How Political Policies Impact Financial Technology Companies

The intersection of politics and finance has become increasingly pronounced in recent years, particularly as financial technology (fintech) companies continue to reshape the landscape of financial services. Political policies, ranging from regulatory frameworks to economic initiatives, play a pivotal role in determining the operational environment for fintech firms.

Understanding these impacts is essential for stakeholders within the industry, as they navigate the complexities of compliance, innovation, and market dynamics.

The Regulatory Environment and Its Implications

Regulatory frameworks significantly influence the operations of fintech companies. Governments worldwide are establishing regulations to ensure consumer protection, maintain market integrity, and prevent financial crimes.

These regulations often encompass a variety of areas, including:

- Data Privacy: With the rise of digital transactions, data protection laws have become paramount. Regulations such as the General Data Protection Regulation (GDPR) in Europe impose strict guidelines on how companies handle personal data. Fintech firms must invest in compliance measures to avoid substantial fines and reputational damage.

- Licensing Requirements: Many jurisdictions require fintech companies to obtain specific licenses to operate legally. These requirements can vary dramatically from one region to another, creating a complex landscape for international fintech firms. Navigating these licensing processes can be resource-intensive and may hinder innovation.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Fintech companies must adhere to stringent AML and KYC regulations to prevent illicit activities. Compliance with these regulations often requires sophisticated technology solutions, increasing operational costs and potentially limiting the agility of smaller firms.

Political decisions regarding regulatory frameworks can either foster innovation or stifle it. For instance, a supportive regulatory environment may encourage startups to enter the market, while overly burdensome regulations could lead to consolidation as smaller firms struggle to comply.

Economic Policies and Market Dynamics

Economic policies, including monetary policy and fiscal initiatives, also significantly affect fintech companies.

The following aspects illustrate how these policies can shape the fintech landscape:

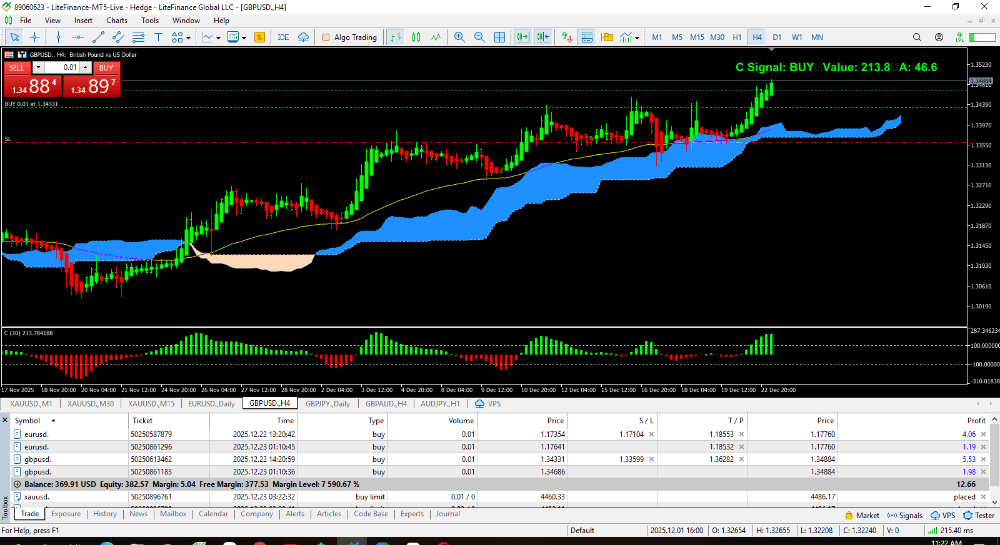

- Interest Rates: Central banks influence interest rates through monetary policy, which directly impacts lending practices and consumer behavior. In a low-interest-rate environment, fintech companies offering loans may experience increased demand, while higher rates could deter borrowing.

- Government Incentives: Fiscal policies, such as tax incentives for technology investments or grants for innovation, can stimulate growth within the fintech sector. Governments that prioritize digital transformation can create an ecosystem conducive to the development of fintech solutions.

- Economic Stability: Political stability and sound economic policies foster an environment where fintech companies can thrive. Conversely, political unrest or economic turmoil can lead to uncertainty, discouraging investment in the fintech sector.

Fintech companies must remain vigilant and adaptable to changes in economic policies. By understanding the broader economic landscape, these firms can better position themselves to capitalize on emerging opportunities and mitigate risks.

International Trade Policies and Global Expansion

As fintech companies increasingly seek to expand their operations globally, international trade policies become a crucial consideration.

The following factors illustrate the impact of trade policies on fintech firms:

- Cross-Border Transactions: Trade agreements and tariffs can affect the cost and feasibility of cross-border transactions. Fintech companies that facilitate international payments must navigate varying regulations and costs, which can complicate their operations.

- Market Access: Political decisions regarding market access can either facilitate or hinder the expansion of fintech companies into new regions. Countries that promote open markets may attract foreign fintech firms, while protectionist policies can create barriers to entry.

- Collaboration Opportunities: International trade policies can foster collaboration between fintech companies and traditional financial institutions across borders. Partnerships can lead to innovative solutions and enhanced services, benefiting consumers and businesses alike.

Fintech firms must develop a comprehensive understanding of international trade policies to successfully navigate the complexities of global expansion. By staying informed about geopolitical developments, these companies can identify new markets and potential partnerships.

The Role of Advocacy and Industry Associations

Given the significant impact of political policies on fintech companies, advocacy and industry associations play a vital role in shaping the regulatory landscape.

These organizations often engage in the following activities:

- Lobbying Efforts: Industry associations advocate for policies that support the growth of fintech companies. By lobbying government officials, they seek to influence regulatory decisions that impact the sector.

- Education and Awareness: Advocacy groups educate policymakers about the benefits of fintech innovation and the potential risks of overly restrictive regulations. By providing data and insights, they aim to foster a balanced approach to regulation.

- Networking Opportunities: Industry associations facilitate networking among fintech firms, regulators, and other stakeholders. These connections can lead to collaboration and knowledge sharing, ultimately benefiting the entire sector.

Engagement with advocacy groups can empower fintech companies to influence policy decisions and ensure that their interests are represented in the political arena.

Conclusion

The interplay between political policies and financial technology companies is complex and multifaceted. Regulatory frameworks, economic policies, international trade agreements, and advocacy efforts all contribute to shaping the fintech landscape. As the industry continues to evolve, stakeholders must remain vigilant and proactive in understanding these dynamics. By navigating the political landscape effectively, fintech companies can position themselves for success in an increasingly competitive market.

References

- General Data Protection Regulation (GDPR)

- Financial Crimes Enforcement Network (FinCEN)

- The World Bank: Global Financial Inclusion

- International Monetary Fund (IMF) on Monetary Policy

- OECD on Digital Economy Policy

- European Banking Authority (EBA) Guidelines

- Financial Technology Association

- The Future of Fintech: McKinsey & Company

- World Economic Forum on Fintech

- The Fintech Times