Tokenization of Real-World Assets: All You Need to Know

With the growth of cryptocurrencies, investors worldwide have begun showing interest in making a digital version of their real assets.

There are a lot of processes to go through when embarking on the journey of tokenizing a digital currency.

Imagine buying and selling your assets on a blockchain on the crypto market.

Here we will explore the depth of real-world asset tokenization, explaining vividly what is involved in it.

What is Asset Tokenization?

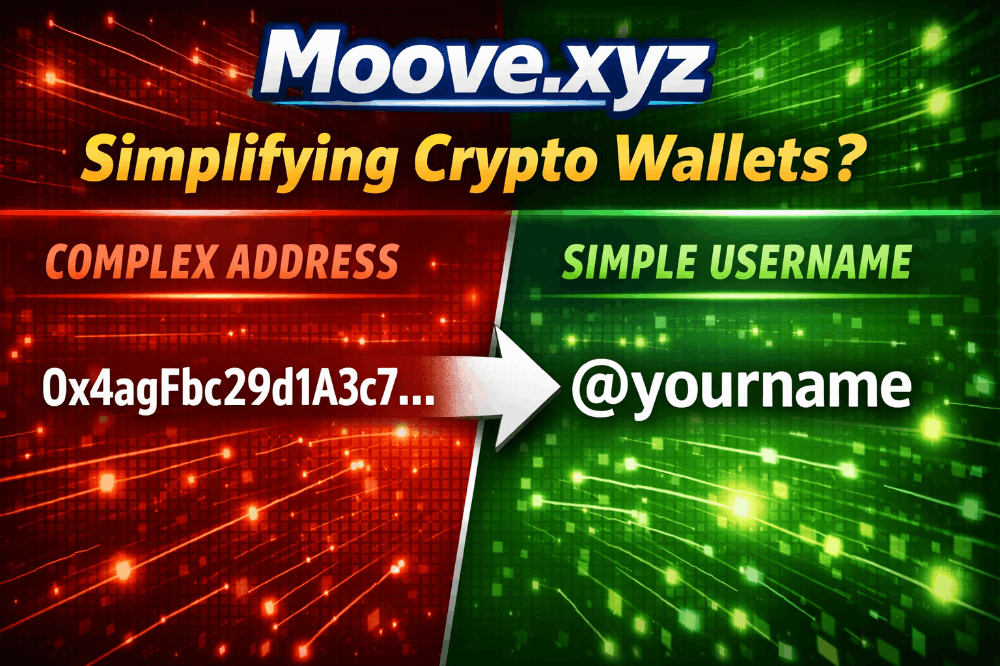

Resource tokenization alludes to the method of recording a given resource's privileges into a computerized symbol that can be held, sold, and exchanged on a blockchain.

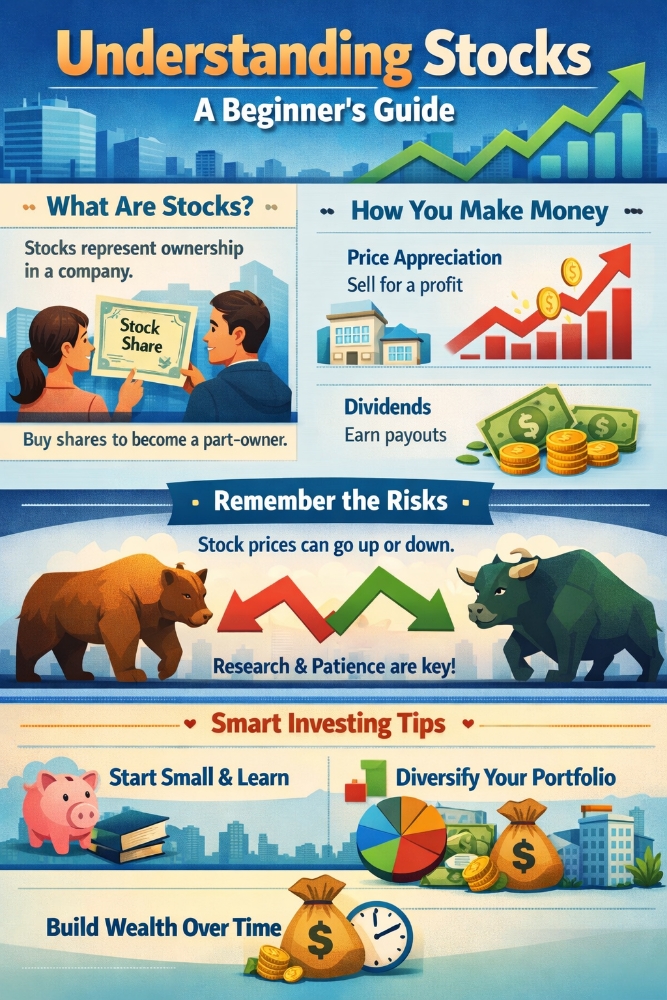

The subsequent tokens address a stake of proprietorship in the basic resource. Any resource, whether actual like land or immaterial like stock in a partnership, can hypothetically be tokenized.

Transforming these resources into computerized tokens makes them all the more effectively distinct, considering fragmentary proprietorship that empowers more individuals to contribute, which can thus make the business sectors for those resources more fluid.

Resource tokenization can empower direct, distributed exchanging of customary resources that now require go-betweens, and can likewise carry more prominent security and straightforwardness to the commercial center.

How is the Blockchain Technology Important?

Image Source

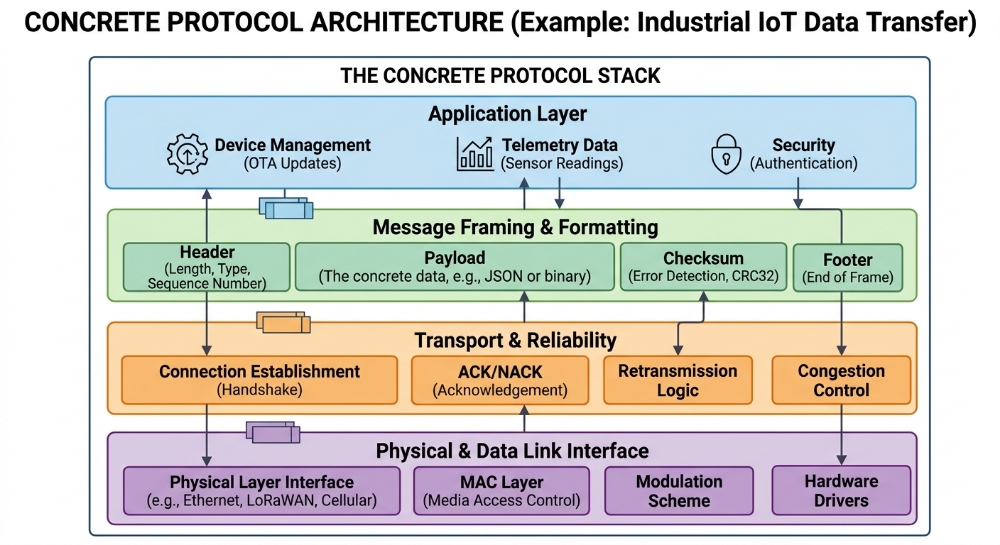

Blockchain technology is at the center of resource tokenization. Blockchains are computerized records of exchanges and resource adjustments put away across organizations of PCs, bringing about a permanent data set that goes about as a solitary, shared wellspring of truth.

Blockchain innovation supports digital currencies like Bitcoin and Ether, giving a safe, straightforward, and decentralized stage for following the possession and move of tokens.

The decentralized idea of most blockchains implies that no single substance can modify the record, upgrading resource security and bringing down the gamble of extortion.

What is the Tokenization Process?

How can one change a genuine resource into a computerized token on a blockchain?

The response will differ based on the project, yet this illustrates how it could work, involving a piece of land as our model.

1. Make the Digital tokens

The first and most significant step is to make the tokens that address partakes in the land property.

To do this, one could make a legitimate element that would exist exclusively to possess the genuine land being tokenized.

The computerized tokens would address partakes in the substance, qualifying holders for a piece of the land's worth and advantages, like rental pay or appreciation.

2. Smart Contract Execution

The issuance, balance following, and payouts of advantages related to the computerized tokens addressing a tokenized resource would be generally represented by brilliant agreements.

Savvy contracts are decentralized projects based on blockchains that satisfy explicit capabilities and run in light of straightforward, auditable code.

Because of a tokenized land property, the related brilliant agreements could deal with basic capabilities like the circulation of rental pay, execution of administration choices decided on by token proprietors (like a DAO), and installment of costs related to keeping up with the land.

3. Token Sale and Distribution

When the advanced tokens and essential brilliant agreements have been made, the following stage is to offer the tokens to financial backers.

This should be possible through confidential deals, an open deal to the general population, or a blend of the two using a whitelist model, as many other crypto projects have done.

The proficient fractionalization of the resource empowered by tokenization could make a greater, more fluid market for the resource.

4. Resource the Board and Administration

As we implied before, when the tokens have been sold, holders can play a job in administrating the basic land, including actual support, occupant relations, and property upgrades, and that's just the beginning.

The specific degree of control given to token holders and as an aggregate and the cycle for deciding on choices would need to be spread out in the important legitimate substance's sanction and encoded into the brilliant agreements related to the resource.

5. Optional Market Exchanging

Tokens addressing shares in the land property could likewise be exchanged on optional business sectors after send-off.

This is where the liquidity benefits become possibly the most important factor.

As opposed to being left with an unsellable property as so many land financial backers have throughout the long term, token holders in this model would have more noteworthy adaptability and a possibly more extensive biological system of purchasers with whom to investigate sticker costs.

CONCLUSION

Asset tokenization turns real-world things like land or stocks into digital tokens on a blockchain. This allows for easier trading, fractional ownership, and potentially more secure transactions. Blockchain technology is key for recording ownership and making the process secure. The tokenization process involves creating digital tokens, smart contracts to manage them, selling the tokens, and potentially trading them on exchanges. This can make traditionally illiquid assets more accessible to investors.

Thank you for reading through this post. Please remember to react to the post and share your thoughts in the comment section below.