Asian Elite Predicts Bitcoin to Hit $100,000 by Year-End

Asian elites are stepping up their crypto investments, projecting Bitcoin to hit $100,000 by the end of the year.

Digital assets are increasingly becoming a popular alternative investment channel for Asian elites. According to research by Aspen Digital, about 76% of family offices and high-net-worth individuals own crypto, compared to just 58% in 2022.

Asian asset managers are increasing their exposure to the market. Many also predict that Bitcoin could reach $100,000 by the end of 2024.

The report shows that in addition to the 76% of respondents who have invested, 16% plan to “put money in” in the future, a significant increase compared to 34% in 2022.

The main reasons for them entering the crypto market are the potential for high returns, along with the need to diversify their portfolio and hedge against inflation.

The survey was conducted with more than 80 family offices and individuals with assets under management (AUM) ranging from $10 million to $500 million, of which 20% have AUM above $500 million.

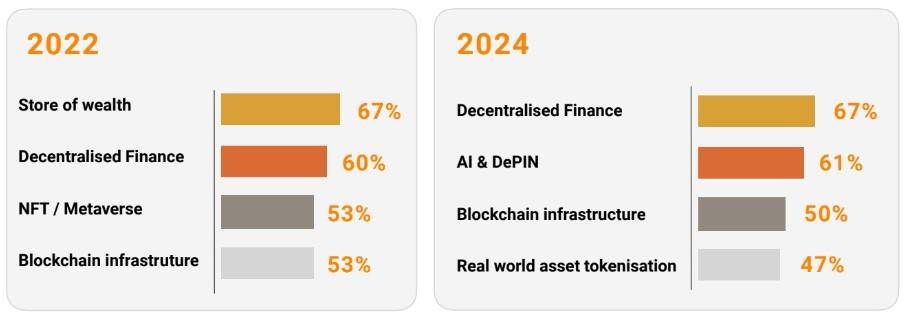

DeFi continues to be the area of interest for 67% of survey respondents, followed by artificial intelligence (AI) and decentralized infrastructure networks (DePIN - 61%), blockchain infrastructure (50%) and tokenization of real-world assets (RWA - 47%).

Re7 Capital expects all types of assets to gradually move onto the blockchain, creating huge growth potential for DeFi, with the number of users of financial services on the blockchain expected to exceed 200 million by 2025.

Some survey respondents also mentioned the ease of trading memecoin on Solana, an Ethereum competitor, while another regulator said that liquid restaking tokens (LRT) are too complex to access.

The private wealth management industry maintains a long-term bullish view, with 31% predicting that Bitcoin will rise to at least $100,000 by the end of Q4, driven by factors such as interest rate cuts, the US presidential election results, and positive developments in the crypto industry.

Despite the optimism, the majority of asset managers allocate less than 5% of their portfolios to digital assets. The report points out that the fragmentation of the digital asset market, regulatory uncertainty, and suboptimal user experience are barriers to the mainstream adoption of digital assets.

However, 30% of participants plan to increase their allocation in the future, with some family offices and individuals increasing their allocation from less than 5% to over 10% following the launch of Bitcoin ETFs and Ethereum spot ETFs in the US.

A few days ago, the giant JPMorgan also said that there are many factors that will create momentum for Bitcoin growth in the near future. With geopolitical tensions escalating and the upcoming US presidential election, institutional investors, especially hedge funds, may see gold and Bitcoin as assets that benefit from this trend.

Sharing the same view with JPMorgan, Standard Chartered Bank said that Middle East tensions could push Bitcoin prices below $60,000, but would be an attractive "bottom-fishing" opportunity for investors.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕖𝕒𝕟𝕚𝕖 𝔹𝕒𝕓𝕚𝕖𝕤 - Have Fun Staying Poor](https://cdn.bulbapp.io/frontend/images/17e87f53-0225-4de1-995f-9f66198cb037/1)