7 step: how to trade forex

1.Learn about forex:

While it is not complicated, forex trading is an undertaking that requires specialized knowledge and a commitment to learning .Before diving into the forex market, it's essential to educate yourself thoroughly about how it works. This includes understanding basic forex terminology, such as currency pairs, pips, lots, and leverage. Familiarize yourself with different trading strategies, technical and fundamental analysis, risk management techniques, and the psychology of trading. There are numerous resources available online, including books, courses, webinars, and forums, where you can learn from experienced traders and experts.

2. Create a brokerage account:

In order to begin trading forex, you must have a trading account at a brokerage.

Start with Demo Accounts: Never start trading directly on a live account if you are a beginner because your real money will be at risk. We advise you to first create a demo account with the broker of your choice and then learn to trade by building & testing out a trading strategy, and figure out what works for you in different market conditions. Only once you are confident about your trading style & strategy, only then you should decide to trade with real money on a Live account.

Once you have found the Forex Broker of your choice, you can then open an account with that broker to start trading (or demo account to learn). This account will enable you to place your trades in the interbank market at the live currency prices.

If you are creating a Live account: All reputed brokers have some sort of KYC (ID & Address proof verification) & you cannot start trading in the market without verifying your account with any of the regulated broker. Once the verification is complete, you will need to make a deposit to fund your live account. These funds will be used to place live trades at the real market prices.

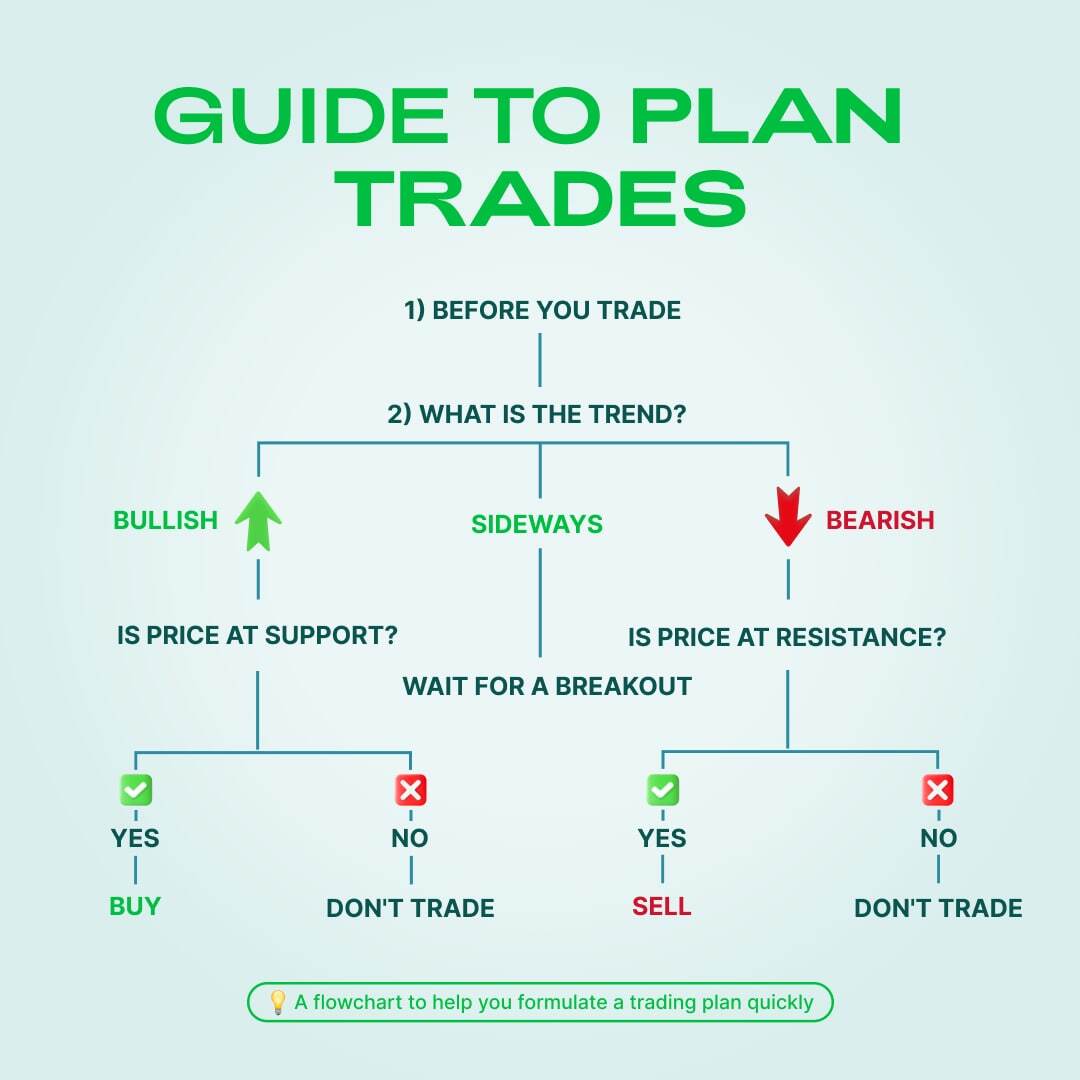

3. Create a trading plan:

Having a trading strategy will assist you in creating general rules and a trading road map, even though it is not always possible to foresee and time market action. A trading plan is a roadmap that outlines your trading goals, risk tolerance, preferred trading style, and strategies. It should include criteria for entering and exiting trades, as well as rules for managing risk and preserving capital. Your trading plan should be based on thorough analysis and research, rather than emotions or impulsive decisions. Review and refine your trading plan regularly as you gain experience and adapt to changing market conditions.

4.Start Trading with Small Positions:

Once you feel confident in your abilities and have a solid trading plan in place, you can start trading with real money. However, it's crucial to start small and only risk an amount you can afford to lose. Begin by trading micro or mini lots, which allow you to risk a fraction of a standard lot. As you gain experience and become more comfortable with your trading strategy, you can gradually increase your position size. Remember to stick to your risk management rules and never risk more than you're willing to lose on any single trade.

5.Always be on top of your numbers:

Check your positions at the end of the day after you start trading. A daily accounting of trades is already provided by most trading software. Verify that you have enough money in your account to make future trades and that there are no open positions that need to be filled.

6.Develop emotional balance:

There are a lot of unknowns and emotional roller coasters when starting out in forex trading. Have the self-control to leave jobs when it's appropriate.

developing emotional balance in forex trading requires self-awareness, mindfulness, acceptance of uncertainty, effective risk management, resilience, and maintaining a healthy work-life balance. By cultivating these qualities and implementing strategies to manage emotions, you can trade with greater confidence, discipline, and consistency over the long term.

7.Continuously Learn and Adapt:

The forex market is constantly evolving, so it's essential to stay updated with the latest news, trends, and developments. Keep learning and expanding your knowledge by reading books, attending webinars, following market analysis, and staying connected with other traders. Be open to adapting your trading strategy as needed based on your experiences and changing market conditions. Embrace both successes and failures as learning opportunities, and never stop striving to improve your trading skills.