Notable Bankruptcies II : The failure of Signature Bank , The Third Biggest Bank Collapse.

Notable Bankruptcies II : The Failure of Signature Bank.

Yesterday we talked about the Bankruptcy of Silicon Valley Bank . In the wake of the collapse of Silicon Valley Bank (SVB) in March 2023, the bankruptcy of Signature Bank just two days later sent shockwaves through the financial industry.

Signature Banks’s failure marked the Third Largest Bank Collapse in US history , further exacerbating the crisis of confidence sweeping through the banking sector.

About Signature Bank

Signature Bank, headquartered in New York, had established itself as a leading player in the cryptocurrency and blockchain ecosystem. Founded in 2001, the bank had grown to become the 29th largest in the United States, with over $110 billion in assets under management. Its close ties to the digital asset industry, however, would ultimately prove to be its downfall.

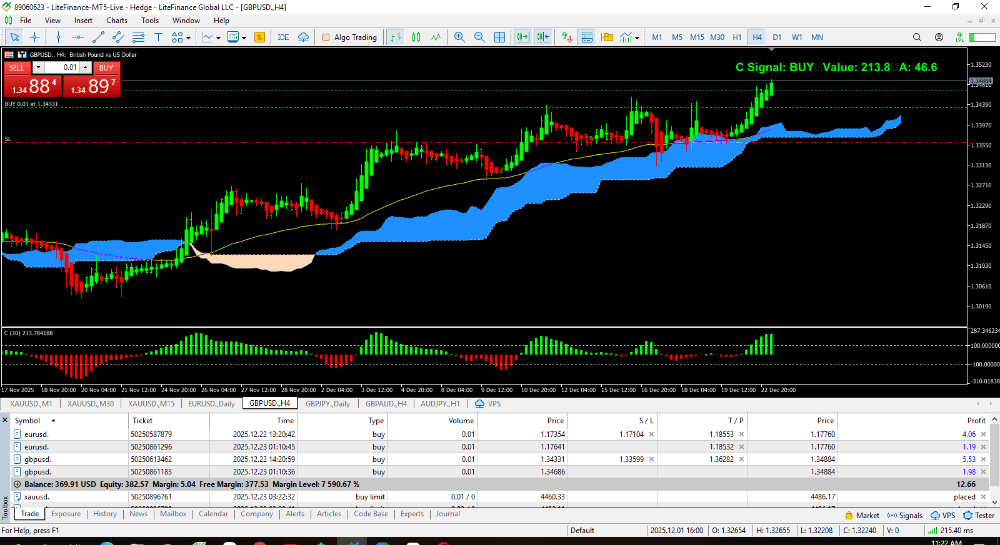

The seeds of Signature Bank's demise were sown in the crypto market's precipitous decline throughout 2022. As the prices of Bitcoin, Ethereum, and other digital currencies plummeted, confidence in the broader crypto ecosystem waned. This, in turn, put significant pressure on Signature Bank, which had become heavily reliant on deposits from cryptocurrency firms and investors.

As the crypto market turmoil intensified, Signature Bank found itself grappling with a classic bank run scenario. Spooked depositors, fearing the bank's exposure to the volatile digital asset space, began rapidly withdrawing their funds, creating a vicious cycle of liquidity issues and further deposit outflows.

In a desperate attempt to stem the tide, Signature Bank's management team sought to shore up its balance sheet by selling off assets and seeking emergency funding. However, these efforts proved futile as the bank's financial position rapidly deteriorated. On March 12, 2023, the New York Department of Financial Services (NYDFS) announced that it had taken possession of Signature Bank, citing a systemic risk to the broader financial system.

The collapse of Signature Bank sent shockwaves through the cryptocurrency industry, which had long viewed the bank as a reliable partner and a safe haven for their deposits. Crypto exchanges, blockchain startups, and digital asset investors suddenly found themselves without access to their funds, further exacerbating the already fragile state of the crypto market.

Beyond the immediate impact on the digital asset ecosystem, Signature Bank's failure also revealed the inherent vulnerabilities of the banking industry as a whole. Like SVB, Signature Bank's over-reliance on a single sector, its aggressive growth strategies, and its apparent lack of adequate risk management practices came under intense scrutiny.

Regulators, policymakers, and industry experts alike have been quick to point out that Signature Bank's collapse was not an isolated incident, but rather a symptom of deeper structural issues within the banking system. The rapid pace of technological change, the emergence of new financial instruments, and the increasing interconnectedness of global markets have all contributed to a more complex and volatile operating environment for banks.

In the aftermath of Signature Bank's bankruptcy, the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve took swift action to prevent a wider contagion. The agencies announced that all depositors, including those with uninsured funds, would be made whole, a move designed to restore confidence in the banking system and prevent a broader financial crisis.

However, these emergency measures have reignited the debate around the role of government intervention in the financial sector. Critics have argued that the bailout of Signature Bank, like that of SVB, sets a dangerous precedent of moral hazard, where banks may be encouraged to engage in riskier behavior in the belief that they will be shielded from the consequences of their actions.

Looking ahead, the failure of Signature Bank has sparked a renewed focus on the need for comprehensive regulatory reform within the banking industry. Policymakers are under intense pressure to strengthen oversight, enhance stress testing, and impose stricter capital requirements, particularly on banks with significant exposure to emerging sectors like cryptocurrency.

At the same time, there is a growing recognition that the traditional banking model may no longer be sufficient to keep pace with the rapidly evolving financial landscape. The rise of fintech companies, digital currencies, and alternative financing platforms have all disrupted the traditional banking value chain, forcing incumbents to rethink their business models and embrace more innovative approaches.

The collapse of Signature Bank may well serve as a catalyst for the banking industry to undergo a fundamental transformation. Experts argue that banks will need to become more agile, diversified, and technologically advanced in order to remain competitive and resilient in the face of future challenges.

This transformation will require significant investment in digital infrastructure, the development of new product offerings, and the cultivation of strategic partnerships with emerging fintech players. Banks that are able to successfully navigate this transition may emerge stronger and better equipped to serve the needs of their customers in the years to come.

CONCLUSION

The bankruptcy of Signature Bank, coming on the heels of the SVB collapse, has laid bare the deep-seated vulnerabilities within the banking sector. As policymakers, regulators, and industry leaders work to address the fallout from these events, they must grapple with fundamental questions about the future of finance, the role of technology in the banking industry, and the delicate balance between innovation and stability.

The outcome of this reckoning will have far-reaching implications for businesses, consumers, and the global economy as a whole. The failure of Signature Bank serves as a stark reminder that even the most well-established institutions are not immune to the risks and volatility of the modern financial landscape. As the industry navigates these uncharted waters, the need for bold, innovative solutions has never been more pressing.