Shiba Inu's BONE Jumps 8,140% in On-Chain Shibarium Anomaly

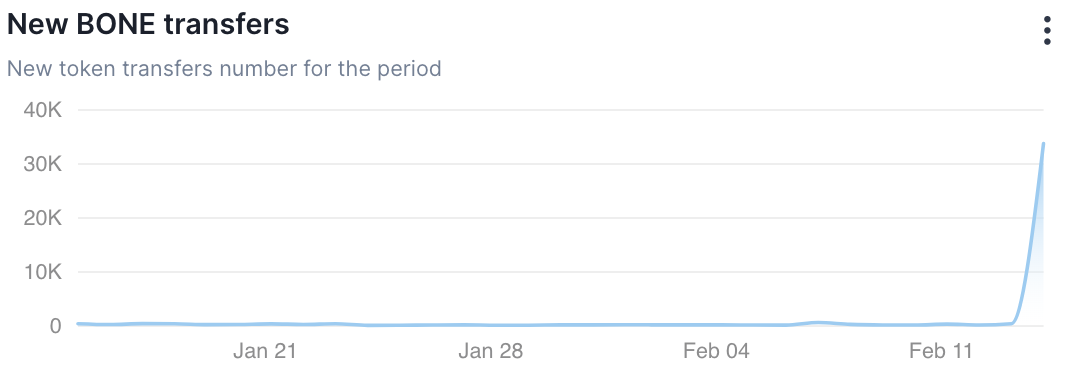

In a recent development within the Shiba Inu ecosystem, Shibarium, the blockchain solution, witnessed unprecedented activity, with the BONE token experiencing an astonishing surge. According to data from Shibariumscan, the number of new BONE token transfers skyrocketed from 415 to a staggering 33,775 within the last 24 hours, marking an extraordinary increase of 8,140%.

BONE holds a unique position among Shiba Inu tokens as the native asset of Shibarium, serving essential functions such as facilitating transactions within the network by paying for gas and enabling validators' participation. However, this surge in BONE's transfer activity stands as an anomaly within the otherwise stable Shibarium blockchain, with no other significant deviations reported. Despite the dramatic increase in on-chain activity, the price of BONE itself has not exhibited corresponding fluctuations. Currently valued at $0.615, the token's price chart shows no discernible jumps despite the remarkable surge in transfer volume.

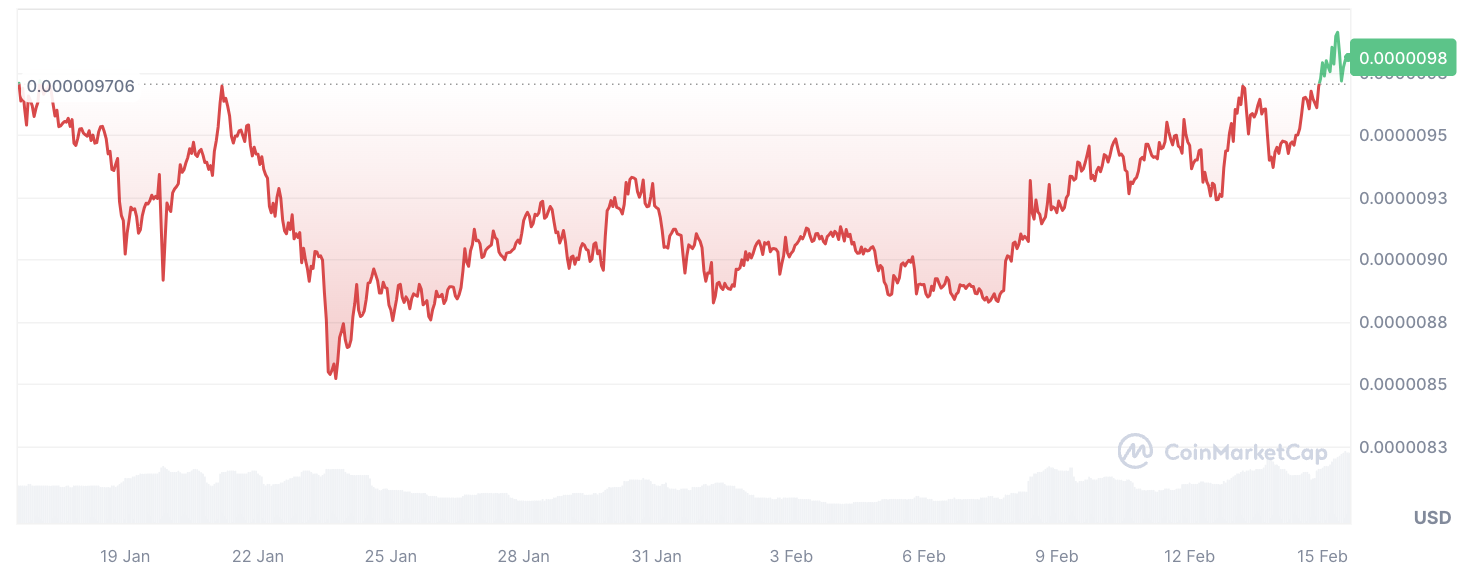

Despite the dramatic increase in on-chain activity, the price of BONE itself has not exhibited corresponding fluctuations. Currently valued at $0.615, the token's price chart shows no discernible jumps despite the remarkable surge in transfer volume.

This raises questions about the potential impact of the anomalous activity on BONE's market valuation and whether it signals genuine market dynamics or possibly a glitch within the blockchain explorer.

BONE token price outlook

The recent history of BONE's price movements adds further intrigue to the situation. Having experienced a significant downturn earlier in the year, followed by a rapid 16% surge in early February, the token entered what observers have termed an "accumulation phase." Given the historical correlation between network activity and token price fluctuations, market participants are keenly monitoring whether the current surge in BONE transfers will translate into tangible price movements.

Given the historical correlation between network activity and token price fluctuations, market participants are keenly monitoring whether the current surge in BONE transfers will translate into tangible price movements.

As speculation mounts within the Shiba Inu community, attention is focused on deciphering the significance of this unprecedented on-chain anomaly. Whether this surge heralds a new phase of price volatility for BONE or merely represents a transient aberration in the data remains to be seen.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)