’s potential to capture a significant portion of the dapp market, which has been on an uptick lately, though the usual cautions about new blockchain platforms apply, including adoption challenges and competition.

Ethereum Name Service (ENS)

ENS has also experienced substantial growth, over 70% in the last month, trading at $22.15 as of Feb. 6. ENS one-month price chart | Source: CoinMarketCap

ENS’s price has jumped over 20% in the last 24 hours amid its partnership with GoDaddy, making it simpler for users to link their web2 domain names with a .eth domain without extra costs.

ENS functions as a decentralized, open, and extensible naming system on the Ethereum blockchain, translating human-readable Ethereum addresses into machine-readable alphanumeric codes.

This system mirrors the Internet’s DNS by making Ethereum addresses more user-friendly and accessible, similar to how DNS simplifies website accessibility for users

Should I invest in crypto?

While above mentioned coins show promising trends based on innovative utilities and growing ecosystems, investing in cryptocurrencies remains highly speculative.

Prices can be volatile, and you should be prepared for the possibility of losing your entire investment.

Diversification and thorough research are crucial, and considering professional financial advice is always a good strategy before making any investment decisions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FAQs

What is the best crypto to invest in 2024?

Is investing in cryptocurrency good or bad?

What is the best coin to buy now?

Read more: Crypto claims to be inclusive. Not for visually impaired, as it turns out

READ MORE ABOUT

bitcoin

ens

ethereum

sui

Janet Yellen calls for Congress to regulate stablecoins, crypto spot markets

By Mohammad Shahidullah

By Mohammad Shahidullah

February 6, 2024 at 6:18 pm Edited by Brian Stone

Edited by Brian Stone

NEWS

Collect the article

share

Treasury Secretary Janet Yellen addressed Congress today, calling for comprehensive legislation to regulate non-securities crypto assets, emphasizing stablecoins.

Appearing before the House Financial Services Committee today, Yellen argued that the risks associated with crypto assets have been growing, and there should be specific congressional action to protect U.S. citizens from the risks of investing in digital assets.

Yellen pointed out that non-compliant crypto platforms have increased, which should be controlled through more comprehensive laws and regulations.

BREAKING: 🇺🇸 US Treasury Secretary Janet Yellen asks Congress to regulate crypto assets "that are not securities." pic.twitter.com/ZCZ1hDZDlk

— Sapna Singh (@earnwithsapna) February 6, 2024

You might also like: Cathie Wood advocates for BTC as next safe-haven asset

The secretary also believes that a federal regulator should have the power to approve or ban any stablecoin issuers based on effective risk and vulnerability assessment.

“Council is focused on digital assets and related risks. Congress should pass legislation to regulate stablecoin and spot markets for crypto assets that are not securities.”

– Janet Yellen

Crypto regulations have become a major political talking point this year, and it’s also a critical focus of the upcoming U.S. Presidential election. The crypto industry has been making concerted efforts to back crypto-friendly policymakers, with significant financial commitments indicating a strategic push to sway policy and election outcomes in favor of digital assets.

A few months ago, a trio of super PACs, backed by influential figures and companies within the crypto space, raised $78 million to support candidates favorable to crypto. The move is part of a broader strategy to counteract regulatory challenges and secure a more favorable policy environment for the industry.

Read more: A Trump re-election could mean ‘friendlier’ crypto laws, GOP lawmaker says

READ MORE ABOUT

crypto regulation

stablecoin

Europe leads Ethereum ETF market with $4.6b AUM

By Naga Avan-Nomayo

By Naga Avan-Nomayo

February 6, 2024 at 6:14 pm Edited by Brian Stone

Edited by Brian Stone

NEWS

Collect the article

share

While U.S. regulators deliberate on spot Ethereum ETFs, Europe and Canada already boast billions in spot and futures ETH-related products.

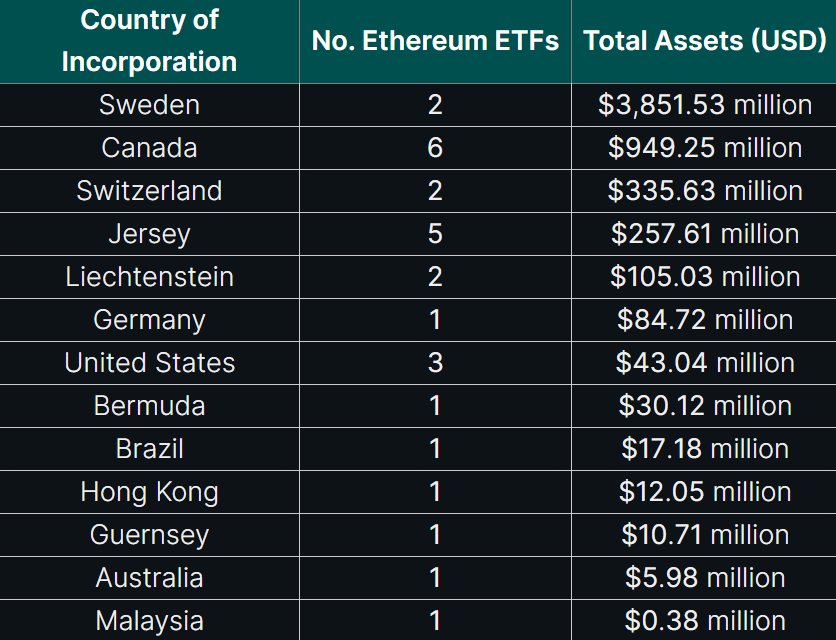

Per a Coingecko study, Europe dominates the global Ethereum (ETH) ETF scene with an 81.4% market share. The area has 13 ETH-backed ETFs split across spot products and futures funds, amounting to $4.6 billion in assets under management (AUM).

Canada is also a big market for ETH ETFs and commands a 16.6% market share of $949 million in AUM. ETFs have also become a gateway into crypto for many Canadian investors. Local regulators introduced stricter measures on crypto companies, leading to an exodus of exchanges like Binance and Bitstamp.

Global ETH ETF AUM stood at $5.7 billion as of Feb. 2, spread over 27 ETFs featuring both spot and futures funds. European Ethereum ETFs have traded since 2017, when Grayscale launched its ETH trust (ETHE). However, Grayscale’s fund was excluded from the study due to its close-ended structure.

The company was engaged with the U.S. Securities and Exchange Commission (SEC) over converting ETHE to a spot Ethereum ETF, but a decision was delayed till May, crypto.news reported. Global Ethereum ETFs markets | Source: CoinGecko

Global Ethereum ETFs markets | Source: CoinGecko

You might also like: Standard Chartered foresees Ethereum ETF approval by May 23

Spot Ethereum ETFs in the U.S.

Following approval of spot Bitcoin (BTC) ETFs in the U.S., SEC chair Gary Gensler stressed that Ethereum-based products may not receive the same treatment. Gensler has repeatedly reiterated that most cryptocurrencies qualify as securities and must register with the SEC.

However, the SEC’s loss to Grayscale in court and the eventual approval of spot BTC ETFs on Jan. 10 may better the chances of a green light for spot ETH funds. A U.S. court found that the SEC’s denial of spot crypto products while allowing futures-based ETFs was “arbitrary and capricious”.

SEC Commissioner Hester Peirce also said Ethereum ETF approvals will not be the same as the Bitcoin counterpart, where a court ruling was required to cajole the securities watchdog into reassessing its decision.

In the interim, several spot ETH ETFs have been delayed until the second quarter of 2024, including bids from issuers like Fidelity and Invesco Galaxy.

Read more: BlackRock’s Larry Fink points to value in Ethereum ETFs, crypto asset class

READ MORE ABOUT

assets

ethereum

ethereum etf

related news

MARKETS

MARKETS

Read more - Bitcoin returns to $45k amid increased trading volume, positive market sentiment

Bitcoin returns to $45k amid increased trading volume, positive market sentiment

4 hours ago NEWS

NEWS

Read more - TradeStation Crypto reaches $3m settlement for offering unregistered interest product

TradeStation Crypto reaches $3m settlement for offering unregistered interest product

8 hours ago NEWS

NEWS

Read more - Bitmain-backed Bitcoin mining firm BitFuFu eyes going public via SPAC deal

Bitmain-backed Bitcoin mining firm BitFuFu eyes going public via SPAC deal

12 hours ago

sign up for daily crypto news in your inbox

Get crypto analysis, news and updates right to your inbox! Sign up here so you don't miss a single newsletter.

Email

subscribe

© 2015-2024 crypto.news

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕖𝕒𝕟𝕚𝕖 𝔹𝕒𝕓𝕚𝕖𝕤 - Have Fun Staying Poor](https://cdn.bulbapp.io/frontend/images/17e87f53-0225-4de1-995f-9f66198cb037/1)