3 cryptocurrencies to avoid trading next week

Trading cryptocurrencies is a risky

Knowing which cryptocurrencies to avoid trading is an important part of a good risk management strategy to improve results.

Key indicators such as RSI, regulations, supply inflation, token unlocks, and demand forecasts provide insights.

For this report, In particular, Binance USD (BUSD), Injective (INJ), and Kaspa (KAS).

Avoid trading with BUSD due to February uncertainties

In February 2023, the New York Department of Financial Services ordered Paxos to stop issuing the stablecoin BUSD. This decision came amid a lawsuit against the cryptocurrency exchange Binance, the token’s issuer in partnership with Paxos

The ability to properly exchange Binance’s stablecoin for U.S. Dollars after February is uncertain. Therefore, this market turmoil could directly affect the token, which speculators should avoid trading for proper risk management.

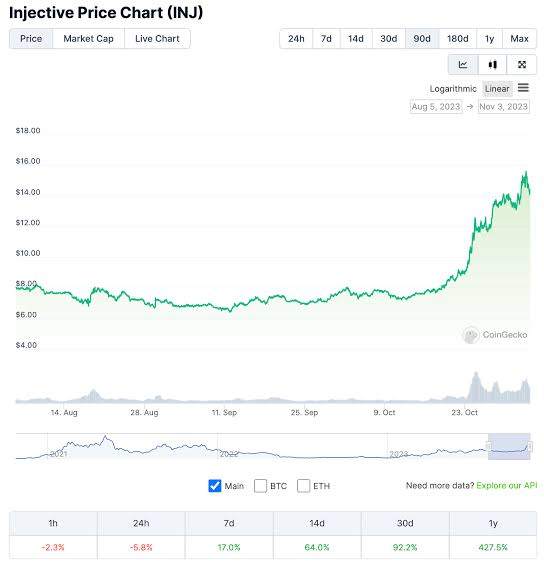

Avoid trading Injective (INJ) this weekend

This weekend, the Injective team will receive over $125 million of INJ from its vesting period unlock.

Kaspa (KAS) supply inflation

Meanwhile, Kaspa is a relatively new cryptocurrency that recently gained the spotlight with an impressive price performance. KAS went from $0.000170 in May 2022 to $0.155 at its all-time high in November 2023.

This movement rewarded early investors with over 20,500% gains in 1.5 years, now retracing 35% at $0.10.

In conclusion, these three cryptocurrencies could experience sudden sell-off events, making them worthy candidates for investors to avoid trading next week and even further until the economics produce the corresponding expected consequences.

Nevertheless, it’s important to understand that the cryptocurrency market’s unpredictability could play in their favor. If these cryptocurrencies manage to absorb enough demand, they may experience value appreciation even under these conditions. Thus, investors must do their own research and make thoughtful decisions to thrive.

Investors should acknowledge the unpredictability of the cryptocurrency market as it could potentially benefit them, but they must research and decide wisely.