Ethereum ETFs See First Weekly Inflow, Bitcoin ETFs Return to Outflow

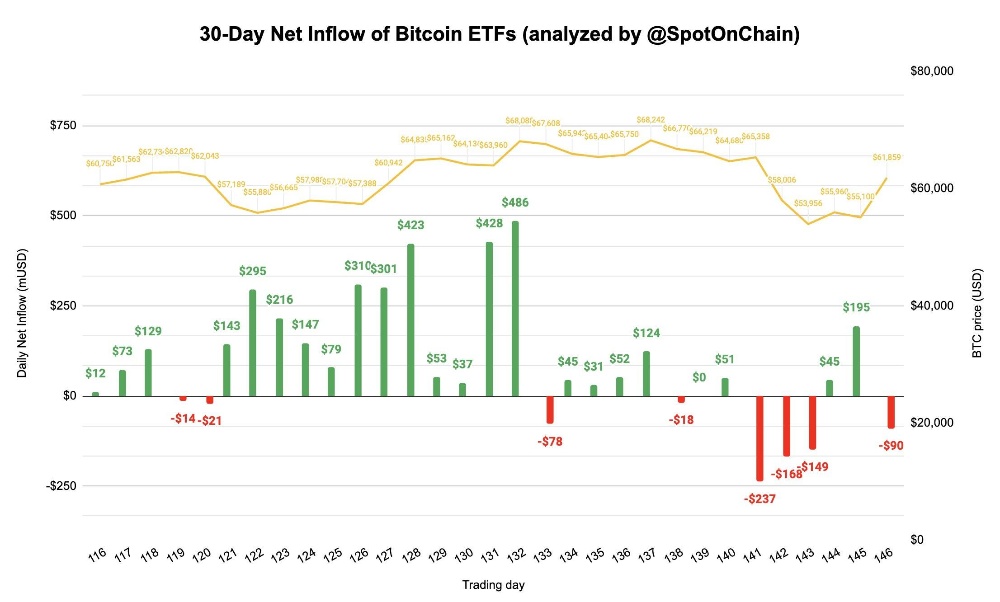

The group of Bitcoin and Ethereum ETFs ended the week of the crypto market's sharp decline with mixed results.

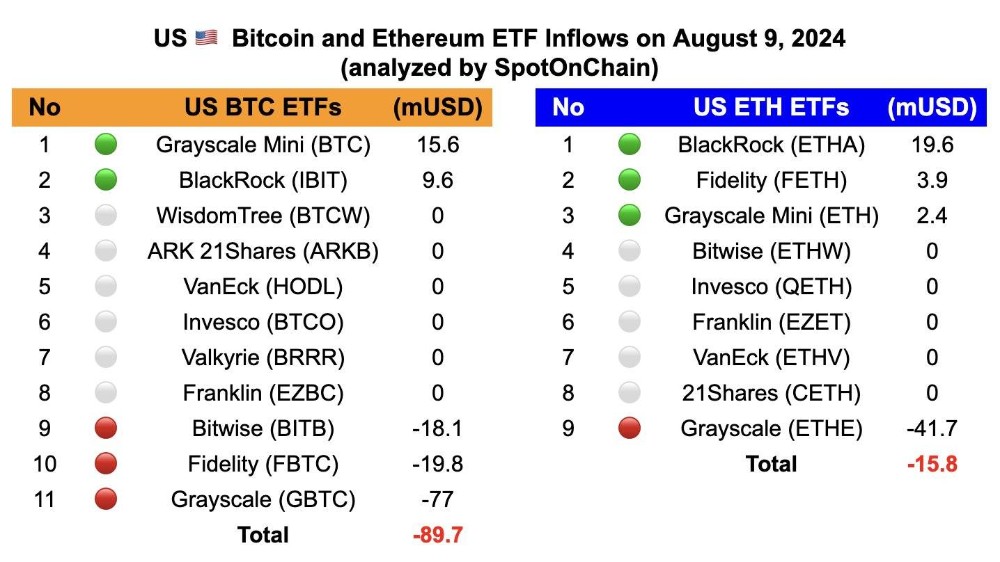

According to data from Farside Investors and SpotOnChain, US Bitcoin spot ETFs ended the trading session on August 9, 2024 (US time) with outflows of $89.7 million, failing to continue the inflows of the previous two sessions.

Thus, the 11 US Bitcoin ETFs ended the first full trading week of August 2024 with net outflows of $255.2 million. It is easy to see that this is the result of Bitcoin's "flash crash" at the beginning of the week, causing the world's largest cryptocurrency to collapse from $60,000 to $49,000 in 12 hours.

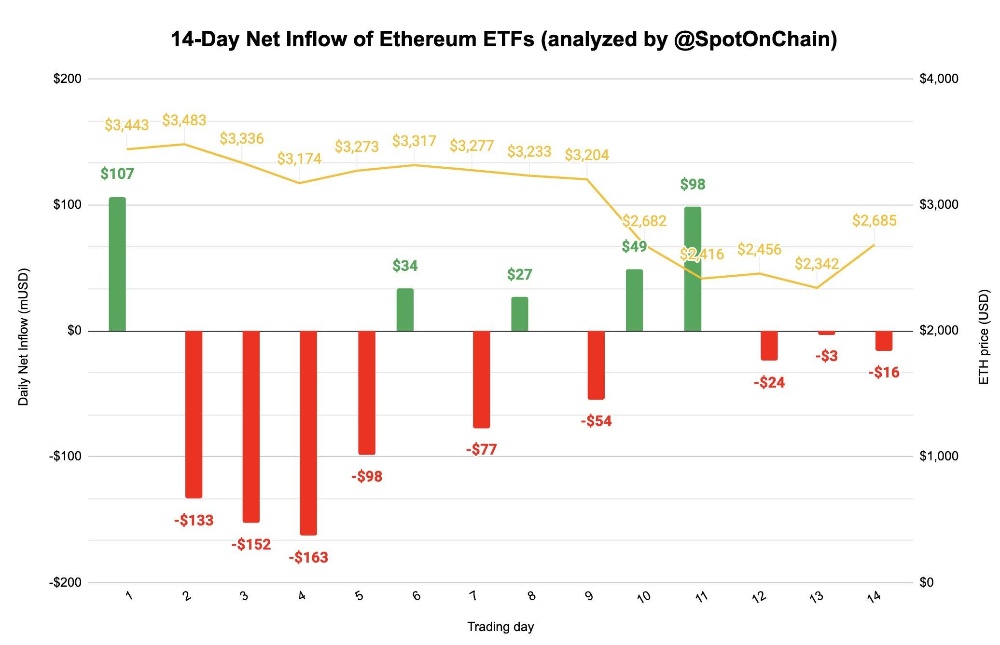

This is the first time Ethereum ETFs have seen weekly inflows since the product group began trading in mid-July. In the previous two weeks, Ethereum ETFs had total outflows of $341.8 million and $169.4 million, respectively.

The trend of ETH ETFs this week is the opposite of BTC ETFs. While Bitcoin funds started the week with outflows, Ethereum ETFs recorded strong inflows during these days, before returning to a state of capital withdrawal in the following days.