MicroStrategy Buys BTC for 9th Consecutive Week

MicroStrategy continues to extend its streak of positive Bitcoin "DCA" weeks to 9 with an additional $101 million purchase, bringing its total holdings to 447,470 BTC.

On the evening of January 6, 2025, the publicly traded company MicroStrategy announced that it had spent $101 million in cash to buy an additional 1,070 Bitcoins over the past week, at an average price of $94,004 per coin.

MicroStrategy's latest Bitcoin purchase was made possible by the sale of nearly 320,000 convertible bonds. As of January 6, the company still had 6.77 billion convertible bonds available for issuance in subsequent sales.

BTC Yield for 2024 is 74.3%, and 48% for Q4 2024.

MicroStrategy has acquired 1,070 BTC for ~$101 million at ~$94,004 per bitcoin and has achieved BTC Yield of 48.0% in Q4 2024 and 74.3% in FY 2024. As of 01/05/2025, we hold 447,470 $BTC acquired for ~$27.97 billion at ~$62,503 per bitcoin. $MSTR https://t.co/CkLrLSkB5M

— Michael Saylor⚡️ (@saylor) January 6, 2025

Similarly, before each announcement of a Bitcoin purchase plan, billionaire Michael Saylor often "teased" by posting an image of the SaylorTracker portfolio tracking tool.

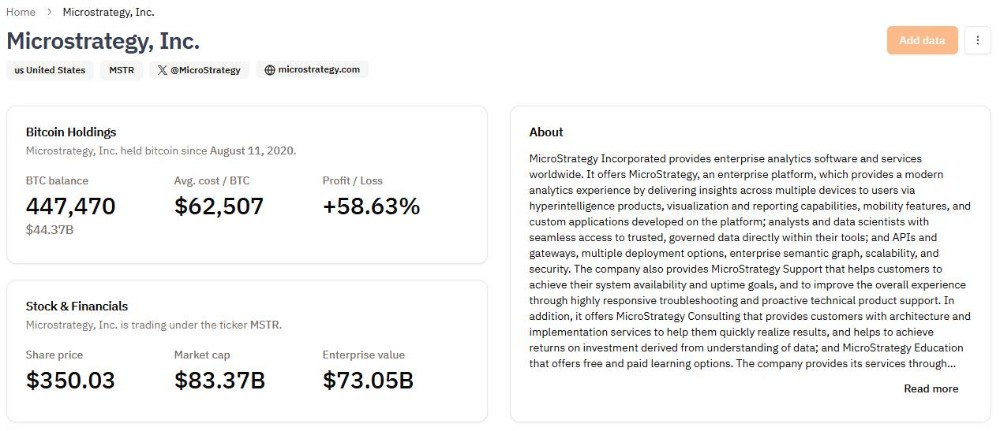

With the latest BTC purchase, billionaire Michael Saylor's company increased its total Bitcoin ownership to 447,470 BTC, with an average purchase price of 62,503 for each BTC.

MicroStrategy's total Bitcoin portfolio is currently recording a profit of more than $16.4 billion, equivalent to a 58.63% gain on a capital of $27.97 billion.

This is the ninth consecutive week that MicroStrategy has made a "positive" Bitcoin purchase, following eight previous purchases that began on November 11. The total capital this company used to buy Bitcoin was up to 17.971 billion USD to collect 195,250 BTC.

Starting with 27,200 Bitcoin (2 billion USD) on November 11;

Followed by 51,780 BTC (4.6 billion USD) just a week later;

Ending November with 55,500 BTC (5.4 billion USD);

In early December, the company continued to collect 15,400 BTC (1.5 billion USD);

In the second week of December, it announced the purchase of 21,550 BTC (2.1 billion USD);

On December 16, it used 1.5 billion USD to add 15,350 BTC to its reserves;

On December 23, it bought 5,262 BTC with the amount of 561 million USD raised from the sale of 1.3 million convertible bonds.

The last week of December "positive" 209 million USD Bitcoin.

Thanks to the strategy of buying Bitcoin regularly since the first time in 2020 until now, MicroStrategy's MSTR stock has "benefited" when witnessing the price increase by 325.42 USD, equivalent to growth of up to 2,285% in the past 5 years.

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)