8 Best Layer 2 Blockchain Tokens to Invest in 2023

It is almost that time again when the crypto bull market kicks in, and Ethereum mainnet transactions become unaffordable for everyone who missed Bitcoin at $1. As such, several projects have made significant progress in creating faster and more functional layer 2 networks.

It is almost that time again when the crypto bull market kicks in, and Ethereum mainnet transactions become unaffordable for everyone who missed Bitcoin at $1. As such, several projects have made significant progress in creating faster and more functional layer 2 networks.

This article looks at the best layer 2 blockchain tokens with the most potential in 2023. We consider factors like tokenomics, network activity, market cap, technology and more.

The Best Layer 2 Coins to Buy Now

If you are stretched on time, here is the TL;DR of the best layer 2 blockchain tokens.

- Arbitrum – A prevalent chain generating over $100K in revenue daily with over 120K daily active users. Its native token (ARB) was released in March 2023 and is the governance token for the network. Currently, the project sits at a $1.2 billion market cap.

- Polygon – The most prominent Ethereum layer two scaling solution, benefiting from the network effect with over $1.17 billion total value locked (TVL) and 350K daily active users. Polygon has recently launched a second chain, Polygon zkEVM, boasting cutting-edge security. Its native token (MATIC) has a $5.3 billion market cap.

- Immutable X – Designed to provide infrastructure for “the future of gaming”. Currently, the project has a $28.9 million TVL with a $662.05 million market cap. One of its newest features is a seamless and automated wallet creation tool, aiming onboard the masses to crypto gaming.

- dYdX – A perpetual exchange with its own Ethereum layer 2 blockchain to bolster scalability and facilitate endless new use cases. StarkWare powers the platform to ensure quick withdrawals, decentralisation and cryptographic guarantees thanks to its STARK proofs.

- Loopring – A well-established blockchain leveraging zkRollup technology to ensure greater security and decentralization. It currently has $75 million TVL and a $229 million market cap. According to its website, its newest iteration can compute up to 2,025 transactions per second (TPS).

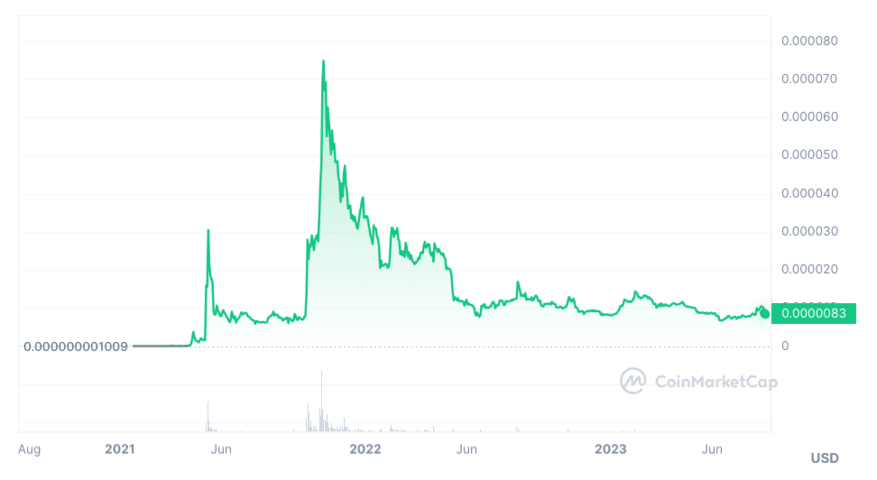

- Shiba Inu – Meme coin turned DeFi ecosystem Shiba Inu has recently launched its Ethereum layer 2 scaling solution, Shibarium. Shiba Inu has a vast community comprising 10 million holders. As a result, its new L2 may fare in high demand, bolstering the SHIB price.

- Optimism – With over 100K daily active users and $200K in daily revenue, Optimism has been a top performer lately. The project has attracted some of the industry’s most prominent protocols, such as ChatGTP Co-Founder Sam Altman’s Worldcoin and Coinbase’s newly launched layer 2 Base Protocol.

- Mantle – A highly decentralized layer 2 that uses $MNT as its governance token. It cuts transaction costs by up to 80% by batching transactions and separating its data availability layer from Ethereum roll-ups. As a result, Mantle describes itself as “hyper scalable”, hypothetically capable of processing 600 TPS.

Analyzing the Best Layer 2 Tokens

Now that we have provided our layer 2 tokens list, let’s dive deeper into each token, what makes them unique and what gives them such potential.

1. Arbitrum – Popular Chain Generating Over $100K in Daily Revenue With 120K Daily Users and $1.2 Billion Market Cap

Abrtirum is a top-rated layer-two scaling solution, currently second only to Polygon by market cap. However, Arbitrum sits top of our list of best layer 2 blockchain tokens due to its network activity to market cap ratio. Since its launch in March 2021, Arbitrum has become one of the most used Ethereum layer two rollups. There are 435 protocols active on the Arbtirum chain, 120K daily active users, a $2.8 billion TVL and a whopping $1.5 billion in locked stablecoins.

Since its launch in March 2021, Arbitrum has become one of the most used Ethereum layer two rollups. There are 435 protocols active on the Arbtirum chain, 120K daily active users, a $2.8 billion TVL and a whopping $1.5 billion in locked stablecoins.

This is significant, considering the Arbitrum token’s market cap is just $1.29 billion. Furthermore, the platform has generated over $120K in revenue in the last 24 hours.

With the crypto bull run expected to occur soon, much of the stablecoin value on the network may trickle into $ARB as investors gain confidence in the market’s direction.

On top of the deep liquidity, low transaction fees, and a vast ecosystem comprising hundreds of dApps, one of Arbitrum’s main draws is its trailblazing GMX protocol. This is one of the first decentralised perpetual exchanges enabling users to trade with leverage using a non-custodial exchange. GMX exploded in popularity amid the collapse of FTX, where significant amounts of retail and institutional funds were lost due to irresponsible fund custodians.

GMX exploded in popularity amid the collapse of FTX, where significant amounts of retail and institutional funds were lost due to irresponsible fund custodians.

To process transactions, Arbitrum utilises optimistic rollup technology for reporting to the Ethereum mainnet. This facilitates transactions for minimal fees and increases transparency but comes at a trade-off of delayed transaction finality and increased centralisation compared to zkRollups.

Looking at Arbitrum’s tokenomics, one thing to be aware of is that only 12.5% of its tokens are circulating. The token will follow a monthly unlock beginning in March 2024 and ending in 2027.

This could impact the price of Arbitrum, but it is also worth noting that 43% of tokens are in the Arbtrum treasury, which the Arbitrum DAO controls. Essentially, these tokens will only be sold if the community feels it will benefit the ecosystem in the long term.

2. Polygon – The Most Prominent Layer 2 With Over 350K daily active users and Polygon zkEVM, a Cutting-edge zkRollup

Polygon is the number one Ethereum layer two blockchains by many metrics. It has 350K daily active users – even higher than Ethereum’s with just over 300K. On top of that, it has 465 protocols and a $1.19 billion TVL with $1.2 billion in stablecoins.  As such, Polygon benefits from a network effect, where the amount of users, liquidity, and protocols helps further benefit the network, enabling low-term growth. This is because the factors mentioned above will generally attract more investments and developers, which help advance the ecosystem even more.

As such, Polygon benefits from a network effect, where the amount of users, liquidity, and protocols helps further benefit the network, enabling low-term growth. This is because the factors mentioned above will generally attract more investments and developers, which help advance the ecosystem even more.

One of the exciting things about Polygon is that it has attracted significant enterprise adoption from the likes of Starbucks, Nike and Reddit.

In recent months, Polygon launched its Polygon zkEVM, the first Ethereum virtual machine (EVM) compatible zkRollup to integrate smart contracts and developer tools.

zkRollups are a novel technology providing near-instant finality, more decentralisation and use less data on the layer 1 chain than optimistic rollups.  However, they are more challenging to implement than optimistic rollups. Polygon’s zkEVM is currently running and functional, with many dApps already deployed on the network, like Quickswap and Balancer.

However, they are more challenging to implement than optimistic rollups. Polygon’s zkEVM is currently running and functional, with many dApps already deployed on the network, like Quickswap and Balancer.

This shows that the Polygon ecosystem is at the forefront of crypto innovation, and its native token, $MATIC, could have a bright future.

Polygon has a $5.4 billion market cap, with 93.1% of tokens circulating. As a result, Polygon is less likely to experience strong sell pressure compared to newer layer two projects.

3. Immutable X – Designed for “The Future of Gaming” and Features a Seamless and Automated Wallet Creation Tool to Onboard the Masses to Crypto Gaming

Immutable X is an Ethereum L2 blockchain aiming to serve blockchain gaming with scalable, secure and decentralised infrastructure connected to the Ethereum mainnet. The network provides builders with the tools and infrastructure to create the next generation of crypto gaming. It features countless developer tools like API’s and software development kits (SDKs). This makes building on Immutable X seamless and quick, attributing to its vast growth, with projects like Guild of Guardians and Gods Unchained already building there.

The network provides builders with the tools and infrastructure to create the next generation of crypto gaming. It features countless developer tools like API’s and software development kits (SDKs). This makes building on Immutable X seamless and quick, attributing to its vast growth, with projects like Guild of Guardians and Gods Unchained already building there.

A blockchain gaming market forecast by MarketsandMarkets estimates a whopping compound annual growth rate (CAGR) of 70.3% between 2022 and 2027. This puts the estimated market size at around $70 billion by 2027.

Immutable X is the leading L2 solution facilitating blockchain gaming within the Ethereum ecosystem. Therefore, its token (IMX) could present significant upside potential.

Another unique feature of Immutable X is its development of “Immutable Passports”, a passwordless, non-custodial wallet which can be created automatically. The complexity of wallets is a significant barrier to mass adoption, particularly in the gaming sector, since gamers are not accustomed to creating wallets, managing seed phrases etc.  Reddit undertook a similar solution with its “Digitial Avatar” NFTs, which onboarded 10 million users without them needing to manage a wallet since Reddit did it for them.

Reddit undertook a similar solution with its “Digitial Avatar” NFTs, which onboarded 10 million users without them needing to manage a wallet since Reddit did it for them.

Immutable X also offers many other products like a scalable NFT minting tool and an NFT order book which maximises NFT liquidity and distribution by sharing orders across multiple marketplaces.

The $IMX market cap is currently $673 million. Currently, 56% of tokens are circulating, and the vesting schedule will continue into the end of 2025.

4. dYdX – A Decentralised Perpetual Exchange With Its Own Layer 2 Blockchain for Maximum Scalability and Functionality

One of the more interesting hypotheses about the future of crypto is that every dApp will have its own layer 2 blockchain, leveraging the main layer 1 chain for finality and security. dYdX, a decentralised perpetual exchange, has embraced this theory, building a layer two for maximum scalability and functionality. The dYdX layer 2 blockchain is used for leverage trading and has amassed a significant user base. According to its website, over 500K traders have used the chain in the last 24 hours, accruing a $1.6 billion 24-hour trading volume.

The dYdX layer 2 blockchain is used for leverage trading and has amassed a significant user base. According to its website, over 500K traders have used the chain in the last 24 hours, accruing a $1.6 billion 24-hour trading volume.

Its platform offers low fees with no gas costs, quick withdrawals, lighting fast trade execution and much more.

The native token, $dYdX, is used to participate in staking pools, liquidity providing and governance.

Currently, the $dYdX market cap is $304 million, with 15% of tokens in circulation. It also has $344 million TVL. The platform is backed by some of the most prominent venture capitalist (VC) firms in crypto, including Andreessen Horowitz, a16zcrypto, Paradigm, Polychain and many more. Considering its institutional backing, dYdX undoubtedly has the funding and support of enough experienced individuals to succeed long-term.

Considering its institutional backing, dYdX undoubtedly has the funding and support of enough experienced individuals to succeed long-term.

The flagship product for dYdX is its L2 trading web app. It enables users to trade crypto derivatives for many assets, including Bitcoin, Ethereum, Cardano, Dogecoin, BNB and much more.

Interestingly, dYdX is currently migrating to the Cosmos ecosystem. This is to further aid its scalability and build a new, fully-customisable blockchain from the ground up, all while tapping into the Cosmos ecosystem liquidity.

5. Loopring – Well Established zkRollup L2 Capable of Upto 2,025 TPS

Loopring is a highly scalable layer 2 blockchain with its origins dating back to 2017. The platform aims to provide low-cost, secure transactions and claims to process up to 2,025 TPS. Earlier versions of Loopring were capable of just two or three TPS, but its incorporation of zkRollups has led to a vastly more scalable network.

Earlier versions of Loopring were capable of just two or three TPS, but its incorporation of zkRollups has led to a vastly more scalable network.

According to its website, transactions of Loopring are roughly 1/00th the cost of the Ethereum network, but its usage of zkProofs means users benefit from complete Ethereum-level security.

The blockchain boasts a native app called Loopring Layer 2 App, which features an automated market maker (AMM), order book exchange, and a payments solution so users can send and receive crypto for a fraction of the cost as on the Ethereum mainnet. It also features an innovative native wallet powered by a social recovery mechanism, so users do not need to store seed phrases to recover their accounts.

It also features an innovative native wallet powered by a social recovery mechanism, so users do not need to store seed phrases to recover their accounts.

Loopring’s market cap is $248 million, with $77 million TVL and a 96.87% circulating supply. Considering its proven track record, continued innovation and relatively low market cap, Loopring could be one of the best cryptos to buy now.

Furthermore, Loopring has released a developer portal in recent weeks, making it easier and faster for developers to build on the network. Attracting new developers is crucial for blockchains because a chain thriving with new developer innovation usually attracts new users soon after.

6. Shiba Inu – Vast Community of 10 Million Holders and Recently Launched its Layer 2 Blockchain, Shibarium

While Shiba Inu was initially considered a joke meme coin, it has begun transitioning to a legitimate DeFi ecosystem. On 16 August, the project launched its layer 2 blockchain, Shibarium.  The exciting thing about the project is that the Shiba Inu ecosystem already comprises several in-demand dApps like its ShibaSwap DEX, Shib the Metaverse, an NFT collection and more.

The exciting thing about the project is that the Shiba Inu ecosystem already comprises several in-demand dApps like its ShibaSwap DEX, Shib the Metaverse, an NFT collection and more.

With this in mind, many of these dApps could be integrated into the network, quickly drawing a large user base.

Furthermore, Shiba Inu already has 10 million holders. This provides Shiba Inu with a formidable community. If they embrace Shibarium, it could quickly become one of the top layer 2 networks by TVL and users, attracting more development. Following its launch, Shibarium was almost instantly on the receiving end of significant FUD. However, a recent blog post clarified the confusion, highlighting that the FUD was caused by a fake screenshot rather than tangible issues on the Shibarium network.

Following its launch, Shibarium was almost instantly on the receiving end of significant FUD. However, a recent blog post clarified the confusion, highlighting that the FUD was caused by a fake screenshot rather than tangible issues on the Shibarium network.

Ultimately, as one of the best meme coins, Shiba Inu stands well-equipped to transition into one of the top DeFi ecosystems.

7. Optimism – $1 Billion TVL and Used by Leading Players Like Worldcoin and Coinbase’s Base Protocol

Due to the spectacular popularity of Arbitrum, Optimism often falls under the radar of crypto investors. This is partly due to the vast amount of dApps on Arbitrum and the popular airdrop which occurred early in 2023. However, Optimism should not be underestimated. It boasts comparable tokenomics and statistics to Arbitrum, with over 100K daily users, $1 billion TVL and over $600 million in stablecoins. The platform has generated $89K in revenue over the past 24 hours and has 179 protocols.

However, Optimism should not be underestimated. It boasts comparable tokenomics and statistics to Arbitrum, with over 100K daily users, $1 billion TVL and over $600 million in stablecoins. The platform has generated $89K in revenue over the past 24 hours and has 179 protocols.

While these numbers fall slightly short of Arbitrum’s, Optimism has recently made up for this by attracting some of the industry’s most prominent players.

Recently, ChatGPT Co-Founder Sam Altman launched Worldcoin on the Optimism blockchain. Furthermore, Coinbase’s new layer 2 blockchain, Base Protocol, leverages Optimism’s technology stack. The ability to attract impactful teams to use the Optimism network signifies it holds long-term potential.

The ability to attract impactful teams to use the Optimism network signifies it holds long-term potential.

Optimism currently sits at a $1 billion market cap, with 16% of tokens circulating. With this in mind, and considering its $1 billion TVL, its ratio of TVL to market cap is slightly worse than Arbitrum’s. Nevertheless, its network adoption from esteemed industry players may offset this discrepancy.

8. Mantle – A Highly Decentralised, “Hyper Scalable” Layer 2 Capable of Processing 600 TPS

Mantle is a layer 2 crypto focused on mass adoption and decentralised governance. Its native token, $MNT, is used for voting on the network for all decisions ranging from new initiatives to managing the project’s treasury. The Mantle website dubs the network “hyper scalable” since it uses an innovative modular solution to expand its scalability to 600TPS.

The Mantle website dubs the network “hyper scalable” since it uses an innovative modular solution to expand its scalability to 600TPS.

Mantle’s TVL is currently $38, but this has climbed significantly after averaging around $5 million in July.

According to DeFiLlama, the top dApp on Mantle is Agni Finance, a native DEX with $22 million TVL.

Agni Finance is a Uniswap V3 fork which offers capital-efficient liquidity and will soon be deploying a launchpad for new projects to launch on the Mantle blockchain. Mantle is one of the newest layer 2s on our list, with its token launching in July. So far, it has amassed a $1.3 billion market cap, with 52% of tokens circulating.

Mantle is one of the newest layer 2s on our list, with its token launching in July. So far, it has amassed a $1.3 billion market cap, with 52% of tokens circulating.

Interestingly, the Mantle treasury holds a $2 billion valuation. This provides the project with a significant runway to fund future ecosystem development, and it has already launched a grant program to stimulate its growth.

What is Blockchain Layer 2?

Simply put, a layer 2 blockchain is a network which processes transactions off a layer 1 chain to help improve scalability.

There are numerous types of layer twos, such as rollups, sidechains, state/payment channels, plasma chains and validiums. However, the most common types of layer 2s on Ethereum are rollups and sidechains.

Regarding Bitcoin, the main layer two is Lightning Network, a payment channel that enables users to set up two-way paper-to-peer microchannels.

However, we will stick to Ethereum layer 2’s for now, as this is where the most opportunities lie regarding layer two coins to buy.

Let’s look at the most common types of Ethereum layer 2s and how they work.

Rollup Layer 2s

There are two types of rollups, optimistic rollups and zero knowledge rollups (zkRollups). While they have differences in centralisation, finality and data storage, their basic principle works similarly.

The rollups bundle hundreds of separate transactions and report them to the layer 1 in a single transaction. As such, the fees accrued only amount to one transaction, making transacting on a rollup a fraction of the cost of on a layer 1.

While rollup transactions are computed on a separate blockchain, they are reported to and stored on the main chain for finality. As a result, rollups are guaranteed the same security as the main chain because altering a final transaction on the rollup chain would also mean changing the transaction on the main chain.

Many new rollup layer 2s have emerged recently, with some of the most popular being Arbitrum, Optimism and StarkWare. However, legacy layer 2s like Polygon and Loopring have also transitioned to rollups.

Sidechains

Sidechains work differently from rollups in that they maintain their own network state using their own consensus mechanism. As such, they do not benefit from layer one security the same way rollups do, but this comes with the advantage of not storing data on the layer 1.

Instead of reporting transactions to the layer 1, sidechains run in parallel with the layer one, using bridges to transfer assets between the chains. Sidechains are becoming less used as the emergence of rollups grows.

The most well-known sidechain is Polygon, although, as we discussed earlier, it has recently launched a zkRollup chain, zkEVM.

Blockchain Layer 1 vs Layer 2

Blockchain layer 1 vs layer 2 is a broad topic with much to discuss. However, we will keep it simple by focusing on the benefits of an alternative layer 1 (an Ethereum competitor) compared to the benefits of launching as a layer 2 blockchain.

The first consideration is the network effect. A project which launches as a layer 2 already has access to a thriving ecosystem with an established network effect. As a result, there are already dApps, users and liquidity, which the layer 2 can tap into. On the other hand, layer 1s generally have to build from the ground up.

On top of that, layer 1 blockchains are eager to attract new layer 2s to help with scalability and strengthen the ecosystem. As a result, layer 2s can often receive grants and expert assistance developing, testing and launching their blockchain.

However, one of the main issues for layer 2s is the lack of flexibility compared to launching a layer 1 chain. With a layer 1 chain (such as Cardano), the developers can be as innovative and experimental as they like.

However, Cardano has taken years and billions of dollars to build and has yet to reach its expectations.

In conclusion, layer 2 chains are often more straightforward to create, offering an established network effect comprising developers, users and liquidity. Therefore, layer 2 token prices could potentially explode much faster.

Why Invest in Layer 2 Blockchain Coins?

As we saw with the Polygon MATIC price in the last bull run, helping solve the scalability issue in crypto can be a very lucrative use case. With that in mind, here are the reasons to buy layer 2 coins.

Upcoming Bull Market

With the Bitcoin halving set to occur in April 2024, many analysts forecast that the next crypto bull run is set to commence soon. Gas fees on Ethereum often reach exorbitant prices during the peak of the bull run, forcing many users to seek cheaper means of transacting.

As a result, layer 2s are in an advantageous position to capture much of the upcoming bull run liquidity, potentially leading to higher layer 2 blockchain coins’ prices.

Ethereum Has Long-term Layer 2 Plans

According to the Ethereum website, Danksharding, a planned upgrade, seeks to facilitate even cheaper rollup transactions by reducing the data they need to store on the main Ethereum chain.

In turn, this will provide much more potential to the capabilities and use cases of layer 2s and help increase their prices.

“Pick-and-Shovel” Strategy

Pick-and-Shovel investing refers to buying an asset that provides tools or infrastructure rather than investing in a product itself. The benefit is that it offers a more diverse approach since it inadvertently includes exposure to all the products (or, in this case, dApps) that use it.

By buying a layer 2, investors gain exposure to all the dApps built upon the network, presenting a great way to diversify further. Furthermore, projects like Immutable X, designed specifically for NFTs and gaming, could prove an efficient way to diversify into those sectors.

High Upside Potential

While Bitcoin and Ethereum sit at market caps well over $100 billion, the largest layer 2 by market cap is Polygon, which is at just over $5 billion. Furthermore, many layer 2’s on our list have less than $1 billion market caps.

Although they could present a higher risk, low market cap layer 2s could provide vastly more upside potential than well-established coins like Bitcoin or Ethereum.

How to Decide Which Layer 2 Blockchain Tokens to Invest in

Deciding which layer 2 to invest in can be overwhelming. However, we have broken down the main things worth considering below.

Market Cap

As with any asset class, market cap plays an impactful role in the potential of a crypto. Each project has a ceiling based on the market’s liquidity and the individual project’s importance.

Therefore, understanding a project’s significance and comparing it to its market cap is a great way to decide which tokens are best to buy.

Network Effect

The best way to determine a project’s significance is to understand its network effect. This comes down to considering factors like its daily active users, daily revenue, number of protocols (and success of protocols), number of developers and total value locked on the chain.

A chain that scores high for each but has a relatively low market cap may fare a better investment.

Tokenomics

It is also essential to consider tokenomics. Factors like the level of utility that the token provides, the circulating supply and the vesting schedule all play a significant role in the success of a project.

Conclusion

Layer 2s are some of the most high-potential cryptos on the market today. However, after thoroughly examining the eight best layer 2 blockchain tokens, we found that Arbitrum could be the best layer 2 on the market today.

It benefits from a strong network effect with 435 dApps and over 120K daily active users. Furthermore, its market cap is around $1 billion, significantly less than our next top pick, Polygon.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)