Can I get a crypto loan without collateral on Binance?

Photo: Courtesy of Binance

Photo: Courtesy of Binance

Table of contents

1.Main Takeaways

2.Introduction to Crypto Loans

3.Why do Crypto Loans require collateral?

4.What are the risks of crypto loans without collateral?

5.Advantages of using Binance Crypto-loans

6.Conclusion

7. Disclaimer

Main Takeaways

- Binance crypto- loans are easily and instantly obtained with two requirements: a verified Binance user account and crypto-assets as collaterals.

- Loans obtained could be used without limitations and users can borrow up to 65% the value of their collaterals

- Centralized crypto-exchanges like Binance run Crypto-loans with adequate security and this makes it attractive for crypto traders

- Binance crypto-loan process is devoid of the many bottlenecks often encountered while taking loans from commercial banks.

- A crypto-loan without a collateral is risky and should be considered a ‘bait’ from the lender who could be a fraud out to steal something important from you e.g. your identity or your sensitive details like password, wallet key phrase etc.

- A Collateral, no matter how small, is a trust that the lender can hold onto when something goes wrong after taking a crypto-loan. So it is impossible to get a crypto-loan on Binance without a collateral.

- As a crypto-loan taker, disabuse your mind from believing that there are crypto-loans without collaterals so that you would not fall into the hands of scammers. You should use trustworthy exchanges like Binance.

Introduction to Crypto Loans.

Why on earth would you think there are crypto-loans without collaterals? In commerce and Finance, Trust is an issue. A collateral is a way to be held accountable in case you decide by commission or omission not to honour your loan terms. A collateral is there to protect those lending you their crypto-assets to use for the main time. So you need to raise an eye brow when you come across ‘non-collateral loans’ in the crypto space.

Reasons to utilize crypto loans.

If you are a crypto-trader holding your crypto-assets for long term, you would not want to sell your assets at a point where their prices have depreciated. If you need funds to carry out urgent purchases or to foot urgent medical bills and there is a significant decrease in the value of your crypto-assets, what would you do? Binance crypto loans are means to bail you out when you find yourself in this kind of predicament. A Binance loan is an alternative to liquidating your crypto-assets.

When accessing Binance crypto-loans, you are more fortunate than a Colleague scouting for a bank loan because you only need a verified Binance account and crypto-asset in your Binance wallet. You do not need credit score, guarantor, physical assets and the heavy paper works that the banks often ask of us.

How Binance loan is calculated.

Binance loan interest are calculated every hour, not monthly like your traditional bank. Loan terms are shorter than bank loans, from 7 to 180 days. The volatile nature of crypto-assets which could results in a lower value of your collateral over time is the primary reason why interest are calculated on an hourly basis and issued on shorter terms.

Binance loans are instant.

Binance loans are instantly transacted, extremely liquid and highly convertible and any experience trader know these qualities are profitable for him when using a crypto exchange.

When you want to borrow a crypto-asset on Binance loans, determine the kind of crypto-asset that you want to borrow and also the amount of it.

Select the crypto-asset you want to use as your collateral on your loan. Then, you should go ahead to select your loan term which usually are 7,14,30,90 and 180 days. Once you are satisfied with your loan order details, you can then activate your loan.

How to use Binance loans

How do you use Binance loans? First, you need to have a verified Binance account. Sign into it and locate[Finance]-[Crypto Loans]. Select the asset that you want to borrow after which you enter the amount that you want to borrow.

You also need to select the asset that you want to use as collateral and the amount of it. After this, you should choose your loan duration(7,14,30,90 or 180 day) and then go ahead to tap the [Borrowing Now]button.

Confirm your details to be sure that those are what you want and then click the [Confirm] button. Binance loans can be renewed 24 hours before expiration or due date of the ongoing loan term.

Repayment of Binance loans.

Repaying your Binance loans is a very simple process often done right there on Binance load order page. Interest is usually required to be repaid first before your principal which could be repaid by installments if need be.

However, there is no penalty to have your loan repaid before due date. The loan amount that you repay consist of the principal which you borrowed and the interest on your borrowed amount.

Binance LTV and Liquidation.

In order to understand how Binance loans work, there are two factors worth your consideration. These are LTV and Liquidation.

LTV means Loan-to-value ratio and it is defined as the average value gotten from dividing the Loan value by the Collateral value multiplied by 100%.

Liquidation is a process where by your collateral is used against your wish to repay the loan you borrowed when you are unable to repay your loan. A 2% liquidation is imposed on your borrowed amount by Binance.

Why do Crypto Loans require collateral?

Why do crypto loan providers require collateral? A crypto-loan provider knows that a collateral reduces his risks of loaning out crypto-assets in case you are unable to make a refund. The following could be said of a collateral:

1.A collateral is used as a security deposit

A collateral is a kind of security deposit to cushion the ‘trust paradigm’ which is found in almost all human activities. A collateral reduces the lending risks of lending platforms like Binance loans and this is because Binance loans do not use credit checks nor insist you bring a guarantor before it can issue you the loans.

A collateral is seized when the debtor fails to repay his loan and this is a just security measure. Binance loans allows you to borrow crypto assets even when you have no credit history, no employment, or no physical properties.

2.A Collateral is used to calculate a lending risk

A lending risk is assessed using a collateral. Binance uses collaterals to calculate the borrower’s lending risk. A smaller collateral means a greater risk and a higher collateral means a lower risk. The mathematical tool used to determine the lending risk is called LTV which is an abbreviation for Loan-to-Value.

LTV is the ratio derived from dividing the value of a loan by the value of a collateral multiplied by 100%. The maximum LTV for using the Binance loan platform is 65%. You can not borrow more than 65% of your collateral. By using LTV, Binance can assess lending risks, offer you crypto loans and at the same time safeguard your Business if you are taking a loan for your Business. Photo: Courtesy of Binance

Photo: Courtesy of Binance

What are the risks of crypto loans without collateral?

There are certain risks posed by non-collateral loans. Credit checks and collaterals cushion lending risks. While credit checks are cumbersome processes used by traditional banks to determine your worthiness for a bank loan, a crypto-collateral is just a crypto-asset in your possession pledge for a loan. The obvious risks for a crypto-loan user going for a loan without collateral includes:

1.Scams

You are prone to scams when you go for non-collateral loans and you can lose all your crypto assets in your crypto-wallet or account. This is because scammers offer these kinds of non-collateral loans and in return, they demand for your sensitive information which they can use to steal your crypto-funds and even lock you out of your account and in the end, you can not have your loan.

So, it is important to verify the legitimacy of any non-collateral loans technically and otherwise to avoid falling prey to scams.

2.Interest rates on the high side

In the event that you get a legitimate non-collateral loan, you will find out that there would be a crazy interest rate on the loans and the loan amount might be small and loan duration short. These harsh conditions imposed by this kind of non-collateral loans make it unsuitable for you to make good use of your crypto-loans. To be on a safer side, it is not advisable to encourage you to go for non-collateral loans. Photo: Courtesy of Binance

Photo: Courtesy of Binance

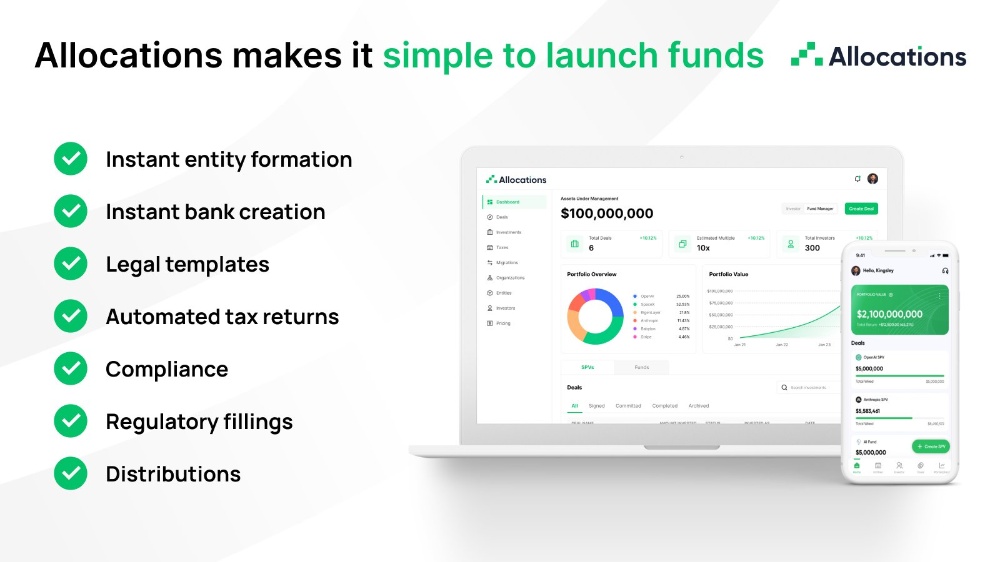

Advantages of using Binance Crypto-loans

Binance loans lend crypto assets to verified users at attractive interest rates. Binance loans have several advantages which include the following:

Transparency

Your loan interest would only be calculated for the number of hours tenable even when you decide to repay your loan before due date. Some lending facility would penalize you with a fee for early repayment for having caused inconvenience to them.

Intuitive user interface.

The Binance loans user interface is easy to access and use. It has an automation feature that automatically calculates your loan interest at competitive rates.

Staking

You can use some specific collaterals for staking on Binance staking as a creative way to reduce your loan interest. This is because, at the end of your staking term, you are rewarded with extra crypto-assets which you can use to offset part of your loan interest.

Multiple assets

A wide array of crypto-assets are supported by Binance loans giving the borrower the flexibility of choice. Over 160 crypto assets could be lend to you and you have over 50 assets that you can use as collateral. This might not be the case with other crypto-exchanges.

Choice of usage

When you get a loan from Binance loans, you are at freedom to do whatever you feel good with it. You can withdraw it and use in another exchange, you can withdraw to solve your urgent financial need, you can utilize it for trading on Binance spot, margin and futures markets and you can also use it on Binance savings to generate income.

Conclusion

Non-collateral loans might exist elsewhere. Dealing with such lenders would require you to be very cautious about the high probability of getting scammed. It is better to get crypto-loans from very secured platforms like Binance Loans which looks after the security of all its users. Getting a crypto-loan from Binance loans is an easy and profiting adventure.

From time to time, Binance makes it a corporate duty to offer promotions on crypto-loans, the last time was where interest on loans were reduced to about 0.000573%. Prior to this, there was the VIP tiered promotion where certain percentage of interest was reduced according to the various Binance VIP statuses.

With this kind of regular interest rate reduction promos, Binance loan users could save more and also make good use of their crypto-loans. Why not get a Binance loan today and experience the great delight that comes with it?. You can get started here: https://www.binance.com/en/loan?ref=11515767

Disclaimer

The content herein is socially researched from Binance Archives but remains the personal opinion of the writer. To get involved with any product or service of the crypto ecosystem, you might need the service of a financial adviser. The writer of this content is not a financial adviser.

Note

I featured this article on medium and it could also be accessed there via: https://medium.com/@mikhailikpoma/can-i-get-a-crypto-loan-without-collateral-on-binance-e63a6bdfa337

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)