The Future of Bitcoin: A Digital Revolution Unfolding

Introduction

In the realm of digital currencies, Bitcoin has emerged as the pioneer, capturing the imagination of investors, technologists, and the general public alike. Since its inception in 2009 by the pseudonymous creator Satoshi Nakamoto, Bitcoin has come a long way, from a niche concept to a global phenomenon. In this blog, we will explore the potential future of Bitcoin, the challenges it faces, and the role it may play in the evolving financial landscape

The Journey So Far

Bitcoin's journey has been nothing short of extraordinary. From being virtually worthless in its early days, it went on to capture the attention of the investment community, leading to astronomical price increases and media frenzy. Bitcoin's decentralized nature and the underlying blockchain technology have enabled it to thrive as a store of value, a medium of exchange, and a symbol of financial freedom.

The future, however, holds both promise and uncertainty for Bitcoin.

- Institutional Adoption: One of the key driving forces behind Bitcoin's future is institutional adoption. Companies and financial institutions are increasingly recognizing the value of Bitcoin as a hedge against inflation and a store of value. As more traditional players enter the space, they bring legitimacy and regulatory compliance. This could lead to greater acceptance and integration of Bitcoin into the global financial system.

- Mainstream Acceptance: As more people become familiar with Bitcoin, it is gradually shedding its reputation as a tool for cybercriminals and is being recognized as a legitimate investment. This could lead to a broader user base and more use cases for Bitcoin in everyday life.

- Global Economic Uncertainty: Economic uncertainty and monetary policies, such as inflation and quantitative easing, continue to drive interest in Bitcoin. People are seeking alternatives to traditional fiat currencies, and Bitcoin offers a decentralized option that is not tied to any government or central bank.

- Technological Advancements: The technology underpinning Bitcoin, the blockchain, continues to evolve. Improvements in scalability and efficiency could make Bitcoin more accessible and user-friendly, further bolstering its appeal.

Challenges on the Horizon

Despite its potential, Bitcoin faces several challenges that could shape its future in various ways:

- Regulatory Scrutiny: Governments and regulatory bodies worldwide are still grappling with how to regulate cryptocurrencies. Future regulations could either legitimize Bitcoin or impose stringent restrictions that limit its growth.

- Environmental Concerns: Bitcoin mining's energy consumption has come under scrutiny, with concerns about its impact on the environment. This could lead to pressure for more sustainable mining practices or even influence Bitcoin's public perception.

- Market Volatility: Bitcoin's price volatility is a double-edged sword. While it attracts traders and speculators, it can deter its adoption as a reliable store of value and medium of exchange. Stablecoins and other cryptocurrencies designed for stability may pose competition.

- Competition: Bitcoin is no longer the only cryptocurrency in the market. Competing cryptocurrencies like Ethereum, Cardano, and Solana offer different features and capabilities. Bitcoin must continue to innovate to stay ahead.

The Future Scenarios

The future of Bitcoin can unfold in various ways, depending on how it navigates these challenges and opportunities:

- Global Digital Reserve Currency: Bitcoin could evolve into a global digital reserve currency, used by governments and central banks as an alternative to traditional fiat currencies.

- Integration into Financial Markets: If Bitcoin continues to gain institutional acceptance, it may integrate more seamlessly into financial markets, with Bitcoin-based exchange-traded funds (ETFs) and other investment vehicles becoming mainstream.

- Use in Everyday Transactions: With improved scalability and efficiency, Bitcoin could become a widely accepted medium of exchange, facilitating everyday transactions.

- Stagnation or Decline: If regulatory challenges prove insurmountable, or if Bitcoin fails to address its scalability and environmental issues, it could stagnate or decline in relevance.

Cross-Border Remittances: Bitcoin has the potential to revolutionize the way cross-border remittances work. Its borderless nature, low transaction fees, and speed could make it an attractive option for sending money across the world. This would particularly benefit individuals in countries with high remittance costs.

Financial Inclusion: Bitcoin has the potential to bring financial services to unbanked and underbanked populations. People in regions with limited access to traditional banking systems could use Bitcoin to store and transfer value, opening up new economic opportunities.

Privacy and Security: Enhanced privacy features in Bitcoin could attract users who are concerned about the transparency of the blockchain. Innovations in security will be crucial as hackers continuously target cryptocurrency platforms.

Lightning Network: The Lightning Network, a layer-2 solution for Bitcoin, aims to address the scalability issue by enabling faster and cheaper transactions. If it gains widespread adoption, Bitcoin could become a more practical payment solution for daily transactions.

Integration with Smart Contracts: While Bitcoin's primary function is to be a digital store of value, there's potential for it to incorporate smart contract functionality. Projects like RSK and Stacks are working to make this a reality, potentially bringing programmable money features to Bitcoin.

Shift in Dominance: Bitcoin is currently the dominant cryptocurrency by market capitalization, but this could change. As other cryptocurrencies continue to innovate and gain adoption, they may challenge Bitcoin's supremacy. The crypto landscape could shift dramatically in the coming years.

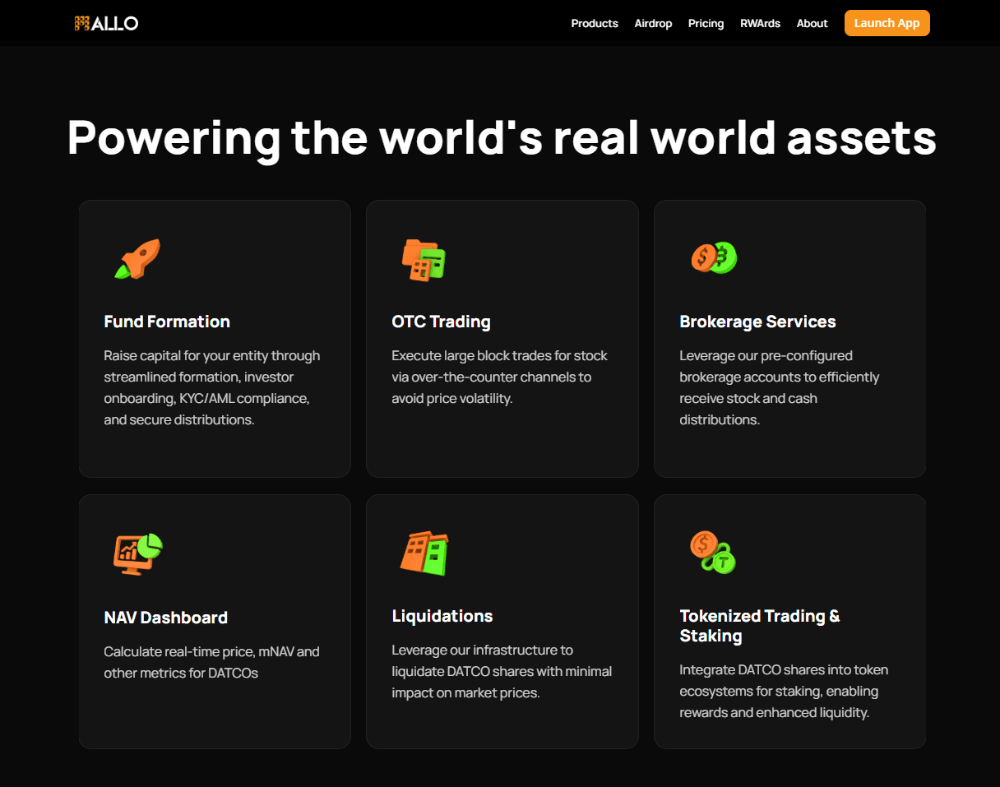

Maturity of Ecosystem: The Bitcoin ecosystem is evolving beyond just a digital currency. It now includes lending, borrowing, and earning interest on Bitcoin holdings, as well as Bitcoin-backed tokens. This ecosystem's growth could add new dimensions to Bitcoin's utility.

Blockchain Interoperability: Bitcoin might not be the only blockchain in use for the long term. As interoperability solutions develop, Bitcoin could potentially work seamlessly with other blockchains, opening up new possibilities and use cases.

Bitcoin's future is full of possibilities, but it's also fraught with challenges and uncertainties. Its role in the global economy and financial system will continue to evolve, influenced by technological advancements, regulatory decisions, market dynamics, and the overall sentiment of its users and investors.

For those considering investing in or utilizing Bitcoin, it's essential to stay informed about the latest developments and exercise caution due to the inherent volatility and risks associated with the cryptocurrency. The future of Bitcoin is, indeed, a captivating journey that will be closely watched by the world for years to come.

Conclusion

The future of Bitcoin remains uncertain, but its potential to disrupt and reshape the financial landscape is undeniable. As it continues to evolve, Bitcoin must navigate a complex landscape of regulation, environmental concerns, and competition. Its role in the future will largely depend on how it responds to these challenges and opportunities. Whether it becomes a cornerstone of the global financial system or remains a niche asset for tech-savvy enthusiasts, Bitcoin's journey is sure to be an intriguing one to watch.