The Evolution of Fintech in Modern Finance

The Rise of Fintech: Disrupting the Financial Landscape.

The financial services industry, once a domain of traditional brick-and-mortar institutions, is undergoing a seismic shift. Fueled by technological innovation and a growing consumer demand for convenience and accessibility, financial technology, or Fintech, is rapidly transforming how we manage our money. This article delves into the rise of Fintech, exploring its impact on various financial services, the opportunities it presents, and the challenges it needs to address.

What is Fintech?

Fintech is a broad term encompassing a wide range of technology-enabled financial solutions. It can include:

- Mobile payments and digital wallets:Solutions like Apple Pay, Google Pay, and Venmo have revolutionized how we pay for goods and services, enabling contactless and instant transactions.(https://www.apple.com/apple-pay/), Google Pay (https://pay.google.com/about/), and Venmo (https://venmo.com/)

- Peer-to-peer (P2P) lending and borrowing:Platforms like LendingClub and Prosper connect borrowers and lenders directly, bypassing traditional financial institutions and offering potentially lower interest rates and faster loan approvals. https://www.chime.com/) and N26 (https://n26.com/en-eu/blog/how-to-transfer-money-from-one-bank-to-another),

- Digital challenger banks: These online-only banks, such as Chime and N26, provide a full suite of financial services, including checking and savings accounts, debit cards, and bill pay, often with lower fees and higher interest rates compared to traditional banks.

- Robo-advisors: These automated investment platforms use algorithms to manage investment portfolios based on an individual's risk tolerance and financial goals. They offer a low-cost alternative to traditional financial advisors.

- Blockchain technology: Blockchain, the underlying technology behind cryptocurrencies like Bitcoin, has the potential to revolutionize financial transactions by offering a secure and transparent way to record and track data.

The Driving Forces Behind the Rise of Fintech.

Several factors have contributed to the meteoric rise of Fintech:

- Increased smartphone penetration: With smartphones becoming ubiquitous, consumers have embraced mobile banking and financial apps, demanding convenient and on-the-go access to their finances.

- Growing dissatisfaction with traditional banks: Traditional banks have often been criticized for high fees, cumbersome processes, and a lack of innovation. Fintech companies have stepped in to address these concerns by offering more user-friendly and affordable solutions.

- Demand for financial inclusion: Billions of people globally lack access to traditional banking services. Fintech companies are developing solutions to reach the unbanked and underbanked populations, promoting financial inclusion.

- Advancements in technology: Technological advancements in areas like artificial intelligence, big data, and cloud computing are empowering Fintech companies to develop innovative solutions and personalize financial services.

The Impact of Fintech on Different Financial Services

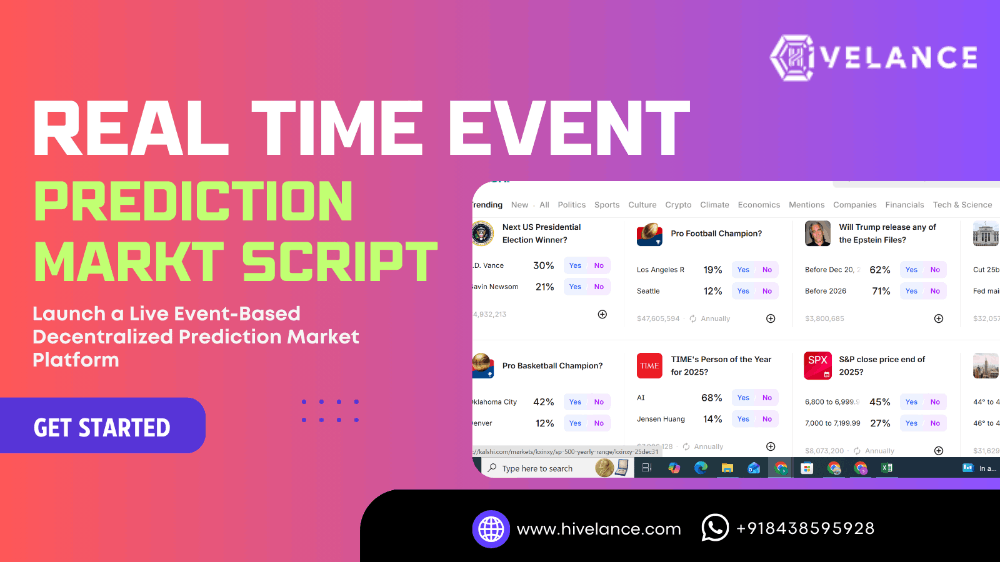

Fintech is disrupting various financial services, offering consumers more choices and greater control over their money. Here's a closer look at some key areas of impact:

- Payments: Mobile payments and digital wallets have significantly transformed how we make payments, offering speed, convenience, and security.

- Banking: Digital challenger banks are challenging the dominance of traditional banks by providing a more streamlined and user-friendly banking experience with lower fees and competitive interest rates.

- Lending and borrowing: P2P lending platforms offer more flexible and potentially lower-cost loan options compared to traditional banks, while also providing alternative investment opportunities for lenders.

- Investing: Robo-advisors are democratizing investing by providing affordable and accessible investment management solutions for everyone, not just the wealthy.

Opportunities Presented by Fintech

The rise of Fintech presents several exciting opportunities:

- Increased financial inclusion: Fintech solutions can reach the unbanked and underbanked populations, promoting financial empowerment and economic development.

- Enhanced financial literacy: Educational tools and resources offered by Fintech companies can increase financial literacy and enable people to make informed financial decisions.

- Improved access to financial services:Fintech provides geographically dispersed populations with access to a wider range of financial services, breaking down geographical barriers.

- More affordable and convenient financial services: Fintech companies often offer lower fees and more user-friendly interfaces compared to traditional financial institutions, making financial services more accessible to everyone.

Challenges and Regulations

- Regulation: As the Fintech industry evolves rapidly, regulators need to keep pace to ensure consumer protection, financial stability, and a level playing field for all financial institutions.

- Financial inclusion: While Fintech can promote financial inclusion, ensuring equitable access to technology and digital literacy is essential for bridging the digital divide and reaching underserved populations.

- Data privacy: Fintech companies collect vast amounts of consumer data.

The Future of Fintech: A Collaborative Landscape

The future of Fintech is likely to be one of collaboration between established financial institutions and innovative Fintech startups. Traditional banks can leverage Fintech solutions to enhance their offerings, improve efficiency, and better serve their customers.

Conversely, Fintech companies can benefit from the established infrastructure and regulatory compliance expertise of traditional institutions. This collaborative approach can create a win-win situation for both consumers and the financial services industry as a whole.

Here are some key trends to watch in the future of Fintech:

- Embedded finance: Integration of financial services into non-financial platforms. Imagine buying insurance directly within your ride-sharing app or accessing credit options while shopping online.

- Open banking: Open APIs (Application Programming Interfaces) will enable secure data sharing between financial institutions and third-party providers, fostering innovation and creating a more interconnected financial ecosystem.

- Artificial intelligence (AI) and machine learning (ML): AI and ML will be increasingly used for fraud detection, personalized financial advice, and automated investment management.

- Blockchain technology: Blockchain has the potential to revolutionize financial transactions by offering a secure and transparent way to record and track data.

Conclusion: Fintech – A Force for Positive Change

The rise of Fintech is reshaping the financial services industry, offering consumers greater control, convenience, and choice in managing their money. While challenges exist, Fintech presents significant opportunities for financial inclusion, innovation, and a more accessible financial system.

As Fintech continues to evolve and collaborate with traditional institutions, the future of finance promises to be more inclusive, efficient, and empowering for everyone.