Complete Handbook: What's Behind Today's Cryptocurrency Market Decline?

Unless you’ve been living under a rock, you know that crypto is extremely volatile. However, the crypto market sometimes moves outside its usual, more commonly known day-to-day price range, such as when a sudden price drop occurs. A sudden price drop could happen due to factors such as industry turmoil and a heated situation in traditional finance. That said, why is crypto down today? Follow along as we explore today’s crypto price drop!

To survive and thrive in the Web3 space, you must remember that this market presents outrageous price swings. So, instead of panicking when the price of crypto decrease, take a step back and ask yourself, “why is crypto down exactly?” Also, see if you can determine if there’s a way to predict these moves.

Not long ago, you had to go full-time crypto to get such insight and understand market movements in time before crypto went down. Now, however, traders can use Moralis Money to anticipate when crypto is about to move up or down.

Of course, it’s important to properly understand other macro and micro factors impacting the cryptocurrency market.

All in all, today’s article will help you create a much clearer picture regarding price fluctuations. Plus, it will provide you with all the essentials to get started with Moralis Money. As a result, you’ll be able to stay ahead of the curve at all times!

Why is Crypto Down Today?

“Why is crypto crashing right now?” is a common question people ask, and there are many different reasons why. We will look at those reasons in a bit; however, when we analyze the “why is crypto down?” question, isn’t it true that you’d also like to know how you can anticipate price movements?

The answer to that lies in on-chain data.

Most tools providing this data are usually created by data scientists who do not have any trading experience. As a result, they cause information overload, which leads to analysis paralysis or confusion. Fortunately, there’s a new tool simplifying the entire process to discover what crypto to buy now as the price is low.

With Moralis Money, you can start utilizing fully customizable filters today! That way, you get on-chain data in an easy-to-understand and actionable manner. So, if you want to anticipate cryptocurrency moves, take Moralis Money for a spin:

Cryptocurrency has no regard for office hours or timezones – it’s on 24/7! Also, as we’ve already mentioned, this market is extremely volatile. These two characteristics combined result in countless opportunities. Every fast, large move up or down allows you to pocket great profits if you time your positions correctly. Of course, these moves can also wipe you out. So, proper timing is the key!

Main Reasons for Crypto Market Fluctuations

A significant reason for large and fast moves in crypto is size. Even the largest cryptocurrency, Bitcoin, is still relatively small. As such, major holders (whales) can significantly impact the price by buying or dumping their stack or shorting or longing the market.

Another important aspect is the overall traditional global financial market conditions. There’s only one economy. It would be foolish to expect that crypto markets can be isolated. Their relationship with various traditional markets varies – it can move with them or even in the opposite direction.

For instance, when the tech markets suffer a loss of appreciation, crypto markets also suffer. Overall, it’s safe to say that any turbulence in the overall traditional global markets spills over into crypto. In addition, here are some macroeconomic events/factors to consider:

- Rising interest rates

- Inflationary fears

- Global conflicts (e.g., the fallout from the Ukraine conflict)

- Pandemic crisis

- Bank rumblings

- Supply chain issues and bottlenecks

Crypto can sometimes react in the opposite direction of traditional markets. After all, many investors who understand crypto see cryptocurrencies as a hedge against traditional markets.

With that in mind, growing fears in legacy finance systems have the potential to push the cryptocurrency market toward the upside.

Is the Bitcoin Price Why Crypto is Down Today?

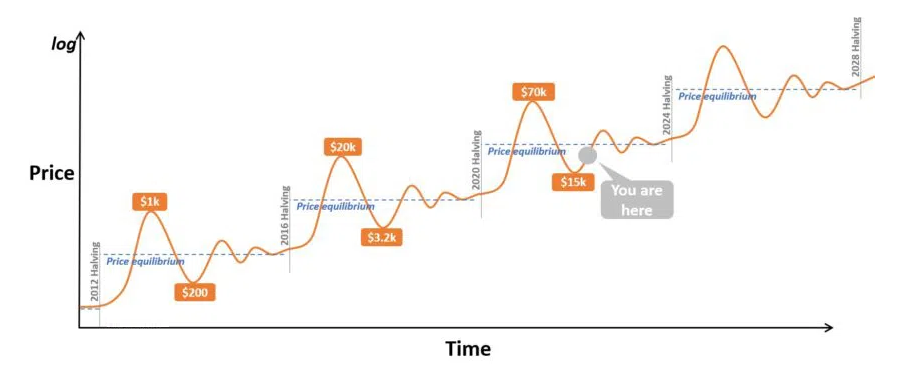

The above-mentioned macroeconomic aspects usually affect the crypto market as a whole. However, the crypto space has its own cyclical nature.

As you may know, the entire crypto market follows its own market cycles. So far, these cycles have coincided with Bitcoin halvings, which take place approximately every four years. The Bitcoin halving refers to the event when the reward for mining new Bitcoin blocks is reduced in half. This means that BTC miners receive 50% lower rewards for verifying on-chain transactions.

The Bitcoin halving refers to the event when the reward for mining new Bitcoin blocks is reduced in half. This means that BTC miners receive 50% lower rewards for verifying on-chain transactions.

With that in mind, it’s obvious that you should never enter any crypto trade or investment without knowing (at least approximately) where we are within the ongoing crypto cycle.

Bitcoin’s dominance has gone down a lot over the last two cycles. However, the first cryptocurrency represents nearly 50% of the entire crypto market. Thus, whenever the price of BTC is down, you can expect it (with some occasional exceptions) to drag the entire crypto market down with it.

So, all factors that affect the BTC price (e.g., Bitcoin mining fallouts) also impact the rest of the crypto market. When considering crypto as a whole, you also need to keep in mind that this market is pretty young. It is still much like a “wild wild wild west.”

Currently, only a few countries have clear regulations when it comes to crypto companies, crypto investing, and crypto trading. As such, new crypto regulations (or just rumors about them) can impact the entire crypto market. Especially if the regulation is being enforced in a larger country, and if it is unfavorable (usually is), it tends to cause price drops.

What is a Bear Market?

A bear market refers to a phase when prices are in a clear downtrend on large timeframes (weekly, monthly). For the crypto space, a bear market means large price drops from their previous all-time highs (ATHs). For Bitcoin, this can be more than an 80% price depreciation, but for altcoins, this can be a lot more brutal.

The opposite of a bear market is a bull market. While most folks divide crypto markets into these two parts, it’s more accurate to consider every market cycle in four stages: accumulation, markup, distribution, and markdown.

Plus, it’s important to keep in mind that even if crypto is down, there are also lots of local moves up during bear markets. Moreover, those who use Moralis Money will be the first to discover which cryptos are most likely to break out soon!

Individual Crypto Markets

When you look at specific crypto markets, the reasons for “why is crypto down?” get a whole new dimension.

Short-lived price pumps and dumps of individual projects follow their own beat. That is especially the case during the bull run when traders are trying to find tokens before they pump.

Here are the most common micro aspects to consider when looking at a price drop in crypto:

- Whale (holders with large positions) activity

- “Buy the rumor, sell the news” events

- Important announcements

- Project airdrops or token burns

- The blockchain network in question could be having issues or experiencing downtime

- Hacks or scams like rugpulls

Will Crypto Be Up Tomorrow?

Even in the middle of a bear market, there are many days when the price can rally quite a lot. As such, there will always be many “tomorrows” when crypto will be up.

Also, it helps to zoom out on some of the early cryptocurrency assets that are still around. For instance, if you look at the BTC price, you will see that despite several pullbacks, the asset is overall gaining value. Of course, whenever you are in a bull market, higher prices are more likely than in a bear market. Still, once you know how to find new coins early and determine what crypto to buy now (or sell), you can profit in any market, especially if you focus on altcoins!

Did you know the average altcoin experience 50x-70x gains during a crypto bull market? That said, the price appreciation can be a lot higher – even 100x or 1000x is not that uncommon.All in all, many factors impact the crypto market, and you can easily get lost in analyzing them all. Fortunately, on-chain data can help you cut through that fog of uncertainty and confusion. That’s why Moralis Money is so powerful.

Now, you don’t have to be a full-time crypto trader to understand the crypto markets.

Moralis Money is designed to help you overcome the three main obstacles that crypto traders face:

- Avoid FOMO with Token Explorer

- Dodge scams with Token Shield

- Bypass lack of time with Token Alerts

With this game-changing tool, you can spot the next big crypto coin on autopilot. But remember – timing is key! So, make sure to get ready today!

Getting Started with Moralis Money

The best time to search for opportunities is typically when crypto is down. As such, instead of wasting your energy on figuring out why crypto is down, you better determine what the best crypto to buy right now is.

Fortunately, you can do that without breaking a sweat with Moralis Money’s core features:

- With Token Explorer, you query real-time, on-chain data to get a list of crypto tokens experiencing increasing or decreasing momentum. Then, you can easily position yourself on the right side before a large move. This allows you to finally say goodbye to FOMO when the price is at its peak!

- Token Shield helps you reduce risk by marking tokens with security scores. No more rugpulls for you!

- Token Alerts lets you set up email notifications and automatically detect whenever a new coin matches your preset criteria. With Token Alerts, you’ll find hidden crypto gems on autopilot!

Here’s how you can get started with Moralis Money in four simple and easy steps:

- Visit Moralis Money and open Token Explorer.

- Apply the Coin Age filter to find all the coins minted in the last X days.

- Use the “Add Another Filter” button to further refine your list and remove garbage coins. You can choose between many filters, including Holders, Buyers, and Experienced Buyers.

- Mix and match additional filters to find your winning combo. So, just select a metric, select a filter, enter a value, select a timeframe, and run your query!

You can complete the above four steps in a matter of seconds.

However, for an even faster start, you can use preset filters:Finally, you have a proper chance to front-run those massive crypto moves!

How to Use Token Shield?

Token Shield does its thing automatically! Whenever you run a query with Token Explorer, you’ll see security scores for all tokens that match your filters. By using the color-coded shield icons, you can lower your risks. Of course, it is up to you to determine your risk tolerance. However, we recommend sticking to tokens with green shields to stay safe.

In addition, you don’t have to manually analyze the security scores of all the tokens on your list. Instead, you can further refine your list based on those numbers. For example, this is how you’d get tokens that have a security score of 80 or higher:

How to Switch Among Supported Chains

Moralis Money’s team of expert altcoin traders and Web3 developers understood the importance of having access to multiple networks. As such, you can use Moralis Money to explore opportunities across all leading chains.

Aside from some obvious choices, such as Ethereum and BNB Chain, Moralis Money also supports popular layer-2 (L2) networks. So, you can use Token Explorer to find gems on Arbitrum, Optimism, and Polygon.

Switching between networks with Moralis Money is as easy as pie – these are the two clicks that do the trick:

- Click the network option

- Select the network you want to explore

Full Guide: Why is Crypto Down Today? – Summary

Throughout today’s article, you learned that there’s no simple answer to the “why is crypto down?” question. However, in short, it could be due to the following reasons:

- Troubles of the overall traditional global financial markets

- Tech industry downtrends

- Crypto cycles (bear market)

- Unfavorable crypto regulations

- Issues with Bitcoin miners (e.g., electricity blackouts)

- Whales dumping their bags

- Hacks, scams, tech issues (primarily affecting individual projects)

- “Buy the rumor, sell the news” events

You also learned that crypto remains highly volatile and offers many opportunities. Thus, the 50x-70x gains are still in the cards for the next bull run.

You now know you can spot those opportunities with Moralis Money. As we explore this tool further, you also received an actionable answer to “how to get rich quick?” – by investing in the right altcoins at the right time!

So far, every cycle has given birth to several opportunities like the one offered by the HEX crypto asset. Hence, there’s no need to stay fixated on the “is it too late to buy HEX?” concern. That said, make sure to check out our HEX crypto price prediction. Also, if you are a HEX fan, you may want to prepare for the PulseChain mainnet launch.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)