The Resurgence of the Crypto Economy, Market Dynamics and Implications for New Tokens

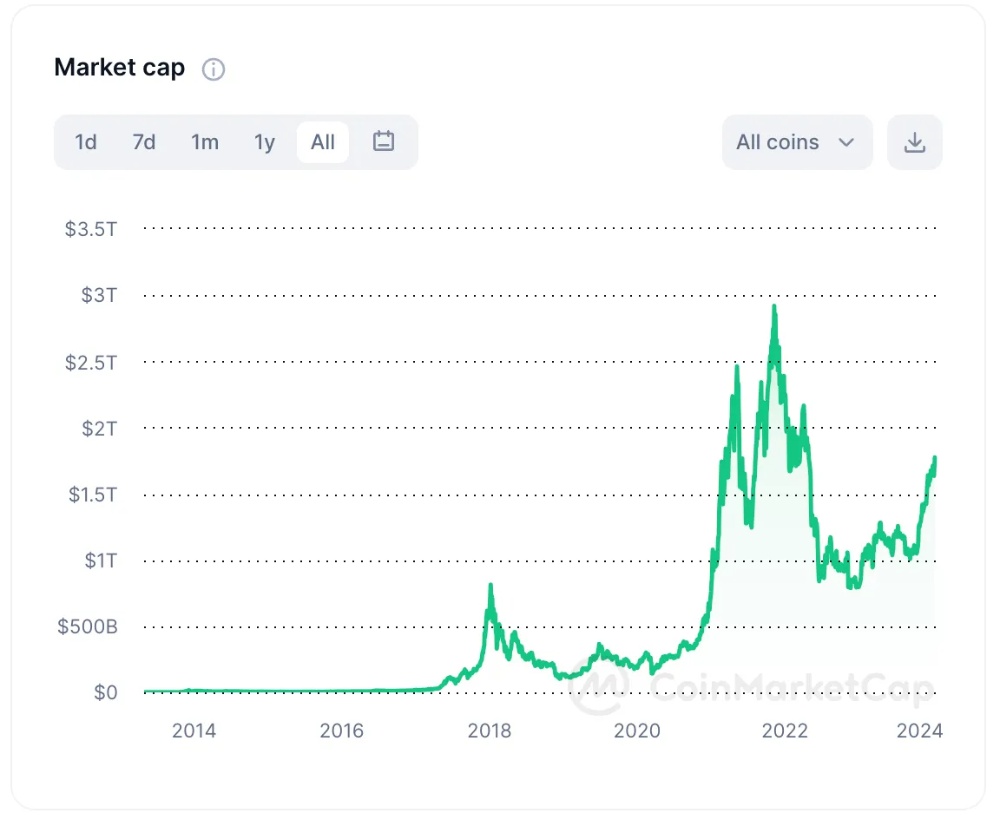

The crypto economy, after navigating a turbulent period in 2022/2023, is showing signs of a robust comeback. With a global market cap standing at $1.69 trillion and a nuanced shift in market dynamics, it’s essential to delve into the various facets of this resurgence. This comprehensive analysis will cover the current state of the crypto market, the significance of the Fear and Greed Index, and the implications for new token launches.

I'll provide a general overview of the dynamics and implications that were relevant up to my last update.

Resurgence of the Crypto Economy:

Bitcoin Dominance:

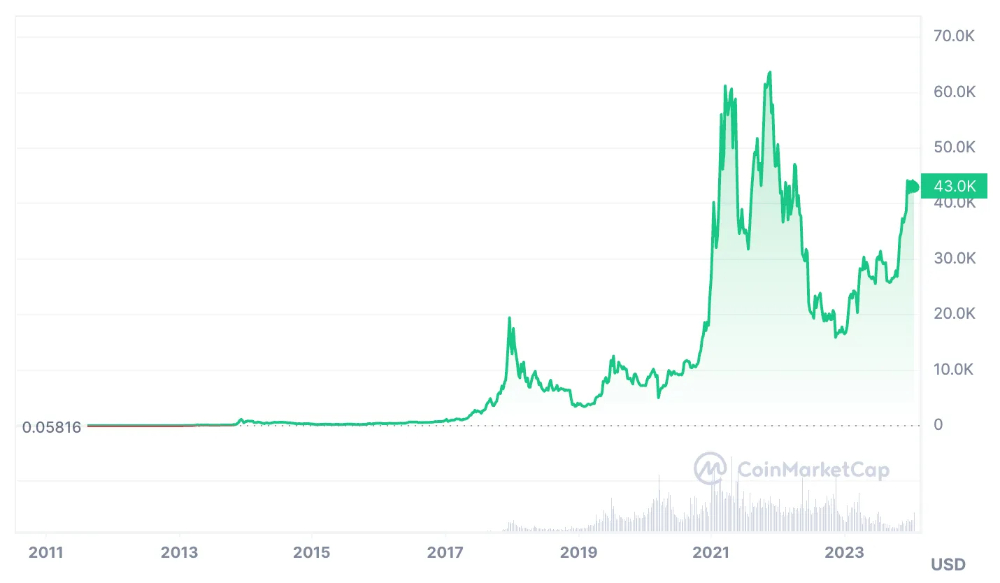

Bitcoin (BTC), as the first and most well-known cryptocurrency, has continued to play a significant role. Its price movements often influence the broader market.

Altcoins and New Tokens:

The crypto market has seen the rise of various alternative cryptocurrencies (altcoins) and new tokens. Ethereum (ETH) and Binance Coin (BNB), among others, have gained prominence, and new tokens are frequently introduced through Initial Coin Offerings (ICOs) or token launches.

DeFi (Decentralized Finance):

The emergence and growth of decentralized finance (DeFi) projects have been a notable trend. These projects aim to recreate traditional financial systems with decentralized, blockchain-based alternatives, offering services like lending, borrowing, and trading without intermediaries.

NFTs (Non-Fungible Tokens):

Non-Fungible Tokens (NFTs) gained immense popularity, enabling the tokenization of digital and real-world assets like art, music, and real estate. This trend has brought attention to blockchain technology beyond cryptocurrencies.

Market Dynamics:

Regulatory Developments:

Governments and regulatory bodies worldwide have been working on establishing frameworks for cryptocurrency regulation. Regulatory clarity or changes can significantly impact the market.

Institutional Involvement:

Institutional investors have increasingly shown interest in cryptocurrencies, with some allocating a portion of their portfolios to digital assets. This involvement is often seen as a positive sign for market maturity.

Technology Upgrades:

Upgrades to existing blockchain networks, such as Ethereum's transition to Ethereum 2.0, aim to address scalability and energy efficiency concerns. Technological advancements can influence market dynamics.

Community and Social Media Influence:

The crypto community's influence on social media platforms can lead to rapid price movements. News, developments, and sentiment within the community can impact market trends.

Implications for New Tokens:

Tokenomics:

The economic model of a token, including its supply mechanism, utility, and governance, plays a crucial role in its success. Well-designed tokenomics can contribute to long-term sustainability.

Use Cases and Utility:

Tokens with clear use cases and utility are more likely to attract interest. Whether a token facilitates decentralized applications, governance, or other functions, its purpose is essential for adoption.

Security and Compliance:

New tokens need to prioritize security and compliance with regulatory standards. A robust security infrastructure and adherence to legal requirements can build trust among users and investors.

Market Sentiment:

The sentiment surrounding the overall crypto market can impact new tokens. Positive market conditions may foster a more receptive environment for the introduction of new projects.

Adoption and Partnerships:

Collaborations and partnerships with established entities or integration into existing platforms can enhance a new token's chances of success and adoption.

It's crucial to stay updated on the latest developments in the cryptocurrency space, as market conditions and trends can change rapidly. Always conduct thorough research and consider the risks associated with investing in or developing new tokens.

Current State of the Crypto Market

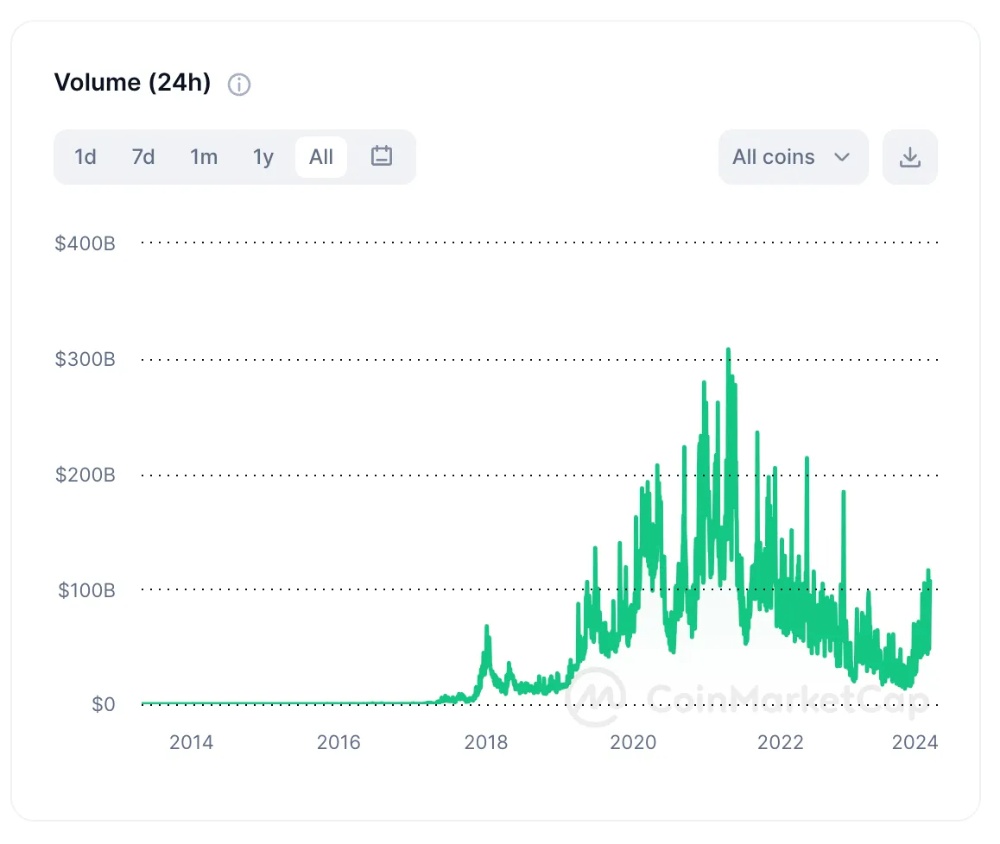

Market Valuation and Volume: The global crypto market cap, at $1.69 trillion, indicates a marginal decrease of 0.42%. This subtle dip suggests a period of consolidation in an otherwise volatile market. The total crypto market volume over the last 24 hours (as of Jan 13th 2024) stands at $65.1 billion, marking a 27.69% decrease, which could be reflective of various macroeconomic conditions and market sentiments.

Decentralized Finance (DeFi) and Stablecoins: DeFi’s market volume is $5.17 billion, about 7.94% of the total volume, underlining its growing influence in the crypto ecosystem. In contrast, stablecoins account for a significant $57.03 billion (87.61% of the total market volume), highlighting their role as a hedge against volatility.

Bitcoin’s Dominance: Bitcoin’s current market dominance is at 49.75%, a slight decrease of 0.65% over the day. This indicates a diversification trend among investors, exploring altcoins and other crypto assets.

The Fear and Greed Index

Understanding the Index: The Fear and Greed Index, currently standing at 63, signifies ‘ higher greed’ and is a critical tool in gauging market mood. This index synthesizes data like volatility, social media sentiment, and Bitcoin dominance, offering insights into the emotional biases of the market.

Historical Context and Current Implications: This ‘extreme greed’ level that was reached in Dec 2023 was not seen since 2021, aligns with Bitcoin’s significant rally and the broader market’s recovery. Such a sentiment suggests investor confidence and a robust rebound from the previous downturns. The index also serves as a strategic tool for investors, providing cues on when to enter or exit the market.

The Fear and Greed Index is a sentiment indicator used in the cryptocurrency market to gauge investors' emotions and market sentiment. It provides a numerical representation of whether the market is currently characterized by fear or greed. This index takes into account various factors and data points to determine the prevailing sentiment.

Components of the Fear and Greed Index:

Price Momentum:

The recent price movements of major cryptocurrencies are considered. Rapid price increases may indicate greed, while significant declines may suggest fear.

Volatility:

Market volatility, measured by the standard deviation of price changes, is factored in. Higher volatility often correlates with increased fear in the market.

Market Momentum/Volume:

Trading volumes and the momentum of the market are assessed. Increased trading activity and positive momentum may indicate greed, while low volume and negative momentum may signal fear.

Social Media Sentiment:

The index may incorporate data from social media platforms and online forums to assess the sentiment of the cryptocurrency community. Positive or negative discussions can influence the overall sentiment.

Dominance of Bitcoin:

The dominance of Bitcoin in the overall cryptocurrency market capitalization is considered. A high Bitcoin dominance may suggest a more cautious market, while a lower dominance could indicate greater risk appetite.

Google Trends:

The frequency of Google searches related to cryptocurrencies is often considered. A surge in searches may indicate increased public interest and potential greed.

Options and Futures:

Data from options and futures markets, including open interest and contract positions, may be factored in to assess market sentiment.

Fear and Greed Levels:

Extreme Fear (0-20):

Indicates that investors are extremely bearish and fearful. This may present buying opportunities, as markets are perceived to be oversold.

Fear (21-40):

Suggests that investors are cautious, and there might be opportunities for contrarian investors.

Neutral (41-60):

Reflects a balanced sentiment, with neither extreme fear nor greed dominating the market.

Greed (61-80):

Indicates that investors are optimistic and greedy. This may be a signal that the market is overbought, and a correction could be possible.

Extreme Greed (81-100): Suggests that investors are excessively bullish and greedy. This could be a signal that the market is overextended and due for a pullback.

It's important to note that while the Fear and Greed Index can provide insights into market sentiment, it's just one tool among many, and investors should use it in conjunction with other analysis methods. Additionally, market sentiment can change quickly, so regular monitoring is crucial for staying informed about shifts in investor sentiment.

Implications for New Token Launches

Investor Confidence and Capital Inflow:

The positive market sentiment could lead to increased interest and capital inflow for new token launches. Investors, riding the wave of market optimism, may be more inclined to explore and invest in new crypto projects.

DeFi’s Emergence and Stablecoin Dominance:

The growth of DeFi presents opportunities for new tokens in this space, while the dominance of stablecoins indicates a market leaning towards stability and risk aversion. New tokens need to balance innovation with clear risk mitigation strategies to appeal to this evolving investor base.

Navigating Market Volatility:

Despite the positive sentiment, the market’s inherent volatility remains a challenge. New tokens must have strategies to manage rapid shifts in investor sentiment and market dynamics post-launch.

Regulatory Considerations:

Compliance with evolving regulations is paramount for new tokens to gain investor trust and legitimacy. A clear regulatory stance can significantly enhance the appeal of a new token offering.

Competition and Community Engagement:

The improving market conditions could lead to increased competition among new tokens. Distinct value propositions, community building, and robust marketing strategies are essential for standing out in this crowded space.

The Fear and Greed Index, along with other market indicators, can have implications for new token launches. Understanding the prevailing sentiment in the cryptocurrency market is crucial for developers, investors, and projects looking to launch new tokens. Here are some implications for new token launches based on different Fear and Greed Index levels:

Extreme Fear (0-20) and Fear (21-40):

Buying Opportunities:

During periods of extreme fear or fear, the market may be oversold, presenting potential buying opportunities for new tokens. Investors may be more cautious, but strategic launches with strong fundamentals could attract interest.

Lower Speculative Activity:

Investors may be less willing to engage in high-risk speculative activities during times of fear. New tokens should emphasize stability, security, and clear use cases to gain trust.

Neutral (41-60):

Balanced Sentiment:

A neutral sentiment indicates a balanced market. New token launches during these periods may face less extreme reactions, providing an opportunity for projects to establish themselves without the excessive influence of fear or greed.

Focus on Fundamentals:

Projects launching new tokens should emphasize strong fundamentals, utility, and long-term value propositions. This is a time to build a solid foundation and showcase real-world applications.

Greed (61-80) and Extreme Greed (81-100):

Caution for Overbought Conditions:

During periods of greed or extreme greed, the market may be overbought, and there's a risk of a market correction. New token launches should be cautious, as investors might be more driven by FOMO (Fear of Missing Out), and hype may overshadow fundamentals.

Potential for Quick Gains:

Greed-driven markets can provide opportunities for quick gains, but new tokens should be wary of short-term speculation. Establishing a strong community and long-term vision is essential even in bullish conditions.

General Considerations for New Token Launches:

Market Research:

Conduct thorough market research to understand current trends, investor sentiment, and potential demand for the type of token being launched.

Clear Use Case:

Clearly define the use case and utility of the new token. Projects with practical applications and real-world use tend to fare well regardless of market sentiment.

Security and Compliance:

Emphasize security measures in the token's design and implementation. Ensure compliance with relevant regulations to build trust among potential investors.

Community Engagement:

Build and engage with a strong community. Community support can play a crucial role in the success of a new token.

Long-Term Vision:

Focus on a long-term vision and value proposition. Avoid overly relying on short-term market conditions and hype.

Adaptability:

Be adaptable to changing market conditions. The crypto market is dynamic, and being able to adjust strategies based on sentiment shifts is important.

Ultimately, the success of a new token launch depends on various factors, including the project's fundamentals, the team's credibility, market conditions, and investor sentiment. It's important for token issuers to stay informed about the broader market dynamics and tailor their strategies accordingly.

Thoughts

The crypto economy’s current phase, marked by a stable market cap, the rise of DeFi, and a sentiment of ‘higher greed’, paints a picture of an industry on the upswing. For new tokens, this environment presents both opportunities and challenges. As the landscape continues to evolve, it is crucial to engage in discussions on these developments and their broader implications for the crypto market and upcoming projects.

Here are two key questions for new token launches:

Strategies for New Tokens Amid Regulatory Changes:

In light of the evolving regulatory landscape, what strategies should creators of new crypto tokens adopt to ensure compliance while still fostering innovation and attracting investors?

Differentiation in a Crowded Market:

With the increasing number of crypto tokens being launched, how can new tokens differentiate themselves in this crowded marketplace, both in terms of technology and their value proposition to potential investors and users?

These questions are critical for anyone involved in or considering launching new crypto tokens. Your perspectives and experiences in addressing these issues would be invaluable.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)