On-chain carbon credits

Introduction

What are voluntary carbon markets?

First things first. Carbon credit (or carbon offset) is a tradable certificate that allows its owner to emit a predefined amount of greenhouse gases. One carbon credit represents one ton of carbon dioxide (CO2) or CO2 equivalent greenhouse gas emissions. Once an entity buys a carbon credit and claims that it has been used to reduce emissions, the carbon credit is retired, i.e., it is taken out of turnover and cannot be traded anymore.

Voluntary Carbon Market (VCM) is a type of market where entities buy and sell carbon credits voluntarily. The underlying for these credits is greenhouse gases that are removed or reduced from the atmosphere. By purchasing carbon credits on VCM corporations or individuals support the projects which otherwise would be non-viable financially.

Why are legacy carbon markets broken?

Legacy, or off-chain carbon markets are inefficient and flawed in many ways:

· Lack of price discovery. That most voluntary carbon transactions happen over the counter (OTC) leads to poor transparency of the market. The value of carbon credits depends on multiple factors, such as project type, vintage, or country. This makes it even harder to know the real market price of a voluntary carbon credit.

· Illiquidity. As mentioned above, the voluntary carbon market is done mostly not on exchanges but OTC which results in the highly fragmented and illiquid markets. The heterogeneity of carbon credits implies that different carbon offset types trade in low volumes.

· Poor market transparency. Since the market is voluntary and not regulated by a single entity, it’s hard if not impossible to obtain information on the owners of active carbon credits, on the project details, or on how much each owner spent.

How blockchain can fix it?

Bringing carbon markets onto the blockchain could solve most, if not all these problems. Blockchain is a decentralized and public ledger that cannot be modified any single entity. This would make on-chain carbon markets more transparent than legacy markets. Furthermore, tokenization of carbon credits will add more liquidity to the markets by bringing many users to which the markets would otherwise be inaccessible. Transporting carbon offsets to the blockchain will also result in improved price discovery because similar carbon credits will be combined in a single pool which facilitates their comparison.

Protocols

The most notable protocols building in the space are mentioned below.

Toucan

Toucan’s Carbon Stack contains three modules:

· Carbon Bridge.

· Carbon Pools.

· Toucan Meta-Registry

Anyone can bring their carbon credits from off-chain sources to on-chain through Carbon Bridge. To bring carbon credit from a legacy registry to Toucan registry one should retire their credits in the original source to prevent double counting. Once the bridging is complete, carbon credits can be fractionalized into tokens calls TCO2 where T can mean “Toucan”, “Tonne”, or “Tokenized, and CO2 represents carbon dioxide.

If Toucan protocol did stop here, it would have been no different from legacy carbon markets. Since there are too many carbon projects, and carbon credits are typically project-specific, the carbon markets tend to be illiquid. To aggregate carbon credit with the similar features would be a natural solution to the problem. This is what the protocol did by launching Carbon Pools.

Carbon trading is mostly done over-the-counter, not on centralized exchanges. This means that these markets are not fully transparent and lack the discovery of price. Toucan’s Carbon Pools group alike carbon offsets into pools creating more liquid markets and a more transparent price signal for various carbon categories. Once a carbon credit is tokenized, a standardized token called carbon reference token is created. These tokens can be traded on decentralized exchanges where liquidity is much deeper. Thus, Carbon Pools make carbon markets much more liquid, less fragmented, and more transparent.

Toucan Meta-registry is where all the fractionalized carbon credits are stored. Other details, such as project-specific information, retirement of carbon credits are also recorded here.

Klima

One of the biggest visions of Toucan was that other projects or protocols would use their infrastructure to build things on. This is what KlimaDAO did. That is a project with the goal to create a carbon-based currency. Users can buy its coin, KLIMA using BCT, Toucan’s token. KLIMA token is backed by one BCT 1:1 which, in its turn, is linked to carbon offsets from real projects.

When a BCT token is deposited into KlimaDAO treasury, more KLIMA is minted to the market. You can think of KlimaDAO as a blackhole for BCT — they lock away BCT and thus carbon offsets from the market pushing the price of carbon credits higher.

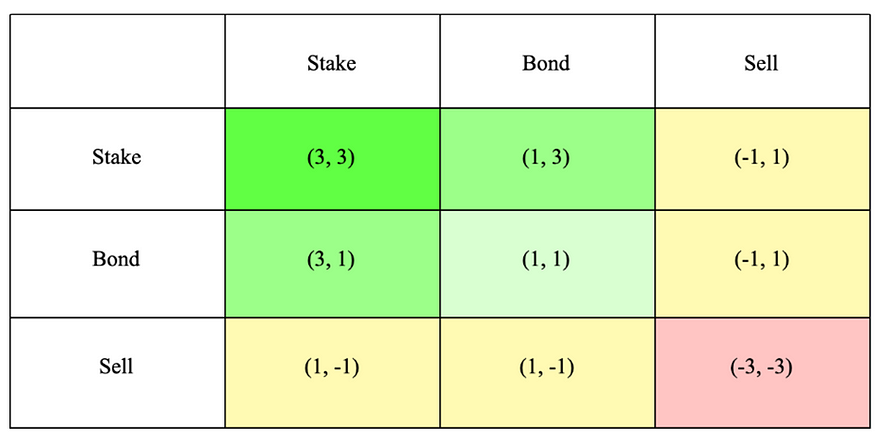

Reward mechanisms for investors are bonding and staking.

Bonding

Bonding is getting KLIMA by adding reserve assets, such as MCO2 (see below) or BCT to the KlimaDAO treasury. You can get KLIMA at discount

Staking is another value accrual mechanism of the protocol. By staking your KLIMA tokens, you’ll get sKLIMA tokens which have a 1:1 ratio to KLIMA. How does the protocol reward the stakers? Recall that KLIMA is backed by real carbon credits. When the treasury has more credits than it needs to back KLIMA, it will mint new tokens and distribute them to stakers. Staking is win-win both for the protocol and users. For KlimaDAO it’s beneficial because staking tokens for some period locks up supply thus decreasing the selling the pressure. Users benefit from staking through receiving staking rewards. At the time of this writing, APY is 21%.

These all can be summarized in the game-theoretic view of KlimaDAO actions. Staking is the most beneficial action for the protocol for the reasons mentioned above. Next is bonders. They increase liquidity by adding reserve assets to the treasury. But their action result in selling pressure when they sell their bonds. Finally, sellers are the least desired actors for the protocol. Their selling pressure can decrease confidence in the project; thus, they get least rewards of the three groups. MOSS

MOSS

MOSS is an environmental platform operating in Brazil, the country containing 40% of the world’s tropical forests and which is considered “Saudi Arabia of Carbon Credits”. Though the country has enormous potential, carbon credits of their environmental projects are among the cheapest in the world.

MOSS consists of two separate projects: MCO2 token and Amazon NFT project. MCO2 is a ERC-20 token representing one carbon credit which is minted by MOSS based on the supply and demand of carbon credits.

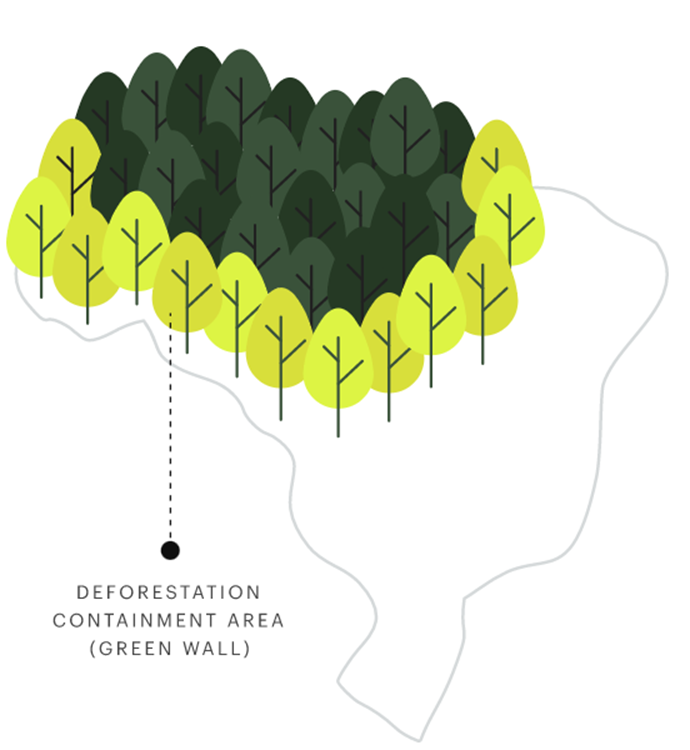

An Amazon NFT represents a piece of Amazon forest. Proceeds from the sale of NFTs will go to the project called “Green wall” which will restrain deforestation in the region. The mission of Green Wall is to preseve the threatened borders of the rainforests. The whitepaper claims that to save Amazon with the area of 600 million hectares is much less costlier than you would think. Since most of the deforestation comes not from natural disasters but from human activity, guarding the edges of the forests through building a wall does make sense both environmentally and economically. This is 600 million hectares vs 20 million hectares! (area of Amazon forest borders) Flowcarbon

Flowcarbon

Flowcarbon is one of the leading projects in climate technologies. The way Flowcarbon works is as follows. First, carbon credits from multiple environmental projects will be deposited into Specific Purpose Vehicle (SPV). The next step is to tokenize these credits into GCO2 tokens. But since these tokens are vintage year- and project-specific, they will be combined into a bundle with other similar carbon credits from different projects.

Finally, a GNT token will be minted from that bundle; the number of issued GNT tokens will be equal to the number of GCO2 tokens in that bundle’s smart contract.

Their GNT token is backed by carbon credits from multiple “market-recognized carbon registries”. These credits have not been retired yet; so, once purchased they can always be brought off-chain and be retired by a holder.

Other than GNT, Flowcarbon also uses NFTs to bring attention to climate change problem. They launch a collection of 200 net carbon negative pieces of art called Flow3rs on November 28. About 70% of the proceeds from NFT sales will be employed to retire carbon credits. The issuers of these credits include Valparaiso project which is located in Brazil and whose mission is to preserve Amazon rainforests.

Universal Carbon

Universal Carbon, or UPCO2 is the first tradable REDD+ (see below) carbon credit token. Developed by Universal Protocol Alliance, it is backed by voluntary REDD+ carbon credits. The term REDD+ has been defined as “reducing emissions from deforestation and forest degradation in developing countries, and the role of conservation, sustainable management of forests, and enhancement of forest carbon stocks in developing countries”.

Controversies

KlimaDAO entered the market with “sweeping the floor” which meant to encourage crypto users to buy the cheapest carbon credits in the markets. Their reasoning was that if those useless or bad credits are taken out of circulation, only the credits of the good projects will remain in the market.

The problem with this initiative was that those bad credits were associated with the low-quality, dubious environmental projects. Those were of such low reputation that their sale on several leading carbon markets was not possible. Experienced carbon credit traders hadn’t traded those credits for years because they knew what those credits were worth.

Considering this, Verra, the operator of the world’s leading carbon crediting program, the Verified Carbon Standard (VCS) Program, issued a statement on November 25, 2021. By emphasizing that it “does not administer these activities and tokens and in any event takes no responsibility for these activities and tokens” and that tokens “have not been licensed or otherwise authorized by Verra are not verified, endorsed, or recognized by Verra as representing or equating to VCUs or an environmental benefit associated with VCUs”, they distanced themselves from KlimaDAO and Toucan protocol.

Unsurprisingly, KLIMA and BCT (Toucan’s Base Carbon Tonnes) tokens lost a significant part of their value following the statement. This is the chart of BCT price. And this is KLIMA price chart:

And this is KLIMA price chart: Conclusion

Conclusion

Though carbon markets have the potential to fight the climate change, they have their own flaws. They are illiquid, opaque, and not accessible to most investors. Blockchain technology can change this in many ways. First, collecting the carbon credits with similar features will improve price discovery that legacy carbon markets lack. Also, tokenization of carbon credits will result in better liquidity.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)