Valuation and Fundamental Analysis in a Volatile Market

The cryptocurrency landscape is a whirlwind of innovation, speculation, and, let's face it, volatility. While the potential for returns is undeniable, navigating this dynamic space requires a keen understanding of how to value cryptocurrencies and assess their underlying fundamentals. This article delves into these crucial aspects, equipping you with the knowledge to make informed investment decisions.

Understanding Valuation in Crypto:

Deep dive

Unlike traditional assets with intrinsic value based on tangible factors, crypto valuation is a complex dance between perception, utility, and market forces. Here are some key frameworks to consider:

Market Capitalization (Market Cap):

The simplest metric, multiplying circulating supply by price, offers a basic understanding of a project's relative size. However, it doesn't account for future potential or utility.

Market Cap:max_bytes(150000):strip_icc()/Market-Capitalization-ba038aeebab54f03872ead839a2877a4.jpg)

Discounted Cash Flow (DCF):

Adapting traditional valuation methods, some analysts attempt to project future cash flows generated by a crypto project's token and discount them back to present value. This approach requires careful consideration of assumptions and the project's specific economic model.

DCF:max_bytes(150000):strip_icc()/DCF-f7593de5b9444e378b90a237a9bd83f6.png)

Network Valuation:

For blockchain-based projects, metrics like active users, transaction volume, and fees collected can indicate network health and potential future value. However, these metrics need to be interpreted in context and shouldn't be viewed in isolation.

Fundamental Analysis: Unveiling the Project's Core

While valuation methods offer a quantitative lens, fundamental analysis delves deeper into the project's DNA, uncovering its potential and risks. Here are key areas to explore:

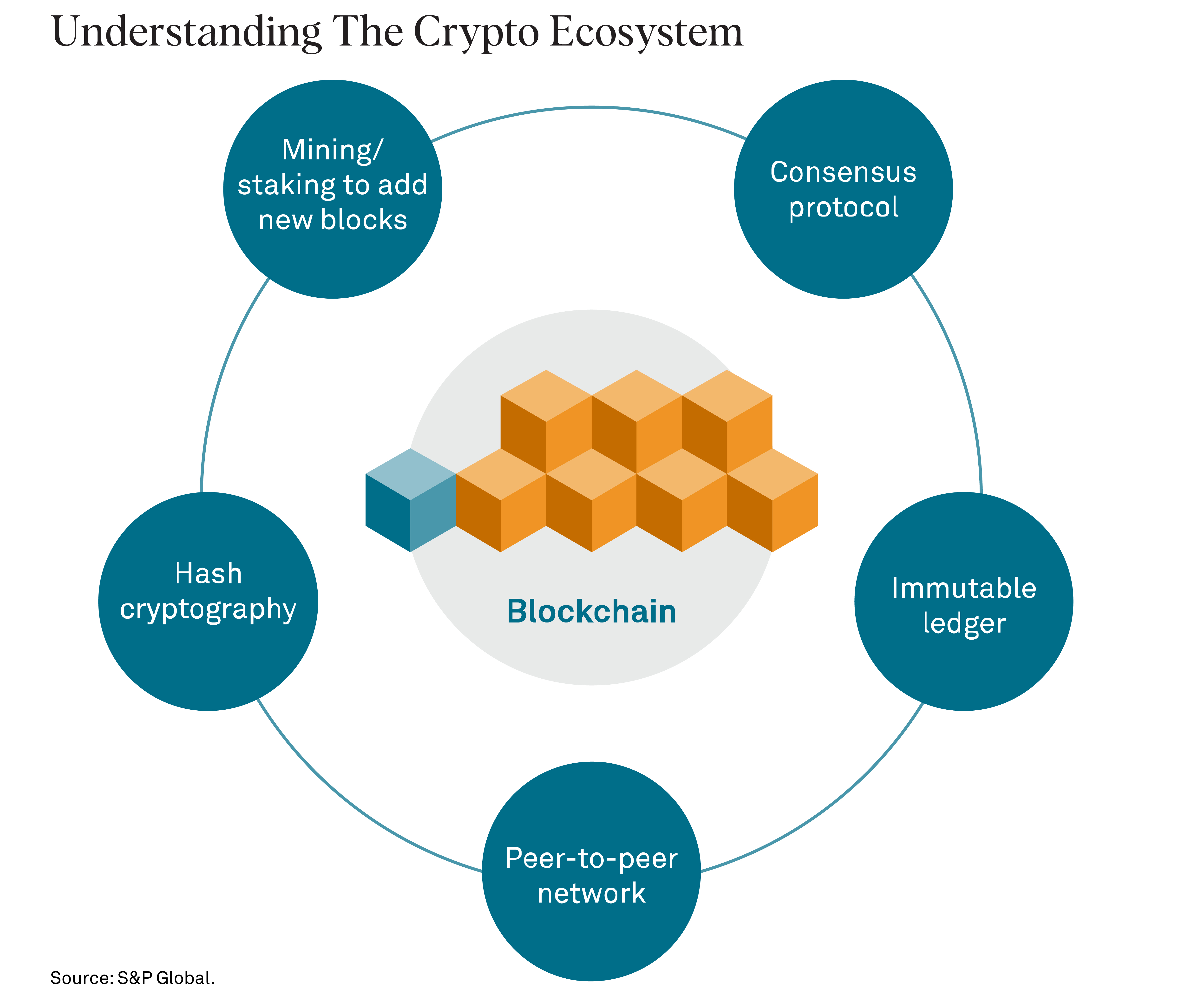

Technology:

Assess the underlying technology, its innovation, and its potential to solve real-world problems. Consider the consensus mechanism, scalability, and security features.

Team:

Research the team's experience, expertise, and track record. A strong, passionate team with relevant experience is crucial for long-term success.

Community and Adoption:

Analyze the project's community engagement, developer activity, and real-world adoption. Strong community support and active development are positive indicators.

Tokenomics:

Understand the token's distribution, utility within the ecosystem, and potential inflation/deflation mechanisms. Tokenomics significantly impact long-term value proposition.

Roadmap and Vision: Evaluate the project's roadmap, its milestones, and its long-term vision. A clear and achievable roadmap with a well-defined vision inspires confidence.

Tokenomics

Remember:

Crypto is inherently volatile:

Don't expect absolute certainty in valuations or analysis. Embrace the dynamic nature of the market and factor in risk tolerance.

Do your own research:

This article provides a framework, but delve deeper into specific projects you're interested in. Read white papers, join communities, and stay informed.

Diversify and stay balanced:

Don't put all your eggs in one basket. Diversify your crypto holdings and maintain a balanced portfolio across different asset classes.

Diversification:max_bytes(150000):strip_icc()/diversification.asp-FINAL-b2f2cb15557b4223a653c1389389bc92.png)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)