Solana’s Resurrection Is Shaping a New Crypto Narrative

Welcome, enjoy your reading!

“Too late” in 2021. “Dead and buried” in 2022.

Now, with SOL’s price popping off like a champagne cork, it’s the perfect time to take a closer look at Solana.

To get a good grasp of Solana, we need to know how the project came about, what it does under the hood, the challenges it’s overcome, and the bright future that lies ahead.

In this deep dive we’ll touch on topics such as:

- Why make another blockchain?

- Solana’s inception

- How Solana works

- The Solana ecosystem

- SOL tokenomics

- Solana’s bright future

- Solana’s troubled past

And remember folks, none of this is financial advice!

With that disclaimer out the way, let’s dive in. And what better way to get this investigation started than with a blatantly obvious question:

Why make another blockchain?

Aren’t there enough to choose from already?

Well yes, even back in 2017 when the Proof of History white paper dropped, there were more than enough blockchain projects that were either operational or still in the works.

Yet Solana’s founding father saw things differently.

Meet Anatoly: Photo of Anatoly Yakovenko by Kimberly White/Getty Images for TechCrunch. License: CC BY 2.0.

Photo of Anatoly Yakovenko by Kimberly White/Getty Images for TechCrunch. License: CC BY 2.0.

Having previously worked at Qualcomm and Dropbox, Anatoly Yakovenko knew a thing or two about building systems that were fast, secure and scalable. So much so that he constructed his career around performance optimisation.

He understood that blockchains like Bitcoin and Ethereum could never scale to meet the demands of global finance, at least not in their current forms. Anatoly had the vision to bring internet scale finance on-chain. While the largest crypto networks struggled to get their transactions per second (tps) into double digits, established networks like Visa were chugging along at several thousand tps. Not to mention the transaction fees required to interact on these decentralised blockchains…

The early crypto networks captured the hearts and minds of crypto anarchists around the world, but they were still very far from capturing the wallets of the next billion people. To offer an alternative platform that could rival the likes of Visa and NASDAQ, Solana would need to drastically minimise both time and cost of the network’s transactions.

The TL;DR? Solana has managed to achieve that. But that’s just the tip of the iceberg.

Solana’s inception

To truly understand Solana, we need to go back to 2017. Ethereum had shown the world that… You know what, scratch that. Let’s head back to the 1980s instead.

From what I can gather, two academic papers seem to have left their mark on Anatoly:

- On Optimistic Methods for Concurrency Control, H. T. Kung, John T. Robinson, 1981

- Using Time Instead of Timeout for Fault-Tolerant Distributed Systems, LESLIE LAMPORT 1984

I won’t bore you with the contents of these 40-year-old research papers but the takeaway is that networks can operate at very fast speeds if their nodes have a reliable source of time. In crypto terms, a reliable clock would facilitate the coordination of the block producers, much more efficiently and timely than what the competitors were doing. From Anatoly’s viewpoint, herein lay the secret to unlocking ultra-fast blockchain performance. If the nodes in the network could find a way to agree upon time, without having to rely upon each other, a throughput of up to 710,000 tps could be achieved.

Let’s put that into perspective.

With close to a trillion dollars’ worth of monetary value maintained by open source code, Bitcoin is arguably the strongest network out there today. But it’s terrible at coordinating its participants (7 tps is usually the number thrown around). And those fees! A few days before writing this article, a Bitcoin user spent over $3M in fees for a single transaction.

Meanwhile, Ethereum’s Virtual Machine (EVM) and smart contract ecosystem is an incredibly promising environment for decentralised applications (dApps). But in 2017, the throughput was marginally better than Bitcoin’s at 15 tps. On top of that, developers wishing to create applications on Ethereum need to learn Solidity, a new programming language designed specifically for Ethereum.

Now while Bitcoin and Ethereum would eventually need to resort to additional layers of networking to scale out their activity, Anatoly figured it would be possible to leverage his concept’s high throughput and create a powerful single chain solution, a high-performance monolithic blockchain. Whereas most blockchains required vertical scaling, Proof of History combined with Proof of Stake and a series of 8 key innovations would allow for horizontal scaling.

Could this be a viable way to surmount Vitalik’s famed blockchain trilemma though?

The opportunity to offer an entirely new level of performance in the crypto ecosystem was there. And Anatoly ran with the idea.

In November 2017 he published the Proof of History white paper. The initial codebase for the project was written in the C programming language but this was changed thanks to the feedback from an ex-Qualcomm colleague, Greg Fitzgerald, who encouraged Anatoly to change it to Rust. By February 2018, the first prototype was published to GitHub, under the project name Loom. Anatoly went on to co-found a company by the same name and recruited Greg, another ex-colleague named Stephen Akridge and a handful of others.

The Loom project was short lived however as an Ethereum based project called Loom Network entered the scene. To avoid confusion, Anatoly’s brainchild was swiftly renamed to Solana, in tribute to Solana Beach, a Californian town where the ex-Qualcommers had spent time surfing several years prior. Today there are two distinct organisations in the Solana ecosystem: Solana Labs, a US-based company software company and the Solana Foundation, a Swiss non-profit that oversees the open source aspect of the project.

Finally, after a couple of years of investment and development, Solana removed its training wheels and launched its mainnet beta in March 2020.

So, how exactly does Solana do all this?

How Solana works

With 400ms block times, a theoretical throughput of 710,000 tps and fees as low as $0.00025, it’s remarkable to think this ecosystem works entirely on a decentralised network.

Here are a handful of the features that make this possible.

Proof of History

While Solana is technically a Proof of Stake (PoS) blockchain, it relies heavily upon its Proof of History (PoH) mechanism to coordinate the blockchain’s validators. In simple terms, PoH adds timestamps to the blockchain ledger, enabling a rapid sequencing of validators. This allows them to know their order in advance, avoiding back and forth communication between the nodes. How it actually does this is through a SHA-256 hashing function. Hashing (unlike encrypting that can be decrypted) is designed to be a one-way function. Taking a hash’s output and using it as the input of the subsequent timestamp creates an increasingly difficult chain of code to crack.

This video from Solana provides a bit more clarity:

One of the most interesting things about this way of working is that blocks that arrive late can simply be slotted into the appropriate place in the chain thanks to their predefined timeslot.

Staking on Solana

Solana’s PoH goes hand in hand with its PoS consensus. As per the Solana white paper:

This specific instance of Proof of Stake is designed for quick confirmation of the current sequence produced by the Proof of History generator, for voting and selecting the next Proof of History generator, and for punishing any misbehaving validators.

With no strict amount of SOL required to become a Solana validator, it would appear that it’s fairly straightforward to get a node up and running. But that’s not entirely true.

First of all, the hardware required to pass such high frequency transactions prices a lot of people out of the game from the get-go. In addition to this, validators are required to vote for each block they agree with. This can rise to 1.1 SOL per day and with SOL currently trading hands at around $60, that’s over $24k of votes per year for a high performing node!

Let’s break it down further.

1.1 SOL per day works out at 401.5 SOL per year. The APY for validators is currently 7.72%. That means you’d need to have over 5200 SOL staked in order for the rewards to cover your voting cost. With SOL priced at $60, that works out a $312,000 capital allocation, not to mention the hardware, network and maintenance.

If that prices you out of the game, you can always stake your SOL with a validator, but they will charge a fee for this of course. The unlock period takes 5 days and there is a risk of partial slashing if your validator of choice decides to misbehave.

See here for Solana’s official documentation on running a validator.

Parallel Processing

One of the things that makes Solana’s performance so impressive is the fact that validators can process tens of thousands of smart contracts in parallel, not in series like on other chains. This is thanks to Solana’s Sealevel mechanism, one of the key 8 Solana innovations.

The exact methodology gets pretty deep into coding and hardware at the microprocessor level, but this extract from gives a simple high-level breakdown:

The reason why Solana is able to process transactions in parallel is that Solana transactions describe all the states a transaction will read or write while executing. This not only allows for non-overlapping transactions to execute concurrently, but also for transactions that are only reading the same state to execute concurrently as well.

Solana Virtual Machine

Many popular crypto application are copy pasted from Ethereum onto other EVM environments. This could be to Ethereum Layer 2 projects or even to alternative Layer 1 ecosystems.

Solana however runs its own Solana Virtual Machine (SVM) on Rust, meaning dApps cannot be ported over just like that. Projects must be coded from scratch, or at least require some heavy workarounds to be able to run on Solana.

A notable project in this regard is a relatively new one called Eclipse, an Ethereum Layer 2 concept powered by the Solana Virtual Machine. A project that brings together the security of Ethereum with the speed of Solana is certainly one to keep an eye on.

Decentralisation

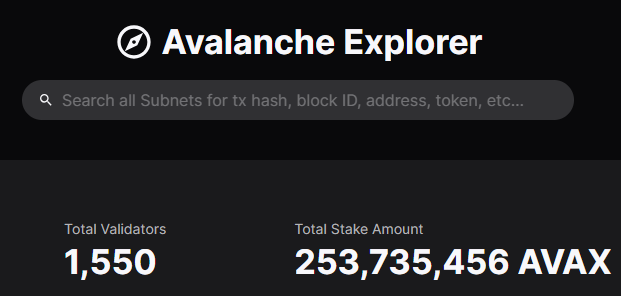

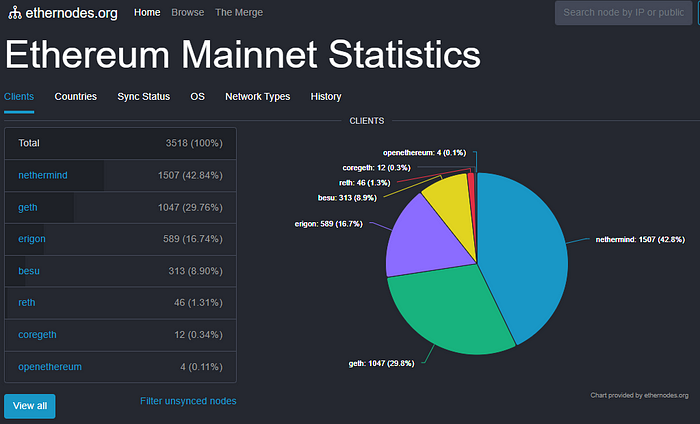

As far as decentralisation goes, Solana is not doing too bad at all. With 1,985 validators, that’s more than Avalanche (1,550) but less than Ethereum (3,518). Source: https://solanabeach.io/validators

Source: https://solanabeach.io/validators Source: https://subnets.avax.network/

Source: https://subnets.avax.network/ Source: https://www.ethernodes.org/

Source: https://www.ethernodes.org/

The issue with relying upon validator count however is that the number of validators doesn’t correctly represent the decentralisation of the ecosystem, as some validators could be holding a significant amount of the staked currency, as is the case currently on Ethereum.

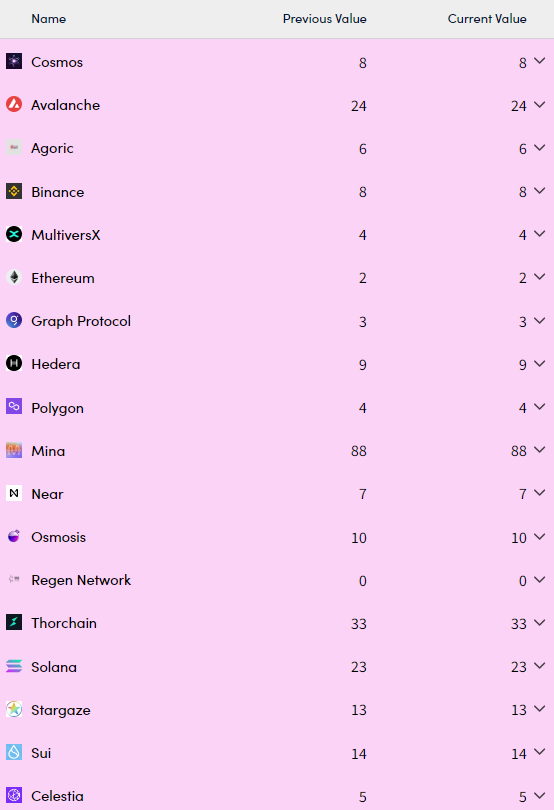

This is where tools such as Nakamoto coefficients come in handy for better measuring decentralisation. Solana’s Nakaflow score is currently 23, similar to Avalanche’s (24). Source: https://nakaflow.io/

Source: https://nakaflow.io/

Notice Ethereum’s painfully low score? As the barrier to entry is 32 ETH for self-staking, the majority of stakers end up using pooled services such as Lido or Coinbase, which greatly decreases the network’s Nakamoto coefficient.

At the other end of the spectrum, we see Mina Protocol with a comparatively high score of 88. I have yet to dig into this project, but from what I gather this is a lightweight blockchain that can be run on a smartphone. If this is the case, it’s an interesting example of how simplifying access to node-running and validating can greatly increase a crypto project’s apparent level of decentralisation.

In any case, despite Solana’s tangled history with FTX, it’s encouraging to see this healthy level of decentralisation compared to other blockchains.

So what is it exactly that’s pulling users and developers towards Solana?

The Solana ecosystem

While it might not be as vast as the landscape of Ethereum and its rollup-centric roadmap, Solana certainly does have a lot of activity going on in various sectors.

Hardware focused

Hardware is a topic that continues to emerge in the Solana discussion.

At first, we can discuss how high the hardware requirements are for validators to run the infrastructure. There are promising developments with Solana Firedancer (more about that below) but even so, running a performant system to rival the likes of Visa and Nasdaq isn’t going to run off a simple Raspberry Pi.

An expensive validator rig is not the only thing that comes to mind when talking about Solana and hardware. The Solana Saga phone is a good example of where the crypto industry could be headed, and Solana seems dead set on leading this charge. Source: https://solanamobile.com/

Source: https://solanamobile.com/

I would argue that they are slightly ahead of their time with this product, but you need to start somewhere. Putting a secure wallet directly into a phone instead of relying upon third party apps and extensions seems like a smart move.

But the topic of hardware goes much further than phones. The Helium network for instance is an excellent example of a decentralised physical infrastructure network (DePIN), having only recently opted to migrate from its native blockchain and set up home on Solana. To paraphrase Anatoly from a recent interview at Permissionless, use cases like Helium are the “perfect application of using cryptoeconomics to incentivise the rollout of complex physical infrastructure in the real world.”

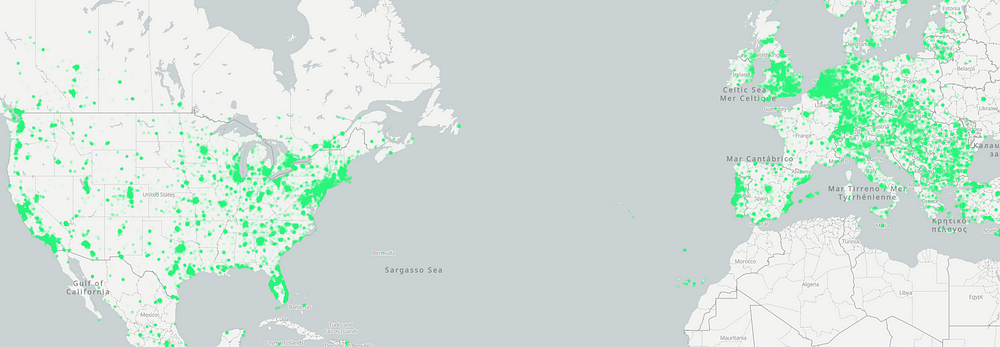

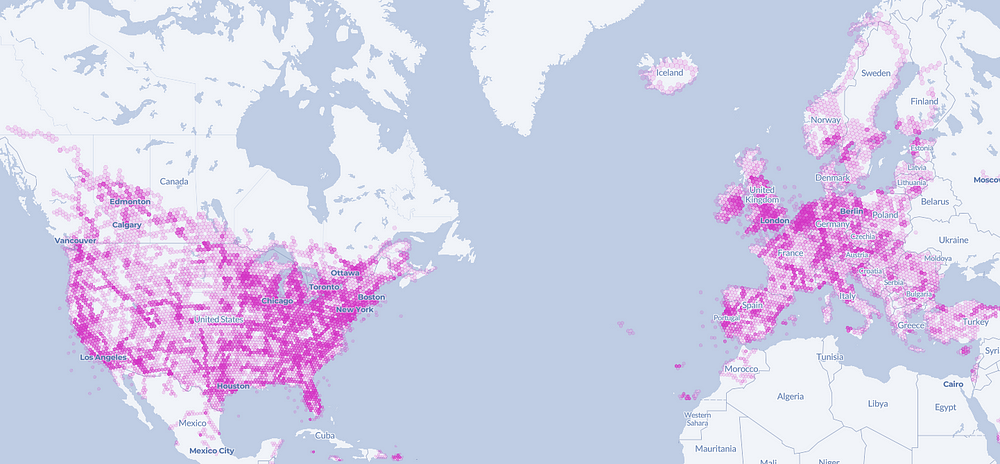

As with so much crypto activity, the vast majority of the action seems to be taking place in North America and Europe. The following screenshot shows the current Helium coverage map (November 2023). Source: https://explorer.helium.com/

Source: https://explorer.helium.com/

Another such DePIN network is Hivemapper, a project aiming to map out the world’s roads, similar to Google’s Street View platform. Not only is this decentralised, but it also promises to provide far quicker image updates due to the number of drivers contributing real-time data.

They have a long way to go to reach the level of authority Google Street Maps has earned but with 6M km of roads covered and over 24,000 drivers active, they seem well on the way to achieving something significant.

In typical fashion, the majority of the data results from activity in North America and Europe. One can only presume there are numerous participants of both DePIN projects earning crypto rewards from their home network and while out driving. Source: https://hivemapper.com/explorer

Source: https://hivemapper.com/explorer

Its thanks to its unique blockchain architecture that Solana projects are able to carry out these impressive feats. When you think about it, the real bottleneck for Solana is hardware. The DePIN narrative (not exclusive to Solana) is something I will be keeping a close eye during the upcoming bull run.

NFTs

No smart contract blockchain can be taken seriously without its fair share of degen activity; Solana’s environment of fast and cheap transactions is the perfect place to host these types of projects. The NFT space is no exception. Since the NFT summer of 2021, Solana has had a relatively good run in this sector. While the market share of non-fungible tokens remains largely dominated by Ethereum, Solana still manages to pop in at second place for all-time sales, albeit at a fraction of Ethereum’s totals. Source: https://www.cryptoslam.io/

Source: https://www.cryptoslam.io/

A similar environment in this respect is Polygon, with more or less the same number of buyers, but less than half of the sales volume. Whereas many cheaper projects choose to mint on Polygon to avoid Eth L1 gas fees, Solana’s monolithic structure seems to attract higher selling projects than L2 rollups or sidechains. This phenomenon isn’t set in stone though, as there have been cases of high-profile projects choosing to emigrate away from Solana.

One of the more successful projects that has managed to keep the attention of its diehard community is the Degenerate Ape Academy, one of the first big projects to launch in 2021. Fast forward to today and there’s a buzz hovering around Mad Lads, a project launched by executable NFT wallet developer Backpack.

Sources: https://www.madlads.com & https://www.degenape.academy/

Sources: https://www.madlads.com & https://www.degenape.academy/

Throughout the ups and the downs, Solana degens have consistently turned to Magic Eden for their trading and mint launches. This popular NFT marketplace was born on Solana and has since expanded to support NFT trading on Ethereum, Polygon, and even Bitcoin Ordinals.

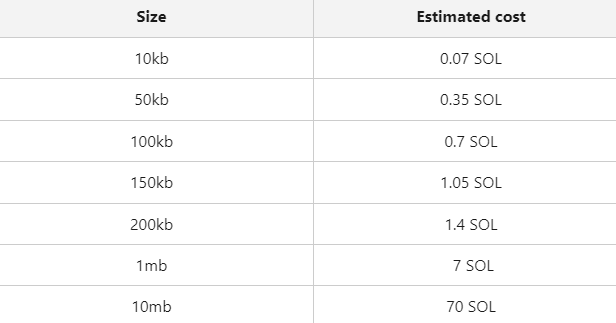

Magic Eden’s marketplace also has a filter for Solana inscriptions. Instead of hosting NFT content on third party storage facilities, users can choose to mint their data straight to the blockchain. This is not a one-size-fits-all solution though, as the cost to inscribe your data rises according to the amount of data to be inscribed: Source: https://help.magiceden.io/en/articles/8615097-unlocking-the-future-inscriptions-on-solana

Source: https://help.magiceden.io/en/articles/8615097-unlocking-the-future-inscriptions-on-solana

DeFi

Considering that Solana runs on Rust, it’s not so straightforward to copy a dApp over from Ethereum. This is why there are many Solana-native applications.

As the graph below shows, there was a tremendous drop in TVL as a result of the FTX collapse towards the end of 2022, but there has been some recent signs of activity picking up over the past few months. Source: https://defillama.com/chain/Solana?currency=USD

Source: https://defillama.com/chain/Solana?currency=USD

The drop of FTX related projects along with a few notable hacks has altered the landscape in Solana Defi. Some Solana DeFi projects worth looking into include:

Games

Considering the cheap and fast transactions on offer, it should come as no surprise that a handful of Solana gaming projects have generated their fair share of hype. Star Atlas for example is showing some very promising development and has demonstrated impressive graphics in their recent gameplay videos.

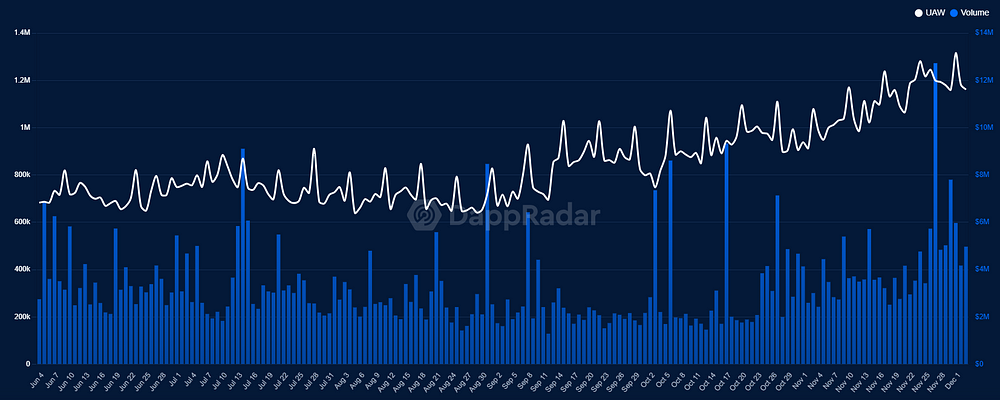

But as we’ve come to learn over the past few years, there is a significant mismatch between crypto’s 4 year hype cycle and the longer timeframes required for AAA gaming production. Nonetheless, we do seem to be entering an uptrend in crypto gaming interest, as the number of unique wallet addresses shows a steady climb upwards. Source: https://dappradar.com/rankings/games/charts

Source: https://dappradar.com/rankings/games/charts

Still, it remains to be seen if this sector, (whether on Solana or elsewhere) can live up to its expectations. And for now, despite the fast and cheap transactions on Solana, there seem to be other chains with stronger gaming ecosystems. A few of these that I’m keeping an eye on include Avalanche, The Sandbox and Immutable.

Payments

Not everyone is interested in playing games or trading digital collectibles. Nor does everyone have the technical capacity to setup DePIN equipment. But everyone does have bills to pay. Of all the use cases for Solana, perhaps the most significant is that of payments.

And who better to help highlight this than Visa with their use of Solana-native USDC settlements, bypassing multiple bank transfers, counterparty risks and leveraging Solana’s 400ms confirmation time.

Another notable payment integration is Solana Pay, a payment system that recently integrated with e-commerce behemoth Shopify.

Explorers & Wallets

Now you’ve got a feel of what’s buzzing on Solana, you’ll need to equip yourself with a good wallet and explorer to participate in the ecosystem.

Well, the explorer is optional, but it’s always handy to have a tool to see where your money is going. Solana Beach is a popular option.

As for a wallet, Phantom Wallet is by far the most popular choice for Solana users but there are plenty of other options to choose from. The Solana ecosystem page lists over 50 alternatives.

If you’re not sure about deploying your SOL and want to keep it somewhere safe, then consider using a hardware wallet such as Ledger.

And speaking of holding your SOL long term, let’s consider the cryptoeconomics of the coin that’s securing this blockchain.

SOL tokenomics

Solana’s native coin SOL is used like pretty much any other PoS crypto: to be staked to secure the network and for paying transaction fees. Similar to Ethereum post EIP-1559, there is a token burning mechanism in place, 50% to be precise.

The token emissions are disinflationary; there is no hard capped limit to how many coins can be minted, but the fee burns theoretically curb any excessive inflation of the coin. Current staking APY rewards are set above 7%, whereas inflation is around 5.6% (this is set to drop to 1.5% by 2030).

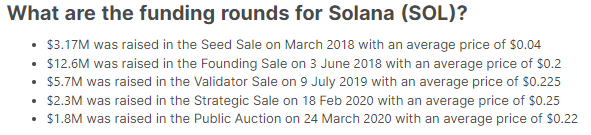

SOL got off to a running start thanks to its initial funding rounds between March 2018 to March 2020. If you think everyone got wiped out by last year’s price crash to $8, take a look at these entry points: https://www.coingecko.com/en/coins/solana/tokenomics

https://www.coingecko.com/en/coins/solana/tokenomics

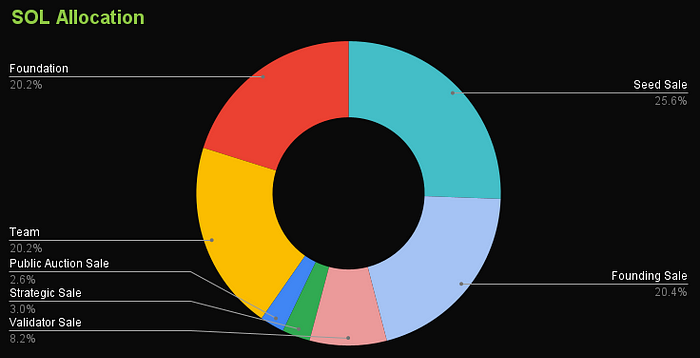

As for token allocation, SOL is often referred to as an investor coin. Most notably, SBF’s FTX and Alameda Research were said to hold up to 10–15% of all SOL before the companies imploded last November. But besides that, there seems to have been many early birds dipping their fingers into the SOL pie over the past few years. https://www.coingecko.com/en/coins/solana/tokenomics

https://www.coingecko.com/en/coins/solana/tokenomics

Which of course brings along the risk of token unlocks and price dumps.

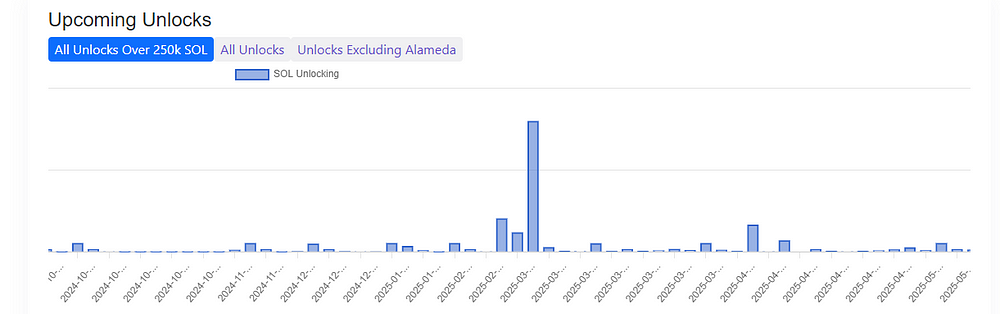

From what I can see there is a relatively calm unlock schedule for the foreseeable future, but things could get volatile in the run up to March 2025 when a significant unlock is set to occur. Put a reminder in your calendar if you’re planning to trade SOL in Q1 2025. Source: https://solanacompass.com/tokenomics

Source: https://solanacompass.com/tokenomics

Solana’s bright future

If ever there had been a time to be bullish about Solana, it’s now.

Let’s face it, the world at large first heard about it when it was too late during the 2021 crypto bull run. Then disaster struck with the collapse of FTX. Now after rising from the ashes, it’s giving investors a chance to get in on the action all over again. Granted, the days of thousand fold gains are behind it but that’s the price to pay for not having Sam Bankman Fried drooling over your coins. Source: CoinMarketCap

Source: CoinMarketCap

Price speculation aside, the list of heavyweight partnerships continues to grow. In the past few months we’ve seen:

- Integration with Google Cloud

- Solana Pay collaborating with Shopify for stablecoin payments

- Blockchain node partnership with Amazon Web Services

And that’s without considering the latest technical update that’s on the horizon.

Firedancer

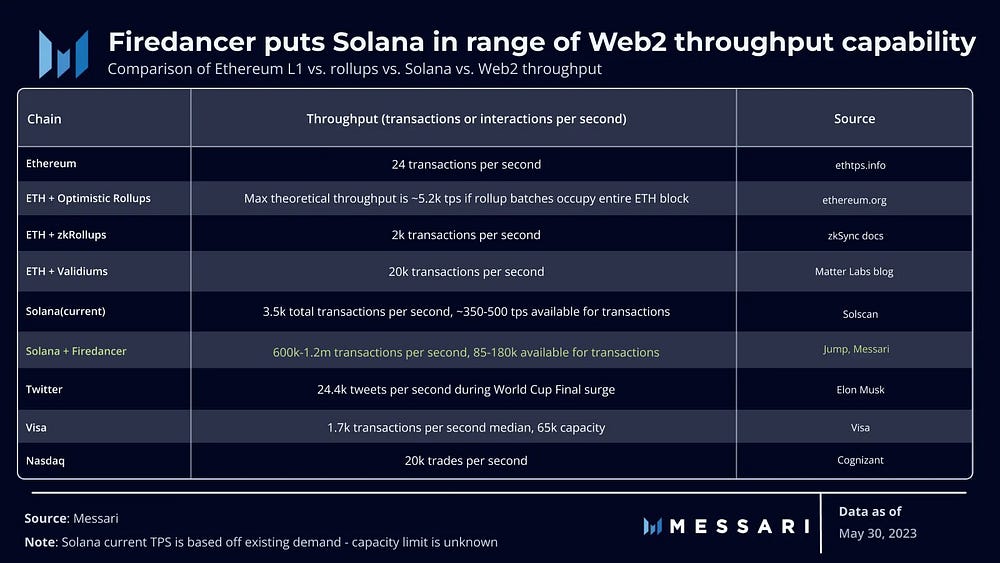

It’s clear to see that Solana is miles ahead of its main blockchain competitors in terms of speed, but the latest improvement looks set to catapult them into another category altogether. Firedancer, is an alternative client for the Solana blockchain, built by Jump Crypto.

First things first, having numerous clients is a very good thing for the security of the blockchain. Besides this, the introduction of Firedancer creates an opportunity for new developers to enter the ecosystem as it runs on the C programming language as opposed to Rust. And thanks to the addition of Firedancer, the cost of hardware to run Solana is predicted to drop which can only benefit its decentralisation.

The speed is where things get interesting as Firedancer brings Solana’s specs above and beyond the capabilities of established TradFi players: Source: @MessariCrypto on X

Source: @MessariCrypto on X

I started on this deep dive with an open mind and I must say it’s been filled with a lot of bullish insights. But if all I did was to paint a beautiful picture and ignore my broken frame, I wouldn’t be doing an honest job.

It’s time to face some harsh truths.

Solana’s troubled past

There’s an air of optimism about Solana these days that may well have to do with the all the trouble standing behind it. So, starting with the elephant in the room:

FTX, Alameda Research, and Sam Bankman-Fried

I don’t think I need to go into detail here, as the FTX collapse has been covered everywhere ad nauseam. Scam Bankrun Fraud’s ponzi scheme has likely made it to the kindergarten curriculum by now. But his recent guilty verdict has been a significant catalyst for the project to move forward as it finally shakes off the cobwebs from its FTX past.

Considering the close ties between the projects, the catastrophic fall of FTX had a very significant impact on the price of SOL. From its all-time high of $260 to the more recent low of $8, this 97% drop almost painted the project for dead. Source: https://www.tradingview.com/

Source: https://www.tradingview.com/

Yet that’s what so remarkable about crypto and decentralisation. The whole idea is that the ecosystem should survive on its own merits. Now, one could say that with FTX gone and a large number of investors having already taken profits, Solana has never looked healthier.

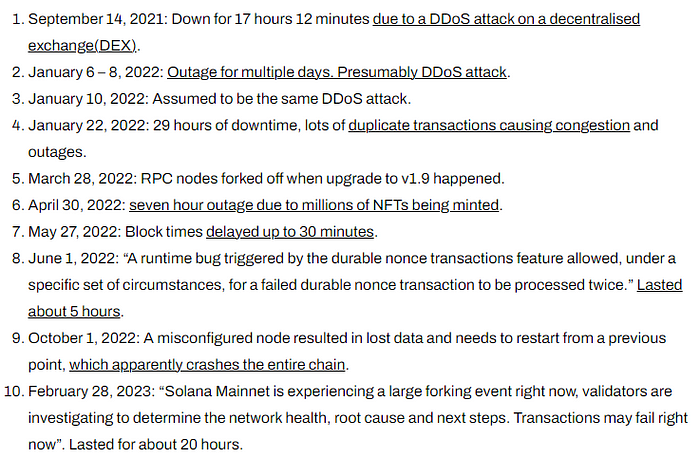

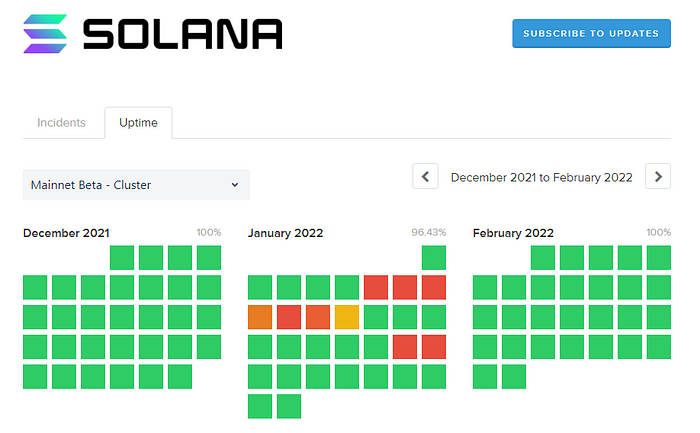

Downtime

This was a huge issue in the past although it’s been a while since they’ve had an outage. Still, this is the risk that comes with a “move fast and break stuff” type of project. The whole idea of a decentralised network is that it’s there for you when you need it, especially if it’s holding your money. Blockchains going offline is a very serious matter.

From what I gathered in my research, Solana has gone down at least 10 times: Source: thechainssaw.com

Source: thechainssaw.com

Well at least they don’t hide the fact; you can review the network’s status history for yourself at: https://status.solana.com/uptime Source: status.solana.com/uptime

Source: status.solana.com/uptime

As with the FTX shenanigans though, this too seems to be a thing of the past (touch wood, fingers crossed, and all that) as the last downtime occurred almost a year ago (February 2023).

Wormhole Exploit

At around $320M, this was a holy whopper of a hack and yet another example of how risky bridges are between blockchains. The funny thing about this story is that a year later, Jump Crypto managed to exploit the hacker and recuperate the stolen crypto.

Don’t you just love this space?

Mango Exploit

Mango Markets used to be one of the biggest trading platforms on Solana. That was until a character by the name of Avraham Eisenberg executed a “Highly Profitable Trading Strategy” (his words, not mine) that resulted in the loss of over $100M in assets.

You can see Laura Shin’s October 2022 interview with Eisenberg here, recorded shortly after the Margo attack.

The SEC

Finally, as I finish writing up this deep dive, the SEC has again taken shots at US crypto exchange Kraken. In their paperwork they refer to several cryptocurrencies as unregistered securities, including SOL.

This just goes to show that you never know what regulatory uncertainty awaits around the corner for crypto ecosystems and their founders. Could be a nothing burger, could also lead to something more serious; time will tell.

Eyes peeled as a new crypto narrative takes shape

The fact that Solana has risen so strongly from its moment of reckoning is a testament to its diehard community and the powerful tech under the hood. Bitcoin and Ethereum both went through their doomsday moments and came out stronger, and it appears this could be the case now for Solana. The OPOS narrative (only possible on Solana) will echo through the threads and long posts of 𝕏 over the coming months as projects from various sectors deploy faster and cheaper alternatives to their alt-L1 competitors.

Of all the “ETH killers” out there, none seem in a better position than Solana in my opinion.

But that’s just the opinion of a random dude on the internet. What counts now is how the Solana community executes during the coming bull run.

Can they keep the network running once bigger projects and companies come to rely on their mainnet, or will yet another outage occur? Are there any more black swan events tied to the project, or did SBF take all the skeletons out of the closet?

And from a higher viewpoint, how will the overarching crypto community’s taste evolve? Will the majority of smart contract developers stick to coding in Solidity and follow Ethereum’s rollup-centric roadmap, or will a new wave of Rust programmers congregate on Solana’s mainchain and develop new use cases to match Solana’s promising performance?

As the crypto space matures, I expect the stronger protocols to continue gobbling up the weaker ones in terms of market share and participant’s attention. Will we see a bitter Ethereum vs Solana rivalry emerge; or will the market hedge with 2 very different approaches, one of rollups and one of a single chain? If so, we’ll likely see more projects like Eclipse emerge that aim to leverage the best of both worlds.

Whatever happens, the coming 24 months promise to be one hell of a ride, for Solana et al.

Thanks for reading!

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)