Tokenization of music rights

Introduction

In October 2015, the famous British singer and songwriter Imogen Heap released a single called “Tiny Human”. The first question that came to your mind may be “so what?”. It is not even news on the face of it; musicians create and record some piece of art regularly. There is even a claim that 100,000 songs are released each day. But one feature of this creation made it unique. The main thing with the “Tiny Human” was that it was released on Mycelia, a decentralized musical database founded by Heap herself who is not only a talented musician but also a technologist. Mycelia was created for musicians to produce, share, and protect their works using Ethereum smart contracts. Perhaps one small (or should I say tiny?) step for the singer, but potentially one giant step for the future of music industry.

What all these means is that “Tiny Human” was released as a digital token on the Ethereum blockchain and users purchasing the token could claim a share of revenue generated by the single. This is how the idea of tokenization of music royalties was born. Heap believes this innovation would make a direct artist-to-fan interaction possible eliminating middlemen. Tokenization, and the blockchain technology which made the concept of tokenization possible, in general, will result in a fairer and more efficient royalty distribution system. Music industry is not known for its transparency; blockchain can change it entirely and give the power back to creators.

The internet has changed the music industry drastically. It increased the availability of music to audiences creating several income streams for creators. Song downloads were overtaken by streaming services. Cassettes were replaced by CDs which had better superior sound. But the industry is not with its own share of problems. And now the music industry can be transformed once again by blockchain technology.

How can blockchain affect music?

The first thing coming to mind when we talk about use cases of blockchain in the music industry is intellectual property (IP) rights. Music rights are so fiendishly complicated and opaque that even professional creators don’t understand them well. “I would say maybe 10% of musicians have a good understanding, 1% of musicians have a great understanding, and 0.1% of musicians have an amazing understanding”, says Justin Blau, a famous DJ who founded Royal about which we talk later in the article.

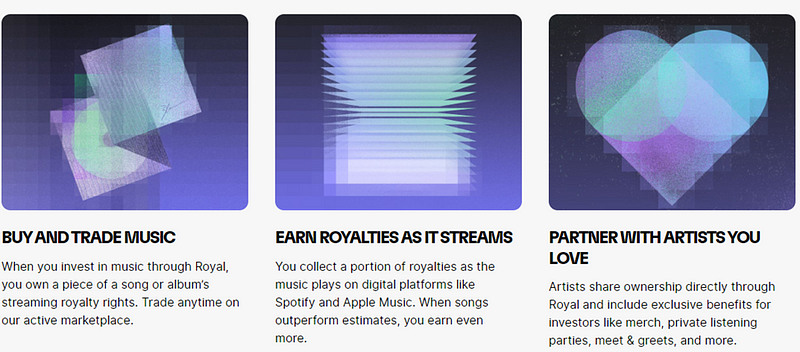

Blockchain due to its public and transparent nature will not only enforce IP rights, but it also enables fractionalization and tokenization of music assets. Besides providing additional income streams for creators, tokenization of music works can change fan experiences as well which can be in many forms, such as VIP event tickets, studio recording sessions, private chat access or access to unreleased music. For fans the benefit of tokenization and fractional ownership is that they can be partial owners of pieces they like; this gives them “skin in the game” in that by buying shares of an album or song they participate in the financial success of failure of their favorite artists.

The business model of the companies mentioned below (and not mentioned but similar to those about which we write in this article) is mostly the same. Traditional holders of music rights can sell part of their royalties, like other securities. If they choose to do so, these platforms can buy those royalty rights and fractionalize them in the form of NFTs. Royalties generated by songs backed by those are distributed to token holders. And like other securities, you can trade your NFTs in secondary markets, such as company’s own marketplace or OpenSea.

Bolero One of the companies tokenizing music royalties is Bolero with its motto “A record label for every pocket.” There are two ways of supporting your favorite musical artist or a particular song — Fan Token and Song Shares. A Fan Token is an investment in an artist’s career, while a Song Share is an investment in a particular catalog. You can think of a Fan Token as a digital asset representing musician’s on-chain career. It is kind of a share in the creator’s career. Fan Token’s initial price is decided by the artist herself but its value, like a typical security, change based on the demand in the secondary market. A Song Share, on the other hand, represents the fractional ownership of a master recording. Users invested in Song Shares can claim royalties which the underlying songs of the Share generate.

One of the companies tokenizing music royalties is Bolero with its motto “A record label for every pocket.” There are two ways of supporting your favorite musical artist or a particular song — Fan Token and Song Shares. A Fan Token is an investment in an artist’s career, while a Song Share is an investment in a particular catalog. You can think of a Fan Token as a digital asset representing musician’s on-chain career. It is kind of a share in the creator’s career. Fan Token’s initial price is decided by the artist herself but its value, like a typical security, change based on the demand in the secondary market. A Song Share, on the other hand, represents the fractional ownership of a master recording. Users invested in Song Shares can claim royalties which the underlying songs of the Share generate.

Speaking of master recordings by the way. Unlike other platform putting royalties on the blockchain, such as Royal and Anotherblock, Bolero seeks to tokenize master recording and intellectual property related to it. What this means for users is that a share of royalties generated various uses of the master recording will go to them, i.e., NFT holders. These uses include but are not limited to:

- Physical sales

- Digital sales

- Sync placements (the use of the song in a TV show, a commercial, a movie etc.)

- Streams

Tokenizing and fractionalizing IP itself creates several revenue sources for fans.

Royal Founded in May 2021 by Justin Lau, Royal is backed by several musicians, such as The Chainsmokers, and Kygo. Royal is one of the first and the largest music NFT marketplaces. The platform mainly is focused on streaming because it is where the lion’s share of income is being generated. Streaming royalties are what users of audio and music streaming service platforms, such as Apple Music, Spotify, and Tidal pay for the tracks. Holders of music rights receive streaming royalties.

Founded in May 2021 by Justin Lau, Royal is backed by several musicians, such as The Chainsmokers, and Kygo. Royal is one of the first and the largest music NFT marketplaces. The platform mainly is focused on streaming because it is where the lion’s share of income is being generated. Streaming royalties are what users of audio and music streaming service platforms, such as Apple Music, Spotify, and Tidal pay for the tracks. Holders of music rights receive streaming royalties.

It’s an at artist’s discretion to choose which percentage of music rights will be allocated to the platform. Buying a token which represents a song or an album entitles a user to get royalties once that song or album streams on streaming service platforms. Token holders get their share of royalties when artists get paid. In July 2022, Royal made its first royalty payout to token holders. The amount of $36,000 as distributed to the holders of four songs — “Ultra Black” (Nas), “Rare” (Nas), “He’s Not You” (Vérité), and “Worst Case” (3LAU).

JKBX

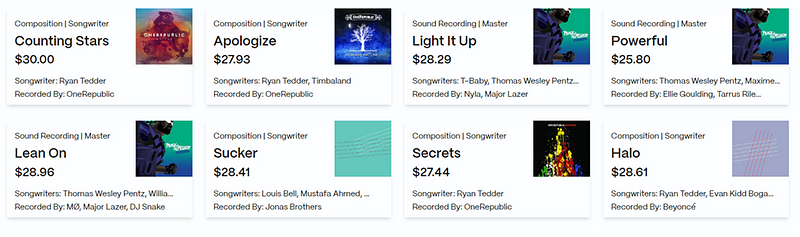

One of the most recent entrants to the game is JKBX (pronounced “Jukebox”). They securitize royalty rights and offer them under the name of Royalty Shares on their platform. Royalty Shares are securities entitling their holders to get a percentage of royalties and other income streams generated by the underlying music. This should be emphasized that Royalty Shares — and the tokenized and fractionalized products of other platforms mentioned in this article — don’t give users any right, such as copyright or commercial use right over the songs, singles, albums or catalogs the royalties of which they have invested.

JKBX is unique in several aspects. First, the quality and popularity of artists featured on the platform. Though there were some good offerings on other projects, many tracks on these platforms leave much to be desired. Popular songs and artists are necessary for the platform in order to attract customers. And as an investment, famous tracks make more sense due to their streaming strength. This is where JKBX can dwarf its competitors I believe. At the time of this writing (29th September 2023), the platform features many sound recordings of popular tracks:

- “Rumour Has It” as recorded by Adele

- “Halo” by Beyoncé

- “Welcome to New York” by Taylor Swift

- Several tracks by OneRepublic, “Counting Stars”, “Secrets”, “Apologize” among others.

Another problem JKBX is keen to solve is illiquidity. Many platforms bringing music assets onto the blockchain lack liquidity; even if your investment is doing well, if you cannot get out of your position and realize the profit, then it doesn’t even make sense to invest in an asset. Some of the players mentioned and not mentioned in this piece either are illiquid or don’t yet have the secondary market at all. JKBX is ambitious to solve the illiquidity problem in Music NFTs market. To create a liquid market JKBX will work with GTS Securities, one of the top market makers on the New York Stock Exchange. This will make it more likely to match you a buyer when you want to sell your investment.

Another problem JKBX is keen to solve is illiquidity. Many platforms bringing music assets onto the blockchain lack liquidity; even if your investment is doing well, if you cannot get out of your position and realize the profit, then it doesn’t even make sense to invest in an asset. Some of the players mentioned and not mentioned in this piece either are illiquid or don’t yet have the secondary market at all. JKBX is ambitious to solve the illiquidity problem in Music NFTs market. To create a liquid market JKBX will work with GTS Securities, one of the top market makers on the New York Stock Exchange. This will make it more likely to match you a buyer when you want to sell your investment.

Opulous

Opulous, a dApp built on Algorand, allows artists to secure capital from her fans. By purchasing so called MFTs (Music Fungible Tokens), users can support their favorite artists. MFTs are digital assets the holders of which will receive rewards depending on how the album or song they invested in performed. To trade MFTs on the platform, you have to own the native token of the protocol, OPUL which is pivotal for Opulous. Besides trading purposes, the token offers some benefits, such as early access to MFT sales if you chose to select your $OPUL. Artists should also purchase OPUL to apply for an MFT sale.

Conclusion

The Internet transformed the landscape of the music industry about 25 years ago. It increased the visibility of artists by augmenting their audiences. The Internet gave us streaming services boosting musicians’ revenues. It affected almost each and every aspect of the music industry from helping novice artists to shaping fan experiences to improving access to high quality music. Now 20–25 years later blockchain technology can drastically change the industry. Its decentralized nature will cut off middlemen earning more revenue to artists and ensuring fans that their payments go directly to musicians they support. The most important impact of blockchain, in my opinion, is tokenization and fractionalization of music rights which makes music assets more accessible and more liquid. This not only grants financial freedom to novice artists but also creates a new asset class of music assets. It is the future of the music industry.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)