How crypto helped turn a 22K debt into 25K profit

I was pushed into the crypto-verse by a friend and looking back....

I am glad he did so.

The Old Life

In my old life, the pre-crypto one, I was poor and in debt. Now in my new life, I am poor without debt.

I take into consideration that my definition of poor might have changed over the last 18 months.

So in my pre-crypto life, I have always been in debt, basically, since I was a teenager I spent every penny I could get my hands on.

Why?

Because you never know what your last day will be, and you can´t take those pennies with you when you go.

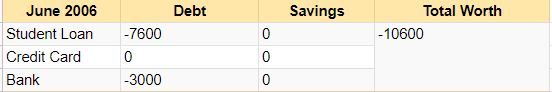

That meant I had a 500 Euro debt when I left high school and a 3000 euro debt when I discontinued my studies, got married, and had a child.

This was my direct debt, in addition, I had a 7600 euro student loan that was waiting to be paid.

And they Did Not live Happily ever After

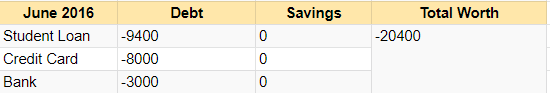

Let´s spare you the ugly details, but 10 years later I was divorced and had an 8000 euro credit debt a 3000 loan, a 9400 euro student loan and I had to pay child support.

By this time I had fully forgotten about the student loan, I moved to a different country and had not received any letters or did any payments since.

Now I will not blame my ex-wife for everything, because I was in debt when we met, but let´s say she did not make it easier. So once divorced I planned to change things around.

My second Life/Love

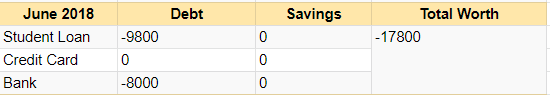

Now just before we divorced, I came into an inheritance, of course, my ex got half. But this allowed me to pay for my divorce and 2000 euro of the 3000 euro bank loan.

More important was that I finally figured out there was a huge difference in the interest you pay for a credit card debt and a bank loan.

Hence I took out a new loan to pay for the credit card debt.

Doing this is not as straightforward as it sounds, because taking out a 7000 Eur loan, to be paid over 7 years, requires several insurances.

Due to these insurances, I will be paying pretty much the same as I previously did during the first 2 years, but after 2 years I was saving a lot of money on interest. And unlike a credit card, I could only pay and not withdraw. So the debt was actually reduced.

I still had those credit cards, fully repaid, and set to end-of-month payments until today.

💩 Happens

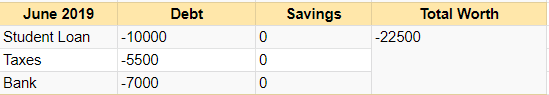

It seems that during my marriage my ex and I were incorrectly informed about where her taxes should be paid. She paid her taxes in the Netherlands and that should have been Spain.

The Spanish Tax Agency has 5 years to check your taxes, anything they find after 5 years will be considered time-barred. Now when this surfaced the Spanish tax agency had about 3 years for which they could still apply her taxes on our mutual income.

Getting back the taxes paid in The Netherlands was possible, but not for me. It required a lot of paperwork, hence it would take months if not years. And well even if she got back some of that money, she was not gonna share.

Because even though we were divorced, I was still (partially) accountable for the time that we were married.

Now there was no way of splitting the 5500 euro, she argued there was no way (in her mind) she could pay a penny.

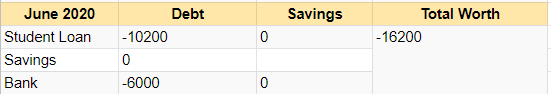

She is receiving a disability pension from The Netherlands and I have a job in Spain. I was afraid that my wages would be garnished if I would let this escalate. Hence I decided to pay all of 5500 in the course of the coming year. I expected to be doing this for another 2 years.

My total (negative) net. worth has never been as bad as that year, -22500 Euro!

As I am so deep in debt I will wallow in it a bit longer.

When you hit rock bottom the only way is up. right?

Now for a bit of good news, I got lucky.

June 2020 arrived, the deadline for the tax assessment passed and I got...... nothing. This gave me an extra year to save money for the last one, which would expire by June 2021.

The Times They Are a-Changin'

Over the last 2 years, my girlfriend and I lived on a very tight budget, with no room for anything but the direct necessities. But I did more to improve the financials.

1. Renting out my parking spot

I was renting an apartment with an underground parking place, but as we did not have a car, we were not using it. Now officially you are not allowed to sublet something you are renting. But if nobody is looking, why not? Renting out that spot makes me one month of rent each year.

2. Keeping score

Secondly, we started keeping track of all money coming in and going out. And if I say we, I mean my girlfriend. I made sure the money was coming in, and she made sure to document every penny going out.

3. Why don´t you get a (better-paying) job

The biggest game-changer was my promotion, it was already discussed in early 2020 but didn´t go into effect till the summer of 2020.

Due to the tax situation, I felt I really had no choice. I explained the whole thing to the hiring manager (a person in our company I met before) and made clear what I would need to earn to be dealing with this situation. He got it and I got even more than I asked for.

Hence in all honesty I was already on my road to financial recovery prior to getting into crypto.

But getting into crypto could only be done due to my financial status becoming a healthy one. Because you should never invest what you can't afford to lose and until 2020 (as you can see) I could not afford to lose a penny.

Actually looking back the last time my finances were healthy was when I was 12 years old, before I started borrowing money from my little brother.

The Gift

That same year I received a huge birthday/Christmas. As I was already saving up to pay the 3rd and last tax assessment, I could use my gift for my first-ever (crypto) investment.

So I bought......

Bitcoin!

And put a $250 on an exchange to see if I could trade my way up.

Now as mentioned I am thankful to the guy who pushed me into crypto at the right time, or maybe just a little too late (but that was my fault as I had no funds).

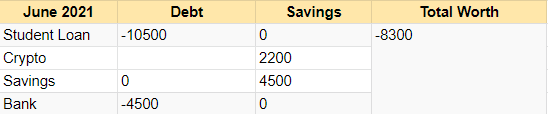

My initial $1000 BTC did very nice in 2021 and thanks to the bull run I had tripled my 250 dollars by the time we hit the bottom in the summer of 2021. During these low months, my portfolio was still worth about 2200 euros.

But 2021 did not end yet

We had a 2nd bull run in October/November of 2021 and I was involved in several projects of which one did amazing. I was able to take out all my investments and still have a 12K portfolio by Christmas.

Now over time, that portfolio dropped a bit thanks to this lovely bear market but as it´s May and I am still holding over 9K in crypto I think it´s okay to put that number down for June.

As I was used to saving 4500 because of the taxes I did so again this year. But I managed to save much more. I took out 1250 euros from my crypto investments and another 1250 euros from the profit in December 2021. Which totals 11.500 in savings.

Due to my new job and increased salary, I was able to save another 700 euros each month by sticking to the old budget, and that money I could use to buy more assets. No crypto this time but bricks.

Instead of throwing away money paying rent, I was able to buy an apartment and pay to become the owner of my first bit of real estate.

Now 2022 was not all happy-happy joy-joy as after 12 years of silence I was contacted by the student loan instance?????.

Twelve years of nothing and it was as if they could smell the money. All of a sudden they knew where to find me. Well, we made a deal and I started paying them already so my Student Loan did not increase.

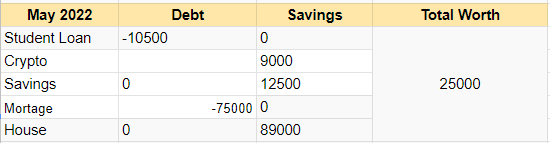

I did save enough to pay off my bank loan and my financial position by June 2022 must look something like this:

So where did that Crypro help you?

I knew you were going to ask that. And the answer is simple.

First of all crypto made me money more money than anything else, but that is the least important part.

Crypto and stacking sats became a game. The more I could stack, the better. So I started looking into the best places to earn, and once I started earning I looked into the best places to store those earnings.

Best does not mean the highest APY´s, but basically a safe place where I can store holdings from a good project and get a nice little bit of interest.

Now, all that reading and writing about crypto taught me a lot about finances. Something I did not care for all those years I was flat broke.

Where was I still Losing Money?

The loan I took out to pay for the credit card debt cost me more than the return I could get if I used that money to invest in a solid crypto project. So I decided to pay off my bank loan 3 years before the deadline.

How can I increase my holdings?

Increasing my holdings led to me buying an apartment and basically staking a bit of money into a project each month. While no longer throwing away money monthly for that same roof over my head.

Where do I make the most interest?

The things I learned taught me that I should not pay off my Student Loan in one go!

The interest on that loan is only 2 % a year. If I invest that money in Bitcoin the expected roi will be much greater than 2%.

The whole stacking sats game made me realize to just keep picking up pennies from the street, just like I do in the crypto-verse (earning through Brave, PreSearch, Cake Defi, NoiseCash, Torum, HIVE) because those little bits will be a lot if you do it daily.

There is money to be made on the streets.

An Amazon product you receive that has just a bit of damage. I got many products for free or at a discount just by contacting the seller (not Amazon).

Shopping once a week and not every other day and buy a lot when the prices are low (I also buy more seats when a coin is on sale).

Review your monthly payments like insurances to ensure you only pay for what you need and keep comparing yours to the offers out there.

Bottom Line

Of course, in the end, it´s the mindset that you need to change.

You need to step up and say enough is enough...I ain´t paying for this sh!t anymore. Then get rid of your ex-wife and start getting rid of that debt.

Once that mindset is changed, diving into crypto will help in understanding finances and how you can make the most of what you got....or have not got (yet). At least that is what it did for me.

Let me know your story as I am very curious to know how your wealth is doing today.

Other Fun Reads By Yours Truly:

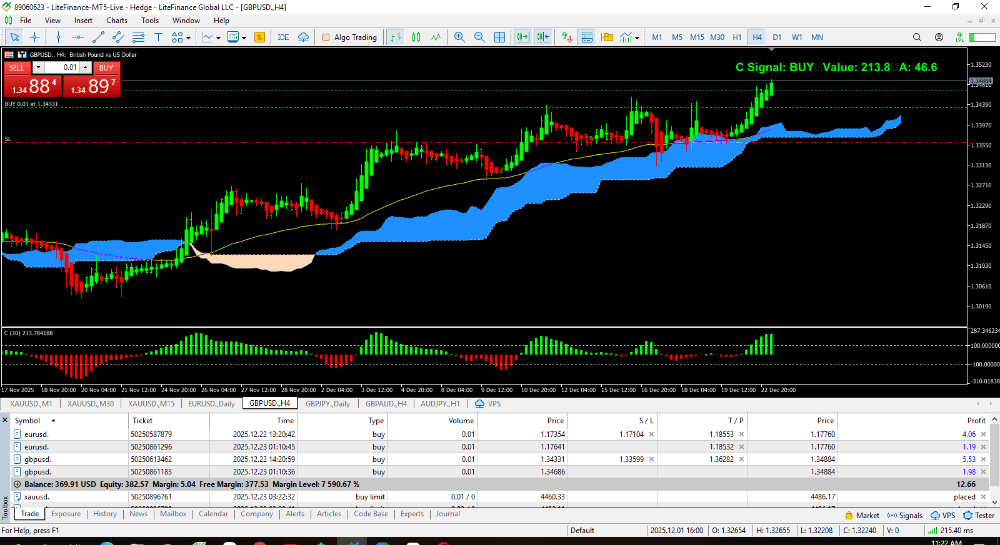

𝐌𝐲 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐂𝐫𝐢𝐬𝐢𝐬: 𝐓𝐫𝐚𝐝𝐞𝐫 𝐨𝐫 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫?

𝗔𝗿𝗲 𝗬𝗼𝘂 𝗧𝗵𝗿𝗼𝘄𝗶𝗻𝗴 𝗢𝘂𝘁 𝔼𝕋ℍ 𝗔𝘀 𝗪𝗲𝗹𝗹?

Is It Worth & Wise Cryptonizing Your Time?

𝖀𝖓𝖕𝖔𝖕𝖚𝖑𝖆𝖗 𝕺𝖕𝖎𝖓𝖎𝖔𝖓 - 𝐍𝐅𝐓𝐬 𝐀𝐫𝐞 𝐃𝐞𝐚𝐝

𝔹𝕚𝕥𝕔𝕠𝕚𝕟𝔹𝕒𝕓𝕪 𝕎𝕖𝕟𝕥 ℙ𝟚𝔼 - I found Some 𝗚𝗢𝗗𝗦 again & lost some

[Source Pic](All pics by MYI & AI unless watermarked or mentioned)