Ways of funding blockchain projects

The success or failure of a startup hinges greatly on its liquidity, and this holds true in the crypto economy as well. No matter how groundbreaking or revolutionary your technology may be, if you lack sufficient funding, your venture may face closure.

Thankfully, in today's landscape, there exist numerous alternative methods to finance your blockchain project that don't require pleading with traditional banks for loans. This article will explore five popular avenues for funding your blockchain venture, offering potential solutions that could spell the difference between failure and success for your project.

What is a blockchain fund, and how does it work?

As previously stated, a blockchain fund serves as crucial financial backing for projects, startups, or initiatives centered around blockchain technology. This funding plays a pivotal role in advancing research, development, and adoption of blockchain technology.

Typically, blockchain funding mechanisms utilize decentralized networks, smart contracts, and cryptocurrencies to facilitate fundraising and investment endeavors. Many funding avenues also entail the creation and distribution of tokens, along with the verification of investors in accordance with know-your-customer (KYC) and anti-money laundering (AML) regulations.

Ways to fund your blockchain project

Financing blockchain projects encompasses various methods, such as bootstrapping, venture capital, crowdfunding, peer-to-peer loans, and initial coin offerings (ICOs).

Below, we'll delve into each of these approaches to funding blockchain initiatives:

- What is bootstrapping?

In the realm of blockchain, bootstrapping involves initiating a new project or supporting its initial phases using personal resources until it becomes financially self-sufficient.

Many view bootstrapping as a straightforward and hassle-free method to fund a startup venture, particularly if the founders and developers can contribute their own funds to kickstart the project. One advantage of bootstrapping is the absence of external shareholders or private investors, allowing the founders to retain full control over the company and potentially reap substantial rewards in the future.

Bootstrapping typically begins with utilizing personal savings, credit cards, or income from other sources to cover the initial expenses of the crypto project. It emphasizes prioritizing essential expenditures and minimizing unnecessary costs to operate efficiently.

Bootstrapped crypto projects adopt a lean approach, remaining adaptable and responsive to market dynamics. They often commence with a minimum viable product (MVP) and gather feedback from users to refine and enhance the offering.

Moreover, bootstrapped ventures focus on generating revenue early on to sustain growth and development. They rely on cost-effective strategies such as word-of-mouth marketing, referrals, and content marketing to expand their customer base.

As the project progresses and revenue increases, bootstrappers can gradually expand operations, hire additional personnel, invest in marketing efforts, or diversify product offerings to further fuel growth.

- What is venture capital?

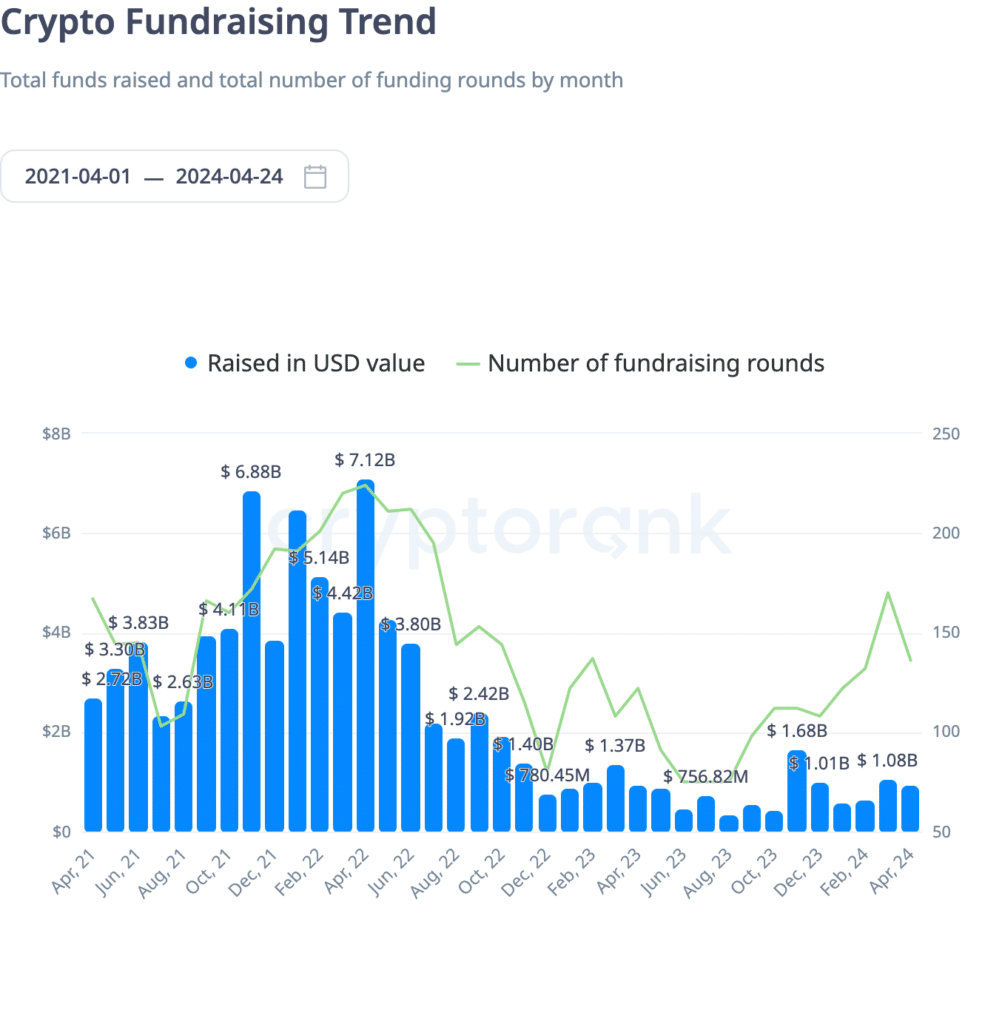

Venture capital represents a form of private equity investment directed towards startups and early-stage companies exhibiting high growth potential. This financing approach, prevalent in conventional financial realms, is gaining traction within the blockchain sector. In recent years, web3 startups have seen increased accessibility to venture capital funding. For instance, during the first quarter of 2022, venture funds amassed over $11 billion to support 917 blockchain and crypto projects, according to a Pitchbook report. Subsequent quarters witnessed a decline in funding, attributed largely to a bearish market sentiment and the setbacks faced by prominent crypto companies like Terra, Celsius, and FTX.

In recent years, web3 startups have seen increased accessibility to venture capital funding. For instance, during the first quarter of 2022, venture funds amassed over $11 billion to support 917 blockchain and crypto projects, according to a Pitchbook report. Subsequent quarters witnessed a decline in funding, attributed largely to a bearish market sentiment and the setbacks faced by prominent crypto companies like Terra, Celsius, and FTX.

However, a resurgence in VC funding for crypto projects was observed in Q4 2023. This upswing was fueled by factors such as the U.S. Securities and Exchange Commission's approval of spot Bitcoin exchange-traded funds (ETFs) and the emergence of novel blockchain applications like real-world asset tokenization and DePIN networks.

Venture capitalists typically prioritize early profitability, seeking returns on their investments in a timely manner. Furthermore, some VCs prefer to adopt a hands-on approach, potentially influencing key decision-making processes within the startup.

Before committing to investment, VC investors typically conduct comprehensive due diligence, assessing factors such as the project's viability, team composition, technological prowess, and market alignment. The investment process typically progresses through stages of due diligence, investment decision-making, funding agreement negotiation, and ongoing support and guidance provision to foster the growth of the startup.

- What is crowdfunding?

Crowdfunding serves as a means for crypto projects to raise capital by gathering small contributions from numerous individuals, typically facilitated through online platforms. It mirrors traditional fundraising efforts, where people collectively support ideas or initiatives they believe in, but in a digital format.

In contrast to conventional venture capital or angel investments, crypto crowdfunding eliminates the necessity for a third-party intermediary, providing direct access to investors.

Three primary forms of crowdfunding exist: reward-based, donation-based, and equity-based.

Reward-based crowdfunding entails providing rewards to those who contribute to the project or startup. Platforms like Kickstarter in the U.S. are popular for this approach.

Donation-based crowdfunding, more common in the non-profit sector, enables individuals or NGOs to fund charitable projects. In the for-profit arena, this type of crowdfunding is less prevalent.

Equity-based crowdfunding offers investors a fractional ownership stake in the company they support. Startups can utilize online platforms such as Crowdfunder, CircleUp, and WeFunder for equity-based crowdfunding instead of pursuing public offerings to secure funds from private investors.

The crowdfunding process generally follows these steps:

Project Creation: An individual or group with a crypto project idea establishes a campaign on a crowdfunding platform like Gitcoin or CoinStarter.

Campaign Description: The creator outlines the project's purpose, goals, timeline, and fund utilization. They may also offer rewards or incentives for varying contribution levels to entice participation.

Promotion: The campaign creator promotes their crowdfunding initiative through various marketing channels like social media, email, and word-of-mouth to broaden its reach and attract potential backers.

Contributions: Interested individuals visit the crowdfunding platform to contribute financially to the crypto project, with contributions varying in size based on the contributor's interest and financial capacity.

Funding Goal: The campaign sets a target representing the amount required to fulfill the project's objectives. Some platforms adopt an "all-or-nothing" model, where the project must meet its goal to receive any funds, while others permit flexible funding, allowing the project to access all contributions regardless of goal attainment.

Campaign Duration: Crowdfunding campaigns typically run for a fixed period, during which the campaign creator engages with backers, provides updates, and encourages additional contributions to meet or surpass the funding goal.

Fund Disbursement: Upon successfully reaching the funding goal, the crowdfunding platform processes contributions and releases funds to the campaign creator, typically after deducting platform fees. The creator utilizes these funds to execute the project as outlined in the campaign.

What are peer-to-peer loans?

Peer-to-peer (P2P) lending, also known as marketplace lending, facilitates direct borrowing and lending between individuals or "peers" without traditional financial intermediaries such as banks.

This lending model is appealing to individuals who prefer not to relinquish equity in their company to outside investors and are willing to assume debt to finance their project.

To obtain a peer-to-peer loan, applicants submit their funding requirements to a P2P lending platform like LendingClub or Prosper. After both the startup and the P2P lending platform agree on the terms and conditions, the loan is listed, allowing individual investors to contribute funds. Once the funding target is met, the startup receives the funds and repays the loan plus interest over the agreed-upon term in predetermined installments, with all transactions managed through the P2P lending platform.

Peer-to-peer lending offers a viable alternative for individuals who face challenges in securing traditional bank loans, a common scenario for many crypto startups. Moreover, it provides an avenue for entrepreneurs who prefer maintaining full ownership of their company without diluting equity.

Final thoughts on funding blockchain

Securing funding for blockchain projects is pivotal for their prosperity, given the significance of liquidity in sustaining entrepreneurial endeavors, particularly within the crypto economy.

Whether opting for bootstrapping, venture capital, crowdfunding, peer-to-peer loans, or ICOs, each funding avenue presents distinct advantages and considerations. Bootstrapping offers autonomy but mandates personal financial commitment and strategic resource management.

Venture capital provides expertise and resources but may entail ceding some control and meeting profit expectations.

Crowdfunding democratizes funding but necessitates effective marketing and engagement with backers, while peer-to-peer loans offer alternative financing without equity dilution but require prompt repayments. ICOs facilitate widespread investment but demand meticulous planning and compliance efforts.

Selecting the appropriate funding strategy hinges on your project objectives, available resources, and risk tolerance. Thorough research into all potential funding channels is imperative to identify the option that best aligns with your project's requirements.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)