How does a Stablecoin project make money?

In just the first 3 months of 2023, amid a downtrend market, Tether - the USDT stablecoin issuer facing countless scandals in the market - reported a net profit of 1.48 billion USD. Tether's rival, the less notorious stablecoin project Circle (USDC), also generated $779 million in revenue in the first half of 2023, according to Cointelegraph. It can be seen that the profits of large stablecoin projects are huge in the crypto market, higher than crypto exchanges or blockchain projects. So where does this profit come from? How can a stablecoin project achieve such large profits even during a downtrend? The answer is that stablecoin projects not only make profits from transaction fees, but also make loans and invest in other assets.

As long as the crypto market exists, the need for stablecoins will exist. Many people believe that crypto will not disappear soon in the future, even though it is only in the early stages of development. In the crypto market, stablecoin issuance projects act as banks. However, while traditional banks must mobilize deposits from users, stablecoin projects only need to find banks with the necessary funds to start issuing stablecoins. In terms of output, the stablecoin project easily finds customers whether in an uptrend or downtrend, because this is an effective method of protecting assets when other cryptocurrencies can fluctuate tens of percent every day.

For companies in the crypto market, the most basic way to make money is to collect service fees. This is no exception with stablecoin projects. When depositing, withdrawing stablecoins or verifying accounts, users need to pay a certain fee. The more demand for stablecoins increases, the more revenue from fees. Companies that issue fiat-backed stablecoins (stablecoins backed by fiat currency) like Tether have a deposit fee of 0.1%, a withdrawal fee of 0.1% or 1,000 USD, whichever is greater. Users need to deposit or withdraw at least 100,000 USD to trade with Tether. Transfers between different accounts are free from Tether. At a market capitalization of 87 billion USD in November 2023, according to CoinGecko, Tether profits can be earned from deposit fees of 87 million USD, from withdrawal fees of 870 million USD.

Circle is a bit more "generous" in that it waives most fees, only charging network fees when transferring USDC to addresses not under Circle management and network fees for transactions through Circle's API. To ensure business operations run smoothly, stablecoin projects need reputable banking partners with abundant deposits. Therefore, the role of traditional banks is also very important in the crypto market. Typically, Circle almost lost billions of dollars in collateral when SVB bank collapsed. Fiat-backed stablecoin projects make money through deposit, withdrawal and verification fees. So what about other stablecoins, like the UST algorithmic stablecoin?

“Your money is safe” is the saying of most CEOs and CFOs of financial institutions, until it is no longer safe and customers cannot withdraw their money. Last year, algorithmic stablecoin TerraUSD (UST) created a crisis in the crypto market by vanishing $45 billion, according to Forbes. So what is UST's operating model? Instead of being backed by fiat money like fiat-backed stablecoins, UST operates based on the mechanism of burning a reserve asset (LUNA token issued by the same company) worth 1 USD. There is an opinion that this is a good stablecoin model, with stable market conditions. The proof is that UST once reached a capitalization of 18 billion USD and ranked third in the list of stablecoins with the largest capitalization, according to CoinGecko. LUNA is also an asset that once reached the top 5 largest market capitalization in the crypto market. Do Kwon, founder of Terraform Labs - the parent company of the TerraUSD and LUNA projects, once sarcastically criticized those who did not support UST, saying they were "poor as hell". “I just woke up, what an exciting morning. You might hear people who seem to be famous talking about UST losing peg for the 69th time. Or you might remember that they're all poor, and you go jogging instead," Do Kwon shared on Twitter. me. However, not everyone believes in UST's operating model. A Twitter user named Algod bets 1 million USD that the price of LUNA next year will be lower than it is now. Another Twitter user named GCR also proposed the same thing for up to 10 million USD. Do Kwon approved everything. And these concerns are well-founded. On May 7, 2022, UST was in danger when about 285 million UST was sold on Curve and Binance. In the following days, UST's situation was even more dire. Even though Luna Foundation Guard raised 1.5 billion USD to protect UST's peg, this stablecoin continued to lose its peg, its capitalization decreased to 1 billion USD (on May 18, 2022), and eventually stopped trading on Binance. . UST and LUNA prices have split more than 10,000 times in just a few days. Millions of investors lost money, including their entire life savings, at least 8 people committed suicide... are some of the outcomes after the UST-LUNA incident. According to CoinDesk Korea, Do Kwon is believed to be the person behind this collapse. He became a red wanted subject by Interpol and was finally arrested in Montenegro in March 2023. Both the US and South Korea officially requested Do Kwon's extradition.

In February 2023, the SEC filed a lawsuit against Terraform Labs and Do Kwon for allegedly raising billions of dollars through the sale of crypto asset securities and orchestrating a fraudulent scheme that resulted in a loss of $45 billion to the market. school. “The defendants fabricated the operation of the Terra blockchain, creating bogus transactions. They lied to investors about UST's stability, hiding the secret agreement signed with a third party to save the asset from collapse," the SEC stated in the lawsuit. UST is probably just a "worm" in the stablecoin market. While algorithmic stablecoins carry great risks, other stablecoins still serve as the lifeblood of the DeFi market. Without stablecoins, there will be There was no crypto market like today.

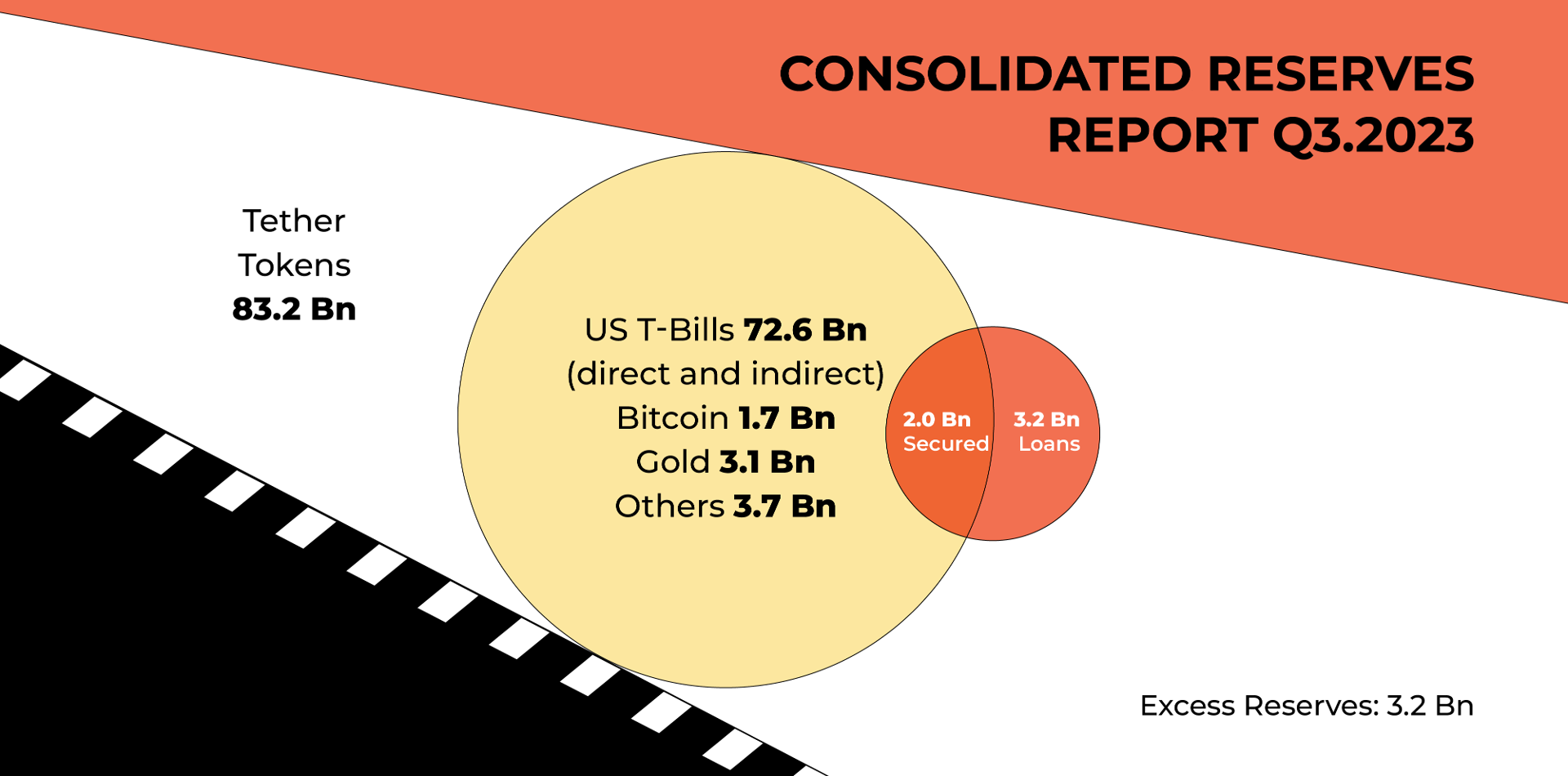

Besides collecting fees from users, stablecoin projects also provide loans to increase profits. Tether's third quarter 2023 report shows $5.5 billion in loans, mainly from some customers who need short-term loans to avoid selling assets at bad prices. Paolo Ardoino, CTO of Tether, said on Twitter that the company accepts Bitcoin as collateral to borrow USDT. Tether's report in September 2021 also revealed a project to lend billions of dollars to large Chinese companies. In October 2021, Tether continued to lend 1 billion USD to the Celsius Network crypto project to receive an interest rate of 5-6%/year. The profit potential from this loan is 50-60 million USD per year. As for Circle, the project does not lend, borrow or use USDC to pay bills. In the event of bankruptcy, Circle's reserve assets are segregated from bankruptcy assets, helping to ensure the safety of user assets.

Besides lending, investing is also one of the main activities and largest source of revenue for stablecoin projects. US Treasury bonds (T-bonds) are considered one of the safest investments in the world, backed by faith and trust in the US government. In the context of sky-high interest rates, US Treasury bills (T-bills) are the favorite choice of both traditional and non-traditional financial institutions. Tether's third quarter 2023 attestation report shows that the company is holding T-bills worth 72.6 billion USD, accounting for more than 85% of Tether's total reserves. According to the US Treasury Department, this number is larger than the number of T-bills held by many other countries, such as the UAE (64.9 billion USD), Italy (40.2 billion USD), Vietnam (36.3 billion USD)...

With an interest rate of about 5.4%, Tether is receiving nearly 4 billion USD per year. Besides treasury bills, Tether also invests in many other assets such as Bitcoin, gold... In addition, the company also plans to invest 500 million USD in Bitcoin mining machines, with Bitcoin mining facilities in Uruguay, Paraguay and El Salvador. As for Circle, the company also holds about 80% of USDC reserves in the form of T-bills with a term of less than 3 months. About the remaining 20% is reserved by Circle as cash in many highly reputable banks in the US such as Citizen's Trust Bank, New York Community Bank... Circle's goal is to reserve cash directly with the Federal Reserve. state. Typically, T-bonds have higher interest rates than T-bills because they have a longer maturity period. However, T-bills currently have higher interest rates because the Fed is keeping interest rates high to control inflation, creating an inverted yield curve. This shows that investors are not confident in long-term financial conditions. Since March 2022, the FED has continuously raised interest rates, causing bond prices to decrease and bond market liquidity to be almost paralyzed. American banks are strapped for liquidity and need money to continue operating, selling short-term instruments to create liquidity. This also causes open market yields (OMO) to increase. The inverted yield curve also shows investors' expectations that the FED will reduce interest rates in the long term. Therefore, when the FED reduces interest rates, the profits stablecoin projects receive from investing in T-bills may no longer be as attractive as they are today.

As for Circle, the company also holds about 80% of USDC reserves in the form of T-bills with a term of less than 3 months. About the remaining 20% is reserved by Circle as cash in many highly reputable banks in the US such as Citizen's Trust Bank, New York Community Bank... Circle's goal is to reserve cash directly with the Federal Reserve. state. Typically, T-bonds have higher interest rates than T-bills because they have a longer maturity period. However, T-bills currently have higher interest rates because the Fed is keeping interest rates high to control inflation, creating an inverted yield curve. This shows that investors are not confident in long-term financial conditions. Since March 2022, the FED has continuously raised interest rates, causing bond prices to decrease and bond market liquidity to be almost paralyzed. American banks are strapped for liquidity and need money to continue operating, selling short-term instruments to create liquidity. This also causes open market yields (OMO) to increase. The inverted yield curve also shows investors' expectations that the FED will reduce interest rates in the long term. Therefore, when the FED reduces interest rates, the profits stablecoin projects receive from investing in T-bills may no longer be as attractive as they are today.

Regardless of changes in the crypto market, demand for stablecoins will always be present thanks to their ability to stabilize assets in highly volatile market conditions. Currently, traditional financial institutions have been entering the fertile stablecoin market, typically Paypal, Visa, Stripe and the USDF Association. This can be a good condition to help the traditional banking market become stronger. Specifically, Paypal has cooperated with Paxos to launch stablecoin Paypal USD (PYUSD), focusing mainly on the US market. Paypal's stablecoin is regulated and monitored by the New York State Department of Financial Services (NYDFS). Even if Paxos goes bankrupt, customers' assets are still protected.

Paypal có thể là đối thủ đáng gờm với Circle trong tình cảnh công ty đang chứng kiến sự sụt giảm liên tục về vốn hóa thị trường sau khi SVB - nơi Circle giữ một phần dự trữ USDC - sụp đổ.

Giống như Tether và Circle, dự trữ của Paypal được giữ bằng T-bills và tiền lãi kiếm được sẽ được chia sẻ giữa PayPal và Paxos.

“Việc PayPal gia nhập thị trường stablecoin ‘là tín hiệu mạnh mẽ cho thấy các khoản thanh toán gần như tức thời, không biên giới và có thể lập trình dưới dạng stablecoin sẽ tiếp tục tồn tại”, Jeremy Allaire, đồng sáng lập và CEO của Circle chia sẻ với CoinDesk.

Ngoài ra, Visa cũng tiến hành thí điểm giao dịch bằng USDC, Stripe triển khai thanh toán bằng USDC, Hiệp hội USDF (nhóm 11 ngân hàng được FDIC bảo hiểm) đang thực hiện những nỗ lực để mã hóa tiền gửi…

Vào tháng 8/2023, Cơ quan Tiền tệ Singapore (MAS) cho biết họ đã hoàn thiện các quy tắc đối với stablecoin. Trong đó, các khoản dự trữ hỗ trợ cho stablecoin phải được giữ ở những tài sản có rủi ro thấp và có tính thanh khoản cao, chúng cũng phải luôn cao bằng hoặc vượt quá giá trị của stablecoin đang lưu hành.

Mới đây, Tether cũng đưa ra chính sách đóng băng các địa chỉ ví liên quan đến các lệnh trừng phạt, nhằm thể hiện cam kết nâng cao bảo mật và an toàn trong thị trường stablecoin.

Đọc thêm Sàn giao dịch crypto kiếm tiền như thế nào?