A game on Blast was drained of 4.6 million USD, the token price plummeted

According to estimates, the damage from the hack is about 4.6 million USD. SSS token price has almost lost all value.

A game on Blast was drained of 4.6 million USD, the token price plummeted.

Super Sushi Samurai (SSS), the game that won the runner-up position in layer-2 Blast's Big Bang Event competition, has just experienced an attack with approximately 4.6 million USD in damage.

The hack happened just a few hours after the project announced the airdrop for early users. In an announcement on the evening of March 21, Super Sushi Samurai confirmed that hackers took advantage of a vulnerability in the mint function of smart contracts before selling them into the SSS liquidity pool.

Coffeexcoin developers from Yuga Labs claim that the liquidity pool was drained because the token contract had an error that allowed them to double their funds. To put it simply, if a user sends their entire balance to themselves through one transaction, they can receive double the original amount.

According to blockchain security unit CertiK, the hack caused more than $4.6 million in damages.

However, what just happened may not have been an attack. The person who withdrew all project funds sent a message signaling that this was a white hat hack. He provided contact information and pledged to refund users.

"We are in contact with the attacker." - Super Sushi Samurai confirmed on X.

Super Sushi Samurai is a game integrated on Telegram and Blast. The new project released SSS tokens on March 17 and plans to mainnet today. However, the news of being hacked caused the SSS price to lose more than 99% of its value.

SSS price fluctuation on 1h frame, screenshot of Tradingview at 01:45 AM on March 22, 2024

As for Blast, this layer-2 went into operation last month after receiving more than 2.3 billion USD in TVL, and quickly became the 4th largest layer-2 in the entire segment.

As is known, Blast is a Layer 2 platform built on Optimistic Rollup technology with a focus on LSD and RWAs.

Blast is a Layer 2 solution on the Ethereum network that uses Optimistic Rollup technology. The problem that Blast poses is that if a user holds ETH or Stablecoins and these assets bring returns lower than 4% for ETH or 5% for Stablecoins, the user is failing because of the RWA protocols. with T-Bill product bringing 5% profit for Stablecoin and ETH staking bringing 4% profit. That's why Blast was born to solve this problem.

Some outstanding features of Blast Layer 2 include:

· Auto Rebasing: Profits from ETH or Stablecoin will be added directly to the original asset to continue to generate profits, as a compound interest method.

· Layer 1 Staking: Ethereum profit blast based on staking. Currently, Blast uses Lido Finance's products, but in the future Blast will replace its partner Lido Finance with a Native Liquid Staking Derivatives platform on the Blast ecosystem itself.

· T-Bill Yield: Users who transfer stablecoins to Blast will receive USDB, an Auto Rebased stablecoin. Profits for USDB come from MakerDAO's T-Bill product. USDB can be exchanged for USDC when transferred back to Ethereum. In the future, Blast will replace partner Lido Finance with a Real World Assets platform on the Blast ecosystem itself.

· Gas Revenue Sharing: Blast returns user transaction fees to the protocol. The protocol can optionally be used to either retain itself or support its users.

In addition to information that excites users, such as the development team including Pacman from Blur, Blend, receiving a $20M investment with the participation of Paradigm and the project also shares frankly about what will happen. Airdop program in the future. Thanks to that, Blast has achieved a number of outstanding achievements such as:

· Blast's TVL has nearly reached $1.2B. If compared to the entire market, Blast is in the TOP 6 higher than Polygon, Avalanche, Optimism, Sui Network or Base.

· There have been a total of nearly 130K people depositing their assets into Blast. Besides, the number of new users depositing money into Blast also ranges from 800 - 2,300 people per day.

Development roadmap of Blast Layer 2

The current development roadmap of Blast Layer 2 is divided into 3 stages:

· Early Assets: The platform starts allowing users to transfer assets from Ethereum to Blast to earn Points & Profits.

· Mainnet: Mainnet official platform and users can withdraw their assets (ETH, Stablecoin) from the network.

· Launch Token: Users can convert Blast Point to the project's Native Token.

· Blast's development roadmap will greatly affect the health of the Blast ecosystem. Let's continue with us in this article what is the impact and what is the risk for Blast?

Blast threats will soon be faced

At the present time, a question we can easily answer is "Why is there more than $1.4B in Blast Layer 2 with nearly 130K participants?" The reason most (99.99%) comes from users wanting to receive a huge airdrop from the project, because in the past Blur used to drop huge airdrops to its early users.

It is for this reason that the first risk to the Blast ecosystem will take place in February when Blast officially mainnets and users can withdraw money from the platform. However, there is a high possibility that the cash flow will not leave strongly because the Point program has not ended yet and Blast has not officially Airdropped to its users.

But by May, Blast will officially have to confront this risk. So at the present time, what Blast needs to do is:

· Build an Airdrop roadmap to continue retaining users.

· Build an Incentives program for projects in the ecosystem like Optimism, Arbitrum, and Sui Network are implementing extremely successfully.

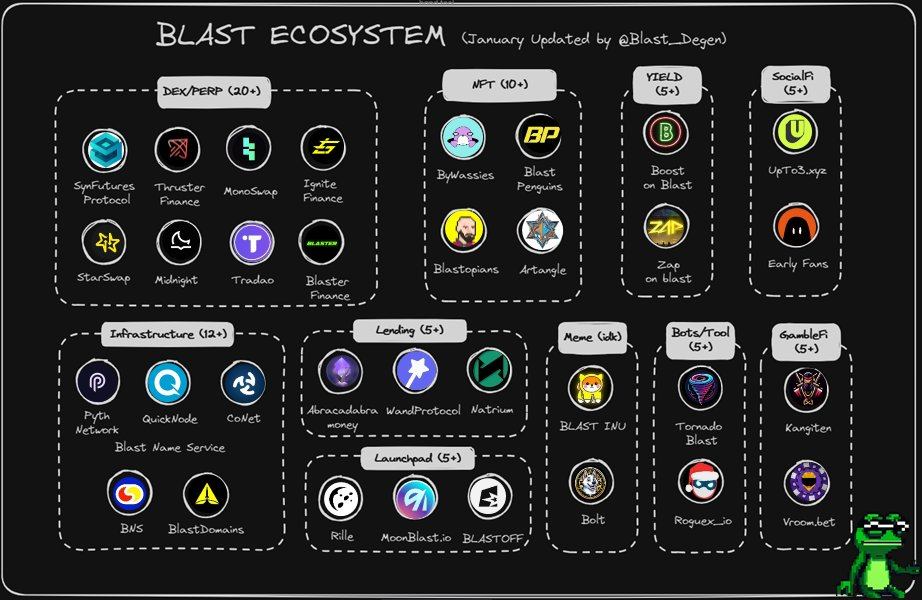

Blast Layer 2 Ecosystem & First Puzzle Pieces

Opportunities that need attention

At the present time, if we pay attention to the project's development roadmap, we see that Blast will soon change partners on Ethereum such as Lido Finance with ETH or Maker DAO with Stablecoins (USDC, USDT, DAI) into partners. Collaboration is on Native projects. Therefore, it is likely that Blast's current cash flow in Lido Finance and Maker DAO will transfer to those two projects. Our job is to find out which project it is? What stage is it in development? Or is there any chance?

It is highly likely that with the transfer of power, the Blast Layer 2 ecosystem will still focus on Passive Income for its users.

Infrastructure pieces

Currently, Blast has integrated a number of basic infrastructure solutions with Native Bridge built by the development team, Oracle with Pyth Network. However, Blast needs to have more diverse infrastructure pieces, especially bridges from third parties such as Orbiter Finance, Stargate Finance, Li.Fi,... or more Oracle platforms to avoid is dependent on the Pyth Networ

Array of decentralized exchanges

The most prominent project in the AMM segment is Thruster Finance with many diverse liquidity pool models. It can be mentioned that Thruster Finance uses the centralized liquidity model (Thruster CLMM) of Uniswap V3, the liquidity pool liquidity model for parity assets (Thruster StableMM) or the conventional liquidity pool model (Thruster CFMM) of Uniswap V2.

In addition, Thruster Finance is also a Launchpad platform that helps projects easily launch their Native Token.

Thruster Finance is backed by a number of reputable members in the Crypto community such as DCFGOD, Not3Lau Capital, LoomDart, Brend, Lawliette, Burr, Casey,... In addition to Blast, there are also a number of projects. in the DEX array include:

Ring Exchange: Is a regular AMM platform with 2 products: Ring Swap which helps users trade different types of assets, Ring Earn where users provide liquidity and then make profits and finally Ring Launchpad.

Ignite: As an AMM product built on Uniswap V2, users providing liquidity will receive LP Tokens in the form of spNFT. In addition, Ignite also provides a number of products such as Yield Booster or Launchpad.

Lending & Borrowing segment

The Lending & Borrowing puzzle piece on Blast has a number of outstanding projects such as:

Natrium Protocol: Natrium is an Isolated Lending Pool platform, allowing assets with different risks to reside in different independent liquidity pools. Besides, users can freely open pools to suit their own needs.

Blastway: Blastway is a conventional Lending Pool platform with several features such as high level of security, user-friendliness, and extreme flexibility.

Derivatives array

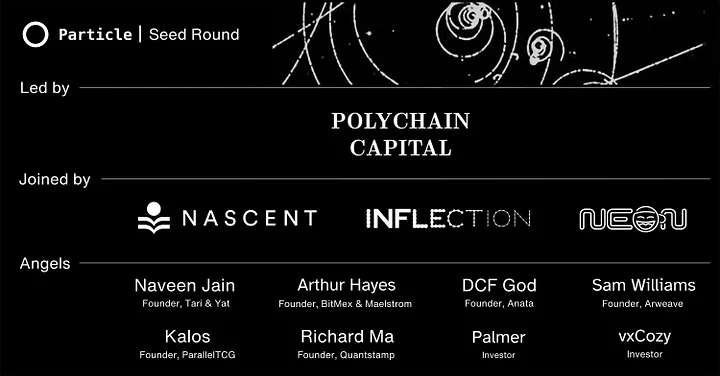

The Perp DEX platform that is receiving the greatest attention on the Blast ecosystem is Particle. One difference of Particle is the Leverage AMM model. By modeling this way, Particle can generate higher interest rates for LPs without any temporary losses. In the early days of January, Particle successfully called for a Seed round with the lead of Polychain Capital and the participation of Nascent, Inflection and Neon DAO.

In addition, Particle was built by individuals who have worked at many large organizations such as Google, Meta or Microsoft.

Besides Particle, Blast also has a number of projects in the Derivatives segment including:

· Bloom Trading: The project wants to build a Leverage DEX built on Rebased Assets with zero transaction fees, x50 leverage and bring high profits to liquidity providers.

· Easy X: Easy X gives users a number of criteria such as allowing users to Long - Short many different types of assets such as BTC, ETH, BNB, AVAX,... with x100 leverage. Additionally, Easy X requires no KTC, is unsupervised, and is user-friendly. The project is backed by many investment funds such as Maven Capital, Nabais capital, Three M Capital, BDE Ventures, ZBS Capital,...

· Cyber Finance: Is a Perpetual platform with a number of features such as 100% on-chain, low transaction fees, supporting many different asset types and providing diverse income sources for many different roles.

· Allspark Finance: Is a Perpetual platform with some characteristics like Cross-chain Margin Trading, liquidity providers can make profit with just 1 click of different assets with different risks divided into pools mutual liquidity without using Gas fees as transaction fees incurred will be sent back to users and using Oracle with high frequency, low latency to provide timely prices to avoid losses due to sudden fluctuations. suddenly.

· Roguex: Is a Perpetual platform that uses the ve(3,3) model to target the Trade to Earn model.

· Trader DAO: Is a Perpetual platform with some features such as building a professional asset management system for LPs, supporting Cross MarginMulti-account and orders will be matched in Off-chain and settled on On-chain .

· Blast Futures: Blast Futures is the first Perp DEX project with an order book and natural returns on deposits, created by a talented team. It brings capital efficiency and high profits to traders through profits coming from ETH staking and RWA protocols. Blast Futures supports trading with no gas fees, no order creation fees, and instant order execution.

Some other notable pieces

On the Blast ecosystem, there are also a number of outstanding projects such as:

· ZAP: Is a Laucnhpad platform operated by the community.

· Early Fans: Is the first SocialFi application on the Blast ecosystem with several features such as Empowering creators to directly monetize their content without advertising, rewarding supportive fans support their favorite creators. It can be said that Early Fans is a version of Friend.tech on the Blast ecosystem.

Personal Comments About Blast Ecosystem

It can be seen that although Blast is built based on Optimistic Rollup technology with a high level of compatibility with EVM, the number of Native DApps and Native Protocols on the Blast ecosystem is very large. At the present time to encourage ecosystem development.

In January 2024, Blast officially launched the Public Testnet program and launched the BIG BANG competition where developers who submit their Blast apps to the competition will have the first chance to receive token rewards in the competition. upcoming airdrop. Blast founder Tieshun “Pacman” Roquerre will judge the competition along with representatives from investors Paradigm and Standard Crypto, among others. Pacman and other members of the Blast team will also provide guidance and mentorship to developers throughout this process.

The BIG BANG program immediately made the Blast ecosystem explode with a series of new projects. However, the projects on Blast are not really high quality as most projects copy the operating models of popular projects today such as Uniswap, AAVE, Compound, Curve Finance, Silo Finance, etc. .. This is still a positive point for the Blast ecosystem though.

In addition, users can flock to Blast because of the Airdrop wave of both Blast and the ecosystem

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)