8 Strategies Used by Successful Crypto Investors in Bull Markets

In the fast-paced world of cryptocurrency investment, success in bull markets often hinges on strategic decisions and insights. Successful crypto investors employ a variety of strategies to maximize gains and navigate the volatile market conditions. One key strategy is to diversify their portfolio, spreading investments across different cryptocurrencies to mitigate risk. They also stay informed about market trends and news, enabling them to make informed decisions about buying and selling.

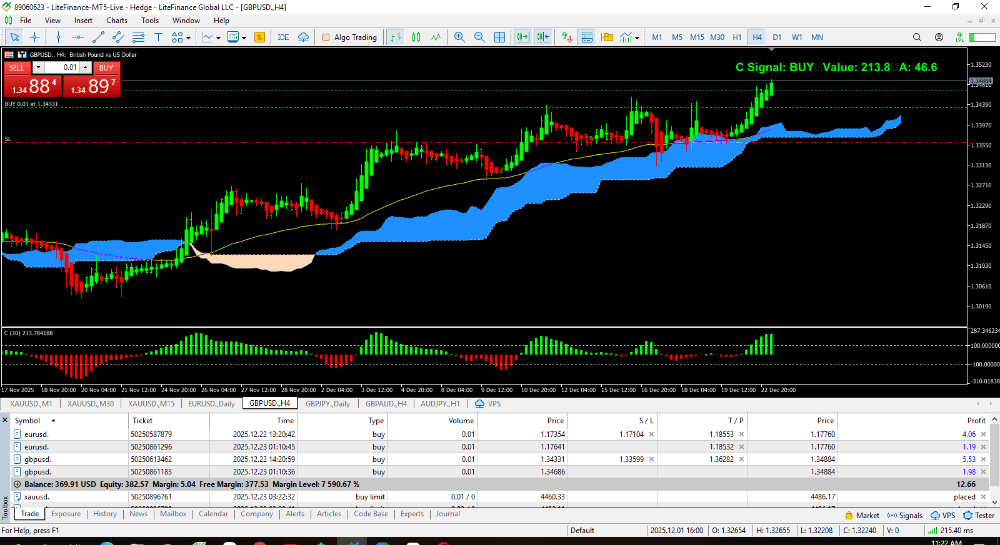

Additionally, successful investors often use technical analysis to identify patterns and trends in price movements, helping them time their trades effectively. They also employ risk management techniques, such as setting stop-loss orders, to protect their investments from unexpected market downturns. Moreover, they remain disciplined in their approach, sticking to their investment strategies and not succumbing to FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt). By employing these and other strategies, successful crypto investors are able to capitalize on bull markets and achieve significant returns on their investments.

What is Crypto?

Cryptocurrency, or crypto, is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks based on blockchain technology. This decentralized nature means that cryptocurrencies are not controlled by any single entity, such as a central bank. Instead, transactions are verified by network nodes through cryptography and recorded on a public ledger called a blockchain.

One of the key features of cryptocurrencies is their anonymity and privacy, as users are identified by cryptographic addresses rather than personal information. Bitcoin, created in 2009, was the first cryptocurrency and remains the most well-known and widely used. Since then, thousands of other cryptocurrencies have been created, each with its own unique features and uses. Cryptocurrencies can be used for various purposes, including online purchases, investment, and remittances, among others.

How Can I build a Profitable Crypto Portfolio?

Building a profitable crypto portfolio involves careful planning and diversification. Here’s a step-by-step guide:

➟ Research and Education

Before investing, learn about the cryptocurrency market, different coins, and their use cases. Understand the technology and trends driving the market.

➟ Set Investment Goals

Define your investment goals, whether it’s long-term wealth accumulation or short-term gains. Your goals will influence your investment strategy.

➟ Diversification

Diversify your portfolio across different cryptocurrencies to reduce risk. Consider investing in major coins like Bitcoin and Ethereum, as well as promising altcoins.

➟ Risk Management

Manage risk by setting stop-loss orders and avoiding over-exposure to any single asset. Consider using a portfolio tracker to monitor your investments.

➟ Stay Informed

Stay updated with the latest news and trends in the crypto market. This will help you make informed decisions about buying, selling, or holding your investments.

➟ Regular Review and Rebalancing

Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalance if necessary to maintain diversification.

➟ Consider Professional Advice

If you’re new to crypto investing or unsure about your strategy, consider seeking advice from a financial advisor specializing in cryptocurrencies.

➟ Long-Term Perspective

Cryptocurrency markets can be volatile, so it’s essential to maintain a long-term perspective. Avoid making impulsive decisions based on short-term price movements.

By following these steps and staying disciplined, you can build a profitable crypto portfolio over time.

Investment Criteria for Building a Profitable Crypto Portfolio Every Beginner Must Know!

Building a profitable crypto portfolio as a beginner requires understanding key investment criteria. Here are some essential factors to consider:

⇏ Market Capitalization

Look for cryptocurrencies with a strong market capitalization. Higher market cap generally indicates a more stable and established project.

⇏ Team and Development

Research the team behind the cryptocurrency project. A strong and experienced team is more likely to deliver on their promises and drive the project’s success.

⇏ Technology and Innovation

Evaluate the technology and innovation behind the cryptocurrency. Look for projects that solve real-world problems or offer unique features.

⇏ Community and Adoption

Consider the size and engagement of the cryptocurrency’s community. Projects with a large and active community are more likely to gain adoption and succeed.

⇏ Use Case and Utility

Assess the cryptocurrency’s use case and utility. Look for projects that have a clear use case and offer value to users.

⇏ Partnerships and Collaborations

Check for partnerships and collaborations with other companies or projects. These can indicate potential for growth and adoption.

⇏ Security and Compliance

Ensure the cryptocurrency adheres to security best practices and complies with relevant regulations. This reduces the risk of fraud or regulatory issues.

⇏ Market Trends and Sentiment

Stay informed about market trends and sentiment. This can help you make informed decisions about when to buy, sell, or hold cryptocurrencies.

⇏ Risk Management

Manage risk by diversifying your portfolio and setting stop-loss orders. Only invest what you can afford to lose.

By considering these criteria and staying informed, beginners can build a profitable crypto portfolio while minimizing risk.

The 9 Golden Rules for Maximizing Gains from Your Crypto Portfolio

Now that you have a grasp of some fundamental criteria for investing in cryptocurrencies, it’s time to understand how to put them into action. Here are some guidelines and tactics you can use to construct a profitable and well-diversified crypto portfolio:

Strategy #1: Invest only what you can afford to lose.

If your goal is to achieve financial stability or freedom through crypto investments, it’s crucial to maintain your primary income source and invest only a portion of your earnings during bear markets to develop a profitable portfolio.

Indeed, buying during bear markets and selling during bull markets is the simplest way to attain financial freedom through crypto investments.

However, it’s important to ensure that you only allocate a percentage of your earnings that you are comfortable losing.

During my early days of investing in cryptocurrencies, I dedicated 10–20% of my salary over a period of time to build my portfolio, and you can do the same by remaining committed to your objectives.

Strategy #2: Follow the 30–20–50 Portfolio Allocation Strategy

This strategy suggests allocating 30% of your funds to Bitcoin, 20% to Ethereum, and 50% to altcoins.

It’s important to note that during a bull market, Bitcoin and Ethereum may yield lower returns compared to altcoins. However, they are more established and stable. Therefore, it’s prudent to invest a higher percentage of your funds in them.

On the other hand, most altcoins tend to offer higher returns during a bull market, but they are less mainstream and carry higher risks.

By diversifying your portfolio with a mix of Bitcoin, Ethereum, and altcoins, you can potentially achieve a balanced and diversified portfolio that offers optimal returns.

Strategy #3: Consider the Risk-Reward Ratio

This rule is particularly important when investing in cryptocurrencies during a bear market. Employing the dollar-cost averaging method can help minimize risk.

Strategy #4: Diversify Your Investments

To implement this strategy, consider purchasing a mix of Bitcoin, Ethereum, top-cap altcoins, mid-cap altcoins, and low-cap altcoins based on your risk tolerance.

However, it’s crucial not to become emotionally attached to any cryptocurrency tokens if your objective is to profit from them.

While some Bitcoin maximalists argue against investing in any other crypto except Bitcoin, I believe in taking a different approach.

Strategy #5: Sell During a Bull Market and Secure Profits

If you’ve successfully built a profitable crypto portfolio during a bear market, it’s advisable to sell a significant portion of your portfolio when the market is bullish. This can help you realize substantial returns on your investment.

Just as you applied dollar-cost averaging during the investment phase, it’s also beneficial to develop a habit of consistently taking partial profits during a bull market.

Strategy #6: Acknowledge Market Cycles

Always bear in mind that the crypto market operates in cycles of bull and bear markets.

As a novice, you might be swept up in the excitement of a bull market after achieving significant profits. You might feel tempted to heed the advice of popular crypto influencers who proclaim slogans like “diamond hands never sell,” “Bitcoin is heading to the moon,” or “Bitcoin will never drop below $40K again,” among other claims.

In my experience, it’s prudent to sell your cryptocurrencies and secure profits when there’s widespread buzz about Bitcoin. This typically signals market saturation. Following this advice could give you many reasons to thank me later!

Strategy #7: Avoid Speculative Moves with Your Crypto Holdings During a Bull Market

While leveraging your crypto assets is not inherently risky, the timing of such actions is crucial.

Staking your coins or borrowing against them at the peak of a bull market can lead to the same mistakes I made in 2021, as previously discussed in this article.

If you intend to take out loans against your crypto assets, it’s advisable to do so early in the bull market to maximize the benefits of the loans. Otherwise, your position may be liquidated, resulting in losses.

Additionally, locking your coins on staking platforms to earn rewards prevents you from selling them until the staking period ends. This means you might miss out on selling at the peak of the bull market.

The goal of this article is to help you maximize gains from your crypto portfolio in the next bull market. Therefore, exercise caution when staking or borrowing against your cryptocurrency, and always consider timing.

Strategy #8: Master the Art of Portfolio Rebalancing

This strategy involves returning your portfolio allocation to its original proportions of 30% Bitcoin, 20% Ethereum, and 50% altcoins.

To achieve this, take profits from your best-performing coins and reinvest the profits into the underperforming coins in your portfolio. This enables you to secure your profits and acquire more coins at a lower price.

Understanding the flow of money in the cryptocurrency market is crucial for this method to be effective.

During a bullish market, Bitcoin typically leads the way, followed by Ethereum, macro/mid-cap altcoins, low-cap altcoins, and finally, meme coins.

Following this pattern ensures that money flows from Bitcoin to meme coins. By adhering to this strategy, you can maximize returns on your cryptocurrency investment.

Unfortunately, many beginners often sell their underperforming assets to buy the best-performing coins, leading to losses and violating the principles of managing a cryptocurrency portfolio.

Conclusion

In conclusion, the strategies used by successful crypto investors in bull markets demonstrate a combination of careful planning, market awareness, and risk management. By diversifying their portfolios, staying informed, and employing technical analysis, investors can enhance their chances of success. Setting stop-loss orders and maintaining discipline are crucial in mitigating risks and avoiding emotional decision-making.

Moreover, participating in communities and learning from experienced investors can provide valuable insights and support. As the cryptocurrency development continues to evolve, adapting these strategies to changing market conditions will remain essential. Overall, by following these strategies and remaining committed to their investment goals, investors can position themselves to maximize gains and navigate the complexities of bull markets with confidence.