DeFi Season Is On The Horizon

In an article from last year, I described the DeFi sector as an ice cream business on the beach, with winter equivalent to a bear market. It’s pointless selling ice cream on the beach during winter, which is why many experienced DeFi investors close up shop during a bear market. In the form of Crypto assets, collateral is converted to stablecoins and fresh accumulation begins, once a bear market bottom has been found.

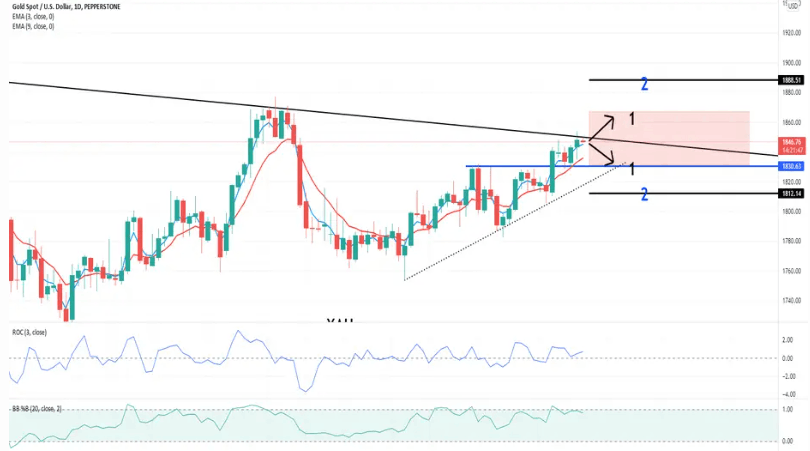

In August of 2022, I called for a Bitcoin bottom in September. This was the case and subsequently created the perfect opportunity for fresh BTC accumulation. Altcoins are always last to respond. Bitcoin usually leads the market for months before altcoins begin responding. The initial response from altcoins is often unimpressive. However, don’t let that fool you. Altcoins are unlike BTC.

Altcoins usually experience multiple mini-altcoin seasons with the ultimate and final season lasting a few weeks. This is when and where altcoins pop! This dynamic is detailed in a previous article, “The Most Anticipated Altcoin Season”. Understanding this is key to maximizing altcoin gains. With “Altcoin Summer” on the way, staking and DeFi protocols are likely to begin spiking, regarding TVL and volume.

DeFi Gains Are Relative To Cost

As a DeFi investor, Crypto assets are your collateral, and the cheaper you can acquire these assets, the better. Relativity is at the heart of financial markets, trading, and DeFi dynamics. Developing and understanding relativity ratios can seriously up your game. What can appear to the inexperienced investor as a simple decision, is often founded on a keen understanding of multiple dynamics, including relativity ratios.

This is perhaps why many newcomers believe investing and trading are relatively straightforward. They witness the manifestation of a trading idea while failing to see and understand the deeper dynamics of its creation. DeFi and staking become incredibly lucrative for the investor who has managed to acquire their assets at discounted prices. Furthermore, once these assets are appreciated, the ratio becomes increasingly attractive. This is why heavy altcoin corrections during a bull market are not to be feared but utilized as buying opportunities. Buying the dip in a bull market should be the standard practice of a Crypto or DeFi investor. Isn’t it funny how investors jump to buy the dips in a bear market and yet become hesitant in a bull market when they should be scooping as much as possible? It’s this counterintuitive behavior that hinders true success in the altcoin market.

This is why heavy altcoin corrections during a bull market are not to be feared but utilized as buying opportunities. Buying the dip in a bull market should be the standard practice of a Crypto or DeFi investor. Isn’t it funny how investors jump to buy the dips in a bear market and yet become hesitant in a bull market when they should be scooping as much as possible? It’s this counterintuitive behavior that hinders true success in the altcoin market.

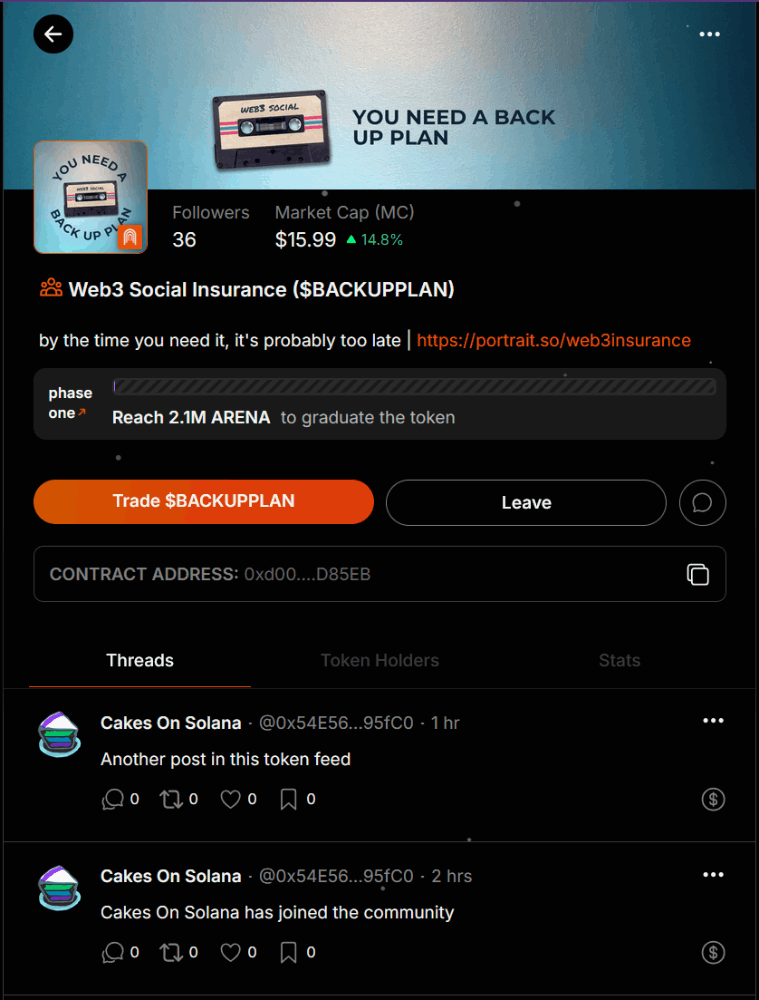

Investors should already have their desired allocations for DeFi and staking protocols. However, life and unexpected expenses can often set one back. That’s why it’s important to build a few passive income mechanisms that can at least aid in ongoing accumulation. Even if they seem insignificant, daily capital void of work, effort, and time is incredibly valuable, especially in our current age.

Final Thoughts

I remember the enormous DeFi yields that were being enjoyed in the final stages of the previous bull market. It’s worth working towards, even if you cannot reach your desired goals, the rewards are truly satisfying. Remember that Crypto and WEB3 offer many income-generative ideas just waiting to be explored. Stay safe, keep stacking, and I will catch you in the next one!

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in me receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.

- Earn yield on your BTC, ETH & stablecoins - https://shorturl.at/uyLT0

- Tokenized real estate / $20 Voucher - https://shorturl.at/joEN5

- Earn free ETH & OP reading & creating - https://shorturl.at/JPW58

- Earn HIVE & HE tokens reading/creating - https://shorturl.at/fBHPX

- Earn free SLCL (SPL) reading/creating - https://shorturl.at/quvP3

- Trade & buy altcoins & micro-caps - https://shorturl.at/atuMS

- Trade Crypto assets & futures - https://shorturl.at/uwSY3

- Earn passive income - https://shorturl.at/gxCIP

- Earn passive BTC - https://shorturl.at/fgEK2

- Free BTC every hour - https://shorturl.at/beinD

- Free BTC & DOGE - https://shorturl.at/dfiK1

- More passive BTC - https://shorturl.at/ahjI1

- Trade & buy altcoin gems - https://shorturl.at/yDENP