he Birth of a New Industry: Introducing Retail Algorithmic Trading

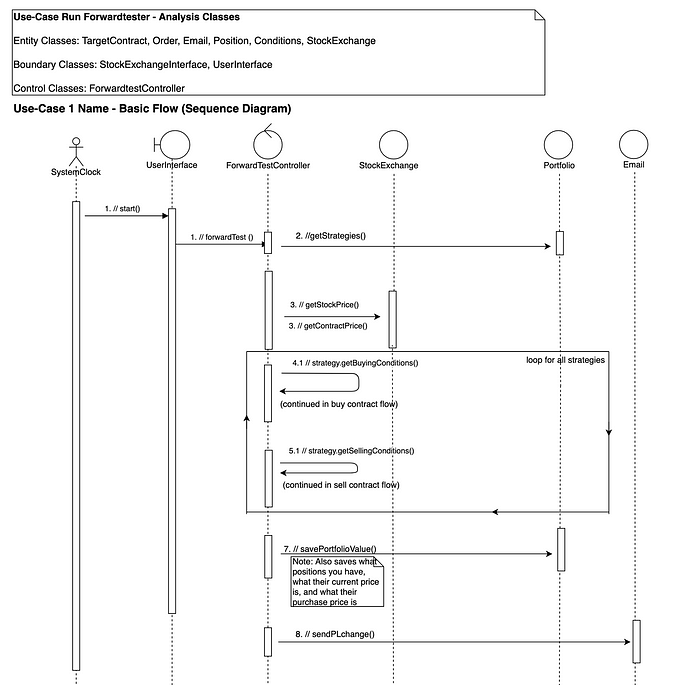

My business started off as a passion project. I was in my first year at Carnegie Mellon University taking a class called Foundations of Software Engineering. I had just finished what we called an “Architectural Haiku”, which was a document that outlined the architecture of the system we were building in class, including the technical constraints, the functional and non-functional requirements, and the design patterns we would use. It was at this point where I said f*** it! I duplicated the document, erased the title, and called it “The AlgoTrading System”. One of the first architectural artifacts of “The AlgoTrading System”

One of the first architectural artifacts of “The AlgoTrading System”

Since then, the AlgoTrading System has underwent a series of dramatic transformations. What started as a command-line tool evolved into a fully-functional web application. In September of the year before last, I opened-sourced the first iteration of the tool NextTrade, which garnered hundreds of users. From there, I rebuilt the system, iterated on it, created a new state-of-the-art AI-Powered Chat, and released the current version of the platform, NexusTrade.

I created an open-source automated trading platform. Here’s how much it’s improved in a year.

One year ago, I wrote about my open-source algorithmic trading platform, NextTrade. I demonstrate why NextTrade is the…

medium.com

This journey has been a wild ride, from a tool with only 1 user, to a powerful system with over 2,000 free users and 10 paid users. The business didn’t come through the traditional avenues of doing product research and interviewing tens of people and figuring out what their problems were. The business started in a very nontraditional way; as a platform firstly for myself and secondly for others. And in this process, upon reflection, I created a brand new industry: retail algorithmic trading.

NexusTrade - AI-Powered Financial Platform

AI-Powered Finance. The fastest, most configurable, no-code platform to exist. Express, evaluate, and optimize your…

nexustrade.io

(Traditional) Algorithmic Trading vs Retail Trading

Traditionally, when we think of algorithmic trading, we’re thinking of PhD graduates working at Jane Street and Citadel. These people are, for a lack of a better word, super geniuses. These are either hedge funds which raise a bunch of money from the ultra-rich, or proprietary trading firms that only hire the Albert Einsteins of our generation. In a previous article, I refer to these folks as category 3 traders.

On the other end of the spectrum, we have the average retail investor. These are the category 1 traders. Most of their investment decisions comes from whatever is on the front-page of Reddit. They don’t look at a company’s revenue or income, and they hyper-focus on non-existent patterns in the stock’s chart. Their best strategy is the “spray and pray” where they buy calls and puts on 5 random companies, like you’re buying lotto scratch-offs at 7/11. This is exactly what the average retail trader is like.

Let’s Think Outside the Box For Trading Strategy Optimization

Improving Algorithmic Trading By Mimicking Neural Networks

medium.com

What is Retail Algorithmic Trading?

For the few traders that are looking to go past /r/WallStreetBets, there’s honestly not a lot of resources available. There are few forums like Reddit’s Algotrading subreddit, but the people there are mostly unhelpful, secretive, and cosplaying as algotraders.

But, in my opinion, algorithmic trading doesn’t really have to be hard. At its core, an algorithm is simply a series of steps, usually executed by a computer automatically. Trading just involves the buying and selling of assets. Algorithmic trading is using a computer to execute trades for you.

The thing about algorithmic trading is… it doesn’t have to be only accessible to MIT grads and the ultra-wealthy. Anybody can be an algorithmic trader.

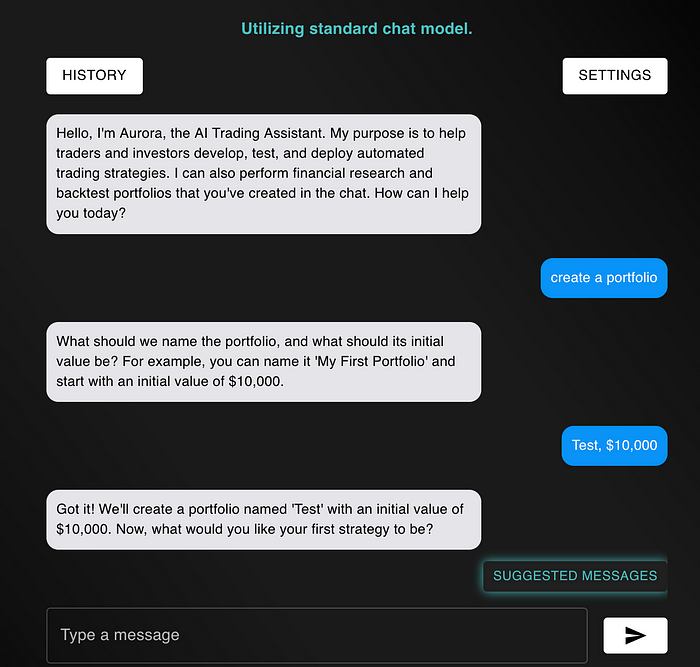

This is especially true nowadays, thanks to the advent of Large Language Models like ChatGPT. In years past, somebody interested in algorithmic trading had to know how to code, build an entire infrastructure, and use un-intuitive UIs (or worse… code) to configure their trading strategies. Now, the only thing you have to do is log into an application like NexusTrade and explain your strategy in plain English to an AI Model that’s trained to understand it. Talking to Aurora, NexusTrade’s AI-Powered Chat Assistant

Talking to Aurora, NexusTrade’s AI-Powered Chat Assistant

Pros of Retail Algorithmic Trading

Traditional retail trading is akin to unsystematic gambling. Algorithmic trading is more like playing poker. While there is luck involved, it is mostly a game of skill and risk-management. Trading is a 0-sum game, with explicit winners and losers. Some people like to make the argument that firms like Jane Street are the ones who are going to win an algorithmic trading contest, but that’s not necessarily true.

You see, when you trade in the market, you’re trading against everybody. That includes the Reddit gamblers who don’t actually make informed investment decisions. Thus, when you create a systematic approach, you can beat them if you put your mind to it.

Additionally, when you switch your trading ideas to algorithms, you are forcing yourself to think systematically. You’re thinking of edge cases: if your portfolio goes down by 10% what should you do? You’re evaluating what happened in the past to inform your decisions in the future. And, you’re also significantly reducing the amount of emotions involved in your trading decisions.

Most importantly, you’re creating a portfolio of strategies that aligns with your goals. This aids in other things such as problem-solving skills, systematic thinking, and thinking about what public businesses actually do and how they make money.

Cons of Retail Algorithmic Trading

Even though algorithmic trading offers a lot of advantages, it’s not a perfect system for everybody. To start, even with the advent of ChatGPT lowering the barrier of entry, it’s still pretty complicated. You have to learn a lot of stuff just to get started, such as “what is a trading strategy?”, “what is optimization?”, and “what is the difference between a technical and fundamental indicator?” It requires a lot of education and studying, and is not something you can just pick up passively.

Another con of algorithmic trading is that its a bit of a rabbit hole. If you’re not truly interested in it, then it might be too much for you to learn. There’s so many different approaches, such as using news sentiment data, social media sentiment, raw technical indicators, fundamental indicators, earnings report, and other unique approaches. This is a lot for a person to learn. Someone could spend 2 hours a day everyday for a month, and have barely scratched the surface on the field of algorithmic trading.

Finally, there’s always the risk of losing money. Trading and investing is inherently risky, and spending your time and effort developing a strategy that fails is physically painful. You think to yourself, “I might as well just bought VOO!” In all trading, especially algorithmic trading, there is no guarantee that you’ll outperform the market. This makes learning the field risky, because it’s an investment with no guaranteed returns.

With all of this being said, algorithmic trading doesn’t have to be complicated. Even the passive investor could benefit from using basic algorithms in their portfolio. For example, let’s say someone wants a growth-focused portfolio that also yields $1,000/month in dividends and is invested 5% in profitable clean energy stocks. Achieving this with algorithmic trading is extremely straightforward for a platform that’s built to support this, and it doesn’t require the expensive maintenance of a financial advisor. In fact, with a baseline understanding, algorithmic trading can pretty much make anybody into their own financial advisor.

Conclusion

Algorithmic trading is not for everybody. While everybody can use basic algorithms to make sure they’re reaching their investment goals, not everybody needs algorithmic trading. The majority of the population would be fine manually purchasing a few hundred bucks a week in index funds like SPY, VOO, and maybe QQQ for our tech enthusiasts.

But algorithmic trading does offer a number of undeniable advantages. Even for people who don’t want to learn a lot, basic algorithms can help them reach their goals for their dividends or invest in companies in industries that they believe in. And, for those interested in learning and trading, you need to be aware: a new industry is emerging. It’s nearly impossible to match the speed and efficiency of a computer, and those who refuse to get with the times will be left behind. I’m excited to be on the forefront of the creation of a brand new industry: the birth of retail algorithmic trading.

Thank you for reading! If you enjoyed this article, please give me some claps and share this article with a friend (or social media)! I have several newsletters you could follow. Aurora’s Insights is the perfect blog if you’re interested in artificial intelligence, machine learning, finance, investing, trading, and the intersection between these disciplines. You can also create a free account on NexusTrade to get access to a next-generation algorithmic trading platform.

NexusTrade - AI-Powered Financial Platform

AI-Powered Finance. The fastest, most configurable, no-code platform to exist. Express, evaluate, and optimize your…

nexustrade.io

NexusGenAI is the platform that hosts NexusTrade’s AI-Powered Chat. It is also open for users on the waitlist!

NexusGenAI

Next Generation Generative AI Configuration. Build your AI Application with no code.

www.nexusgenai.io

🤝 Connect with me on LinkedIn

🐦 Follow me on Twitter

👨💻 Explore my projects on GitHub

📸 Catch me on Instagram

🎵 Dive into my TikTok

PS, did you share with a friend? 🤨

Visit us at DataDrivenInvestor.com

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Have a unique story to share? Submit to DDIntel here.

Join our creator ecosystem here.

DDIntel captures the more notable pieces from our main site and our popular DDI Medium publication. Check us out for more insightful work from our community.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.