8 Ways to Check If It’s a Token Scam

1. Start from the very basics

To verify the legitimacy of a token, you can always start with the most accessible ways, such as Google search and Twitter. This involves researching the token and its team, checking for any red flags or warning signs, and seeking out trusted sources of information, such as official websites, news articles, and verified social media accounts.

1.1 Check for social media red flags

Verified Twitter accounts can often help prove the legitimacy of this project. In addition, you can participate in discussions about the tokens to get a sense of the community’s views and opinions.

Also, be cautious of projects that have a high volume of followers on social media but very little engagement. In addition, automated comments from spam accounts should also be a red flag. If all the comments are like ‘This is a great project’, and ‘Moon incoming’, be warned.

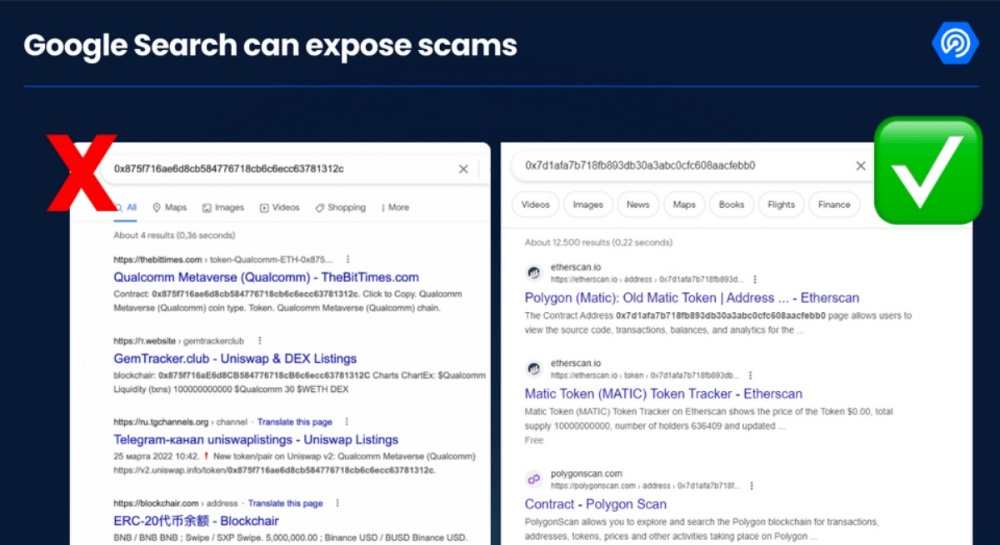

1.2 Check for the token’s address in a Google search

If you do an internet search and can’t find a clear homepage, “whitepaper” or obvious token purpose, it is probably a scam. When you search for a token address, you will have to find the block explorer links, official website and whitepaper easily. If you don’t, consider that a red flag.

Also, please be aware that Google Ads tend to be a freezone for scam website. Never click the advertisements at the top of the Google search results. Always ensure you’re visiting the official website to avoid clicking wallet drainers, or other hacker software.

2. Check code is verified on Etherscan

Visit the block explorer of your chain of choice, and find out if the source code has been verified. For example, on Etherscan, the block explorer for Ethereum, it looks like this. The code pictured below isn’t verified, and that should be a clear warning sign. If code is not verified, you’re probably dealing with a scam.

Why do scammers not simply verify their code?

Because once the source code of a contract is public, everybody can understand the intentions behind the contract. They can then see a ridiculous tax system, or a way for developers to steal all your tokens. Anything really.

Does that mean that every unverified contract is a scam? Nope. But again, this is a potentially very serious red flag.

3. Check the Etherscan comments section

It’s very simple, but on the various block explorers there’s often a comment section. Most of the time there are no comments, but if a project is a scam you’re likely to find an angry mob in the comment section. So, make sure to check it out. If someone is calling it a scam, it is 99% certain to be a scam. If you have been a victim of this activity, do not hesitate to also leave a comment.

Again, go to Etherscan – or another block explorer – and click on the comments tab to read what people are saying about a token.

4. Check the DappRadar blacklists

DappRadar allows the community to help identifying scam tokens. When you’ve found one, you can submit it to our token blacklist on Github.

In addition, if you’re researching tokens you can check the blacklist to see if your token is listed there. If the token address is in the list, it’s a scam.

5. Check the token details in a token explorer

If you cannot find the token on CoinGecko or DappRadar’s Token Ranking (or a similar coin price tracker), the token is probably a scam.

If it is on the token explorer and you see warning notifications like this, proceed with caution: All legit tokens share their information with Token Rankings for the purposes of verification. However, services like CoinMarketCap and Coingecko do require projects to meet certain criteria. Therefore not all tokens – legit or not – will be listed on this token index platforms automatically.

All legit tokens share their information with Token Rankings for the purposes of verification. However, services like CoinMarketCap and Coingecko do require projects to meet certain criteria. Therefore not all tokens – legit or not – will be listed on this token index platforms automatically.

6. Check how many exchanges host the token

If the token is only traded on a couple of decentralized exchanges (DEX), it is almost certainly a scam. Listing on a centralized exchange comes with KYC and additional trust, and the bigger the exchange the better the reputation of a listed token.

Does that mean that a token only on decentralized exchange is automatically a scam? No. Some projects don’t require high trading volumes, others are fine with having tokens only available to Web3 users instead of token traders.

However, a cryptocurrency that’s only listed on a decentralized exchange is a higher risk investment. There’s a bigger chance that you’re dealing with a scam. Below on the left side a token only on decentralized exchanges, while on the right side a token available across multiple centralized exchanges.

7. Check the amount of liquidity in a token’s balance pool

Before you invest in a token, you may want to check general demand and the availability of liquidity. It is very easy to check a token’s liquidity on a platform like Uniswap V2 or other decentralized exchanges.

Liquidity is the amount of cryptocurrency or number of tokens locked in smart contracts that allows people to buy and sell assets through (decentralized) exchanges. If liquidity is less than $100,000 or is dropping at a significant rate, you’re probably looking at a scam.

DappRadar also helps here. When a token has low liquidity on the blockchains we track, we then provide a warning (pictured below). DappRadar offers the Liquidity Score tool providing clarity on a dapp’s liquidity landscape

DappRadar offers the Liquidity Score tool providing clarity on a dapp’s liquidity landscape

While you’re using a decentralized exchange, be sure to check other basic on-chain activity:

- Transaction volumes – the amount of tokens being swapped, often in dollar value.

- Transaction counts – the number of token swaps.

- Unique active wallets interacting with the smart contracts – the number of users connecting to a decentralized exchange with their Web3 wallet.

If any of these seem unusual, do a bit more digging.

On DappRadar we list all decentralized exchanges across the most used blockchains. You can find all DEXs through our DeFi TVL Rankings.

8. Check third party analysis tools

Here are a few token analysis tools:

- Smell Test – this does an automated audit of the token. The lower its score out of 100, the more likely the token is a scam.

- Is it a Honeypot scam? Honeypots are smart contracts with an obvious programming flaw purposefully inserted into them. When attackers attempt to exploit the flaw, another piece of hidden code is activated and essentially attacks the attackers. Whether or not you plan on becoming a crypto hacker, honeypots should always be avoided.

- Learn the basics of DEXtools. It records live token prices and will help you evaluate a token’s true worth in real time.

Scammers will always exist, whether it’s on the blockchain or out in the real world. Follow these tips, and you should avoid the fake tokens designed to take your money.

DYOR and verify with DappRadar

By integrating a huge amount of dapp ecosystem data, DappRadar can also provide you with highly valuable information for your project research.

Use DappRadar’s tools and trackers like Top Crypto Tokens Rankingsto understand a cryptocurrency project’s user base and trading activity and conduct your own market research.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)