What is Cross and Isolated Margin Which is Better?

**Crossing Margin** and **Isolated Margin** are two different margin management strategies used when trading cryptocurrencies. Here are the meanings of these two concepts and the differences between them, friends.

**Crossing Margin**:

- Cross margin allows you to open larger positions using the entire account balance.

- It may offer higher leverage.

- Provides the ability to trade using all capital.

- Usually comes as the default option on many trading platforms.

- It is a more useful option for beginner investors.

**Isolated Margin**:

- Isolated margin refers to the margin balance that investors allocate to a specific position.

- A separate margin can be set for each transaction.

- Isolated margin refers to the margin balance that provides risk management and is allocated to a specific position.

- Isolated margin limits the available collateral for each position, but the margin balance of each position is different.

- Once the position is isolated, the specified margin amount can be changed.

Which margin management is less risky?

**Isolated Margin** is generally a less risky margin management strategy. Here are the reasons:

- **Risk Control**: Isolated margin limits risk by setting a separate margin for each position. This reduces the risk of the investor using his total capital in a single position.

- **Less Leverage**: Isolated margin operates with lower leverage levels. This means it carries less risk. In cross margin, it is possible to use high leverage and this involves more risk.

- **Position Isolation**: Isolated margin determines the margin balance of each position separately. In this way, if one position goes bad, it does not affect other positions.

However, it should not be forgotten that both methods have advantages and disadvantages. Traders should choose a margin management based on their own risk tolerance and trading strategy.

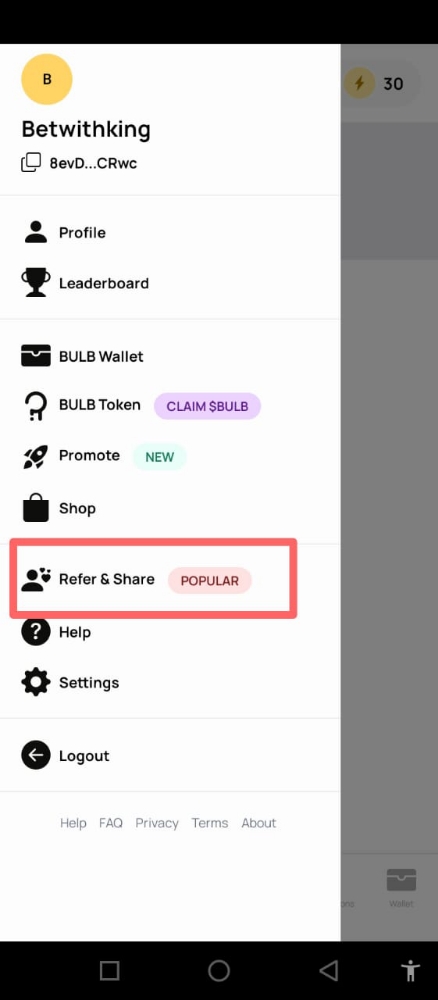

To open a position using **Isolated Margin** you can follow the steps below:

1. **Position Selection**: Select the cryptocurrency you want to trade with isolated margin.

2. **Margin Setting**: Set the amount of margin reserved for trading with isolated margin. This refers to the amount you want to invest.

3. **Opening a Position**: Open a position in the cryptocurrency of your choice and trade using your margin setting.

4. **Risk Management**: Do not forget about risk management when trading with isolated margin. Be careful not to exceed the margin amount you set.

Isolated margin determines the margin balance of each position separately and limits risk. In this way, you can operate in a more controlled manner. However, you should always exercise caution and act according to your own risk tolerance.

To open a position using **Crossing Margin** you can follow the steps below:

1. **Position Selection**: Select the cryptocurrency you want to trade with cross margin.

2. **Margin Setting**: Determine the amount of margin you want to use when trading with cross margin. This refers to the amount you want to invest.

3. **Opening a Position**: Open a position in the cryptocurrency of your choice and trade using the margin amount you set.

4. **Risk Management**: Do not forget about risk management when trading with cross margin. Remember that you carry higher risk in leveraged transactions and think carefully before investing.

Cross margin allows you to open larger positions using the entire account balance. However, you should understand the risks of using high leverage and be careful.