Unveiling the World of Staking in Cryptocurrency: Understanding Token Staking, Its Significance

Staking has emerged as a fundamental concept in the cryptocurrency space, reshaping how users interact with blockchain networks. This blog post aims to demystify staking, explore the meaning of token staking, delve into its significance in the crypto market, and shed light on the importance of APR (Annual Percentage Rate) and its contributions to users.

Deciphering Staking in Cryptocurrency:

- Defining Staking:

Staking, in the context of cryptocurrency, refers to the act of participating in the validation of transactions or the governance of a blockchain network by locking up a certain amount of tokens as collateral.

- Token Staking Explained:

Token staking involves committing a specified amount of cryptocurrency to a staking pool or a blockchain network to support its operations. In return for this commitment, participants may receive rewards, such as additional tokens or a share of transaction fees.

Significance of Staking in the Crypto Market:

- Network Security and Consensus:

Staking plays a pivotal role in the security and consensus mechanisms of proof-of-stake (PoS) and delegated proof-of-stake (DPoS) blockchain networks. Participants are incentivized to act honestly, as their staked tokens serve as collateral.

- Participation and Governance:

Staking allows users to actively participate in the governance of a blockchain network. Token holders can vote on proposed changes, upgrades, or policy decisions based on the number of tokens they have staked.

- Earning Passive Income:

One of the primary motivations for token staking is the opportunity to earn passive income. Stakers receive rewards, often in the form of additional tokens or a percentage of transaction fees, for contributing to the network's security and stability.

APR (Annual Percentage Rate) and Its Contributions:

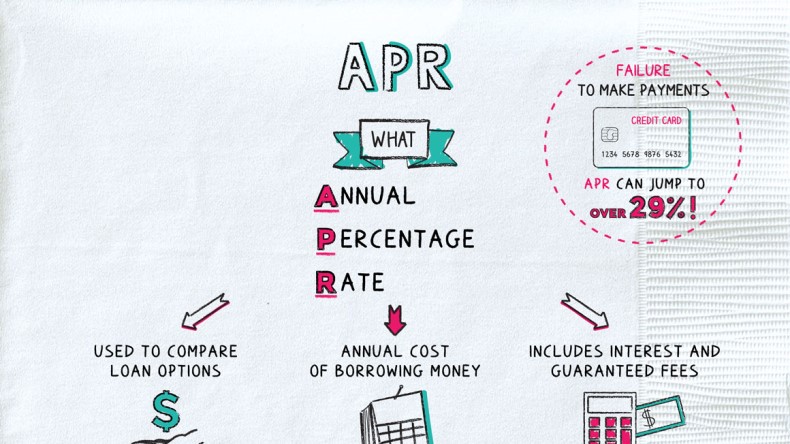

- Understanding APR:

APR, or Annual Percentage Rate, represents the annualized interest rate earned by staking or providing liquidity in decentralized finance (DeFi) protocols. It serves as a metric to quantify the potential returns on staked tokens.

- User Incentives:

APR acts as a significant incentive for users to stake their tokens. Higher APR values indicate greater potential returns, attracting more participants to stake their tokens and contribute to the network's functionality.

- Liquidity Provision in DeFi:

In DeFi protocols, APR encourages users to provide liquidity by staking their tokens in liquidity pools. This enhances liquidity within the protocol, contributing to a more efficient and vibrant decentralized financial ecosystem.

Conclusion:

Staking has become a cornerstone of the cryptocurrency landscape, offering users the opportunity to actively participate in network operations, governance, and earn passive income. The introduction of APR further enhances the attractiveness of staking, providing users with a clear metric to evaluate potential returns. As the crypto market continues to evolve, staking will likely remain a key element in shaping the dynamics of blockchain networks and fostering user engagement.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)