REGULATIONS AND INNOVATIONS: CRYPTO AND TECH HIGHLIGHTS OF THE WEEK

Table of Content:

∘ Introduction

∘ What is Crypto Exchange?

∘ Why Cryptocurrency Exchange Makes a Compelling Business Venture

∘ Critical Components of Cryptocurrency Exchange Development

∘ Challenges in Cryptocurrency Exchange Development

∘ Emerging Trends in Cryptocurrency Exchange Development

∘ The Future of Blockchain, DeFi, and Crypto

∘ Conclusion

Introduction

As

digital currencies gain traction, the significance of cryptocurrency exchange website development grows. A premier cryptocurrency exchange development company recognizes these platforms’ pivotal role in providing users easy access to diverse digital assets. These exchanges offer a secure avenue for investors to manage their assets and make well-informed decisions.

Selecting the best company from top blockchain development firms involves considering factors like experience, work quality, and alignment with specific needs. Research, reviews, and client interactions help gauge a company’s reputation. Cost, timeline, and communication style are also crucial considerations. Before delving into these factors, let’s grasp the essence of cryptocurrency exchange development.

What is Crypto Exchange?

➣ A cryptocurrency exchange, often called a crypto exchange, is an online platform that enables the buying, selling, and trading of various cryptocurrencies. These digital marketplaces facilitate the sale of digital assets, such as Bitcoin, Ethereum, and other altcoins, allowing users to trade these digital currencies against fiat money (traditional currencies like dollars or euros) or other cryptocurrencies.

➣ A cryptocurrency exchange, often called a crypto exchange, is an online platform that enables the buying, selling, and trading of various cryptocurrencies. These digital marketplaces facilitate the sale of digital assets, such as Bitcoin, Ethereum, and other altcoins, allowing users to trade these digital currencies against fiat money (traditional currencies like dollars or euros) or other cryptocurrencies.

➣ Cryptocurrency exchanges play a pivotal role in the cryptocurrency ecosystem by providing a venue for users to execute transactions, speculate on price movements, and invest in various digital assets. There are two main types of cryptocurrency exchanges: centralized exchanges (CEX), where transactions are facilitated by a centralized entity, and decentralized exchanges (DEX), which operate without a central authority, allowing users to trade directly from their cryptocurrency wallets.

⏩ Centralized Exchanges (CEX)

Centralized exchanges are traditional platforms where users deposit their funds, and the exchange acts as an intermediary, matching buy and sell orders. Notable examples include Binance, Coinbase, and Kraken. CEXs offer high liquidity, faster transactions, and a user-friendly interface, making them popular among traders. However, they face security concerns as they store users’ funds on centralized servers, making them susceptible to hacking attempts.

⏩ Decentralized Exchanges (DEX)

Decentralized exchanges, on the other hand, operate without a central authority and allow users to trade directly from their cryptocurrency wallets. Popular DEXs include Uniswap, SushiSwap, and PancakeSwap. DEXs provide enhanced security, privacy, and control over funds but may face liquidity and user experience challenges.

Why Cryptocurrency Exchange Makes a Compelling Business Venture

➢Embarking on a cryptocurrency exchange business is a smart move, driven by its enticing potential for profitability, global demand, and accessibility for aspiring entrepreneurs. Creating a cryptocurrency exchange platform focusing on innovation, low operational costs, and the inclusion of numerous currencies attracts a diverse customer base and opens avenues for global expansion.

➢A standout advantage of cryptocurrency transactions lies in the inherent security provided by blockchain technology, significantly reducing the risks associated with cyberattacks and fraud. This heightened security feature appeals strongly to customers who prioritize the safety of their financial transactions. Consequently, establishing a cryptocurrency exchange platform is a promising business opportunity with substantial growth prospects.

Investing in a cryptocurrency exchange proves to be an attractive business idea for several compelling reasons:

➡️ Global Reach: Cryptocurrencies transcend geographical boundaries, allowing users worldwide to participate. Operating a cryptocurrency exchange provides access to a global customer base, offering services to diverse needs and catering to a broad audience.

➡️ Low Barriers To Entry: Unlike traditional financial institutions, setting up a cryptocurrency exchange requires a relatively lower initial capital investment. The digital nature of the business eliminates the need for physical branches, reducing overhead costs. While regulatory compliance is crucial, the process is generally more straightforward than establishing a traditional financial institution.

➡️ Token Listing Opportunities: Cryptocurrency exchanges have the unique advantage of evaluating and listing new, promising cryptocurrencies. By adding innovative projects to the platform, businesses can attract new projects and traders interested in investing in cutting-edge assets.

➡️ Multiple Revenue Streams: Cryptocurrency exchanges offer various revenue streams, including transaction fees, withdrawal fees, listing fees for new tokens or coins, and premium services for advanced traders. Some businesses even create their native tickets, incentivizing trading and providing additional benefits to users.

➡️ 24/7 Market: The cryptocurrency market operates 24/7, providing continuous trading opportunities. This constant trading cycle can lead to increased transaction volumes, potentially enhancing the revenue potential for the exchange.

However, it’s essential to acknowledge the challenges and risks of operating a cryptocurrency exchange, including regulatory compliance, security concerns, market volatility, and competition. Implementing a well-thought-out business plan, prioritizing user security and satisfaction, and staying informed about evolving regulations are crucial for long-term success in this dynamic industry.”

Critical Components of Cryptocurrency Exchange Development

➡️ Security Infrastructure:Security is paramount in cryptocurrency exchange development. Implementing robust security measures, such as two-factor authentication (2FA), encryption, and cold storage for private keys, helps protect user funds from unauthorized access and cyber threats.

➡️User Interface (UI) and User Experience (UX):Intuitive and user-friendly interfaces are crucial for attracting and retaining users. A well-designed UI/UX enhances the trading experience and improves the exchange’s success.

➡️Liquidity Management:Liquidity is essential for the smooth functioning of an exchange. Integration with liquidity providers, market makers, and order book management systems ensures users can execute trades quickly and at competitive prices.

➡️ Payment Gateway Integration:Supporting various payment methods, including bank transfers, credit cards, and cryptocurrencies, widens the user base. Integrating secure and reliable payment gateways simplifies the deposit and withdrawal processes.

➡️ Regulatory Compliance:Adhering to regulatory requirements is critical for the success and legality of a cryptocurrency exchange. KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures must be in place to ensure a secure and compliant trading environment.

➡️Token Listings:The availability of a diverse range of cryptocurrencies attracts a broader audience. Establishing a streamlined process for adding new tokens to the exchange is crucial for staying competitive.

Challenges in Cryptocurrency Exchange Development

➡️ Security Concerns:The decentralized nature of cryptocurrencies makes them attractive targets for hackers. Constantly evolving security protocols are necessary to stay ahead of potential threats.

➡️ Security Concerns:The decentralized nature of cryptocurrencies makes them attractive targets for hackers. Constantly evolving security protocols are necessary to stay ahead of potential threats.

➡️ Regulatory Uncertainty:Cryptocurrency regulations vary globally, and navigating this complex landscape can be challenging. Exchanges must stay informed about the legal requirements in different jurisdictions to ensure compliance.

➡️ Liquidity Issues:Liquidity is a common challenge for new exchanges. Overcoming this hurdle requires strategic partnerships, market-making initiatives, and the implementation of liquidity pools.

➡️ User Trust:Building and maintaining trust is crucial in the cryptocurrency space. Transparency, timely communication, and a track record of security are vital for gaining and retaining user trust.

Emerging Trends in Cryptocurrency Exchange Development

➡️DeFi Integration:Integrating decentralized finance (DeFi) protocols into exchanges is gaining popularity. This trend allows users to access various financial services directly from the exchange platform, including lending, borrowing, and yield farming.

➡️ NFT Marketplaces:Non-fungible tokens (NFTs) have surged in popularity, and exchanges are increasingly integrating NFT marketplaces. This allows users to trade, buy, and sell digital assets, including art, music, and collectibles.

➡️ Cross-Chain Compatibility:Enhancing interoperability between blockchain networks enables users to trade assets seamlessly across multiple blockchains. Cross-chain compatibility is becoming a key focus in cryptocurrency exchange development.

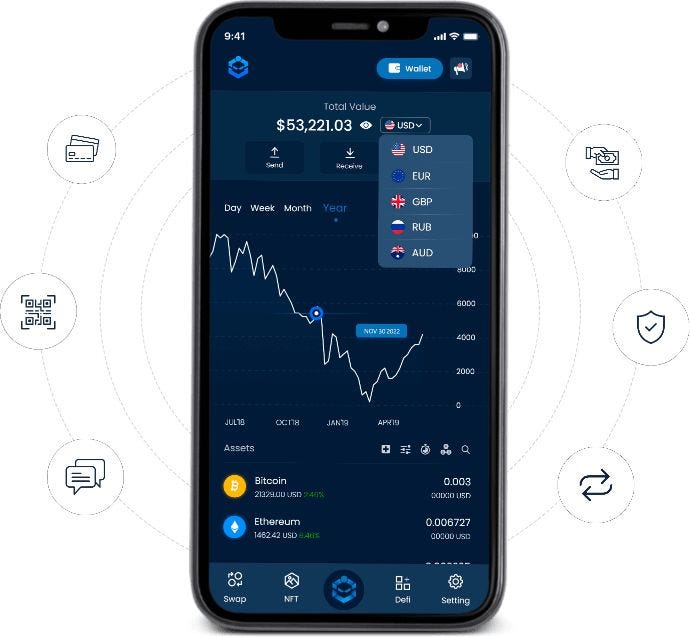

➡️ Mobile Trading Apps:The rise of mobile trading is reshaping the landscape, with users demanding convenient access to their portfolios. Developing mobile trading apps with advanced features is a trend that is likely to continue.

The Future of Blockchain, DeFi, and Crypto

➢ The future of blockchain, DeFi, and crypto holds immense promise, ushering in a transformative era in finance. Blockchain technology is at the forefront of this revolution, streamlining transactions for individuals and businesses, making them not only more accessible but also highly secure.

➢ Decentralized Finance (DeFi) is pivotal in this evolution, offering users unprecedented access to financial services without reliance on central authorities. Beyond cryptocurrencies, DeFi encompasses a range of services such as lending, borrowing, trading, democratizing finance, and providing an attractive alternative to traditional banking.

➢ Simultaneously, crypto is gaining widespread acceptance as both a payment method and a store of value. The growing adoption of cryptocurrencies is paving the way for a new, more secure, private financial system. This shift reflects a broader trend where individuals and businesses recognize the advantages of embracing decentralized technologies.

➢ In the future, it envisions a financial landscape where blockchain facilitates seamless transactions, DeFi redefines accessibility, and crypto establishes itself as a mainstream payment and value storage method. As these technologies continue to evolve, they hold the potential to reshape the foundations of the financial world, offering individuals greater control and security over their assets.

Conclusion

➤ Cryptocurrency is gaining popularity as an alternative to traditional currencies, offering investors a viable option. This guide explores the world of crypto, highlighting its benefits and risks. Crypto boasts advantages like low fees, speedy transactions, security, privacy, and decentralization. However, it’s crucial to acknowledge the inherent risks and conduct thorough research before investing.

➤Cryptocurrency and decentralized finance (DeFi) are transforming the finance landscape, promising a more secure and private financial system. Users, investors, and businesses can benefit from the innovations in Crypto and DeFi. Despite the potential advantages, it’s essential to approach crypto investments cautiously, considering the market’s dynamic nature. In conclusion, crypto and DeFi represent a revolutionary shift in finance, offering numerous advantages for those navigating this evolving landscape.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)