Ultimate Guide to Business Finance Management: Best Practices for Financial Success

Effective business finance management is the cornerstone of a successful enterprise. It encompasses the planning, organizing, controlling, and monitoring of financial resources to achieve business goals. A solid financial management strategy not only ensures sustainability but also paves the way for growth and innovation. This guide explores the core principles of business finance management and offers actionable strategies for long-term success.

Part 1: The Foundations of Business Finance Management

Understanding Financial Statements

Financial statements are the backbone of business finance management. They provide critical insights into a company's performance, stability, and growth potential. Let's explore the three primary financial statements:

- Income Statement

- Also known as the profit and loss (P&L) statement, it shows the company's revenues, expenses, and profits over a specific period. Analyzing the income statement helps you understand profitability trends and identify cost-saving opportunities.

- Balance Sheet

- The balance sheet provides a snapshot of a company's financial position at a given moment. It outlines assets, liabilities, and equity. Understanding the balance sheet is crucial for assessing a company's financial health, liquidity, and leverage.

- Cash Flow Statement

- This statement details the flow of cash into and out of the business. It is divided into three sections: operating activities, investing activities, and financing activities. Analyzing cash flow helps you manage liquidity and plan for future financial needs.

Financial Ratios and Performance Indicators

Financial ratios are powerful tools for evaluating a company's performance. They provide a numerical perspective that can be compared over time or against industry benchmarks. Key financial ratios include:

- Liquidity Ratios

- These ratios measure a company's ability to meet short-term obligations. Common examples include the current ratio and quick ratio.

- Profitability Ratios

- Profitability ratios assess a company's ability to generate profit relative to its revenue, assets, or equity. Common ratios include gross profit margin, net profit margin, and return on equity (ROE).

- Leverage Ratios

- Leverage ratios indicate the degree of financial leverage a company uses. Examples include the debt-to-equity ratio and the debt ratio.

- Efficiency Ratios

- Efficiency ratios measure how effectively a company uses its assets and manages its operations. Examples include inventory turnover, asset turnover, and accounts receivable turnover.

Part 2: Core Strategies for Business Finance Management

Budgeting and Forecasting

Effective budgeting and forecasting are essential for financial stability and growth. Here's how to develop robust budgets and forecasts:

- Establish Clear Objectives

- Define your business goals and align your budget with those objectives. This alignment ensures that resources are allocated appropriately.

- Break Down Costs and Revenue Streams

- Categorize expenses into fixed costs, variable costs, and semi-variable costs. Identify revenue sources and project future income based on historical data and market trends.

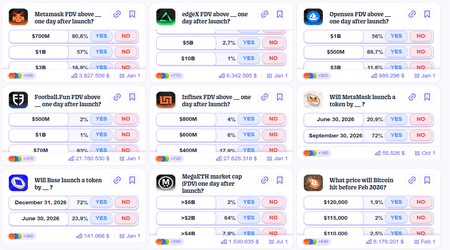

- Create Multiple Scenarios

- Develop multiple budget scenarios to account for uncertainty and risk. This approach allows you to plan for best-case, worst-case, and expected outcomes.

- Review and Adjust Regularly

- Budgeting is an iterative process. Regularly review your budget to track performance and make adjustments as needed.

Cash Flow Management

Maintaining positive cash flow is crucial for business operations. Here are some key strategies for effective cash flow management:

- Optimize Accounts Receivable

- Implement clear invoicing procedures and payment terms. Use technology to automate billing and send reminders for overdue payments. Consider offering discounts for early payment to encourage prompt settlement.

- Control Inventory Levels

- Excess inventory ties up capital and increases storage costs. Implement inventory management techniques such as just-in-time (JIT) or economic order quantity (EOQ) to maintain optimal inventory levels.

- Manage Accounts Payable

- Negotiate favorable payment terms with suppliers and vendors. Aim to balance cash flow while maintaining good relationships with creditors.

- Build a Cash Reserve

- A cash reserve provides a safety net for unforeseen expenses or revenue fluctuations. Aim to maintain a reserve that covers three to six months of operating expenses.

Capital Structure and Financing

Capital structure involves the mix of debt and equity used to finance business operations. Finding the right balance is critical for minimizing risk and maximizing growth opportunities.

- Debt Financing

- Debt financing involves borrowing money that must be repaid with interest. Common sources include bank loans, lines of credit, and bonds. While debt can provide quick capital, excessive debt increases financial risk.

- Equity Financing

- Equity financing involves raising capital by selling shares of the business. This approach does not require repayment but dilutes ownership. Equity financing can attract investors who bring expertise and connections to the business.

- Hybrid Financing

- Hybrid financing combines elements of both debt and equity. Examples include convertible bonds and preferred shares. These instruments offer flexibility in structuring capital.

Tax Planning and Compliance

Effective tax planning can significantly impact a business's bottom line. Here are key considerations for tax planning and compliance:

- Understand Tax Obligations

- Familiarize yourself with federal, state, and local tax requirements. Ensure compliance with income tax, sales tax, payroll tax, and other obligations.

- Maximize Deductions and Credits

- Take advantage of available deductions and tax credits. These incentives can reduce taxable income and lower tax liability. Common examples include research and development (R&D) credits and business expense deductions.

- Work with a Tax Professional

- Tax laws are complex and subject to change. Consult with a tax advisor or accountant to ensure compliance and identify tax-saving opportunities.

Part 3: Advanced Strategies for Business Finance Management

Risk Management and Contingency Planning

Risk is an inherent part of business operations. Effective risk management involves identifying potential risks and implementing strategies to mitigate them. Key risk management practices include:

- Identify and Assess Risks

- Conduct a comprehensive risk assessment to identify potential risks to your business. Consider risks related to finance, operations, compliance, and external factors.

- Develop Contingency Plans

- Create contingency plans for high-impact risks. These plans should outline steps to take in the event of a financial crisis, natural disaster, or other unexpected event.

- Diversify Revenue Streams

- Reducing reliance on a single revenue source can mitigate risk. Explore new markets, product lines, or services to diversify your revenue streams.

- Invest in Insurance

- Insurance can provide a safety net against financial losses. Consider business liability insurance, property insurance, and business interruption insurance, among others.

Technology and Automation

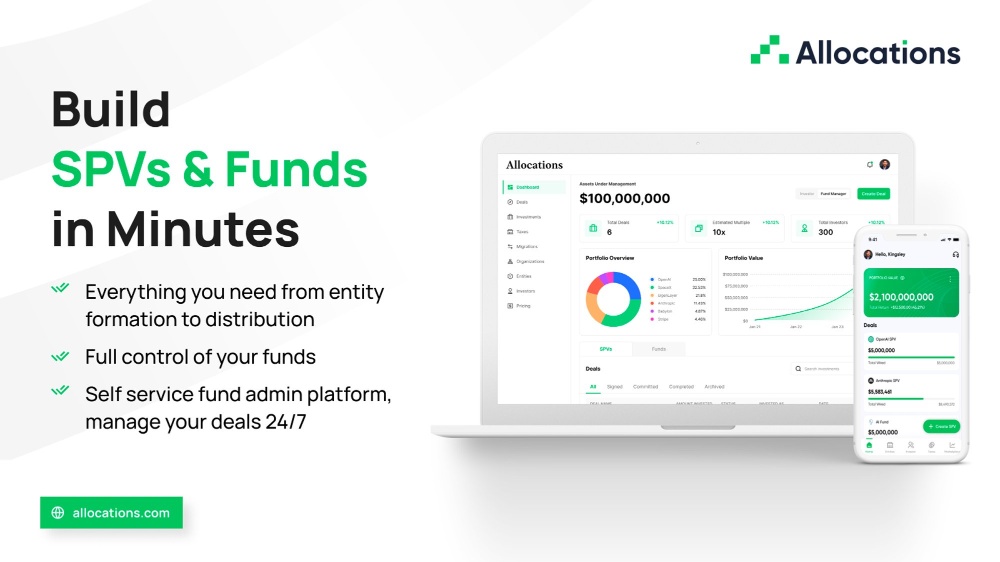

Technology plays a pivotal role in modern business finance management. Embracing automation and digital tools can streamline financial processes and improve accuracy. Key technology strategies include:

- Adopt Accounting Software

- Accounting software automates tasks like bookkeeping, payroll, and invoicing. It provides real-time insights into financial data, reducing manual errors.

- Implement Cloud-Based Solutions

- Cloud-based platforms offer scalability and accessibility. These solutions allow you to access financial data from anywhere, facilitating remote work and collaboration.

- Use Data Analytics

- Data analytics provides valuable insights into business trends and customer behavior. Leverage analytics to make data-driven decisions and identify growth opportunities.

Building Strong Financial Teams and Partnerships

Building a strong financial team and forging strategic partnerships can significantly enhance your business's financial capabilities. Consider these strategies for building and leveraging financial expertise:

- Hire Skilled Financial Professionals

- Recruit professionals with expertise in finance, accounting, and tax compliance. Look for individuals with experience in your industry or with specific financial certifications.

- Develop Strategic Partnerships

- Form partnerships with financial institutions, accounting firms, and business consultants. These partnerships can provide valuable resources and insights to support your business.

- Invest in Employee Training

- Employee financial education is crucial for fostering a culture of financial responsibility. Offer training programs and resources to improve financial literacy among employees.

Conclusion

Mastering business finance management is a dynamic and evolving process. By understanding financial statements, implementing robust financial strategies, and embracing technology, businesses can navigate financial challenges and achieve long-term success. The key is to remain proactive, stay informed about industry trends, and seek professional guidance when needed.

Whether you're a startup or an established business, applying these principles and strategies will help you build a strong financial foundation, ensure compliance, and foster a sustainable path to growth and profitability. Keep learning, adapting, and refining your approach to business finance management to stay ahead in today's competitive business landscape.