What is Cryptocurrency.

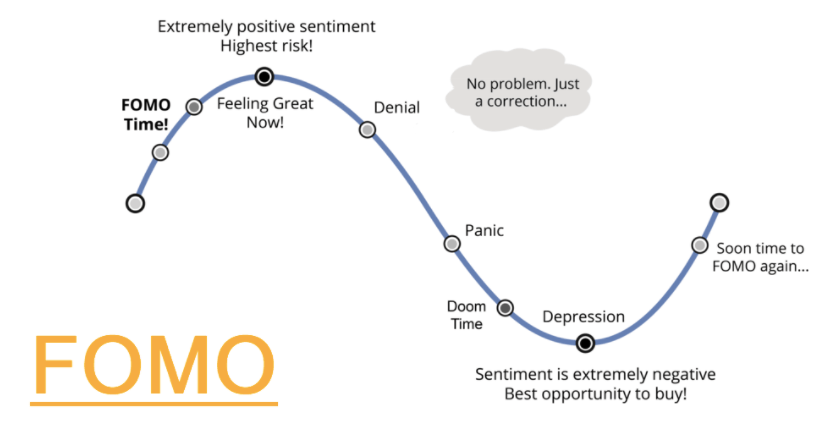

Cryptocurrencies offer investment opportunities with high returns. The recent rise in bitcoin prices shows this. However, the risk is no less high, High Risk High Return. How to manage crypto investment risks, what is cryptocurrency and how to trade buying and selling crypto assets? In fact, cryptocurrency is legal in Indonesia, what are the regulations? Initially, I didn't pay attention to the development of cryptocurrency. However, the development of this type of currency investment at the end of 2020 and continuing in 2021 is very interesting.

First, the price of Bitcoin, the most popular type of cryptocurrency coin (token), increased quite drastically. In just a matter of months, its value rose to a new all-time high. Bitcoin rose 354% in 2020 while breaking its record high price in 2017. Beating the returns of other financial assets. What is also important, this increase was driven by a number of fundamental factors. It doesn't seem to be out of sheer euphoria, as happened before. Second, I observed that cryptocurrencies are becoming increasingly accepted as a means of payment. I myself have experienced it firsthand, where requests were paid in crypto currency for a digital transaction. Recently, PayPal which is the world's largest online transaction platform - 300+ million users, announced that they accept Bitcoin. PayPal users can store and make transactions with Bitcoin. The decentralized nature of cryptocurrencies, without a central bank, makes it easy to transact in the digital world. Very suitable for online buying and selling payments. Third, Crypto asset trading is permitted in Indonesia, regulated by Bappebti - the commodity futures trading supervisory agency. Buying and selling cryptocurrencies, such as Bitcoin, is legal. Didn't the government announce that Bitcoin is illegal? What is not or is not allowed in Indonesia is using Bitcoin as a payment transaction tool. In Indonesia, people cannot buy something and pay with Bitcoin. The existence of legal certainty regarding the permissibility of Bitcoin trading in Indonesia means that investment in this crypto asset is protected. Many companies that are officially regulated are starting to offer services for investing in crypto assets. In my opinion, investing in Cryptocurrency is an opportunity. Opportunity as an alternative instrument for diversification and increasing returns. However, before that, we need to know in detail and comprehensively what Cryptocurrency is, how it works, what the risks are and the buying and selling mechanism.

What Is Cryptocurrency

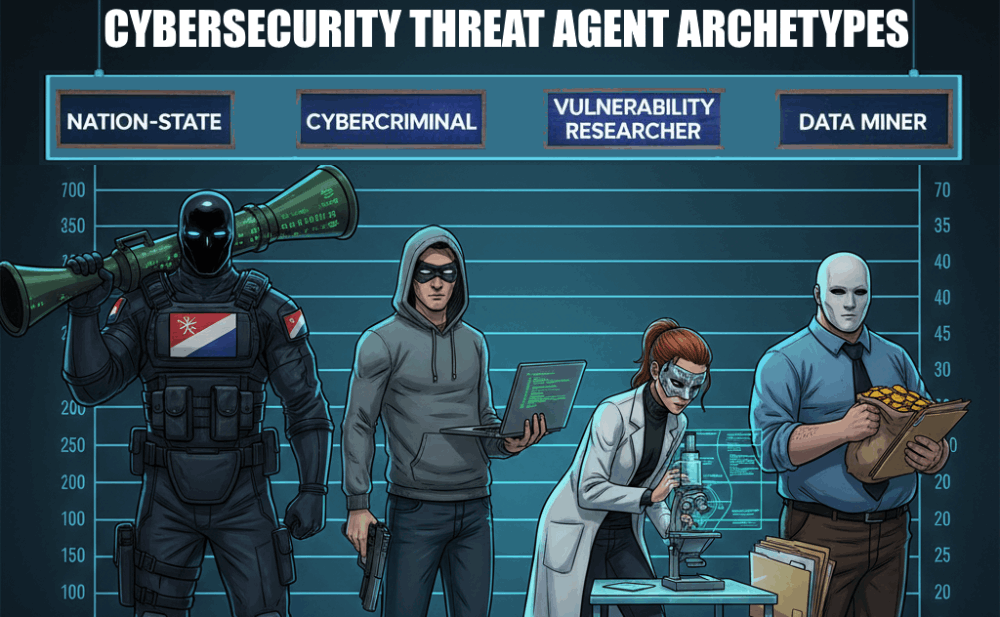

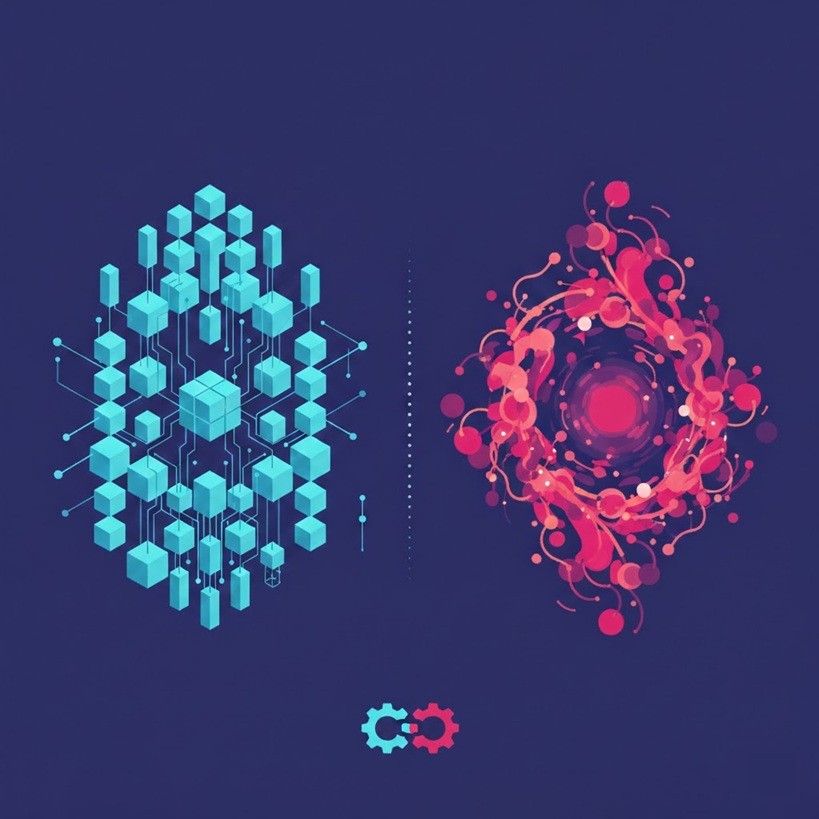

Why is it called Cryptocurrency? The advantage of Bitcoin and other Cryptocurrencies is that they use cryptography and blockchain technology to secure and verify every transaction so that no party can double-spend (spend the same digital asset twice). Blockchain technology allows Cryptocurrencies to be controlled and supervised in a decentralized manner, peer to peer, between one computer and another connected computer. This way of monitoring (1) guarantees the security of crypto and (2) differentiates it from ordinary currencies. In the Rupiah currency, for example, Bank Indonesia as the Central Bank functions as the only institution overseeing the circulation of the Rupiah. Central banks in other countries also perform similar functions for their countries' currencies. In crypto, the monitoring function is carried out by server computers throughout the world, which are connected to each other, which is why it is called a 'blockchain'. All these servers will record every bitcoin transaction in the 'General Ledger' or ledger, which contains records of bitcoin mutations. Because of its decentralized nature, bitcoin cannot be manipulated, for example for double-spending (already used to be used again). Everything is recorded on the server, cannot be changed, is transparent and recorded in many places.

Benefit

This decentralized nature means that the process of transferring or exchanging Bitcoin does not need to go through an intermediary, such as a bank. When a bitcoin transfer occurs, just update it on the blockchain network and it is very safe. Each Bitcoin owner will get a private key and a public key. It's like at an ATM, the private key is the ATM PIN and the public key is the bank account number. These two keys are used to show Bitcoin ownership and if a transfer is made using this key combination as the address and PIN. Every crypto asset delivery can be checked by looking at the block confirmation on the blockchain and also the support chain. For example, check Bitcoin transactions https://www.blockchain.com/id/explorer

With this kind of feature, cryptocurrency becomes a digital asset that can be used for internet network-based virtual transactions. Safe, fast and almost zero transfer fees. Each crypto asset can be traded & transacted globally and 24/7. The exchange rate of each asset is determined by the supply and demand of trading market players. One important feature is that the total supply of Bitcoin is limited by the Bitcoin protocol code to 21,000,000 BTC. Therefore, many investors buy and hold Bitcoin long-term because they believe that Bitcoin will eventually become as rare as gold. The total supply of Bitcoin is limited, making Bitcoin scarce and similar to digital gold. The benefits of cryptocurrency are: Payment tool. Bitcoin can be used to make payments and send money. Transactions between countries are easier and faster with Bitcoin, rather than using credit cards and interbank transfers Fast. Without any intermediaries in transactions, the inter-transaction process takes place quickly. It only takes a few minutes for a transfer between countries, in stark contrast to bank transfers between countries, which take several days Safe. Bitcoin transactions are recorded on the blockchain; a kind of ledger that records all transactions. Can be checked and seen. The existence of a private key and a public key means that Bitcoin ownership can be kept secure Limited. Only 21 million units of Bitcoin were produced. This unchanged amount ensures that Bitcoin remains valuable. In this way, like gold, Bitcoin is inherently scarce. Returns are very promising. A Bitcoin investment worth IDR 1 million in 2013, if exchanged now at the end of 2020, would be worth the same as a new car. The value of Bitcoin has fluctuated, but the trend since the beginning has been that the value of Bitcoin has increased. For simplicity, imagine investing in cryptocurrency is the same as investing in gold. The quantity is limited, has many benefits and the price is slowly increasing. Long vs Short Term Cryptocurrency investments are made by buying and selling assets in the crypto market. To make a profit, people have to buy crypto assets at low prices and resell them at higher prices. Two avenues for investing in crypto are: Long-term. The aim is for Bitcoin to act as a store of value, like gold, because over time the value of the currency continues to decline, in line with the large amount of money printing carried out by governments of various countries, to deal with the economic crisis. Facing a devaluation in currency values, people want to save in valuable assets that are limited in supply, that cannot be mass reproduced, such as Gold and Bitcoin. Short-term. Bitcoin price fluctuations that go up and down very sharply are fertile ground for traders in the short term. Because Bitcoin prices are volatile and the market is open 24/7, traders can enter and exit bitcoin investments in the short term. Traders use advanced techniques such as technical analysis, market sentiment analysis, and other tools to make quick profits in the short term.

Bitcoin & Gold

Even compared to gold, Bitcoin has a number of other advantages, namely: Divisibility (Ability to be broken down into small amounts): If you have 1 gold bar, then want to buy an item worth 0.5 gold bars, it is impossible, because it is very difficult to divide the gold into small pieces to carry out transactions. However, if you have 1 BTC, you can send/transact amounts as small as 0.00000001 BTC. So, you can transact with numbers that are as accurate as you want (such as 0.4981537 BTC). Ease of Transaction: Gold is quite heavy physically so it is difficult to carry everywhere, and dangerous to carry in large quantities. In contrast to Bitcoin, it has no physical weight – as long as there is internet, you can send Bitcoin to anyone in the world in any amount within 10 minutes. Security of Storage: Gold is easy to steal, and to store large amounts of gold safely, you need to take considerable security measures (such as storage safes, security cameras, etc.). However, you can store any amount of Bitcoin in a trusted crypto app or *hardware wallet) as small as a USB stick, such as Ledger or Trezor. Network Effect & Price Appreciation: Gold is an old asset class, and the room for price growth is limited. While Bitcoin is a relatively younger asset class, and because it lives on the internet. Bitcoin benefits from network effects: the more people use Bitcoin, the faster the value and price of Bitcoin will rise.

The type

Even though it is popular, Bitcoin is actually just one cryptocurrency. There are many other types of cryptocurrency. It could be said that all digital assets built using blockchain technology can be called cryptocurrencies. There are various kinds of cryptocurrencies traded on an exchange, the number can reach more than 100. However, there are crypto assets that are popular, sell well in trading, and some that are not. Just like currencies, there are USD and Euros which are very widely traded, there are country currencies which are less popular. Some of the most popular types of cryptocurrency are:

1. Bitcoins

Initially, I thought Bitcoin and cryptocurrency were two parallel things. In fact, Bitcoin is a type of crypto and because it is so popular it is often compared to cryptocurrency. Founded in 2018, Bitcoin is the cryptocurrency with the largest transaction value currently. Bitcoin was born, just when the global financial crisis hit the world economy. Bitcoin created by Satoshi Nakamoto is a new currency – precisely, a crypto currency – that is decentralized. This means that, unlike the currencies we are used to, Bitcoin is not controlled by anyone, whether it be the government or even Satoshi Nakamoto himself.

2. Ethereum

Ethereum or Ether is a cryptocurrency with the 2nd transaction value after Bitcoin. Ethereum was created by Vitalik Buterin in 2014 and its goal was to be a platform on which smart contracts could be created and executed. Developers around the world can build and run decentralized applications on the Ethereum blockchain. The goal is to improve the financial industry, personal information storage, governance with various other uses by using the transparent nature of blockchain.

3. Ripple (XRP)

Ripple is an American company founded with the aim of providing a more efficient way for cross-border payments in the financial industry, especially in the banking sector. This goal is achieved by eliminating intermediaries to reduce transaction costs and time. The xRapid payment service Ripple Network uses XRP, a cryptocurrency that runs on the XRP ledger. XRP functions to facilitate transactions on the Ripple network.

4. Bitcoin Cash

Created in 2017, Bitcoin Cash is a cryptocurrency with the advantage that transactions can be carried out more quickly compared to Bitcoin.