I Uncovered What Crypto Millionaires Are Buying (The Next 1000x Altcoins)

I

set out to uncover some of the top altcoins that millionaires and even crypto billionaires are buying.

How did someone in 2018 when Bitcoin was less than $5,000 identify, spend $400 on this crypto, that less than three years later, would be worth over $4 million!

They could have bought anything from Ethereum, a flat-screen TV, or even their very own water park. Was all of this a coincidence? or was there a secret to staying ahead of the markets that they knew that we did not.

Today, we’ll be trying to find this truth by uncovering what many crypto millionaires are buying in this bear market.

Uncovering the Crypto Millionaires’ Secret: How They Made Millions

To do this, we are going to be going whale hunting, looking for clues that these large crypto investors or whales leave behind when they buy crypto projects. In the hopes of us finding crypto projects that could potentially 1000x come the next bull market.

We’ll be using a combination of four different tools.

Following the Whales: Tracking Crypto Investors’ Moves

But before uncovering what I found with these four tools, first we need to discuss why even do this in the first place.

Let’s say there is an investor, Jeff, and he’s invested early in companies like Airbnb, Uber, and Facebook. Now, this would suggest that he probably has a good inside look at what companies to invest in early. So what if we could see what he was investing in before everyone else?

Well, in traditional investing, that is near impossible. But with crypto and using the blockchain, we can see what these crypto millionaires using their wallet addresses are buying.

And that’s because every transaction that’s ever been recorded is saved on the blockchain, but it’s not as simple as following every large crypto wallet address to find these hidden projects.

Some large crypto-walled addresses aren’t active anymore, or others are actually of exchanges like Binance or Kucoin.

We are looking for active investors who have at least several million dollars in crypto, and we can do this by using the first tool.

Tool 1: Block Explorers — Peeking into Crypto Wallets

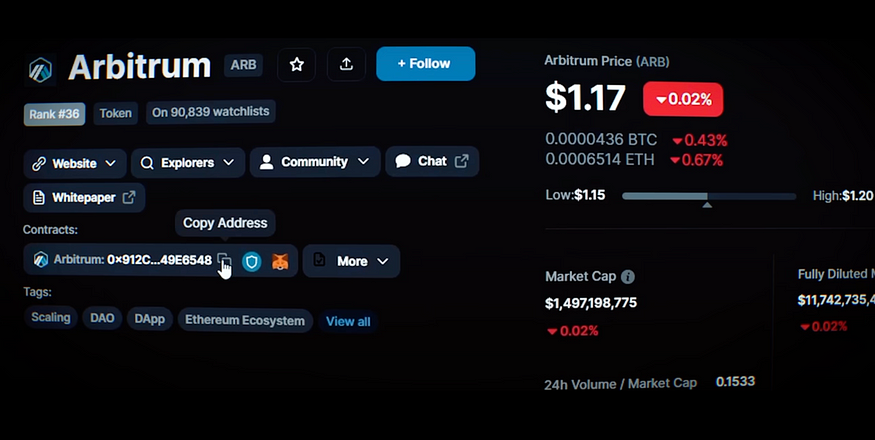

First, we need to head over to a site like Coin Market Cap, and look up any crypto of your choosing. In this case, we’re going to be using Arbitrum, and that’s because it’s a fairly new crypto that just launched, which means that it’s likely to have more active users on this platform. From there, we can click on the contract address, and this is going to bring us to our first tool, the Block Explorer.

In this case, we’re going to be using Arbitrum, and that’s because it’s a fairly new crypto that just launched, which means that it’s likely to have more active users on this platform. From there, we can click on the contract address, and this is going to bring us to our first tool, the Block Explorer.

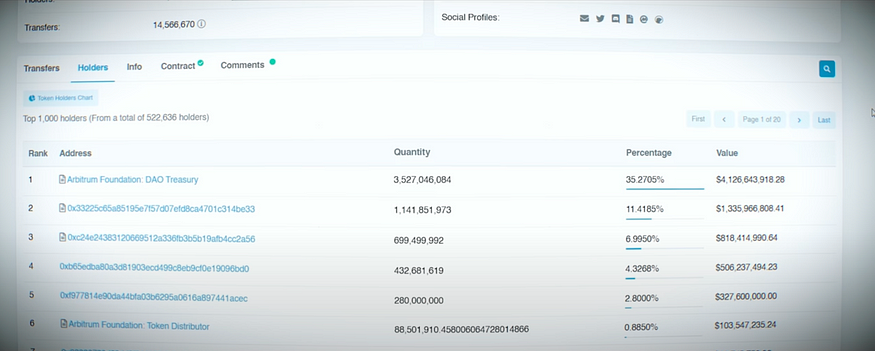

Now, every crypto is going to be different, but all you have to do is click on the contract address, and it will take you to the appropriate one. Once on the Block Explorer, you can go to the holder’s tab and you can see every investor of this particular crypto from largest to smallest. But looking at large crypto wallet addresses for breadcrumbs is only part of the equation because remember we’re looking for actual investors that are active.

Once on the Block Explorer, you can go to the holder’s tab and you can see every investor of this particular crypto from largest to smallest. But looking at large crypto wallet addresses for breadcrumbs is only part of the equation because remember we’re looking for actual investors that are active.

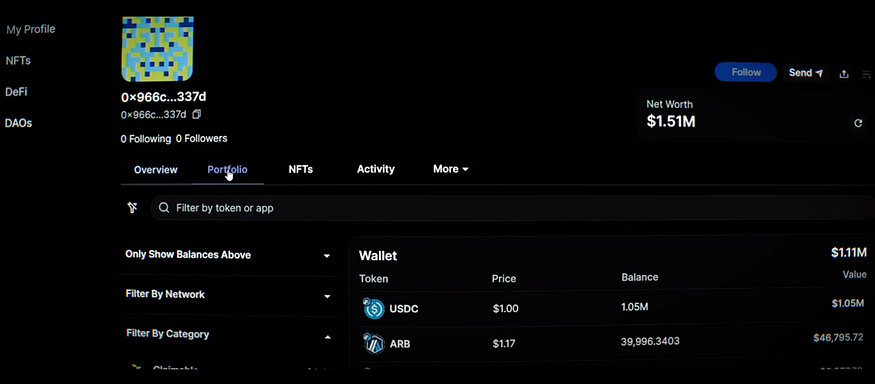

But after looking, I found a wallet address that had $53,000 worth of Arbitrum. And right away, you can see this wallet is worth $1.5 million and has over a dozen different cryptos.

However, we’re not done because we need to see exactly what they’re buying. And viewing wallet addresses portfolios inside of Block Explorers isn’t very easy to use and can sometimes feel like searching for a needle in a haystack.

However, we’re not done because we need to see exactly what they’re buying. And viewing wallet addresses portfolios inside of Block Explorers isn’t very easy to use and can sometimes feel like searching for a needle in a haystack.

But we can paste this wallet address over in zapper.fi, the second tool.

Tool 2: Zapper.fi — Streamlining Crypto Portfolio Analysis

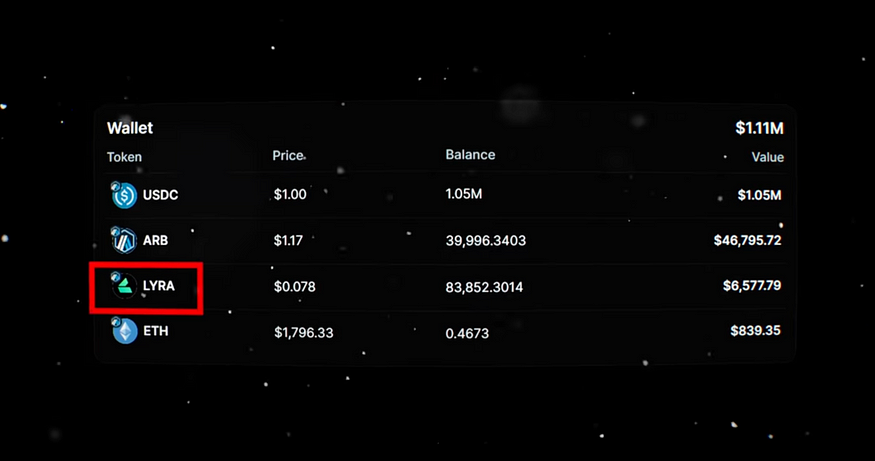

From here, we can get a nice breakdown of all the different cryptos that are in this portfolio along with exact amounts. Now, there are quite a few tokens inside of this wallet, but one, in particular, that I had not heard of before was that of Lyra, a decentralized protocol that has a market cap of $30 million. And what’s interesting here is that out of his entire $1.5 million portfolio, he only has $7,800 in this project, which may sound like a lot, but to put this in perspective, it would be like having $1,000 total to invest in crypto and only putting in $5 into a project.

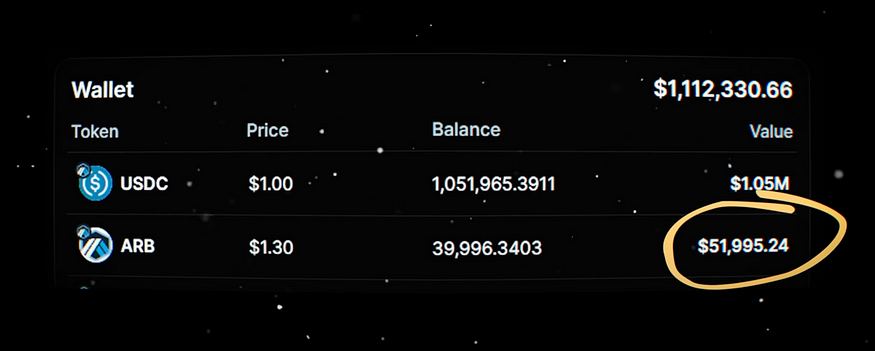

Now, there are quite a few tokens inside of this wallet, but one, in particular, that I had not heard of before was that of Lyra, a decentralized protocol that has a market cap of $30 million. And what’s interesting here is that out of his entire $1.5 million portfolio, he only has $7,800 in this project, which may sound like a lot, but to put this in perspective, it would be like having $1,000 total to invest in crypto and only putting in $5 into a project. And this is only the tip of the iceberg. But let’s move on to another wallet. Now, this wallet had $57,000 worth of Arbitrum and a little over a million dollars in total across the different projects it’s in.

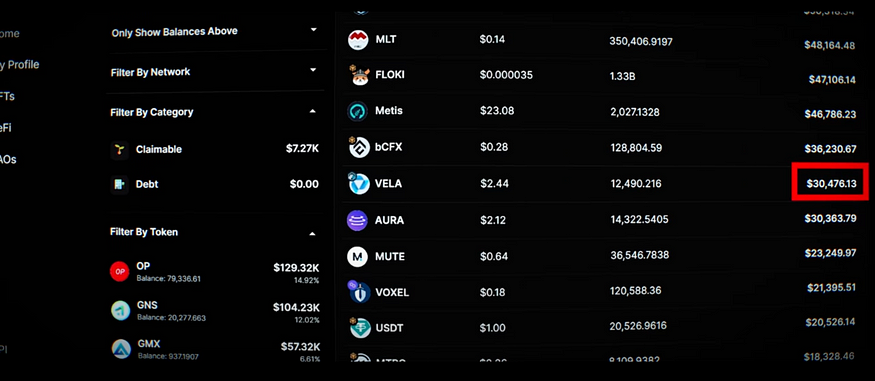

And this is only the tip of the iceberg. But let’s move on to another wallet. Now, this wallet had $57,000 worth of Arbitrum and a little over a million dollars in total across the different projects it’s in. Now, a crypto protocol that caught my eye was that of Vela Exchange, which is a hybrid exchange on the Arbitrum ecosystem, and they have over $30,000 worth of this token, which is over 3% of their entire portfolio. So this is significantly higher than the other project that we looked at compared to the last portfolio.

Now, a crypto protocol that caught my eye was that of Vela Exchange, which is a hybrid exchange on the Arbitrum ecosystem, and they have over $30,000 worth of this token, which is over 3% of their entire portfolio. So this is significantly higher than the other project that we looked at compared to the last portfolio.

But this entire process is very time-consuming, and there’s actually software that will do all of this heavy lifting for us. And this brings us to tool number three, whalestats.com.

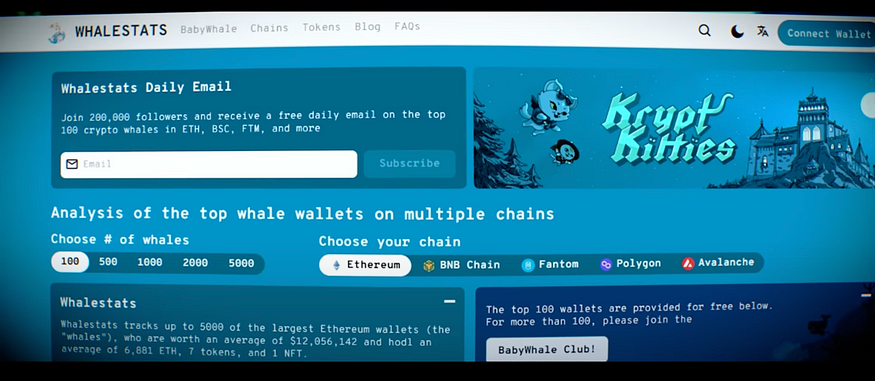

Tool 3: Whalestats.com — Unveiling the Wealthiest Crypto Whales

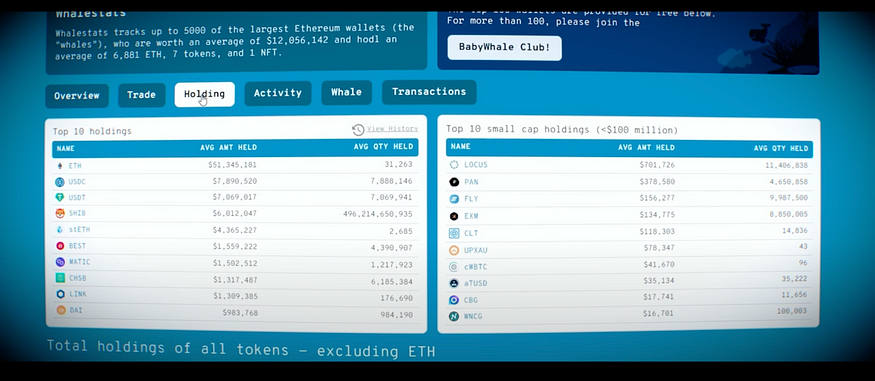

This tool pulls together top whales and lets us not only see what the wealthiest people are buying but also gives us an entire breakdown of their portfolio.

So when looking at the top wallets on the platform right away, you can see a wallet that’s valued at over 44 billion. But the wallet that caught my attention had over half a billion dollars in it and over a hundred different tokens. And this is where I wanted to start my search.

So when looking at the top wallets on the platform right away, you can see a wallet that’s valued at over 44 billion. But the wallet that caught my attention had over half a billion dollars in it and over a hundred different tokens. And this is where I wanted to start my search.

Now, right away, the most noteworthy part about this portfolio is that they have over $300 million in Shiba Inu. Now, this sounds crazy, but since the launch price of Shiba Inu has increased by over 15,000,000%, they could have actually gotten that $300 million from investing as little as $1,500 bucks. But I believe Shiba Inu has had its day for these types of returns. So I wanted to look at some smaller projects inside of the list.

Moving down, you can see that he has over $12 million of incoming crypto transactions, one of the top being $7 million worth of Matic. And I think Polygon Matic is a great layer two with a lot of functionality, but there’s no way that project is going to 100x anytime soon. And to do so, it would have to increase by over $900 billion, which is almost the entire net worth of crypto as a whole right now.

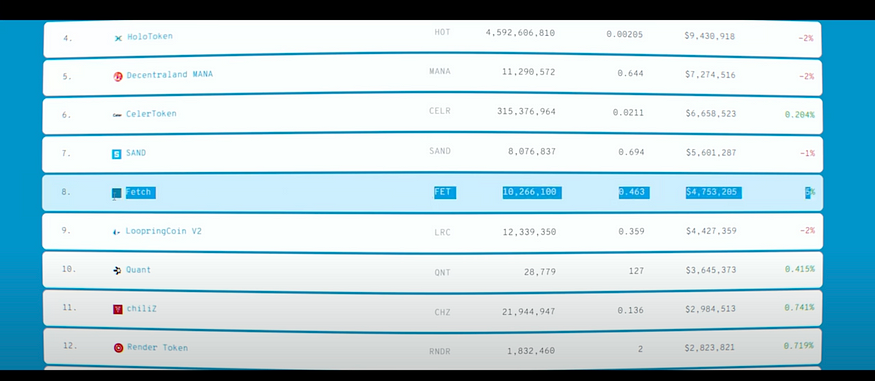

Moving on to some of the smaller tokens, it gets a bit more interesting. Now, he has some common metaverse projects such as Sand and Mana, but one project, in particular, that caught my eye was Fetch.ai, and he has $5 million worth. Now, this is an artificial intelligence project, and the thing is with these AI crypto projects is I’m just not sure if I’m sold on them as a whole. Yes, AI does have some use cases, but it seems like these crypto projects know that if they throw AI anywhere inside their protocol, people will come to it almost as if it’s like a marketing service.

Now, this is an artificial intelligence project, and the thing is with these AI crypto projects is I’m just not sure if I’m sold on them as a whole. Yes, AI does have some use cases, but it seems like these crypto projects know that if they throw AI anywhere inside their protocol, people will come to it almost as if it’s like a marketing service.

Now that being said, he does own $5 million worth of this crypto, but once again, $5 million to him would be the equivalent of if you had a thousand dollars to invest in crypto only putting in $10 into this project.

So still very small amounts here, but there’s one tool that I may even like a bit better than Whale Tracker, and that’s Whale Trades.

Tool 4: Whale Trades — Real-Time Tracking of Crypto Trades

It does a combination of what the three other tools previously do except it shows live trades from about 15 major exchanges. Using this tool, I found a crypto wallet that has about $3.5 million worth of altcoins. Now, what’s interesting about this wallet is that they have over 40 different projects. Now, their top position is Sand, which is worth a little over $300,000, and that’s already on my watch list.

Using this tool, I found a crypto wallet that has about $3.5 million worth of altcoins. Now, what’s interesting about this wallet is that they have over 40 different projects. Now, their top position is Sand, which is worth a little over $300,000, and that’s already on my watch list.

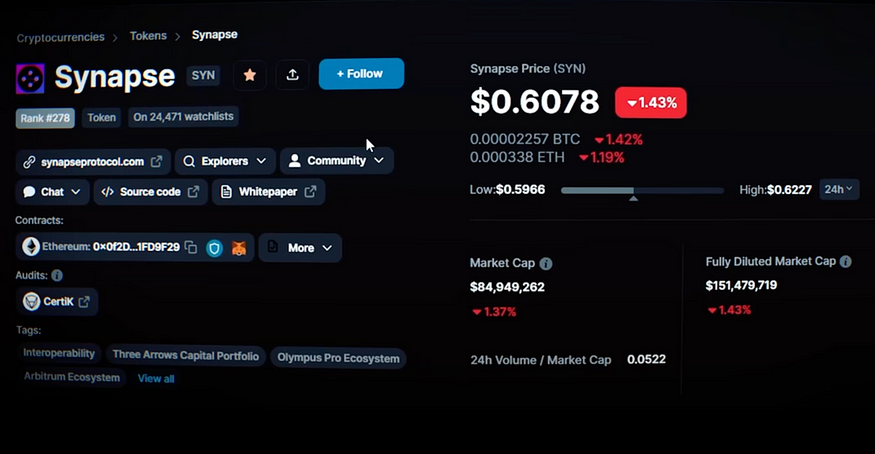

Now moving down, you can see that they have some more familiar tokens such as Ethereum, Matic, Fantom, Mana, and I was familiar with a lot of these projects on the list until I got down into one, in particular, which is the KNS token or Kyber network, which is a decentralized exchange on Ethereum, and it’s retraced by almost 90% with a market cap of over a hundred million dollars. So this is definitely a smaller project, and I added it to my watch list. Now, one more small altcoin that I found in this portfolio was Synapse. And this protocol specifically focuses on crypto bridging, and this helps facilitate transactions between large cryptocurrency projects.

Now, one more small altcoin that I found in this portfolio was Synapse. And this protocol specifically focuses on crypto bridging, and this helps facilitate transactions between large cryptocurrency projects.

Now, I do have some other projects inside of my portfolio already that do have some type of bridge component, but I don’t have one that is solely focused on bridging as a whole. So I went ahead and added this one to my watch list, and the fact that it’s at a 150 million market cap, and that may sound like a lot, but it’s peanuts really compared to middle and big caps. But what I’m doing not only with this crypto wallet address but other ones that I come across in my research is:

But what I’m doing not only with this crypto wallet address but other ones that I come across in my research is:

- I’m taking them over to Zapper.fi, and I’m going to set up notifications. So if a large transaction occurs, I can be notified immediately.

But out of these projects, which ones did I actually pull the trigger on to add to my portfolio?

Well, the answer to that is none of them right now because I think that more important than the actual cryptos I mentioned is the method in which I used to find them.

Because none of these cryptos may take off. Some of them may, some of them may not, but one of them will, and I will find that by continually using this method.

The tools mentioned in this blog, including Coin Market Cap, Block Explorers, Zapper.fi, Whalestats.com, and staying updated on social media and news platforms, can aid in discovering altcoins that are attracting the attention of wealthy investors.

However, remember that investing in cryptocurrencies carries risks, and it’s crucial to make informed decisions based on your own research and risk tolerance.

Always consider consulting with a financial advisor or professional before making any investment decisions, especially in the volatile and rapidly evolving world of cryptocurrencies. Happy hunting for the next hidden gem!

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)