Why Working Hard Stops You From Getting Rich

In a world where success is often equated with working long hours, sacrificing sleep, and giving up personal time for the sake of your career, many people believe that hard work is the key to financial success. This mentality is ingrained in our culture, leading to an idea that if you work harder than anyone else, you will eventually achieve wealth. However, this is not always the case.

While hard work can certainly pay off in some areas, the truth is that working harder doesn't always lead to getting rich. In fact, there are numerous reasons why relentless hard work may actually be a barrier to wealth accumulation. It’s time to reframe our understanding of success and realize that to build wealth, it’s not just about how many hours you put in, but how strategically you work and invest your time and resources.

This article will delve into the reasons why working hard can actually stop you from getting rich, and it will provide alternative approaches to achieving financial success.

1. The Myth of the “Hard Worker”

Our culture reveres those who work tirelessly, and the "hard worker" is often seen as the epitome of success. You’re expected to put in 50-60 hours a week, endure grueling commutes, and put your personal life on hold for your career. While this work ethic can lead to job security and promotions, it often doesn’t translate into financial freedom.

The Reward of Hard Work vs. Wealth Creation

Hard work, in many professions, is rewarded with a higher salary. However, this is linear—meaning that the more hours you work, the more you earn, but your time is still capped. The traditional path of working for an employer means you’re trading time for money. You can only earn more if you increase your hours or climb the corporate ladder.

But there’s a ceiling to this model. For example, a high-paying job that demands 80-hour work weeks may reward you with six-figure salaries, but it doesn’t free you from the cycle of working for money. The question is: how can you make your money work for you instead?

The Hard Work Trap

The hard work trap arises when people believe that the only way to succeed is through unrelenting effort. This leads to burnout, neglect of personal relationships, and often deteriorating mental and physical health. Over time, this unsustainable model limits wealth-building opportunities.

2. Time is Your Most Valuable Asset

One of the biggest reasons hard work fails to translate into wealth is that time is a finite resource. The more time you spend working, the less time you have to invest in activities that create passive income, long-term growth, and wealth generation.

Time for Active Work vs. Passive Income

When you're stuck in the cycle of working long hours for a paycheck, you're only earning active income—income you must work for. The wealthiest people don’t rely solely on active income; they focus on building assets that generate passive income. Passive income comes from investments, real estate, royalties, and businesses that can run without your constant involvement.

For instance, owning a rental property or a business that earns you money without day-to-day involvement allows you to free up your time for more wealth-building activities. Time becomes an asset that works for you, rather than something you sell in exchange for money.

The Dangers of Time-For-Money Mindset

The idea that time = money traps people into thinking the only way to increase their wealth is to work harder. But when you work long hours, you’re losing out on the chance to develop systems, learn new skills, or build passive income sources. Wealth is not built by spending all your time in one place; it’s built by leveraging your time through smart investments and systems.

3. Working Hard Does Not Necessarily Mean Working Smart

There’s an important distinction between working hard and working smart. Many people who work long hours don’t stop to analyze whether the work they’re doing is actually contributing to their long-term wealth.

The Importance of Strategy and Leverage

You could spend all day and night working on something, but if it's not the right activity, you won't get far. The key to getting rich is strategic action, not just busyness. This could involve outsourcing tasks, automating processes, or finding ways to scale your efforts. Many people burn out trying to perfect something they could easily delegate or automate.

Leverage: The Key to Smart Work

Leverage is the ultimate tool for building wealth. Leverage can come in many forms: money, time, and people. Smart workers leverage other people's time, skills, and money to achieve more in less time. For example, hiring a virtual assistant to handle administrative tasks, investing in the stock market, or using technology to automate your business can multiply your efforts and free up more of your time for higher-value activities.

Wealth is about making your money and resources work for you, and not the other way around.

4. The Role of Investments in Building Wealth

Working hard for money is an admirable pursuit, but it is investments that truly grow wealth. Many people who work long hours spend little to no time learning about investments that could create long-term financial freedom.

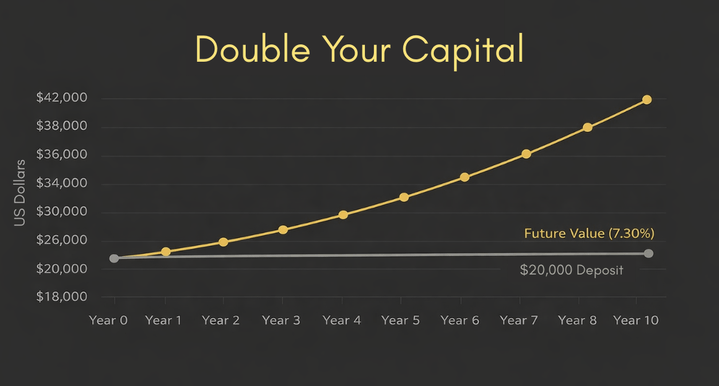

The Power of Compound Interest

One of the most powerful wealth-building tools is compound interest. But in order to take advantage of compound interest, you need to invest your money in places that grow over time—such as stocks, bonds, mutual funds, or real estate. If you are stuck working for a paycheck and not investing your money, your wealth will grow very slowly, if at all.

For example, if you start investing in the stock market early and consistently put money into index funds or growth stocks, you’ll be able to capitalize on the compounding growth of your investments. But if all you do is work harder to earn more money without investing that income, you miss out on the ability for your money to grow on its own.

Real Estate as a Passive Income Source

Real estate is another powerful investment vehicle. Many wealthy individuals achieve financial freedom by investing in properties that generate rental income. While purchasing and managing properties requires some effort, real estate is one of the best ways to build wealth passively. Working hard and saving for a down payment is great, but your money won't start working for you until you put it into investments like real estate.

5. Lack of Financial Education

Working hard for money often means focusing on earning more rather than understanding how money works. This lack of financial education keeps many people stuck in the cycle of trading time for money.

Financial Literacy: The Missing Ingredient

The reality is that many people spend their entire careers earning a paycheck without learning the basics of investing, managing money, and building wealth. Without financial literacy, you’ll never be able to make informed decisions about your money, and you’ll continue to work harder just to maintain your lifestyle.

Wealthy individuals often invest time in learning how money works—whether it’s reading books, hiring financial advisors, or studying markets. They understand the importance of budgeting, investing in assets, and minimizing liabilities.

The Rich Know the Rules of Money

The wealthy don’t just work hard; they learn the rules of money and how to use it effectively. This knowledge leads them to create multiple streams of income, minimize taxes, and make wise investments that appreciate over time.

6. Working Hard Prevents You From Taking Risks

Another reason hard work may stop you from getting rich is that it keeps you in your comfort zone, focusing solely on safe, predictable income sources. True wealth is often built through calculated risks—investing in new businesses, entering the stock market, or starting entrepreneurial ventures. However, when you’re entrenched in a full-time job or an unyielding work schedule, it’s difficult to make time for these risk-taking opportunities.

The Fear of Losing Security

The fear of losing job security or a stable paycheck holds many people back from taking risks. But those who are willing to step outside their comfort zone, take risks, and invest in ideas or businesses with growth potential often experience exponential wealth growth.

Calculated Risks and Leveraging Opportunities

Risk-taking doesn't mean reckless decisions. Wealthy people understand the difference between calculated risks and blind gambles. They take the time to learn, analyze, and plan their investments to reduce risk. By working smarter, not harder, you can free yourself from fear and open yourself up to wealth-building opportunities.

7. Lack of Focus on Personal Development

Hard work is often synonymous with focusing on the day-to-day grind—doing your job to the best of your ability. However, this often distracts you from focusing on personal growth and skill development that could lead to greater opportunities.

Investing in Your Skills and Mindset

The most successful people understand the importance of continuous learning and personal development. This includes not only technical skills but also mindset shifts, such as thinking long-term, focusing on opportunities rather than obstacles, and developing resilience.

For instance, investing time in learning about personal finance, entrepreneurship, or a new technology field could increase your earning potential far more than simply working harder at your current job.

8. The Illusion of Control

Working hard often creates the illusion of control—especially in the context of being a high achiever. However, true wealth is often built by embracing uncertainty, being open to change, and adapting to new trends and technologies.

The Need for Adaptability

Hard work keeps you entrenched in your current situation, often making you resistant to change. Wealth-building is about adaptability, seizing opportunities in an ever-changing world, and learning how to pivot when necessary. Whether it's adjusting to new industries, technological advancements, or financial systems, those who work smart embrace change rather than fight against it.

9. Prioritizing Wealth Building Over Time Spent

In the end, building wealth isn’t about how many hours you work but how you prioritize your time and resources. The truly wealthy understand that their time is best spent working strategically to grow their money, rather than working longer hours for more paychecks.

The Wealth-Building Mindset

The wealthy cultivate a mindset that prioritizes creating opportunities for growth—whether that’s through investments, building businesses, or developing new skills. Rather than relying on hard work alone, they focus on smarter, more efficient ways to generate wealth.

Conclusion: Work Smart, Not Hard

The truth is that working hard can get you only so far. While hard work is important, it’s not the only factor in building wealth. By working smarter, leveraging your time and resources, investing in assets, and continuously educating yourself, you can break free from the hard work trap and start accumulating wealth. It’s not about working harder; it’s about working more effectively, making wise decisions, and learning how to make your money work for you.

You May Like :

How Tipping Secretly BROKE The Economy

My Millionaire Habits That Cost Literally NOTHING

Why The American Dream Is Dead